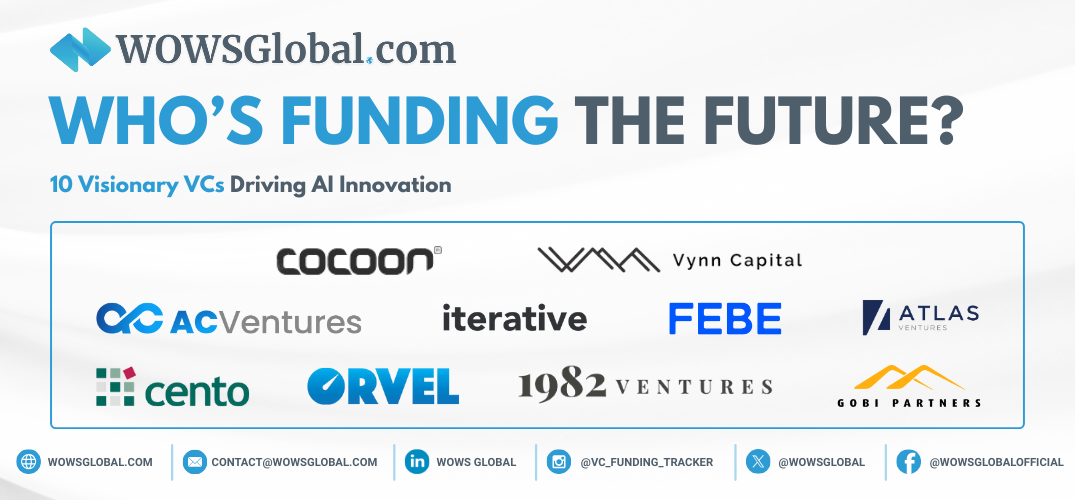

Who’s Funding the Future? 10 Visionary VCs Driving AI Innovation

SEA Early Startups Funding VC AI in Southeast Asia 5 Minutes

Southeast Asia’s venture capital landscape is surging with innovation, and at the heart of that movement are bold investors fueling AI-first and tech-driven startups. These 10 standout funds aren’t just betting on the future they’re actively building it. From deep tech leaders to specialized sector investors, here's a closer look at the tech-forward VCs shaping the next wave of groundbreaking companies.

-

Cocoon Capital - Early-Stage AI Empowerment Cocoon Capital offers initial investments between $500K and $1 million, focusing on early-stage startups primarily in Singapore, Vietnam, and the Philippines. They specialize in supporting AI-driven platforms like Augmentus, which deploys AI robotics solutions for SMEs.

-

Gobi Partners - Bridging AI Across Borders Gobi Partners invests $1-10 million per venture, focusing on Malaysia, Indonesia, and the Philippines. Their AI portfolio includes Deliveree, an AI logistics optimization platform, and EasyParcel, demonstrating their capability in scaling AI solutions regionally.

-

Vynn Capital - Strategic AI Investments in Essential Industries Vynn Capital typically invests between $500K and $3 million, targeting sectors like logistics, travel, and fintech. Geographically, they are active in Malaysia, Vietnam, and Indonesia. Their notable AI-backed investments include Dropee, a B2B marketplace employing AI-driven inventory management.

-

FEBE Ventures - Vietnam’s AI Innovation Champions FEBE Ventures, primarily focused on Vietnam and Indonesia, invests $250K-1 million in early-stage startups deploying AI across multiple sectors. Their key investments include Nano Technologies, an AI-backed wage access solution, and Kim An Group, a fintech platform leveraging AI for credit assessments.

-

AC Ventures - Powering AI Integration in Indonesia AC Ventures commits between $500K-5 million primarily focused on Indonesia's burgeoning AI market. Their portfolio includes startups like KoinWorks, employing AI-driven credit scoring, and Shipper, utilizing AI logistics optimization.

-

Cento Ventures - Pioneering AI Infrastructure Investments Cento Ventures focuses on early-growth stage investments of $1-5 million in Southeast Asia, especially Thailand, Indonesia, and Vietnam. Their portfolio highlights include Pomelo, an AI-powered fashion e-commerce platform, and iPrice, using AI for e-commerce price comparison.

-

Atlas Ventures – AI-Driven Opportunities with Regional Ambition

Atlas Ventures is an early-stage investor based in Singapore, deploying $500K–$3 million into startups that integrate AI across fintech, healthtech, and enterprise SaaS. With a strong presence in Indonesia, Vietnam, and Thailand, Atlas backs companies like MED247 (AI-powered digital clinic platform) and Aigens (F&B tech leveraging AI for customer experience). Their approach blends capital with operational support and deep local insight, making them a compelling partner for AI-first founders. -

Orvel Ventures – Backing Disruptive Tech from Day Zero Orvel Ventures is a relatively new but fast-growing VC firm investing $250K to $2 million in early-stage AI startups across Southeast Asia, particularly in Vietnam, Thailand, and Indonesia. The fund focuses on AI applications in logistics, workforce productivity, and predictive analytics. Notable investments include Abivin, a Vietnam-based AI logistics optimization platform, and Talentport, which uses AI to match Southeast Asian talent with global employers.

-

1982 Ventures – Fintech-First, AI-Empowered Based in Singapore, 1982 Ventures is a fintech-focused VC investing between $300K and $3 million. They actively back startups leveraging AI to solve financial inclusion, risk assessment, and digital lending challenges across Indonesia, Vietnam, and the Philippines. Key investments include Wagely (earned wage access with AI underwriting) and Brick (open finance APIs with AI fraud prevention layers).

-

Iterative – YC-Style Acceleration for SEA AI Startups

Iterative operates more like an accelerator fund, investing $150K-$500K with a laser focus on early-stage founders building tech-first companies, many with AI at their core. Based in Singapore and focused across SEA, Iterative has funded startups like Spenmo (AI-powered expense automation) and Mindtera (an AI-based mental wellness platform for workplaces).

The AI Investment Playbook Is Evolving

What sets these firms apart isn’t just their willingness to back AI it’s their strategic lens. Whether through verticalized AI in fintech and healthtech or foundation models being deployed for climate or commerce, these VCs are betting on AI as infrastructure. Their portfolios reflect a deep shift toward long-term defensibility and platform-scale outcomes.

Why Founders Should Pay Attention

For startup founders, aligning with a tech-centric investor means more than funding it means gaining a long-term collaborator who understands the nuances of AI development, go-to-market timing, and regulatory navigation. These funds don’t just write checks they bring roadmaps, talent networks, and credibility to the table.

WOWS Take

These 10 funds aren’t just making bets they’re crafting blueprints for Southeast Asia’s tech future. From generative AI and deep tech to sustainability-driven innovation, these firms reflect the energy, urgency, and bold ambition required to power the next decade of digital transformation.

As startup founders and tech builders look for the right partners, like WOWS Global these AI-forward funds are ready not just with capital, but with the expertise and networks to take ideas to scale.

Related Posts

-

SME KPI Reporting Invest in Startups SEA 5 Minutes

Vimigo: The SME Performance OS Turning KPIs into Daily Wins

We break down how vimigo turns frontline activity into results through recognition-driven performance. Want to explore funding or strategic options in HR-tech? Schedule a call with our investment team today. -

SEA India Business Growth MENA 7 Minutes

Turmeric Capital: Turning Regional Contenders into Global Consumer Champions

Turmeric Capital invests in breakout consumer brands across GCC, India, and Southeast Asia, pairing operator DNA with a cross-border playbook. From omnichannel retail to F&B and lifestyle, the firm backs efficient unit economics and formats that travel, turning regional contenders into global champions. -

Startup & Venture Capital Early Startups Founder Investment 3 Minutes

How to Choose Which Startup to Invest In

Choosing a startup isn’t a coin toss. This quick-read playbook covers market sizing, founder fit, unit economics, risk mapping, and terms, written in a toned-down sports recap style. Wrap up with “WOWS Insight,” where WOWS Global explains how it matches investors with companies that fit their thesis, stage, and traction. -

SEA Thailand Drone Platform Business Business Growth 5 Minutes

DroneEntry: Building the Full-Stack Enterprise Drone Platform for Southeast Asia

From an AIT-anchored hub in Thailand, DroneEntry unifies DJI Enterprise hardware, mission execution, and professional training for regulated, data-driven industries across SEA. Our spotlight breaks down differentiation, catalysts, and team plus what it means for investors and partners. Schedule a call with WOWS to dive deeper into the opportunity. -

SEA Indonesia AI Startups Founder 3 Minutes

Event Recap: Tech in Asia Conference 2025, Jakarta, What Builders, Founders, and Investors Are Really Talking About

The must-know insights from Tech in Asia 2025 Jakarta, AI, capital discipline, and Indonesia’s role, fresh from WOWS Global’s vantage point. -

SEA SME Lending Bitcoin Crypto 3 Minutes

Unocoin: India’s Crypto Veteran Built for Everyday Use

Founded in 2013, Unocoin has built a retail-first crypto app for India: SBP for habit-forming investing, one-tap Crypto Baskets, crypto-backed lending, public Proof-of-Reserves, and Lightning-fast BTC transfers. As rules tighten and transparency matters more, Unocoin’s durability and compliance posture position it as a pragmatic on-ramp for India’s mass market.