1982 Ventures: Catalyzing Fintech’s Next Generation in Southeast Asia

1982 Ventures Fintech SEA 6 Minutes

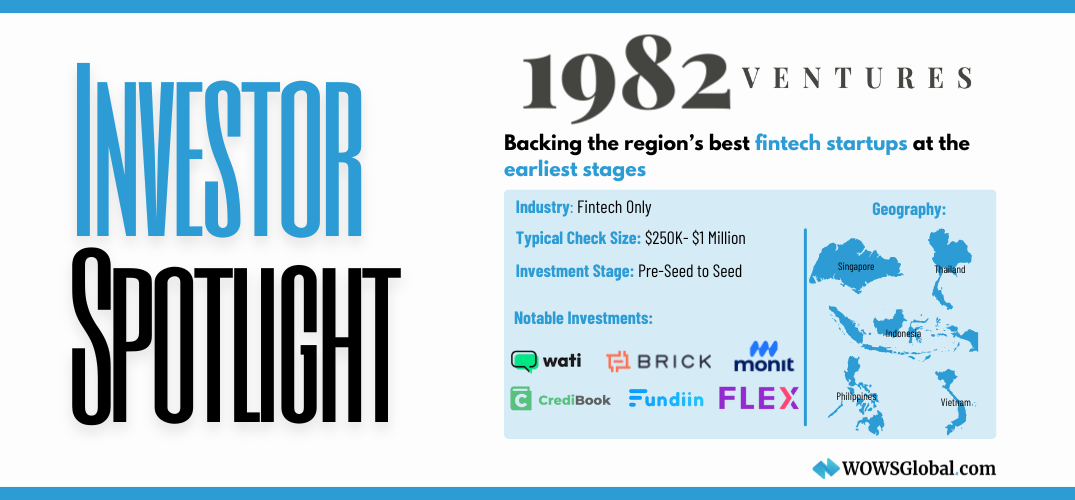

In the heart of Southeast Asia’s booming fintech scene, 1982 Ventures stands out as a laser-focused VC firm that’s not just betting on the future—it’s building it. With a core belief that Southeast Asia is the most exciting fintech opportunity globally, 1982 Ventures has positioned itself as the go-to first investor for fintech founders ready to take on this high-growth region.

Fintech-First, Southeast Asia Always

Core Investment Focus

1982 Ventures is singular in its mission: backing the region’s best fintech startups at the earliest stages. Their strategy revolves around funding founders who are modernizing financial services across emerging markets in Southeast Asia, with particular focus on:

-

Digital Banking

-

Payments & Remittances

-

Alternative Lending

-

Insurtech

-

Embedded Finance

-

Wealth & Personal Finance

-

SME Finance Infrastructure

Their fintech-only thesis means portfolio companies benefit from a network and expertise designed specifically for navigating regulatory, partnership, and growth complexities within financial services.

Geographic Focus

The firm is unapologetically regional: headquartered in Singapore and investing across Indonesia, Vietnam, the Philippines, Thailand, and other SEA markets. While global VCs often overlook early-stage SEA fintech, 1982 Ventures sees a region ripe for disruption and transformation—and is betting early and boldly.

Investment Strategy & Stage

1982 Ventures invests at pre-seed and seed stages, writing initial checks typically between $250,000 and $1 million. They aim to be the first institutional investor—bringing not just capital, but strategic fintech firepower to the cap table.

The firm often leads rounds and takes board seats, working closely with founders on:

-

Market validation

-

Product development

-

Regulatory navigation

-

Talent acquisition

-

Follow-on fundraising

Their high-conviction, hands-on approach means startups receive more than funding—they get an operator-level partner for the road ahead.

Portfolio Highlights: Backing Fintech Breakouts Early

1982 Ventures has already built a reputation for spotting fintech stars early in their journeys:

-

Brick (Indonesia) – A fintech infrastructure API startup powering open finance in Indonesia. 1982 Ventures backed Brick from the very beginning.

-

WATI (Singapore) – A customer engagement platform built on WhatsApp for SMBs, now used globally by businesses to improve customer communication. WATI has since scaled to over 100 countries.

-

Credibook (Indonesia) – A bookkeeping and digital payment solution for Indonesian micro and small businesses, driving financial inclusion through tech.

-

Fundiin (Vietnam) – A buy-now-pay-later platform built for the Vietnamese consumer market, enabling better financial access for a new generation.

-

Monit (Indonesia) – A financial wellness platform providing tools for budgeting and financial planning.

-

Flex (Vietnam) – A company providing technology and financial solutions to help merchants and businesses optimize performance. Exited in February 2025. Details of the exit type and size are not publicly disclosed.

Their growing portfolio includes dozens of startups across SEA tackling foundational financial problems—everything from underwriting to compliance to embedded insurance.

Why Founders Choose 1982 Ventures

Fintech founders in Southeast Asia don’t just need capital, they need allies who understand:

-

How to navigate regulators across fragmented jurisdictions

-

What it takes to build trust in financial products

-

Which partnerships unlock scale in bank-dominated markets

-

How to raise global capital while staying rooted locally

That’s what 1982 Ventures delivers.

Their partners come from deep fintech backgrounds and offer unmatched insight, introductions, and conviction. More than just a term sheet, founders get:

-

Instant fintech credibility

-

Access to an exclusive founder and LP network

-

Hands-on operational support at the most critical stage

WOWS Global: Connecting You to Investors Like 1982 Ventures

At WOWS Global, we’re in the business of making the right connections. 1982 Ventures is one of the most relevant VCs for early-stage fintech founders across SEA, and a valuable partner for startups looking to break into or scale within this region.

Whether you're building infrastructure APIs, embedded finance solutions, or inclusive digital banking tools, a partner like 1982 Ventures could unlock the regional momentum you need.

Ready to raise capital and scale your fintech startup? Connect with WOWS Global today and explore our investor network.

Related Posts

-

SME KPI Reporting Invest in Startups SEA 5 Minutes

Vimigo: The SME Performance OS Turning KPIs into Daily Wins

We break down how vimigo turns frontline activity into results through recognition-driven performance. Want to explore funding or strategic options in HR-tech? Schedule a call with our investment team today. -

SEA India Business Growth MENA 7 Minutes

Turmeric Capital: Turning Regional Contenders into Global Consumer Champions

Turmeric Capital invests in breakout consumer brands across GCC, India, and Southeast Asia, pairing operator DNA with a cross-border playbook. From omnichannel retail to F&B and lifestyle, the firm backs efficient unit economics and formats that travel, turning regional contenders into global champions. -

SEA Thailand Drone Platform Business Business Growth 5 Minutes

DroneEntry: Building the Full-Stack Enterprise Drone Platform for Southeast Asia

From an AIT-anchored hub in Thailand, DroneEntry unifies DJI Enterprise hardware, mission execution, and professional training for regulated, data-driven industries across SEA. Our spotlight breaks down differentiation, catalysts, and team plus what it means for investors and partners. Schedule a call with WOWS to dive deeper into the opportunity. -

SEA Indonesia AI Startups Founder 3 Minutes

Event Recap: Tech in Asia Conference 2025, Jakarta, What Builders, Founders, and Investors Are Really Talking About

The must-know insights from Tech in Asia 2025 Jakarta, AI, capital discipline, and Indonesia’s role, fresh from WOWS Global’s vantage point. -

SEA SME Lending Bitcoin Crypto 3 Minutes

Unocoin: India’s Crypto Veteran Built for Everyday Use

Founded in 2013, Unocoin has built a retail-first crypto app for India: SBP for habit-forming investing, one-tap Crypto Baskets, crypto-backed lending, public Proof-of-Reserves, and Lightning-fast BTC transfers. As rules tighten and transparency matters more, Unocoin’s durability and compliance posture position it as a pragmatic on-ramp for India’s mass market. -

Climate Tech Greentech SEA Energy 7 Minutes

INNOPOWER & EIV: Scaling Decarbonization in Southeast Asia

From Bangkok’s power ecosystem to a $100M growth vehicle with TRIREC, INNOPOWER & EIV are unlocking real-world decarbonization, EV charging, industrial efficiency, and green power, while giving founders a fast track to customers in Southeast Asia.