Founders – Here’s How to Conquer Your Fundraising Fear in 3 Simple Steps

Finance Funding Investment Investor Startup

Founders of early-stage startups know the time will come when they need to seek additional funds. This funding is necessary if they are to sustain and grow their business in a healthy way.

While the fundraising process may be a necessity it is not something the vast majority of founders look forward to. Rather the opposite, it is something they are rightly apprehensive about.

This is quite natural because most founders have no experience in the fundraising arena. The thought of getting out there to persuade professional investors that your business is worth investing in can cause angst. For many founders this challenge ranks above any other they face in getting their venture off the ground.

Fear and trepidation or not, founders know that fundraising is a must. It cannot be shied away from if you are to survive. So, let’s take the bull by the horns and look at 3 simple steps to help you overcome that dreaded fundraising fear.

Step #1: Don’t Raise Money too Early but do Plan Ahead

Trying to reach out to professional investors too early in your startup journey will be wasting your time and theirs. This means you need to establish a base for your business and begin progression with firm plans.

Depending upon which business sector you are in will depend upon how things are approached. It is clear that a product-based business will differ from a service-based industry. For example:

Is it a product you are looking to launch? If so, do you need funds to develop a prototype? Or have you already bootstrapped those funds?

If you are in the service industry, do you already have clients? or do you have proof that potential clients are expressing a real interest in using your proposed service?

While a compelling pitch is needed, this must also be supported by factual background data. Founders must be able to demonstrate the progress they have made to date. Stats, any financial data, and sensible projections make a far more compelling story than generalizations.

Timing is key

This makes it vital that you get the timing of your fundraising campaign right. Don’t try too early, don’t leave it too late – Balance is key. That last statement is far easier said than done but with planning, it can be achieved.

The bottom line here is that only you as the founder really know what funds are available and how long they will last. To achieve this an honest and accurate assessment must be made. Once this is understood you will be clear on the length of time you have to sustain and progress your business to a certain level before additional funding is necessary.

Because every founder’s needs are different, thought needs to be put into the timing. The reality is that securing the necessary funding for your startup will usually take longer than you envisage.

Between 3 and 6 months is often bandied about as the time taken to achieve this. While this should be seen as a reasonable timescale, do not take it as gospel. Be prepared for the process to take between 6 and 9 months and plan accordingly.

Founders are seeking something many others want!

The brutal fact is that there are far more founders out there looking for funds than there are investors willing to give. That means you need to capture an investor’s attention and do that quickly. To do so, planning, preparation, and a readiness to confidently address the questions investors will ask have to be seen as an absolute must.

It is imperative for a founder to get their startup strengths out early in the pitch. Investors are not looking to ‘suggest’ ways your business could flourish, they are looking at you to convince them in ways that it will.

Step #2: Cut to the Chase – Target the Right Type of Investor

Professional investors have their preferred profiles. They have decided on the type of startup they are most likely to invest in and they are very unlikely to change that strategy.

This makes doing your homework essential. The investors you are looking for need to be interested in the products or services you intend to offer.

There are various ways to go about such research. Founders can spend productive time looking at investor profiles, understanding the different funds out there and what types of startups they have already invested in. This will help you to narrow down the field of investors who could and should have potential interest in funding your project.

Pitching to investors whose investment profile does not fit your business is wasting both your time and theirs.

On the other hand, an investor who is knowledgeable about the products or services you intend to offer is a very positive way to go. Investors who see your proposal as being within their investment comfort zone will be far more accessible. They are likely to lean towards what you have to offer and have an understanding of your specific funding needs.

Advice should be listened to – It does not always have to be taken!

Another highly effective way to do this is through networking. Make no mistake, getting to know other entrepreneurs and sharing startup experiences is a great way to build up your business knowledge in general. It can also be highly effective in terms of learning how to conquer your fear of fundraising.

Those founders who have already been through the fundraising process can help highlight the challenges faced and hopefully allay some of your concerns associated with raising funds. First-hand experience from those who have ‘been there and done that’ cannot be underestimated and should be taken advantage of.

But this is where gut instinct comes in. The more networking you do, the wider variety of folks you will speak with. Some will offer advice and direction that fits your style and what you are after. Others may go against the grain. Use your instinct to sort the wheat from the chaff.

Investor’s straight-shooting questions need to be addressed

This could justifiably be a whole article on its own but rather than get bogged down with the different investor types and their varying demands, here are just 10 common investor questions that will invariably come up during your fundraising meetings.

Founders need to clearly understand that investors have learned from past experiences and this will be evident from the type of questions you will be asked.

- What is the market opportunity?

- What is your USP (Unique Selling Proposition)?

- Can you give details of the early traction that your company has achieved?

- What makes customers choose your solution?

- Can you further explain your business model?

- How will potential customers find you?

- Why is your team the right one to back? (and who is looking after operations while you are here!)

- How healthy is your financial status?

- What is your long-term vision for your company?

- What are the potential risks to the business?

It is also very likely you will be asked about the major competitors in your field. It stands to reason that founders should have a good handle on this and therefore preparation on how to respond positively should be your goal.

Founders need to be prepared for these and similar questions. Being unable to answer, long hesitation, or “I’ll get back to you on that” is unlikely to cut it.

Make a ‘cheat sheet’ of answers you feel are relevant from this list, add more, and then make notes at each meeting on any curve-ball questions investors throw at you. Compiling such a list will allow you to have some comprehensive responses to the type of questions investors will put over during your various meetings.

Fundraising is an art – Founders need to be prepared for….

Before getting into Step #3 and how you can lean on experts in the startup and fundraising world, let’s consider a few things that founders need to be aware of and be prepared for.

The amount of funding you will need should be carefully (and realistically) totaled up. The period this funding covers should be anywhere between 12 and 24 months. Do the math and work out different periods over the amount(s) needed. This will give you flexibility during investor negotiations.

Even assuming you are targeting the right type of investor, founders need to understand that a typical investor will look at between 40-50 startup funding proposals before investing in one they feel fits their investment profile and portfolio.

This means rejection has to be accepted, accepted perhaps, but not to the extent it prevents you from continuing your determined search.

Founders need to be prepared for the long haul. This includes gathering accurate stats on how the business is currently functioning, forecasts on how you intend it to grow, and pulling together a compelling presentation and pitch.

We have already mentioned some expected timescales to secure the funding required but with that founders also need to be aware of how much ‘out of office’ time needs allocating.

When getting out on the road and into serious pitch meetings this can easily take 20+ hours out of an already heavy week’s schedule. With such preparation time and time on the road, you need someone at base who is capable of running things efficiently while you are away (as per one of the investor questions stated above).

Founders need to understand that an investor will be investing in your business idea and you. This means both have to match what they are looking for if they are to part with the funds you need.

Step #3: Conquer Fundraising Fear – Seek Expert Assistance

It is little wonder that many founders dread the testing but essential task of fundraising. Having to go it alone can be very daunting indeed. However, that does not need to be the case. There is a tried and trusted solution that will make your fundraising journey a much more manageable one.

That solution is to partner with the highly knowledgeable team at WOWS Global. By doing so you will receive expert advice, assistance, and a structured way forward to maximize your fundraising efforts.

WOWS Global has established a state-of-the-art online ecosystem that offers a full suite of tools for founders to take advantage of. From the fundraising perspective, we can help with such things as:

- Pitch Deck Preparation.

- Due Diligence Preparation.

- Research and Market Insights.

But things certainly do not stop there. Our experienced team is here to assist with all aspects of a startup’s journey. You will be able to take advantage of our comprehensive ESOP, legal, financials, valuations, and human resources management services.

WOWS Global also has the ability to match the correct type of investor with your startup. This is one particular benefit that cannot be underestimated.

To take the strain and pain out of your fundraising efforts please do not hesitate to reach out to us on: contact@wowsglobal.com

Related Posts

-

Investment AI Innovation Smart Cities Smart Fintech Analysis

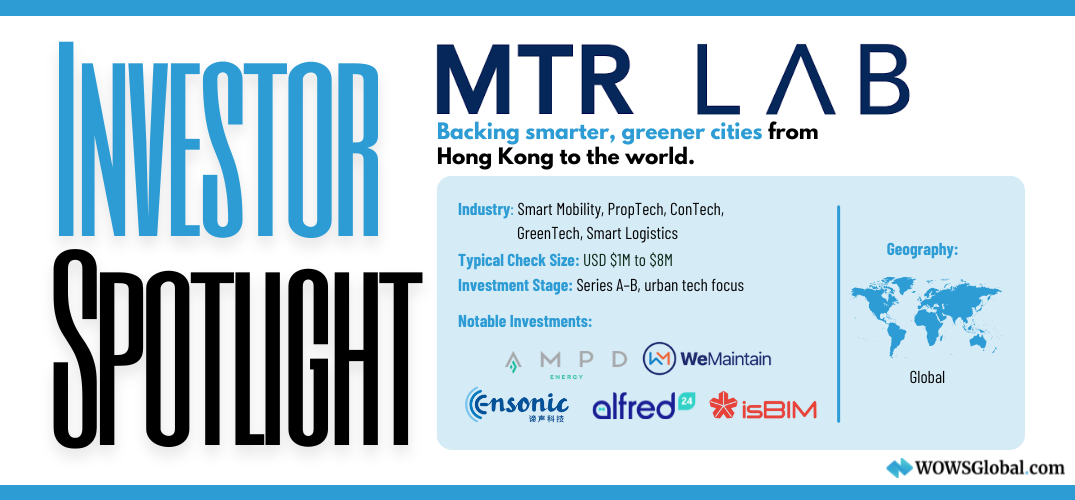

MTR Lab: Investing in the Future of Smart Cities

MTR Lab is the strategic venture arm of MTR Corporation, investing in early-growth startups driving smart city and sustainability innovation. With a focus on urban tech, from clean energy and mobility to PropTech and smart logistics. MTR Lab helps founders scale impactful solutions across Hong Kong and beyond. -

AFG Partners Fintech VC Asia finance

AFG Partners: Empowering Global B2B Fintechs to Scale Across Asia

AFG Partners is a strategic venture capital firm backing global B2B fintech and enabling tech startups. Headquartered in Singapore and Hong Kong, AFG focuses on helping early-stage companies expand into Southeast Asia’s dynamic financial markets. Explore their investment strategy, standout portfolio, and why founders value their cross-border expertise and collaborative approach. -

Financial mistakes startup Fractional CFO

Financial Mistakes That Hurt Businesses—Startups & SMEs Alike

Many startups and SMEs unknowingly make financial mistakes that hurt profitability, cash flow, and long-term success. From misinterpreting cash in the bank to scaling without financial planning, these pitfalls can be costly but avoidable. Discover the most common financial mistakes and how to fix them in this guide by WOWS Global. -

Startup MVP Lean Startup Feedback

The MVP: Turning Bare Bones Into Billion-Dollar Dreams (Or a Glorified Prototype)

The MVP (Minimum Viable Product) is your scrappy, bare-bones version of your grand vision. Learn how to strike the right balance between too minimal and too polished while preparing for an MVP launch in this startup guide. -

Indonesia Investment News

Validus Raises $50M from HSBC to Boost SME Lending in Indonesia

Discover how Validus is using a $50M debt facility from HSBC to boost SME lending in Indonesia and support financial inclusion across Southeast Asia. -

Early-Stage Investors Funding Funding Round Fundraising for Founders Investor

Shh! Don’t Share These Fundraising Insider Secrets

Startup founders need to fasten their seatbelts and prepare for a roller-coaster ride if they are to achieve success. It is a straight fact that founders will find themselves wearing many hats to get their venture up, running, and thriving.