Ficus Capital: Building Ethical and Impact-Driven Ventures Across Southeast Asia

Impact Investing Fintech Healthcare Greentech SEA 4 Minutes

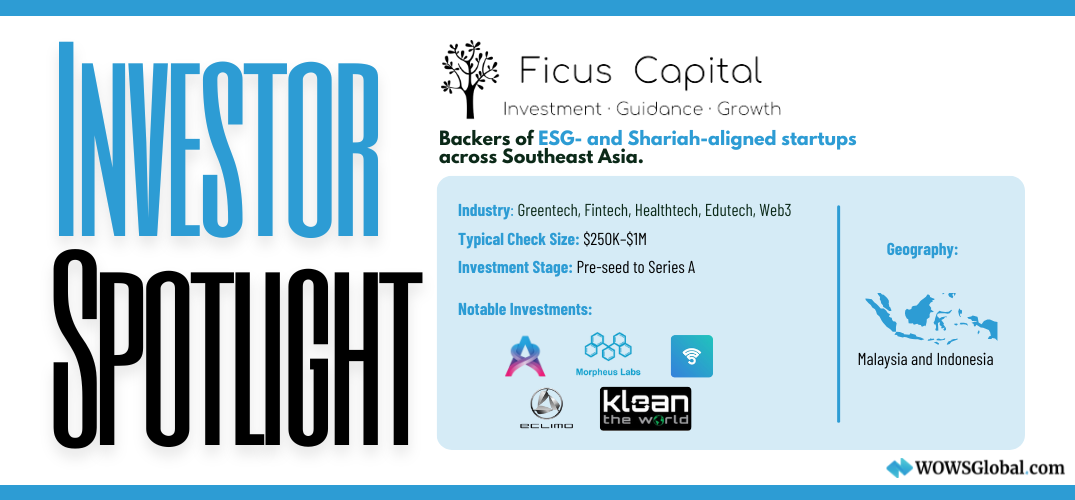

Ficus Capital isn’t just Southeast Asia’s first ESG-Islamic VC firm it’s one of the few funds globally that fully integrates Shariah compliance with a rigorous ESG investment thesis. From Kuala Lumpur, Ficus is quietly but confidently backing a new generation of startups that prove profit and principle can go hand-in-hand.

ESG + Shariah: A Distinct Investment Framework

Core Investment Focus

Ficus Capital backs early-stage startups that are shaping the future of Southeast Asia, while staying anchored in a robust ESG-Islamic framework. Its sector focus includes:

-

Greentech & Sustainability

-

Logistics & Mobility

-

Fintech & Digital Infrastructure

-

Healthtech

-

Edutech

-

E-commerce Enablement

-

Big Data & Cloud Services

-

Web3 & Emerging Technologies

These startups are chosen not just for their commercial potential, but for their alignment with Ficus’s proprietary Quadruple Bottom Line (QBL) investment methodology: People, Planet, Profit, and Principle.

Geographic Focus

Ficus Capital invests across Southeast Asia with a strong emphasis on Malaysia and Indonesia, supporting founders who are solving real-world problems in Muslim-majority and ESG-conscious markets. With regional growth and social equity as guiding values, Ficus ensures its investments are both scalable and sustainable.

Investment Strategy & Stage

Ficus typically backs early-stage startups, from pre-seed to Series A, writing initial tickets from $250,000 to $1 million. The firm runs two main funds:

-

Ficus SEA Fund – Backed by MAVCAP, this $13.6M vehicle focuses on startups addressing market gaps across ASEAN with digital-first and impact-led solutions.

-

Ficus Greentech Fund – A collaboration with Malaysia’s GreenTech and Climate Change Corporation (MGTC), this fund accelerates net-zero aligned businesses.

Ficus often co-invests alongside institutional and strategic investors, bringing both capital and compliance expertise to the table. They are active in shaping governance, guiding Shariah alignment, and preparing startups for long-term growth and global expansion.

Portfolio Highlights: Where Principles Meet Innovation

Ficus’s growing portfolio includes high-impact, high-integrity startups such as:

-

Eclimo (Malaysia) – An electric vehicle manufacturer promoting green mobility and battery tech, homegrown in Malaysia.

-

Assemblr (Indonesia) – A visual platform democratizing AR creation for users across education, entertainment, and enterprise.

-

Simplify – A peer-to-peer internet sharing startup that boosts access and affordability in underserved areas.

-

KLEAN – A recycling ecosystem powered by reverse vending and AI, making waste management circular and rewarding.

-

Morpheus Labs – A Web3 and AI-driven blockchain development platform simplifying DLT adoption across enterprises.

Why Founders Choose Ficus Capital

In a region where many founders struggle to find aligned capital, Ficus offers a unique proposition:

-

Deep expertise in Islamic and ESG investing

-

Strong institutional partnerships (MAVCAP, MGTC, Islamic banks)

-

Commitment to long-term governance and ethical scaling

-

Ability to open doors to Halal markets and socially responsible LPs

At Ficus, due diligence goes beyond the cap table it’s about character, community, and contribution.

WOWS Global: Your Gateway to VCs Like Ficus Capital

At WOWS Global, we connect founders with investors that align with their mission and model. Ficus Capital is an ideal partner for startups operating at the intersection of impact, innovation, and integrity especially those seeking capital that matches their values.

If you're building something that’s good for the world and ready to scale in Southeast Asia, we’d love to help you connect.

Related Posts

-

Capital SEA B2B ASEAN 7 Minutes

Cocoon Capital: Backing Southeast Asia’s Quiet B2B Revolution

From AI-powered stroke diagnostics to pharma distribution and SME payment rails, Cocoon Capital backs the “invisible” infrastructure powering Southeast Asia’s next wave of growth. This Investor Spotlight unpacks their B2B and deep-tech thesis, how they invest, and the founders they champion. -

Tourism Travel SEA Tech 5 Minutes

Yacht Me Thailand: Digital Yacht Charter Platform for a Fragmented Market

Yacht Me Thailand is digitising yacht and boat charters across Thailand’s top marine destinations. With operator-first tools, sustainability at its core and ambitions to become a regional boating OTA, the platform is emerging as a notable travel-tech and marine tourism play. -

Fintech AI Startups Early Startups SEA 4 Minutes

The Dip in SEA Fintech Funding: What Startups Can Learn

SEA fintech funding has dipped, but capital is still on the field for disciplined teams. This article unpacks what the new funding rules look like and how founders can upgrade models, governance, monetization, and capital stacks. Learn where investor expectations have shifted and how WOWS Global can help you get raise ready. -

Series B Singapore SEA India 5 Minutes

Iron Pillar: Scaling India-Built Tech Into Southeast Asia

Iron Pillar is a venture-growth firm backing India-built technology as it scales across Southeast Asia. This spotlight covers stage focus, typical checks (US$5–15M), sectors, SEA go-to-market via Singapore, and notable portfolio patterns in SaaS and platforms. For founders and co-investors, it’s a practical guide to where Iron Pillar fits, and how to engage. -

SEA Startup & Venture Capital Proptech Media 4 Minutes

Catcha Group: Company-builders Powering SEA’s Internet Plays

Catcha Group has spent two decades building and backing Southeast Asia’s internet champions, from classifieds and OTT to flexible workspaces. With hands-on operating support and smart consolidation plays, the firm has turned category leaders into headline exits. -

Biotech AI SEA Startup & Venture Capital deep-tech 6 Minutes

Granatus Ventures: Deep-Tech Builders Bridging Armenia and Southeast Asia

Granatus Ventures backs IP-rich startups in AI, biotech, robotics, and advanced/quantum computing, pairing early checks with an Armenia engineering engine and a Singapore touchpoint for SEA pilots. Learn how their SDG-aligned thesis translates into practical capital and deep technical diligence.