How to Choose Which Startup to Invest In

Startup & Venture Capital Early Startups Founder Investment 3 Minutes

Picking a startup isn’t a coin toss, it’s coverage, scouting, and game management. The winners blend founder grit, a real market, and numbers that move in the right direction. Here’s a crisp playbook, written like a Sunday recap but paced for thoughtful investors.

Pre-game scouting: the market

Start where the audience sits. Is the addressable market large, growing, and reachable today, not in theory? Look for a specific wedge (a niche the team can dominate) that expands into a broader field. Track regulatory tailwinds, customer urgency, and replacement cycles. Big stadiums matter, but so does ticket demand.

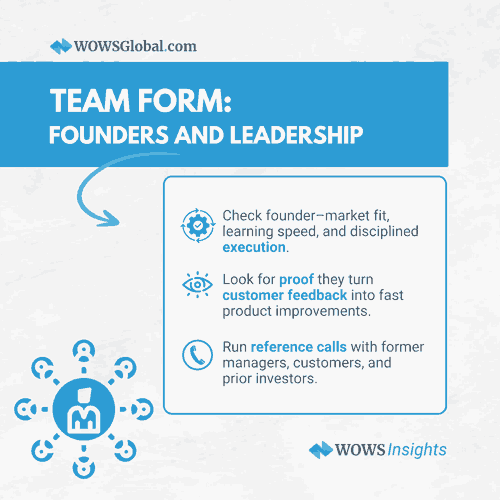

Team form: founders and leadership

Great teams win ugly games and adapt mid-match. Assess founder–market fit, learning velocity, and evidence of disciplined execution. Do they turn customer feedback into product improvements fast? Check reference calls with ex-managers, customers, and prior investors. Look for complementary skills across product, sales, and ops, and a bench that can scale.

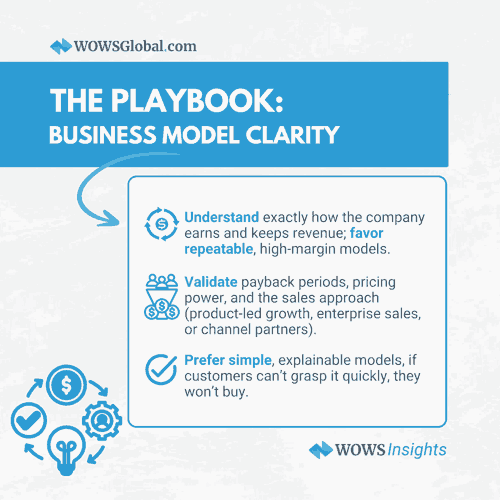

The playbook: business model clarity

How does this startup make money and keep it? Favor repeatable, high-margin revenue with sane payback periods. Understand sales motion (bottom-up PLG, top-down enterprise, or channel-led), pricing power, and gross margin path. Simplicity wins: if you can’t explain it in two sentences, neither can customers.

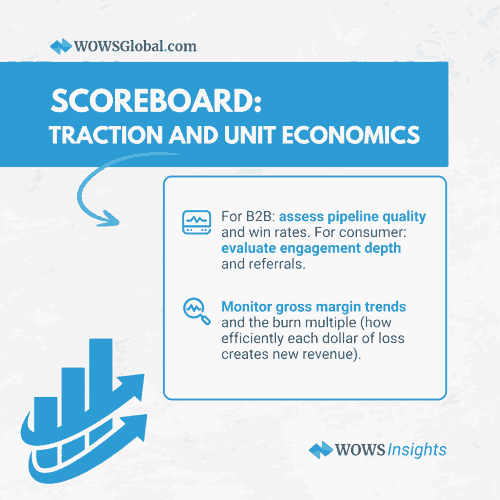

Scoreboard: traction and unit economics

Early scores matter. Track month-over-month revenue growth, user retention by cohort, and sales efficiency (LTV/CAC, payback months). For B2B, pipeline quality and win rates; for consumer, engagement depth and referral loops. Don’t ignore gross margin progression and burn multiple, how efficiently each dollar of loss drives net new revenue.

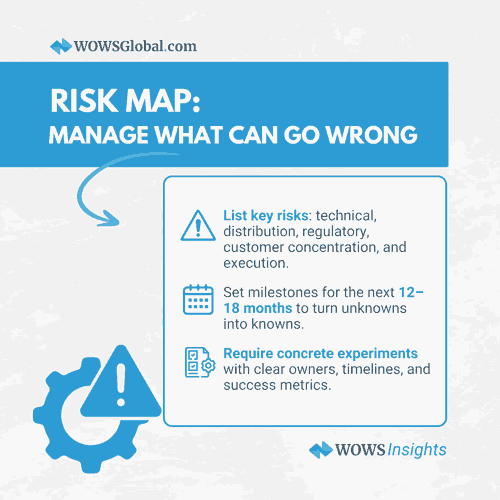

Defense wins championships: risk map

Chart the riskiest assumptions: technical feasibility, distribution, regulatory, concentration, or execution risk. What milestones convert unknowns into knowns over the next 12–18 months? Insist on concrete experiments, not vibes: specific timelines, owners, and success metrics. A startup with a plan to de-risk is already playing smarter defense.

Moat and momentum: can they hold the lead?

Ask how advantage compounds: data network effects, workflow lock-in, unique supply, brand trust, or proprietary distribution. Momentum amplifies moats, so watch cycle time, how quickly the team ships, learns, and ships again. Market timing matters: being just early with stamina beats being late with style.

Terms and alignment: the final whistle

Good deals align incentives. Sanity-check valuation against stage, growth, and quality of revenue; run downside scenarios. Prefer clean terms over exotic structures that mask price. Clarify use of funds, reporting cadence, and governance. Your job isn’t to coach every play, but you should know the score each quarter.

WOWS Insight

In early-stage investing, access and fit decide outcomes as much as analysis. WOWS Global sits where the scouting reports, locker-room truths, and live game film converge. We curate founder–investor matches around thesis, stage, and traction, then streamline diligence with standardized data rooms and real customer proof. The result: fewer meetings, better conviction, and cleaner terms.

Whether you’re building a category portfolio or hunting one standout, we bring you the right opportunities at the right moment, teams with momentum, markets that matter, and metrics that speak. When you’re ready to move from highlights to signed term sheets, WOWS Global connects you to the company that fits your playbook.

Register with WOWS Global to see curated opportunities as an investor, or submit your pitch to get matched with aligned investors.

FAQs

What’s the quickest way to screen a startup?

Start with three filters: founder–market fit, a clear pain with budget attached, and early proof customers come back. Ask for a one-page metrics summary and two customer references. In 30 minutes, you’ll know if there’s signal: repeatable revenue, credible pipeline, and a plan to reach the next milestone.

How much weight should I give valuation at seed or pre-seed?

Treat valuation as the cost of optioning future growth. Pay up for velocity, learning cadence, and founder quality, discount for complexity and high burn. Anchor on burn multiple and expected dilution across rounds. A “fair” price is one that preserves upside while funding 18 months of milestone-driven progress.

What red flags should stop me immediately?

Unwillingness to share metrics, fuzzy unit economics, or churn hidden behind vanity growth. Watch for single-threaded sales, regulatory blind spots, and a roadmap driven by investor opinion, not users. If references stall, diligence gets defensive, or numbers don’t reconcile, pause. Great founders welcome sunlight and tough questions.

Related Posts

-

Early Startups Fundraising Due Diligence Data Room

2026 Fundraising: What Changed?

Fundraising in 2026 isn’t about moving faster—it’s about showing up prepared. Learn how to build an investor-ready system (modeling, governance, data room, and investor fit) so diligence doesn’t drag and your strongest conversations go the distance. -

SEA & Middle East Investment AI Highlight 6 Minutes

WOWS’ 2026 Predictions: 10 Bets on Where Southeast Asia’s Money Will Move Next

WOWS’ 2026 Predictions are a forward-looking map of where Southeast Asia’s money could move next: operator-led capital, Thailand’s mid-stage moment, SME credit as a major return engine, an AI survival test, and a wave of M&A. Investors, founders, and SMEs can use these 10 bets to plan for what may come. -

Investor Due Diligence Readiness Virtual Data Room Founder 4 Minutes

Data Room Done Right: A Founder’s 30-Item Investor Readiness Checklist

Investors don’t fund mysteries. This Seed–Series A checklist shows exactly what to include, governance, product, metrics, financials, security, and round mechanics, so diligence speeds up, not stalls. Need help? WOWS Global can review and structure your data room. -

Fintech AI Startups Early Startups SEA 4 Minutes

The Dip in SEA Fintech Funding: What Startups Can Learn

SEA fintech funding has dipped, but capital is still on the field for disciplined teams. This article unpacks what the new funding rules look like and how founders can upgrade models, governance, monetization, and capital stacks. Learn where investor expectations have shifted and how WOWS Global can help you get raise ready. -

Term Sheet Ultimate Guide to Term Sheets <em>Term Sheet Negotiation(s)</em> Startup & Venture Capital 3 Minutes

Term Sheet 101 (2025 Edition): Clauses, Red Flags, and Negotiation Tactics

A fast, founder-friendly breakdown of the clauses that matter in 2025 liquidation preferences, anti-dilution, pro-rata, ESOP, board, and information rights, plus negotiation do’s/don’ts and model scenarios. Close your next round with clean terms and fewer surprises. -

SEA Startup & Venture Capital Proptech Media 4 Minutes

Catcha Group: Company-builders Powering SEA’s Internet Plays

Catcha Group has spent two decades building and backing Southeast Asia’s internet champions, from classifieds and OTT to flexible workspaces. With hands-on operating support and smart consolidation plays, the firm has turned category leaders into headline exits.