Wavemaker Partners: Backing Southeast Asia’s Boldest Builders

#SoutheastAsia Early Stage deep-tech Robotics 6 Minutes

Wavemaker Partners: Backing Southeast Asia’s Boldest Builders

Wavemaker Partners is a pioneering early-stage venture capital firm with dual roots in Los Angeles and Singapore. As one of Southeast Asia’s most active investors, Wavemaker is known for discovering high-conviction opportunities in enterprise, deep tech, and sustainability well before the crowd catches on.

With over 180+ investments in Southeast Asia and $300M+ in AUM in the region, Wavemaker is a firm that backs founders solving hard, important problems. Whether it’s enabling B2B e-commerce in the Philippines, automating aquaculture in Indonesia, or building climate-tech companies from scratch, Wavemaker’s portfolio is a masterclass in bold, impact-driven innovation.

Who They Are

Founded in 2003, Wavemaker began as a venture out of Los Angeles and has since evolved into a cross-border powerhouse. The firm has backed 360+ companies globally, including Blue Bottle Coffee, TradeGecko, Coins.ph, and Moka. In Southeast Asia, its Singapore-led team has become a go-to partner for founders building high-growth, early-stage ventures across the region.

Wavemaker’s edge lies in its ability to spot “unobvious” opportunities and take big swings on overlooked sectors especially enterprise and deep-tech. The firm brings not only capital, but also deep operational support, strategic guidance, and a growing ecosystem of corporate partners and investors.

Investment Thesis

Wavemaker invests in early-stage (pre-seed to Series A) startups across Southeast Asia, with a strong tilt toward enterprise software, deep tech, and climate solutions. Around 85% of its portfolio falls under enterprise/deep tech, while over 90% of its active companies contribute to at least one UN Sustainable Development Goal.

Their thesis: True opportunity = Value – Perception. That means backing founders with unique insights into markets others might underestimate—and helping them scale globally.

Notable Investments

-

Coins.ph– Fintech platform acquired by Gojek

-

TradeGecko – B2B SaaS acquired by Intuit

-

Moka.– Indonesian POS startup acquired by Gojek

-

GrowSari – B2B platform transforming Philippines’ sari-sari stores

-

eFishery – Aquaculture tech unicorn solving food security

-

Blue Bottle Coffee – Acquired by Nestlé, redefining specialty coffee

-

Wavecell – Cloud communications exit to 8x8

-

Winc – Wine-tech IPO on NYSE American

Wavemaker has also co-founded companies through Wavemaker Labs (robotics) and Wavemaker Impact (climate tech), building ventures like Miso Robotics and carbon-abating startups from the ground up.

Investment Snapshot

-

🎯 Stages: Pre-Seed, Seed, Series A

-

🌏 Focus: Southeast Asia (Singapore, Indonesia, Philippines, Vietnam)

-

💰 Avg. Check Size: $500K – $3M

-

📁 Sector Focus: Enterprise SaaS, Fintech, Deep Tech, Sustainability

-

🚀 Active Funds: 4 SEA funds, $300M+ under management

-

💼 Notable LPs: IFC, Temasek Pavilion Capital, family offices of tech founders

Why It Matters

In a region often dominated by consumer-focused plays, Wavemaker is rewriting the rules with its enterprise-first and impact-forward strategy. Their hands-on, founder-first approach, coupled with a deep understanding of Southeast Asia’s unique dynamics, makes them a catalytic partner for early-stage startups.

WOWS Take

Whether you're building next-gen enterprise software, innovating in agritech, or tackling climate change, Wavemaker Partners is one investor that doesn’t wait for validation. They bring the conviction, capital, and courage to help founders go the distance starting on Day 1.

Checkout other VCs in WOWS Global’s network and bring your startup in front of the right audience.

Related Posts

-

Biotech AI SEA Startup & Venture Capital deep-tech 6 Minutes

Granatus Ventures: Deep-Tech Builders Bridging Armenia and Southeast Asia

Granatus Ventures backs IP-rich startups in AI, biotech, robotics, and advanced/quantum computing, pairing early checks with an Armenia engineering engine and a Singapore touchpoint for SEA pilots. Learn how their SDG-aligned thesis translates into practical capital and deep technical diligence. -

VC SEA Startups Southeast Asia Early Stage 5 Minutes

Ansible Ventures: Backing Vietnam’s Next Generation of Builders

Ansible Ventures is a Vietnam-first, early-stage VC backing software-first founders at pre-seed to pre-Series A. See their thesis, notable bets, and how WOWS can connect you via warm, qualified introductions. -

SEA Biotech Corporate Venture deep-tech 3 Minutes

GC Ventures: Where Chemistry Meets Real-World Sustainability

GC Ventures, PTT Global Chemical’s corporate VC, backs founders at the intersection of chemistry and sustainability. With hubs in Bangkok and Cambridge (MA), they help deeptech teams scale advanced materials, clean & circular tech, industrial biotech, and digital industrial solutions from lab to plant across Southeast Asia. -

Raise Capital for Startup Early Stage Technology Singapore 2 Minutes

Seeds Capital: Catalyzing Singapore’s Early-Stage Tech Breakouts

Seeds Capital, the investment arm of Enterprise Singapore, bridges public funding with private capital to accelerate promising tech startups from seed to global scale. Operating through a co-investment model, Seeds has backed over 150 startups across sectors from cultivated seafood to healthtech, catalyzing more than S$1.12 billion in private investment. Recently integrated into SG Growth Capital, Seeds Capital continues to fuel Singapore's next generation of deep-tech and frontier tech companies. -

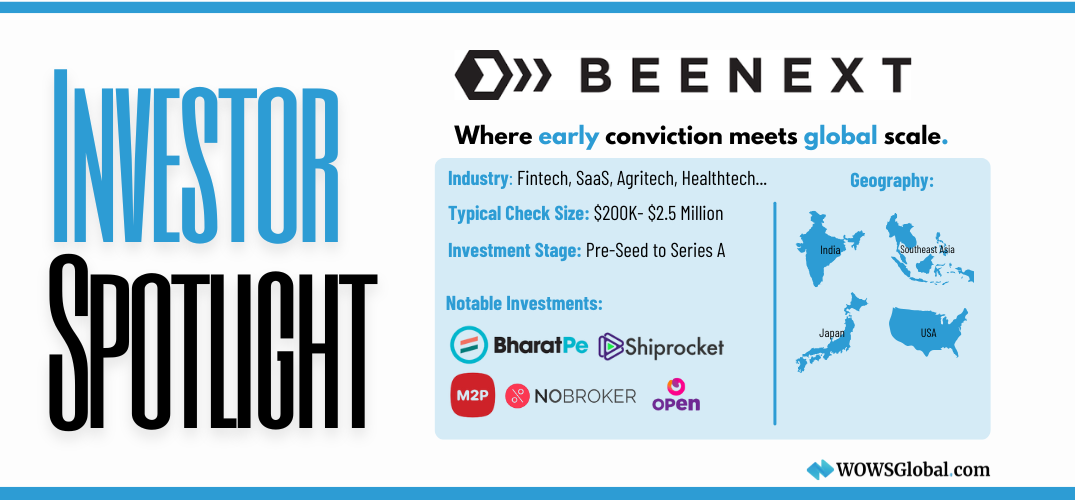

BEENEXT VC Early Stage 5 Minutes

VC Spotlight: BEENEXT – Backing Bold Founders from India to Southeast Asia

BEENEXT is a founder-first VC fund that has quietly become one of the most trusted early-stage backers across India and Southeast Asia. With over 300 investments and a long-term approach, the firm backs transformative companies in fintech, SaaS, logistics, and more. -

Sensory AI deep-tech AI AI-Nose 4-6 minutes

Company Spotlight: MUI Robotics – Digitizing the Sense of Smell with Sensory AI

MUI Robotics is pioneering Sensory AI technology, enabling machines to digitize the sense of smell. With over 600 enterprise clients and profitability within its first year, this Thailand-founded deep-tech startup is now expanding globally. Featured at WOWS Dealflow AI Demo Day, MUI Robotics is reshaping industries from food tech to pharmaceuticals with its AI-powered odor detection and environmental monitoring solutions.