Startups – Here’s a Step by Step Guide on how to Calculate Equity Dilution

Gagan Singh August 14, 2022

Startup founders need a comprehensive understanding of equity dilution. This includes key aspects such as what it is, how it works, what causes it, and how it can be calculated.

Such understanding will aid your fundraising efforts, show the effects of shareholder ownership, allow in-depth projections and analysis to be carried out, and much more.

There is a fair bit to take on board so let’s get started with what you need to know:

The basic premise of equity dilution

As early-stage startup founders will only be too well-aware, fundraising decisions must be made to facilitate growth. Having said this, it must also be understood that raising funds will impact their equity share and that of all shareholders.

Once founders have completed a round of fundraising their percentage of company ownership is decreased. This makes it critical to fully understand the long-term implications of equity dilution. It must also be clear how equity dilution scenarios can be calculated over different periods (for example, 5 years).

What is equity dilution?

Equity dilution is also termed share dilution. As will be seen later in the piece, equity dilution can happen in a wide variety of ways but let’s first concentrate on two of the most common reasons:

The first is when a company issues new shares to investors during fundraising rounds. The impact of this new share issue is to dilute (reduce) the ownership percentage of existing shareholders’ ownership in the company.

The second is when those who hold stock options exercise their right to purchase stock which will cause the same type of impact as issuing new shares to investors.

With more shares given to more people, it stands that existing holders of the company’s common stock will then own a smaller (or diluted) percentage of the company.

The other knock-on effect comes from the fact that existing shareholders will see their share of the company’s profits also diluted. This occurs because the total number of company shares increases but the company’s earnings after tax remains the same, meaning earnings per common share go down. It is often the case that this also lowers the share price.

Another point that founders need to be aware of relates to stock options and convertible notes. That is because they will have a direct impact on equity dilution.

An example of how equity can be diluted

Here’s a very straightforward example of how equity can be diluted:

Let’s assume a startup has 10 shareholders with each shareholder owning 1 share, or 10% of the company each. If those investors each receive voting rights to make company decisions based on share ownership, each investor would have the mentioned 10% control.

The company then issues 10 new shares and one single investor purchases all 10 of the new shares. This would mean there are now 20 total shares in all but the new investor would now own 50% of the company.

As for the 10 original investors, they would now only own 5% each of the company rather than their original 10%. That is because their shares have been diluted to 1 in 20 rather than the previous 1 in 10. This is a clear case of share dilution.

It is evident that company leaders need to mitigate such downsides. This can be achieved by ensuring that money raised through the issuance of new shares is used to grow the company’s revenue and its after-tax profits. By doing so they are raising the PPS (Price Per Share) above the pre-issue price.

A stock dilution formula

Here’s how founders and investors can calculate dilution using a stock dilution formula. Many find that using a simple equation is the way to think about dilution.

This can be explained as follows:

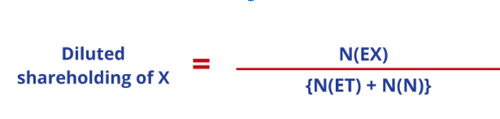

Diluted Shareholding is calculated by dividing the existing shares of an individual (Let that be X) by the sum of the total number of existing shares and a total number of new shares.

An example of diluted shareholding where:

N(EX)= Number of Existing Shares of X

N(ET)= Number of Existing Outstanding Total Shares

N(N)= Total Number of New Shares.

The main focus of this equation is because you want to maximize your ownership stake value. This means that if you dilute your ownership stake by X your company’s value would need to increase by 1/ (1-X) to ensure your equity worth is the same as it was before your stake was diluted.

Further sources of equity dilution

While we have discussed ways that fundraising, the exercising of stock options, and convertible debt can create equity dilution there are many other ways that are not always clear to founders. Here are 5 other reasons to be aware of:

- Issuing of new preferred stock – This is typically to raise money.

- Issuing new common stock – This is typically to co-founders as well as others.

- Issuing new stock options – This is typically to new hires.

- Issuing new warrants – This is typically to lenders.

- Increases in conversion rate of preferred to common shares. This would normally happen in a recapitalization situation.

Even larger areas that can cause share dilution include such things as liquidation preferences, participation rights. and cumulative dividends.

Equity dilution can have a drastic impact on the value of your startup’s portfolio. When any dilution occurs it is imperative that adjustments are accurately made for such things as earnings per share and projection ratios for valuation.

To achieve this with accuracy, smart startups need to take advantage of a highly secure global equity management platform. WOWS Global offers such a platform, one that comes with a complete suite of tools to help you navigate through every step of your financial journey.

That journey will rely heavily on taking advantage of your equity situation and the impact that dilution can have on all concerned.

Are you serious about making the most of a state-of-the-art digital ecosystem that will help your startup spell success? If so, please do not hesitate to get in touch with the highly experienced WOWS Global team at contact@wowsglobal.com for a no-obligation discussion as to how we can help you manage equity dilution most effectively.