How an Equity Incentive Plan Can Supercharge Startups in India

WOWS Global December 4, 2023

In the ever-evolving startup landscape of India, competition is fierce. Startups are constantly on the lookout for ways to attract and retain top talent, while also driving growth and increasing valuation. One highly effective tool that has been gaining popularity is an equity incentive plan. This powerful strategy not only incentivizes employees but also aligns their interests with the long-term success of the company.

By offering equity in the form of stock options or restricted stock units, startups can provide their employees with a stake in the company's future. This not only motivates employees to work harder but also creates a sense of ownership and loyalty. Additionally, equity incentives can attract top-tier talent who are seeking the potential for substantial financial rewards.

Implementing an equity incentive plan comes with its own set of complexities and legal considerations, but when done right, it can supercharge the growth of startups in India. It allows companies to incentivize innovation, attract skilled employees, and foster a culture of entrepreneurship. In this article, we will explore the benefits and best practices of implementing an equity incentive plan, and how it can fuel the growth potential of startups in India.

Understanding the growth potential of startups in India

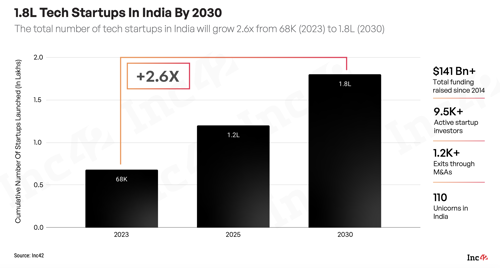

India has emerged as one of the fastest-growing startup ecosystems in the world.

With a large pool of talent, a thriving digital economy, and supportive government policies, the growth potential for startups in India is immense. However, with increased competition and the need to attract and retain the best talent, startups face unique challenges.

Benefits of implementing an equity incentive plan

Implementing an equity incentive plan offers numerous benefits for startups in India. Firstly, it allows startups to attract and retain top talent by offering them a stake in the company's success. This can be a powerful motivator for employees, as they have a direct financial incentive to work hard and contribute to the growth of the company.

Secondly, an equity incentive plan can align the interests of employees with the long-term success of the company. When employees have a stake in the company, they are more likely to think and act like owners, making decisions that benefit the company as a whole. This can lead to increased innovation, productivity, and overall company performance.

Thirdly, equity incentives can help startups compete with larger, more established companies for skilled employees. Many talented individuals are attracted to startups because of the potential for financial rewards. By offering equity, startups can level the playing field and entice top-tier talent to join their team.

Types of equity incentive plans

There are several types of equity incentive plans that startups can consider implementing. The most common ones are stock options and restricted stock units (RSUs). Stock options give employees the right to purchase a specific number of company shares at a predetermined price, known as the exercise price. RSUs, on the other hand, grant employees the right to receive a certain number of shares at a future date.

Each type of equity incentive plan has its own advantages and considerations. Stock options, for example, offer the potential for significant financial gain if the company's valuation increases. However, they can also be more complex to administer and may have tax implications for both the company and the employees. RSUs, on the other hand, provide employees with actual shares of stock, but they may not offer the same potential upside as stock options.

Designing an effective equity incentive plan for startups

Designing an effective equity incentive plan requires careful consideration of various factors. Startups need to determine how much equity to offer, who should be eligible for participation, and how to structure the plan to align with the company's goals and values. It's important to strike a balance between incentivizing employees and preserving the long-term interests of the company.

One key consideration is the vesting schedule. Vesting refers to the process by which employees earn their equity over time. Startups may choose to implement a cliff vesting schedule, where employees become eligible for equity after a certain period of time, or a graded vesting schedule, where equity is earned incrementally over a specified period. The vesting schedule should be designed to encourage employee retention and long-term commitment to the company.

Another consideration is the exercise price or the fair market value of the shares. The exercise price determines the cost at which employees can purchase the shares. Startups need to carefully determine the exercise price to strike a balance between providing employees with an attractive opportunity and protecting the company's interests.

Legal and regulatory considerations for equity incentive plans in India

Implementing an equity incentive plan in India involves navigating various legal and regulatory requirements. Startups need to comply with the Companies Act, 2013, and the Securities and Exchange Board of India (SEBI) regulations. It's important to consult with legal and tax professionals to ensure compliance and avoid any potential pitfalls.

One key consideration is the issuance of securities. Startups need to follow the guidelines set by SEBI for issuing shares to employees. Additionally, startups need to be aware of the tax implications for both the company and the employees. Equity incentives may be subject to tax at the time of exercise or sale, and startups need to carefully consider the tax implications when designing their plans.

Case studies: Successful startups that have utilized equity incentive plans

Several successful startups in India have utilized equity incentive plans to drive growth and attract top talent. One such example is Flipkart, India's leading e-commerce company. Flipkart implemented an equity incentive plan early on, offering stock options to its employees. This not only incentivized employees but also allowed the company to attract and retain top talent in the competitive e-commerce industry.

Another example is Zomato, a popular food delivery platform. Zomato's equity incentive plan played a crucial role in its growth and success. By offering stock options to its employees, Zomato was able to align their interests with the company's long-term vision and motivate them to contribute to its growth.

Challenges and potential drawbacks of equity incentive plans

While equity incentive plans offer numerous benefits, they also come with challenges and potential drawbacks. One challenge is the complexity of administration and compliance. Startups need to invest time and resources to ensure proper administration, record-keeping, and compliance with legal and regulatory requirements.

Another challenge is the potential dilution of ownership. As more equity is granted to employees, existing shareholders may see their ownership stake diluted. Startups need to carefully manage the balance between incentivizing employees and protecting the interests of existing shareholders.

Implementing and managing an equity incentive plan

Implementing and managing an equity incentive plan requires careful planning and ongoing communication with employees. It's important to educate employees about the benefits and mechanics of the plan, as well as any restrictions or limitations.

Startups also need to regularly review and update their equity incentive plan to ensure it remains aligned with the company's goals and values. This may involve revisiting the vesting schedule, the exercise price, or other plan provisions as the company evolves.

Conclusion: Harnessing the power of equity incentive plans for startup growth in India

In conclusion, implementing an equity incentive plan can be a game-changer for startups in India. It allows startups to attract and retain top talent, align employee interests with the long-term success of the company, and foster a culture of entrepreneurship. However, it's important for startups to carefully design and manage their equity incentive plans, considering legal and regulatory requirements and balancing the interests of all stakeholders. When done right, an equity incentive plan can supercharge the growth potential of startups in India, driving innovation, and increasing valuation.