Zafar VC: Powering Southeast Asia’s Healthcare Renaissance

Healthcare HealthTech SEA Biotech Southeast Asia 7 Minutes

Malaysia’s RM1 Billion Bet on the Future of Health

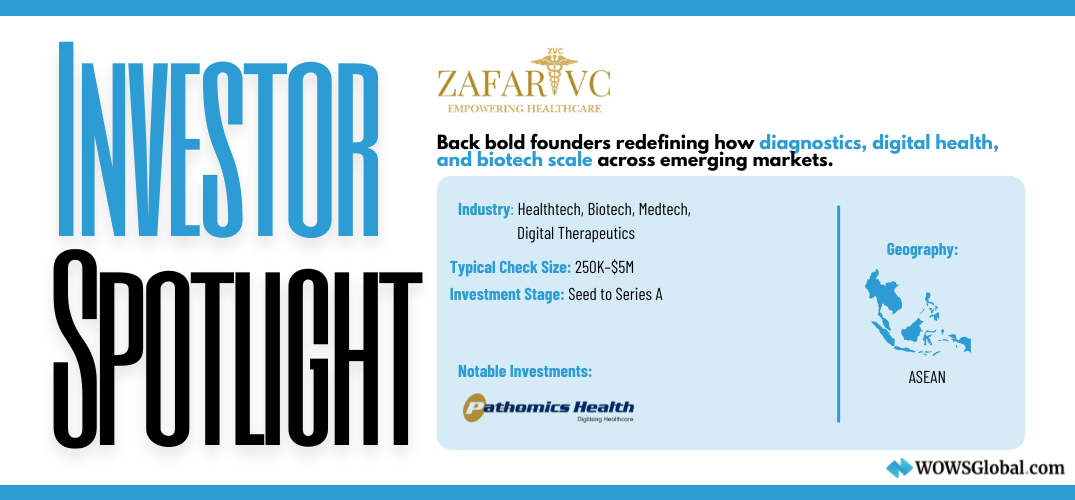

When Zafar Venture Capital (Zafar VC) launched in 2025 with an eye-popping RM1 billion (USD 220+ million) fund dedicated exclusively to healthcare, it wasn’t just a milestone for Malaysia—it was a signal to the entire ASEAN region. Zafar VC is here to rewrite the future of healthtech, medtech, and biotech across Southeast Asia.

Backed by 5 Pillars Ventures, Zafar VC is laser-focused on one mission: Fueling Innovation, Empowering Humanity. With a potent mix of capital, clinical insight, and a collaborative ecosystem mindset, Zafar is not just another check-writing fund it’s a true catalyst for health innovation in emerging markets.

Investment Philosophy: Impact Meets Innovation

Zafar VC believes that healthcare isn’t just a market it’s a mission. Its thesis centers on transforming human health through deep tech, digital tools, and scalable models. Whether it’s AI diagnostics, next-gen medical devices, or digital therapeutics, Zafar seeks founders who dare to tackle complex challenges head-on.

Key investment themes include:

-

Healthtech (telehealth, AI in diagnostics, digital health)

-

Biotech and life sciences

-

Medtech and medical devices

-

Aging population and mental health solutions

What sets them apart? Zafar provides more than money, it offers guidance through regulatory landscapes, connects founders with clinical networks, and supports scale across ASEAN’s diverse healthcare systems.

Geography & Check Size

Zafar VC is headquartered in Kuala Lumpur and primarily invests across the ASEAN region. While it maintains a strong commitment to Malaysia’s healthcare ecosystem—particularly startups aligned with national health priorities, the fund also targets high-potential ventures throughout ASEAN that align with its sector focus.

Typical check sizes:

-

Seed to Series A: $250K – $2M

-

Follow-ons (Series B+): Up to $5–10M depending on traction

Zafar also supports ultra-early-stage ventures through its Medexel Accelerator, providing structured mentorship and up to $250K in pre-seed funding.

Deal Flow & Partnerships

Zafar’s pipeline is fueled by a robust network of accelerators, healthcare providers, and institutional allies. Zafar VC’s growing portfolio reflects its mission to accelerate healthcare innovation across Southeast Asia, with a strong emphasis on digital health, diagnostics, and biotech. Its first publicly disclosed investment, Pathomics Health, is a cutting-edge healthtech company leveraging AI and digital pathology to improve early disease detection and personalized care. Backed during its critical growth phase, Pathomics Health exemplifies Zafar VC’s commitment to supporting visionary founders solving real clinical challenges and building scalable, impact-driven businesses in the region.

Beyond accelerators, Zafar collaborates with public health stakeholders like the National Cancer Society of Malaysia (NCSM), positioning itself at the intersection of public good and private opportunity.

The Team: Multidisciplinary, Mission-Driven

Zainul Alam Abdul Kadir (Managing Partner): 20+ years in strategy, ex-Frost & Sullivan, founder mentor, regional visionary.

Dr. Keith Chong (Senior Partner): PhD scientist and healthcare entrepreneur, deeply embedded in ASEAN’s medtech community.

Their combined strengths ensure portfolio companies get not only capital but also clarity and conviction.

Zafar VC is not just building a portfolio. It’s building a legacy one where Southeast Asia is not just a market for healthtech, but a producer of global-impact healthcare innovation.

WOWS Global: The Future of Health Starts with Zafar VC

At WOWS Global, we specialize in connecting ambitious founders with the region’s most strategic investors. Zafar VC is one of the most relevant venture capital firms for early-stage healthcare startups across ASEAN especially for those tackling critical challenges in healthtech, medtech, and biotech.

Whether you're building AI-driven diagnostics, digital therapeutics, or affordable care platforms, a partner like Zafar VC brings not only capital but deep sector expertise and public-private support to help you scale with purpose.

Raising capital for your healthcare startup?

Let WOWS Global help you get in front of Zafar VC, at the right stage, with the right story.

Related Posts

-

SEA Thailand Drone Platform Business Business Growth 5 Minutes

DroneEntry: Building the Full-Stack Enterprise Drone Platform for Southeast Asia

From an AIT-anchored hub in Thailand, DroneEntry unifies DJI Enterprise hardware, mission execution, and professional training for regulated, data-driven industries across SEA. Our spotlight breaks down differentiation, catalysts, and team plus what it means for investors and partners. Schedule a call with WOWS to dive deeper into the opportunity. -

SEA Indonesia AI Startups Founder 3 Minutes

Event Recap: Tech in Asia Conference 2025, Jakarta, What Builders, Founders, and Investors Are Really Talking About

The must-know insights from Tech in Asia 2025 Jakarta, AI, capital discipline, and Indonesia’s role, fresh from WOWS Global’s vantage point. -

SEA SME Lending Bitcoin Crypto 3 Minutes

Unocoin: India’s Crypto Veteran Built for Everyday Use

Founded in 2013, Unocoin has built a retail-first crypto app for India: SBP for habit-forming investing, one-tap Crypto Baskets, crypto-backed lending, public Proof-of-Reserves, and Lightning-fast BTC transfers. As rules tighten and transparency matters more, Unocoin’s durability and compliance posture position it as a pragmatic on-ramp for India’s mass market. -

Climate Tech Greentech SEA Energy 7 Minutes

INNOPOWER & EIV: Scaling Decarbonization in Southeast Asia

From Bangkok’s power ecosystem to a $100M growth vehicle with TRIREC, INNOPOWER & EIV are unlocking real-world decarbonization, EV charging, industrial efficiency, and green power, while giving founders a fast track to customers in Southeast Asia. -

SaaS AI Startups AI in Southeast Asia SEA 3 Minutes

NET NEW REVENUE FROM NEW VS. EXPANSION

New logos fuel early growth, but as SaaS companies scale, expansion from existing customers becomes a core engine, about 35% of ARR beyond $20M. We break down why, and how operators should respond. Source: 2024 SaaS Benchmarks Report by High Alpha. -

Southeast Asia Healthcare hospitality tech SEA 4 Minutes

Huray: The Insurer-Integrated Chronic Care Platform to Watch

Huray builds payer-integrated digital programs for chronic diseases, combining connected devices, coaching, and clinician-backed pathways. With distribution through major insurers and a focus on measurable outcomes, the company is poised to scale across Asia’s rapidly evolving health-care landscape.