Inside WOWS: Investment Insights and Trends

Welcome to the WOWS blog – your hub for an expert take on the evolving landscape of private investments. From deep dives into market trends to spotlight stories on emerging startups and strategic investment guidance, our blog is dedicated to empowering investors and entrepreneurs alike with the knowledge to succeed.

Featured blog posts

-

Trump Tariffs SEA global trade 6 minutes

Tariff Tsunami: What Trump’s New Trade War Means for Southeast Asia’s Startups

With Trump’s re-election and a 145% tariff on Chinese goods, Southeast Asia’s startup scene is facing a global trade shakeup. Startups dependent on cross-border supply chains and exports are feeling the squeeze, while local-market-focused ventures are seeing new opportunities. Learn how founders and VCs are adapting, and why resilience, localization, and ASEAN-first thinking are now essential for success. -

Gowajee Thai AI voice technology 6 minutes

Company Spotlight: Gowajee – The Future of Thai-Language AI Voice Technology

Gowajee is Thailand’s first Thai-language AI voice tech company, automating call center QA and customer engagement for enterprise clients. With clients like Generali and SCG already onboard, Gowajee is a rising player in Southeast Asia’s booming AI landscape. -

ZWC Partners VC VC spotlight 5 minutes

ZWC Partners: Accelerating Asia’s Digital and Deep Tech Future

With over $2.5 billion in assets under management, ZWC Partners is a powerhouse investor supporting Asia’s high-impact startups in digital, deep tech, new energy, and consumer innovation. Explore their cross-border strategy, portfolio highlights, and why founders choose ZWC. -

Startup governance eFishery financial oversight 5 Minutes

When Hype Meets Reality: The Vital Role of Governance in Startup Success

The recent collapse of AI darling 11x is a reminder that hype alone doesn’t build lasting businesses. As Zilingo and eFishery have shown before, poor governance can undo years of growth. In this blog, WOWS Global explores why internal controls, financial oversight, and transparent governance are essential for investor trust and sustainable startup success. -

Lunash debt recovery AI fintech 4 minutes

Company Spotlight: Lunash – AI-Powered Debt Recovery for the Future of Finance

Lunash is revolutionizing debt collection through AI-driven automation, predictive analytics, and personalized repayment strategies. Learn how this fintech startup is solving inefficiencies in traditional collections and enabling financial institutions to recover overdue loans while maintaining borrower relationships. -

GeoSquare.ai AI retail analytics 6 minutes

Company Spotlight: GeoSquare.ai – AI-Driven Geospatial Intelligence for Smarter Decision-Making

GeoSquare.ai is revolutionizing geospatial intelligence with AI-powered 50m x 50m location grids. From banking to real estate, this Indonesian startup is helping companies make smarter, data-driven decisions with hyperlocal insights. -

eFishery CFO due diligence 8 minutes

The eFishery Fiasco: A Startup Dream Turned Accounting Nightmare

What went wrong at eFishery? This blog unpacks the accounting red flags and shows why financial oversight through fractional CFO services is a must-have for fast-growing startups across Southeast Asia and MENA. -

AIPath.one venture building AI 5 Minutes

Company Spotlight: AIPath.one – AI-Powered Venture Building for Startups & Product Leaders

AIPath.one is automating the hardest parts of venture building—product validation, GTM execution, and competitive analysis—helping startups scale smarter and faster. A standout from WOWS Dealflow’s AI Demo Day. -

M&A readiness SME growth fractional CFO 5 Minutes

Signs Your Business Is Ready for M&A

Mergers & acquisitions aren’t just for billion-dollar companies anymore. Here are 7 signs your startup or SME might be ready to scale, exit, or acquire in 2025. -

March 2025 SEA VC WOWS 5 Minutes

WOWS Investment Highlights – March 2025: Southeast Asia Powers Up as Funds Flow In

March 2025 saw a surge in venture capital activity across Southeast Asia. From Malaysia’s new climate funds to Vietnam’s rise in healthtech and EV, here’s what’s driving the region’s deal frenzy and where smart money is flowing next. -

Integra Partners VC SEA 4 minutes

Integra Partners: Investing in the Future of Fintech, Healthcare & Climate Innovation

Integra Partners is empowering fintech, healthcare, and climate startups across Southeast Asia with hands-on VC support and mission-driven capital. Learn how they're making impact investing scalable. -

construction tech AI Indonesia 5 minutes

Company Spotlight: Konstruksi.AI – Transforming Construction with AI-Powered Efficiency

Konstruksi.AI is transforming the $15.46T construction industry by using AI to eliminate inefficiencies, reduce quality control failures, and simplify compliance. With early traction and strong government engagement, this Indonesian startup is a game-changer in construction tech. -

Reazon Capital VC SEA 6 minutes

Reazon Capital: Empowering Asia's Next Wave of Innovators

Reazon Capital is a self-funded venture firm with unrestricted investment timelines, allowing unparalleled flexibility in supporting high-growth startups across Asia. With a strong focus on entertainment, deep tech, and emerging markets, Reazon Capital invests in Vietnam, Indonesia, and Japan, empowering the next wave of innovators and disruptors. -

Sensory AI deep-tech AI AI-Nose 4-6 minutes

Company Spotlight: MUI Robotics – Digitizing the Sense of Smell with Sensory AI

MUI Robotics is pioneering Sensory AI technology, enabling machines to digitize the sense of smell. With over 600 enterprise clients and profitability within its first year, this Thailand-founded deep-tech startup is now expanding globally. Featured at WOWS Dealflow AI Demo Day, MUI Robotics is reshaping industries from food tech to pharmaceuticals with its AI-powered odor detection and environmental monitoring solutions. -

Insignia Ventures SEA VC 4-6 minutes

Insignia Ventures Partners: Powering Southeast Asia’s Next Tech Giants

Insignia Ventures Partners is one of Southeast Asia’s most influential venture capital firms, with $800M+ in AUM and a portfolio featuring Carro, Ajaib, GoTo, Appier, and Shipper. Focused on fintech, AI, e-commerce, and enterprise tech, Insignia provides capital, strategic support, and operational expertise to high-growth startups. Discover how this powerhouse investor is shaping the region’s next wave of tech giants. -

Financial mistakes startup Fractional CFO 4-6 minutes

Financial Mistakes That Hurt Businesses—Startups & SMEs Alike

Many startups and SMEs unknowingly make financial mistakes that hurt profitability, cash flow, and long-term success. From misinterpreting cash in the bank to scaling without financial planning, these pitfalls can be costly but avoidable. Discover the most common financial mistakes and how to fix them in this guide by WOWS Global. -

Plexis.ai healthcare AI 4-6 minutes

Company Spotlight: Plexis.ai – Transforming Healthcare with AI-Driven Automation

Plexis.ai is transforming healthcare operations by leveraging AI-driven automation to streamline workflows, enhance efficiency, and reduce staff burnout. With proven traction across hospitals and clinics, government contracts, and an ambitious global expansion plan, Plexis.ai is positioned as a leader in the AI automation space. Learn more about how this WOWS Demo Day finalist is disrupting the $50B AI healthcare automation industry. -

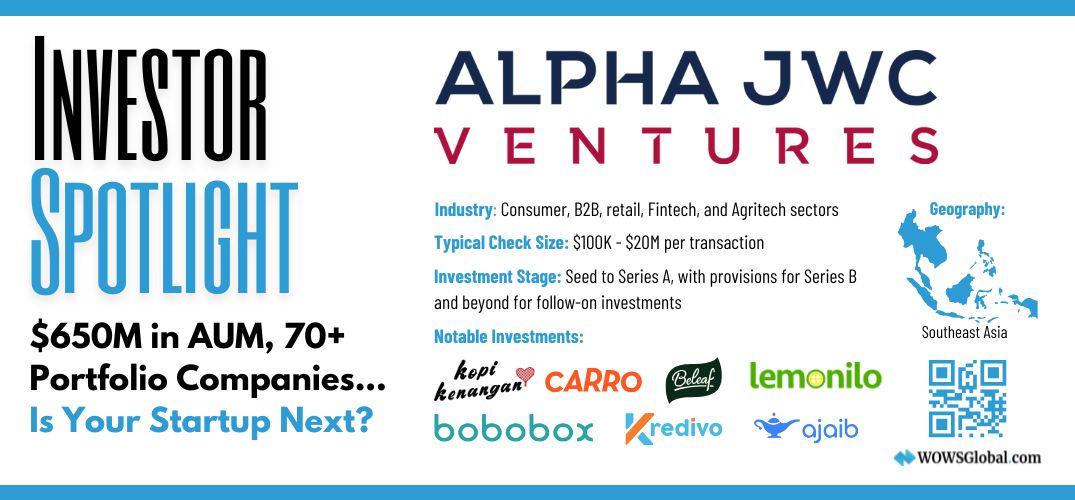

Alpha JWC VC SEA 6 minutes

Alpha JWC Ventures: Powering the Next Generation of Southeast Asian Startups

Alpha JWC Ventures has grown into Southeast Asia’s largest and best-performing early-stage fund, managing $650 million in assets and backing over 70 high-growth startups, including four unicorns and 27 centaurs. Learn how Alpha JWC is fueling innovation across fintech, consumer tech, agritech, and B2B sectors in Indonesia and beyond. -

AI Video Editing Short-Form Video 6 minutes

Company Spotlight: Snapcut – AI-Powered Video Editing at Scale

Snapcut is revolutionizing video editing with AI-powered automation, helping creators and businesses scale content effortlessly. By automating clip selection, captions, and formatting, Snapcut turns long-form videos into scroll-stopping short-form content in seconds. -

AI Security Identity Verification 3-5 minutes

Company Spotlight: Verihubs – Redefining Identity Verification with AI

Verihubs is revolutionizing digital security with AI-driven identity verification, helping businesses combat fraud and ensure compliance. Through face recognition, deepfake detection, and AI-powered authentication, Verihubs is securing digital transactions across fintech, banking, and enterprise security. -

Conversational AI NLP AI 3-5 minutes

Company Spotlight: Kata.ai – Transforming Customer Service with Conversational AI

Kata.ai is redefining customer engagement in B2B commerce through Conversational AI and Natural Language Processing (NLP). By automating interactions and optimizing operations, Kata.ai is empowering enterprises with AI-driven efficiency. -

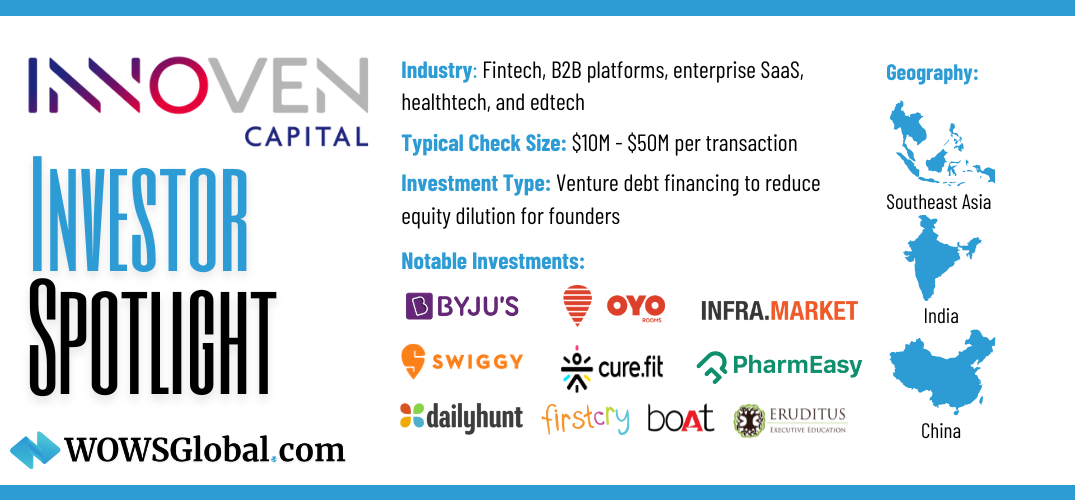

Venture Debt InnoVen Capital Startup Funding 5-7 minutes

Investor Spotlight: InnoVen Capital – Powering Asia’s Startup Ecosystem with Venture Debt

For startups aiming to scale without sacrificing equity, venture debt has emerged as a crucial financial tool. InnoVen Capital, a leading venture debt provider in Asia, has helped over 180 startups grow without dilution. With a focus on India, China, and Southeast Asia, InnoVen Capital has deployed over $400 million across 250+ transactions, backing industry giants like Byju’s, Swiggy, Oyo, and PharmEasy. Learn how venture debt can be a game-changer for your startup. -

Logistics Robotics Automation 6 minutes

Company Spotlight: Quikbot.ai—Redefining Last-Mile Deliveries for Smart Cities

Quikbot.ai is revolutionizing last-mile delivery with its autonomous final-mile delivery platform-as-a-service (AFMD PaaS). Designed for densely populated vertical smart cities, Quikbot integrates with major couriers and retailers, delivering cost-efficient, sustainable, and scalable solutions. With 50–70% cost savings and 30–50% lower emissions, Quikbot is reshaping urban logistics while aligning with global sustainability goals. -

DeepSeek AI Innovation AI Disruption 7 minutes

DeepSeek: The Market Disruptor Reshaping AI and Technology Stocks

DeepSeek’s disruptive AI model is shaking the global tech landscape. By dramatically cutting costs and innovating on legacy hardware, this Chinese AI startup is raising questions about Big Tech dominance and reshaping investment strategies worldwide. -

AI Revolution Stargate Project SEA 7 minutes

Stargate’s Ripple Effect: The $500 Billion AI Revolution and Its Global Impact

Stargate Project, a $500 billion AI megaproject launched by OpenAI, SoftBank, and Oracle, is set to reshape the global AI landscape. From the U.S. to Southeast Asia and the Middle East, discover how this ambitious endeavor is sending ripples across economies, inspiring innovation, and sparking the global AI arms race. -

Healthcare Quick Commerce E-Pharmacy 6 minutes

Company Spotlight: Medino’s—Redefining Healthcare Delivery in India, One 30-Minute Promise at a Time

Medino’s is disrupting India’s $65 billion pharmacy market with a bold promise: 30-minute medicine delivery or it’s free. With a rapidly growing footprint, 24/7 operations, and proven profitability, this quick-commerce healthcare leader is transforming accessibility and convenience for millions. -

Venture Capital Founder Startup Funding 6 minutes

The Founder-Turned VC vs. The Non-Founder VC – Two Species in the Venture Jungle

Venture capitalists come in all forms, but two stand out: the battle-tested Founder-Turned VC and the strategic Non-Founder VC. Learn how their distinct approaches to risk, pivots, and due diligence shape their partnerships with startups and find out which one is the right fit for your journey. -

AI in Southeast Asia Artificial Intelligence 2025 AI-powered 6 Minutes

Southeast Asia's AI Revolution: 2024 Recap and 2025 Outlook

2024 was a defining year for artificial intelligence (AI) in Southeast Asia. From healthcare to fintech and logistics, AI powered innovation and shaped investment trends across the region. As we look ahead to 2025, discover what lies ahead for this transformative technology in Southeast Asia’s growing economy. -

Startup Funding Venture Capital VC Red Flags 5 Minutes

Don’t Accept VC Money If You See These 5 Red Flags in a Term Sheet

A term sheet sets the tone for your startup’s future, but not all deals are created equal. Learn the five red flags you should never ignore when negotiating VC funding to protect your vision and equity. -

SEA Private Equity 2025 Outlook 6 minutes

Southeast Asia’s Investment Rollercoaster: Closing 2024 with Big Moves and a Bold Outlook

As 2024 draws to a close, Southeast Asia’s startup ecosystem is making waves with record-breaking deals, rising unicorns, and bold expansions in healthcare, fintech, and sustainability. Discover how December's milestones are setting the stage for a transformative 2025 in our latest blog. -

Startups Venture Capital Unicorn Startups 5 minutes

Superhero Franchises and Unicorn Startups: Why Investors Love the Blockbusters

What do superhero franchises and unicorn startups have in common? Investors love them for the same reason—they’re scalable, high-impact, and built for long-term success. Learn why your startup needs an origin story, a killer team, and the potential to create a universe of opportunities in this blockbuster blog from WOWS Global. -

AI in Manufacturing Quality Control 4 minutes

AEyeMynd – Redefining Quality Control with Intelligent AI

AEyeMynd is transforming quality control for high-mix, low-volume manufacturing environments with AI-driven solutions. By ensuring unmatched precision and scalability, the company is helping industries like aerospace, medical devices, and automotive achieve operational excellence. -

SEA PE Startup Ecosystem Sustainability 6 minutes

Riding the SEA Investment Wave: Resilience, Innovation and the Road to 2025

Southeast Asia's private equity scene is thriving in 2024, driven by youthful demographics, government-backed initiatives, and innovative startups. As the year ends, SEA is paving the way for a transformative 2025 with strategic investments in fintech, deeptech, and sustainability. -

Fundraising Angel Syndicates VC 6 minutes

The Battle of Angel Syndicates vs. WOWS Global: Why the Choice is Clear

WOWS Global vs. Angel Syndicates: A detailed comparison of costs, network depth, technology, and expert support. Learn why WOWS Global is the better choice for startup fundraising and scaling. -

Recruitment Workforce Management HR Tech 5 minutes

TalentHero – Revolutionizing Recruitment and Workforce Management Across APAC

TalentHero is transforming recruitment and workforce management in APAC with AI-driven solutions to address global talent shortages. Discover how this HR tech leader is redefining the hiring landscape. -

Superagent AI in Real Estate 5 minutes

Company Spotlight: Superagent – Transforming Real Estate with AI-Driven Innovation

Superagent is reimagining real estate with AI, delivering a seamless, efficient experience for buyers, sellers, and realtors. Meet the team and discover their vision for a smarter property market. -

Fractional CFO SME Growth Financial Strategy 6 minutes

Why Fractional CFOs Are the Secret Weapon for SMEs

Need expert financial strategy without the full-time cost? Discover why fractional CFOs are the game-changers for growing SMEs, providing tailored insights in cash flow, forecasting, fundraising, and more. -

SEA MENA Venture Capital 6 minutes

October’s Funding Fiestas and Game-Changers: SEA and MENA’s Wild Ride Through the Investment Winter

October brought record-breaking investments and strategic partnerships to Southeast Asia and the Middle East. From electric vehicles to fintech, learn how startups and VCs are navigating the investment winter with resilience and ambition. -

Series B Southeast Asia Middle East 4 minutes

Series B Showdown: Southeast Asia and the Middle East Break Through in 2024

In a world where raising venture capital feels like pulling teeth, Southeast Asia and the Middle East have become unlikely champions. Specifically, we’re talking about Series B funding—the so-called "make or break" round where startups are expected to have proven product-market fit and demonstrated strong growth metrics. Data from Carta shows a global drop in Series B funding, particularly in the U.S. market, where only the most capital-efficient companies are managing to score checks. But for founders in Southeast Asia and the Middle East, 2024 is shaping up differently. Series B, once a hard sell in these regions, is now a coveted target and, more importantly, an achievable milestone. Let’s break it down. -

Founder Spotlight Sirka.io Entrepreneurship 3 minutes

Founder Spotlight: Rifanditto "Ditto" Adhikara – Personalizing Healthcare with Sirka.io

Sirka.io is transforming the management of chronic health conditions through its proactive and personalized healthcare approach. Led by its founder, Rifanditto "Ditto" Adhikara, Sirka began as a nutrition consultation app, inspired by Ditto’s personal experience with pre-diabetes. The company has since evolved into a comprehensive healthcare platform offering a suite of services, from lifestyle and dietary interventions to medication management and continuous health support. Sirka empowers individuals to lead healthier lives by addressing chronic conditions with tailored solutions. -

Accelerators YC Alternative Venture Capital 6 minutes

Alternatives to Y Combinator: A Better Way to Accelerate Your Startup?

Let’s face it—when most founders think about startup accelerators, Y Combinator (YC) usually tops the list. It's the Ivy League of accelerators, famous for kickstarting unicorns like Airbnb and Dropbox. But, like choosing Harvard, going with YC has its drawbacks. The reality is that Y Combinator, and other traditional accelerators, might not be the silver bullet they seem for every startup. -

Founder Spotlight Enigma Camp Entrepreneurship' 2 minutes

Founder Spotlight: Muhammad Irfan – Solving Youth Unemployment with Enigma Camp

In the face of rising youth unemployment and a growing skills gap, Muhammad Irfan founded Enigma Camp to address these pressing global challenges. His company provides comprehensive training programs designed to prepare fresh graduates for careers as software developers, helping bridge the gap between education and employment. By offering end-to-end services, from talent acquisition to project-based work placement, Enigma Camp is ensuring that young professionals are equipped with the tools they need to succeed in the rapidly expanding tech industry. -

Startup Team MVP Business Strategy 3 minutes

Every Startup Needs a Dennis Rodman: The Real MVPs Behind Success

Building a startup team is a lot like assembling a band of misfits and expecting them to perform like the '96 Chicago Bulls. You’ve got your dreamers, your doers, your wild cards—and somehow, you’ve got to make them all play together, harmonize even, if you want to make it through the grind of startup life. It’s not about having a team of flashy superstars. It’s about finding the Dennis Rodmans of the world—the people who do the dirty work, hustle, and take pride in keeping the machine running while someone else dunks. -

409A Valuation VC valuation Startup Fundraising Post Money Valuation 4 minutes

409A Valuation vs. VC Valuation: What Every Startup Founder Needs to Know

Navigating the world of startup valuations can be challenging, especially when balancing 409A valuations for IRS compliance with VC valuations for fundraising. In this article, we break down the key differences between these two crucial valuation types, how they impact your company’s growth, and why both are essential for startup founders in Southeast Asia and the Middle East. Whether you’re issuing stock options or negotiating with investors, understanding these valuations can set your business up for long-term success. -

ESOPs Southeast Asia Startups Talent Retention 5 minutes

ESOPs: Unlocking the Future of Talent and Capital for Southeast Asian Startups

ESOPs are a crucial tool for startups to retain talent and ensure long-term success. Learn how Southeast Asian startups can navigate the complexities of ESOPs and even implement virtual options to motivate their teams. -

Business Plan Startups Financial Planning 6 minutes

The Business Plan: How to Predict the Future Without a Crystal Ball

Writing a business plan is like trying to predict the future. It’s not about perfection; it’s about creating a roadmap that can evolve as your startup grows. Learn how to strike the balance and use it to guide your entrepreneurial journey. -

Saivya Chauhan Blitz Electric Founder Spotlight 7 minutes

Founder Spotlight: Saivya Chauhan, the Force Behind Blitz Electric

Meet Saivya Chauhan, the visionary founder of Blitz Electric, a company tackling the flaws of the gig economy through sustainable logistics and better pay for delivery drivers. Learn how he’s shaping the future of last-mile logistics with electric vehicles. -

Southeast Asia SME Lending Mergers Sustainability 6 minutes

Southeast Asia’s Investment Frenzy in September 2024: Startups Thriving Across Sectors

September 2024 has been a landmark month for Southeast Asia’s startup scene, with significant investments across fintech, AI, sustainability, and EVs. Learn how these industries are driving the region’s innovation. -

Startup MVP Lean Startup Feedback 5 minutes

The MVP: Turning Bare Bones Into Billion-Dollar Dreams (Or a Glorified Prototype)

The MVP (Minimum Viable Product) is your scrappy, bare-bones version of your grand vision. Learn how to strike the right balance between too minimal and too polished while preparing for an MVP launch in this startup guide. -

Impact Investing SEA Startup Ecosystem 5 minutes

The Impact Hustle: How SEA’s Impact Investing is Changing the Game

Impact investing is transforming Southeast Asia's startup scene by blending profit with purpose. Learn how investors are backing businesses that deliver both financial returns and measurable social impact. -

Term Sheets Redemption Rights Anti-Dilution Liquidation Preference 5 minutes

Key Considerations for Founders in Startup Term Sheets: Do’s and Don’ts

Negotiating a term sheet is a critical step in securing investment. Learn the essential do’s and don’ts for founders when handling valuation, liquidation preferences, anti-dilution, and more. -

Data-Driven Decisions Business Strategy Data Overload 3 minutes

Data-Driven Decisions: The Fine Line Between Insight and Overload

Data is essential for modern decision-making, but too much can lead to overload. Learn how to find the balance between data insight and analysis paralysis for smarter, more confident decisions. -

Startup Fundraising 409A Valuation Financial Model Pitch Deck 5 minutes

Case Study: MedTech Startup in Southeast Asia Raises $3 Million USD with WOWS Global’s Premier Package

A Southeast Asia-based MedTech startup successfully raised $3M in Series A funding using WOWS Global’s Premier Package. Learn how our full-service fundraising solution helped them secure new investors and reinvestment from existing backers. -

Fintech XenCapital Helicap Venture Debt 5 minutes

XenCapital Secures $50M Credit Facility from Helicap to Empower Southeast Asian Businesses

XenCapital, the lending arm of Xendit, has secured a $50M credit facility from Singapore's Helicap to provide vital financing to underbanked businesses across Southeast Asia. This partnership reflects the region's growing reliance on alternative lending solutions to drive financial inclusion. -

Venture Debt SEA Startups Genesis Alternative Ventures 4 minutes

Genesis Alternative Ventures Raises $125M for Second Venture Debt Fund: Boosting SEA’s Investment Landscape

Genesis Alternative Ventures closes $125M for its second venture debt fund, providing crucial growth capital to Southeast Asia’s startups. Discover why venture debt is the perfect tool for startups looking to scale without diluting equity. -

#SoutheastAsia #Startups #MegaDeals 7 minutes

Big Checks, Bigger Risks: The Anatomy of Southeast Asia’s 2024 Startup Deals

Southeast Asia in 2024 is booming with big checks and bigger risks. As startups raise colossal sums, the stakes have never been higher. Fintech, e-commerce, and foodtech lead the charge, but who’s cutting the checks, and who’s taking the bait? Learn more about this high-stakes poker game unfolding in one of the world’s most dynamic regions. -

#PitchDeck #Startup #BusinessStrategy 3 minutes

The Pitch Deck: Turning Bold Ambitions into Buzzwords and Bullet Points

Creating a pitch deck is a delicate art of condensing bold ideas into bullet points and buzzwords. Learn how to craft a winning deck that strikes the perfect balance between vision and viability. -

Whistleblower Compliance Entrepreneurship 7 Minutes

Founder Spotlight: Pav Gill - The Visionary Behind Confide

Pav Gill, the whistleblower behind the Wirecard scandal, turned his experience into Confide, a platform dedicated to fostering transparency and accountability. In this Q&A, Pav shares how his journey shaped Confide's evolution into a complete compliance solution, his entrepreneurial insights, and his advice to future founders. -

Indonesia Investment News 3 Minutes

Validus Raises $50M from HSBC to Boost SME Lending in Indonesia

Discover how Validus is using a $50M debt facility from HSBC to boost SME lending in Indonesia and support financial inclusion across Southeast Asia. -

startup pivot business growth Mike Cappelle 2 minutes

The Startup Pivot: From Bright Ideas to ‘What the Hell Were We Thinking?’

Pivoting a startup can be a rollercoaster, where bright ideas sometimes lead to hard lessons. Explore how changing course can make or break a business, with insights from WOWS' Co-Founder and COO, Mike Cappelle. -

Financial Model Case Study Funding Success 3 minutes

Case Study: Transforming Financial Planning for HealthTech Innovators

Discover how WOWS Global crafted a detailed financial model for HealthTech Innovators, helping them secure $10 million in funding. Learn about our process and the impact of a robust financial strategy. -

409A Valuation Post Money Valuation Fair Market Value 3 minutes

Case Study: Comprehensive 409A Valuation for FinTech Solutions Group

Learn how WOWS Global provided FinTech Solutions Group with a detailed and accurate 409A valuation, ensuring compliance and supporting strategic financial planning. -

ESOP Employee Stock Option Plan Employee Retention 3 minutes

Case Study: Driving Employee Engagement through Customized ESOP Solutions

Discover how a tailored Employee Stock Ownership Plan (ESOP) significantly boosted employee engagement, retention, and productivity for a rapidly growing company. Learn about the steps involved in designing and implementing a successful ESOP. -

Southeast Asia startups Grab Antler Papaya Growsari 6 minutes

August Recap of the Southeast Asian Startup Scene: A Wild Ride into a New Era

August 2024 was a game-changing month for Southeast Asia’s startup scene. From Grab’s major acquisition to Antler’s ambitious fund, explore the moves reshaping the region’s future. -

venture debt startup ecosystem startup funding Mike Cappelle

The Rise of Corporate Investors and Venture Debt in Early-Stage Funding

In 2024, corporate investors and venture debt are reshaping early-stage funding. Discover how these trends are creating new opportunities for startups and what founders need to know. -

term sheets startup funding liquidation preferences 5 minutes

Understanding Term Sheets: Essential Insights from Gagan Singh, CEO of WOWSGlobal

Learn from Gagan Singh, CEO of WOWSGlobal, as he breaks down the critical elements of a term sheet. Protect your startup's interests with insights into liquidation preferences, anti-dilution provisions, redemption rights, and board matters. -

SAFE agreement Thailand startups Southeast Asia 6 minutes

Surfing the SAFE Wave: How Thailand's Startups Are Riding High

Thailand’s startups are catching the wave of innovative funding with SAFEs. Learn how these agreements are transforming early-stage financing in the region, the benefits they offer, and the legal challenges they present. -

Sunny Khurana Spark founder spotlight startup resilience 7 minutes

Founder Spotlight: Sunny Khurana, the Visionary Behind Spark

Sunny Khurana, the visionary founder of Spark, is on a mission to redefine connections through curated experiences. In this interview, he shares his journey, insights, and advice for aspiring entrepreneurs. -

Papaya startup hospitality tech Southeast Asia 5 minutes

Papaya's Expansion: A Fresh Take on Hospitality Tech in Southeast Asia

Papaya, a fintech startup from Thailand, is revolutionizing the hospitality industry in Southeast Asia. With fresh funding from BEENEXT and A2D Ventures, Papaya is ready to scale its digital ordering and payment platform across the region. -

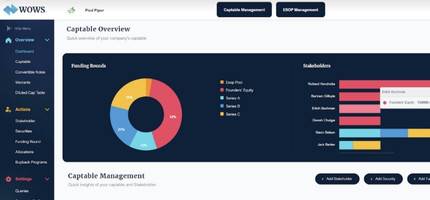

cap table investor relations 4 minutes

Is Your Investor "Cap Table Material"?

Choosing the right investor is like finding a life partner—make sure they’re “cap table material.” Our cheeky checklist will help you spot the keepers from the flings. Read on! -

startups venture capital 5 minutes

Don't Screw Yourself by Giving Away Redemption Rights: A Cautionary Note for Startups

Startup founders, beware! Redemption rights in your term sheet can become a financial burden that jeopardizes your business. Learn how to negotiate better terms and protect your company’s future. -

Startups Fractional CFO Fundraising 5 minutes

Why Your Accounting Director Might Not Be Enough: The Surging Demand for Fractional CFOs in Startups

In the fast-paced world of startups, having an Accounting Director may not be enough. Discover why over 75% of pre-Series B startups are turning to fractional CFOs for strategic financial guidance that can make or break your growth trajectory. -

Fintech Startups Social Investing Willy Tan 8 minutes

An Interview with Willy Tan: Founder of Seeds on Empowering Financial Literacy in SEA

Dive into our exclusive interview with Willy Tan, the founder of Seeds, a groundbreaking social investing platform in Southeast Asia. Discover his journey, the platform's mission, and insights on building a fintech startup focused on financial literacy. -

SaaS ASEAN Business Growth 5 minutes

Why SaaS Alone May Not Be Enough in ASEAN - Embracing SaaS+ Service

In ASEAN’s diverse markets, offering only SaaS often falls short. Learn why combining SaaS with high-quality services (SaaS+ Service) is crucial for growth and success in the region. -

Startups Entrepreneurship Venture Capital 3-4 minutes

Navigating the Pitch Process: Questions Startups Should Ask VCs

Facing rejections while pitching your startup? Equip yourself with the right questions to ask VCs to better understand their investment focus and select partners who truly believe in your journey. -

Early-Stage Investors Funding Funding Round Fundraising for Founders Investor

Shh! Don’t Share These Fundraising Insider Secrets

Startup founders need to fasten their seatbelts and prepare for a roller-coaster ride if they are to achieve success. It is a straight fact that founders will find themselves wearing many hats to get their venture up, running, and thriving. -

Angel Investors Investor Venture Capitalists Different Types of Investors

Here Are 5 Different Types Of Investors And How They Can Meet Founders Needs

When it comes to establishing and growing your business, investors play a major role. It is the level and quality of investor involvement that can determine a startup's success or failure. -

Equity Management Finance Funding Funding Round Fundraising for Founders

The A-Z of Fundraising for founder (Part: 2 E-H)

Founders of startups have a lot to contend with as they formalize their ideas, turn them into reality, and then proceed to grow their business healthily. -

Funding Funding Round Fundraising for Founders Investment Startup Funding

The A-Z of Fundraising (Part: 1 A-D)

Founders of startups have a lot to contend with as they formalize their ideas, turn them into reality, and then proceed to grow their business in a healthy way. -

Funding Funding Round Investment Investor Startup Startup Funding Stock

Founders – Are you Ready for Your Next Funding Round?

It is no secret that startup founders need to seek funding at different stages of their venture. However, this is no straightforward process. To secure the amount of funding you are after it is necessary for founders to fully understand what each funding round entails and when the time is right to begin each stage. -

Equity Equity Management Finance Investment Investor Startup Stock

What is Equity and how can Early Stage Startups Founders Leverage it?

When starting a new venture, founders of early-stage startups need all the leverage they can get. In that respect, equity and how it is distributed must play a major part in every founder’s strategy. -

Cap Table Equity Management Finance Investment Startup Stock Dilution

Startups – Here’s a Step by Step Guide on how to Calculate Equity Dilution

Startup founders need a comprehensive understanding of equity dilution. This includes key aspects such as what it is, how it works, what causes it, and how it can be calculated. -

Finance Funding Investment Investor Startup

Founders – Here’s How to Conquer Your Fundraising Fear in 3 Simple Steps

Founders of early-stage startups know the time will come when they need to seek additional funds. This funding is necessary if they are to sustain and grow their business in a healthy way. -

ESOP Funding Investor Startup Stock

Stock Options Explained

Let’s take a look at what stock options are, discuss important issues relating to exercise periods, and explain a highly effective way in which anyone who holds options can sell them. -

Funding Fundraising for Founders Investment Investor

Master These 8 Powerful Habits for Success in Fundraising

Startup founders will quickly realize that fundraising is an art. The more effective your fundraising efforts are, the more likely you are to raise those much-needed funds in the required timescales. -

Finance Investment Stock Options

The Meaning of Exercising Stock Options

Why on earth would a professional business person with experience and key industry skills look to take a position in a fledgling company at a salary lower than they could command on the open market? -

Cap Table Finance Funding Startup

Easy Cap Table Management for Early-Stage Companies

Getting your startup off on the right footing means there are a whole host of things that need putting in place. While the early stages of such a venture are the beginning of an exciting chapter it can also be an extremely hectic one. -

Finance Investment Investor Startup

Start-Up Fundraising: Challenges & Roadblocks

90% of start-ups fail. To say all of them don’t have valid business cases, professional leadership teams or a strong drive to succeed would be too simple and naïve. Data from thorough market research demonstrates that a majority of start-up leaders believe that their greatest obstacle lies in fundraising. Considering Southeast Asia alone has 79 open Venture Capital funds with over $4.7 billion ready and available, not including alternative sources of funding, this should not be the case. Outlined below are some of the key reasons why fundraising remains a challenge based on the perspective of a regional start-up CFO and VC investment committee board member. -

ESOP Finance

How Employee Stock Option Plans Work for Startups

Getting your business off the ground in the most efficient way is a challenge all startups face. Fledgling companies that achieve this are the ones most likely to thrive. -

Cap Table Finance Funding Startup

Startup Cap Table Management in 2022 – What to Know as You Grow

Startups need investment in order to raise capital and grow their business. This funding comes from investors who are known as shareholders and it is no secret that any potential investor will want returns. -

Cap Table Startup

4 Reasons Every Startup Should Use a Digital Cap Table

A capitalization table (cap table) is a record of a company’s ownership structure accompanied by the information of the relevant stakeholders. In recent times, companies will often have multiple types of securities from common stock and preferred shares to convertible notes, warrants and options, each with its own unique vesting periods and owned by a multitude of different shareholders. Managing these ever-changing equity structures and various securities as companies go through fundraising rounds can be tedious and time-consuming on manual spreadsheets. -

ESOP

Unlocking The True Value of ESOPs

An average start-up will have an Employee Stock Ownership Plan (ESOP) of 7.5-10%. ESOPs are employee benefits that give workers ownership of shares within the company they represent as a form of compensation. It can be seen as a mutually beneficial tool for both employees and employers. Employers utilize ESOPs to attract talent in an ever-challenging labor market, incentivize loyalty amongst employees and most of all, benefit from cash cost-savings on payroll. Correspondingly, employees have the opportunity to become shareholders and earn ownership for their hard work by being invested and rewarded as the company grows. -

Finance Investment Investor Startup

Private Equity Outperforms Public Markets

According to McKinsey, by nearly any measure, private equity has outperformed public market equivalents with an average net global return of 14% per annum. Simultaneously, the number of private companies that entered the public market grew dramatically with a record 64 per cent year-on-year increase to 2,388 IPOs in 2021. Taking into consideration both these phenomenon’s, it is understandable that investors are now eyeing private market opportunities where they have the opportunity to invest pre-IPO to maximize returns. -

Finance Funding Raising Funds Simple Agreement for Future Equity

KISS or Keep It Simple Security Convertible Note

Raising funds to ensure your startup thrives is a challenge that most founders face. Offering equity for the funding you intend to raise is one very tried and trusted way to achieve this but it is not the only method. Those founders who need to raise capital to grow their company can take advantage of convertible security instruments. In this respect there is one that really stands out; a KISS convertible note, alternatively known as a Keep It Simple Security. Here’s what KISS is all about and how it can be used to leverage those much-needed funds for your venture: -

Fundraising for Founders Funding Funding for Founders Fundraising Rounds

The Things We got Wrong About Fundraising

Founding a successful company is no easy feat. It is no secret that startup founders will find countless challenges that need to be overcome along the way. However, the belief, determination, and effort you put in to be at the helm of a growing, well-structured and healthy company are worth all of that effort and some. As a founder, you would not be human if you did not make mistakes along the way. That is part of the journey and learning from such mistakes will make you even stronger. With mistakes in mind, the fundraising process that founders go through is a major area where mistakes are made. Here are some key pointers that founders get wrong during the fundraising process. Understanding these and avoiding them will make your fundraising efforts much more effective. -

Funding for Founders Fundraising Raise Capital for Startup Angel Investors

Here are the Fastest Ways to Raise Money for Founders

Founders of startups will very quickly find that the business world in which they are entering is a highly competitive one. As a founder, you are convinced that your idea will work and that the company will grow into an established, profitable enterprise. However, being convinced of this yourself is not enough. To achieve your goals and ambitions there are many hurdles to overcome. One major challenge in getting your startup off the ground and moving forward in a balanced and structured way relates to a founder’s fundraising abilities. With that in mind, let’s take a look at some key ways that startup founders can raise funds fast. -

Raising Money for founder Raising Money for startups Equity Financing

How Can Equity Debt Prevent Me From Raising Money?

Fundraising can be the most challenging aspect that a startup founder faces. This is particularly the case for first-time founders. But fear not, there is a way that founders can raise funding without going through the normal angel investor or venture capital routes to secure those much-needed funds. That is by taking on equity debt. Here’s what it is all about: -

Fundraising Fundraising for Founders Fundraising Rounds Invisible Venture Capital

The A-Z of Fundraising (Part: 3 I-N)

Founders of startups have a lot to contend with as they formalize their ideas, turn them into reality, and then proceed to grow their business healthily. As you progress, the world (and art!) of successful fundraising will become more and more important. Similar to all business sectors, startup founders will encounter fundraising abbreviations, acronyms, terms that speak for themselves, and others that are far more obscure. To help you grasp exactly what these terms mean, here’s a comprehensive A-Z of fundraising from WOWS Global. This handy reference guide will help every founder talk the fundraising talk with confidence. Because we are digging deep to deliver everything related to fundraising this guide will be split into easy-to-read parts. This is part 3 covering the letters I to N: -

Equity Management Private Equity Investments Private Equity Management

The Best Methodologies for Effective & Efficient Private Equity Investment Management in 2022

In the private equity investment management world, in-depth knowledge and understanding will give you the advantage. That is regardless of whether you are a founder of an early startup, have a company that is establishing itself or you are an investor looking to make informed investment decisions. This article intends to explain the best methodologies for effective & efficient private equity investment management to put you ahead of the game. -

Funding Funding Round Company Funding

What is Funding? Understand The Different Types of Funding

Founders of startup ventures do not need to be told that funding is required to get their business off the ground and to keep it growing in a positive fashion. While that is a given, the challenge for many founders is understanding exactly what funding is, what the different types of funding are, and how each will impact their company ownership structure. With these factors and more in mind let’s take a look at company funding and how founders can take advantage of the method(s) that best meet their needs. Doing so will be a big step towards helping your company grow healthily and successfully. -

Fundraising Fundraising for Founders Fundraising Rounds

Let’s Be Honest: Fundraising Sucks

Of the many elements that founders need to glue together to get their startup off the ground, there is no doubt that fundraising causes the most angst. Forget the dazzling press releases detailing huge, easy fundraising successes. These are the exception rather than the rule. -

Fundraising Venture Capitalists

10 Things I Wish I’d Known Before I Tried Fundraising

Fundraising – A founder’s fear and joy. The process of raising much-needed funds to keep your early startup running and growing is certainly a challenge and can be a long, testing road. There will be highs and lows along the way but when your goal is finally achieved the result will justify that journey. Founders need to be fully prepared and determined if they are to secure the funds they require. To help you better understand the fundraising process here are 10 things that successful startup founders wish they had known before starting their fundraising efforts: -

Fundraising for Founders Fundraising Funding for Founders

The A-Z of Fundraising (Part: 4 O-S)

Founders of startups have a lot to contend with as they formalize their ideas, turn them into reality, and then proceed to grow their business healthily. As you progress, the world (and art!) of successful fundraising will become more and more important. Similar to all business sectors, startup founders will encounter fundraising abbreviations, acronyms, terms that speak for themselves, and others that are far more obscure. To help you grasp exactly what these terms mean, here’s a comprehensive A-Z of fundraising from WOWS Global. This handy reference guide will help every founder talk the fundraising talk with confidence. Because we are digging deep to deliver everything related to fundraising this guide will be split into easy-to-read parts. This is part 4 covering the letters O to S: -

Perfect Pitch Deck Pitch Deck for Founder

Essential Items of a Perfect Pitch Deck

Startup founders need to be aware of just how important their pitch deck presentation to potential investors is. The quality, content, and overriding message relayed are very likely to make or break your funding aspirations. With this in mind, the highly experienced team at WOWS Global is on hand to explain what your pitch deck should be used for and to explain the essential items that need to be included. Here are…. -

Perfect Pitch Deck Pitch Deck for Founder Pitch Deck for Startups Step-by-Step Guide to Build Your Pitch Deck

Startup Founders - Here’s Your Step-by-Step Guide to Build Your Pitch Deck

Startup founders need to put a compelling and persuasive pitch deck together when they are seeking a round of investment funding from investors. It is this essential funding that will go towards growing your company in a structured and successful way. -

Fundraising for Founders A - Z of Fundraising Fundraising

A-Z of Fundraising for Founders (Part: 5 T-Z)

Founders of startups have a lot to contend with as they formalize their ideas, turn them into reality, and then proceed to grow their business healthily. -

Employee Attrition Manage Employee Attrition Employee Attrition in Startups

Top 5 Ways to Manage Employee Attrition in Startups

Founders of startups face many hurdles in getting their fledgling venture up and running. One of the most challenging aspects is recruiting and then retaining the key personnel required to create a winning team. -

Secondary Markets Stock Market Secondaries

Secondary Market Explained

When thinking of the secondary market most people will typically consider this to be the “stock market”. This is because the secondary market is where investors who already own securities can buy and sell them. -

Investor Pitch Pitch Presentation Pitch Deck Presentation

5 Tips On How To Deliver A Persuasive Investor Pitch

Of the many hats a startup founder must wear comes the one that involves presenting your pitch deck to investors. For most founders, this task is a double-edged sword. -

Investor Pitch Pitch Presentation Pitch Deck Presentation Mistakes in Investor Pitch

8 Things NOT to do when pitching to an Investor

The vast majority of founders know that preparing their pitch deck is a challenge. However, from there, presenting a persuasive investor pitch can be even more challenging. Indeed, many industry insiders feel that delivering an effective pitch is an art form! -

Venture Debt Venture Debt Financing

Venture Debt Financing Explained

Startup founders will be very aware that essential funding is required if they are to grow their business in a structured and successful way. There are a variety of different ways to secure the finances needed and the one that will be looked at here may be a lesser-traveled route for founders but it should not be discounted. -

Public Markets Private Markets Private Equity Venture Capital Stock Market

Public Markets vs. Private Markets - What Are The Differences?

Public Markets This is where most companies raise funding through the issuance of stock. The stock exchange is the best-known public market. It is where individuals, as well as institutional investors (think banks and hedge funds), buy and sell stocks. -

Most Read Blogs WOWS Global 2022 Milestones

Most Read Blogs of 2022 on WOWS Global

For WOWS Global 2022 was an incredible year. WOWS GLOBAL set out to assist start-ups with their fundraising/secondary transactions and this year has been full of vital stepping stones on this mission. -

WOWS Cap Table Fundamentals of Cap Table Cap Table Management

The Fundamentals of a Cap Table

Smart founders need to be aware that putting in place a cap table is something that needs to be done as early as possible in their startup journey. -

Venture Capital Southeast Asia Startup Investor

A Guide to Southeast Asia's Most Active VCs

The Southeast Asian (SEA) startup market is in a very healthy state. This guide will explain exactly why before getting into details on 10 of the most active VCs in the region -

Du Diligence Startup Founders What is Due Dilegence?

Due Diligence for Startups and Checklist

Due diligence is an essential process for startup founders, angel investors, venture capital firms, and individual investors. This process must be treated as a two-way street if those involved are to get the best possible out of any funding deal. -

Pre Money Valuation Post Money Valuation Startup's Valuation

Pre Money and Post Money Valuation - What Does it Mean?

Startup founders will often hear the terms pre-money valuation and post-money valuation mentioned. But what is the difference between these two valuation terms and why are they so important for founders to understand? -

Startup Incubator Incubator Program

Here are 7 Important Lessons you can Learn From an Incubator

Early-stage startup founders may well have heard about incubators but are not sure what they are all about. If that is you, let’s put things right by explaining what an incubator is and some of the important lessons you can learn by joining an incubator program. -

Startup Term Sheet Startup Founders

Startups: The Ultimate Guide to Term Sheets - Part 1

The importance of a term sheet cannot be underestimated. Any founder who is being offered funding from a professional investor or venture capital firm will find a term sheet attached. While the thought of receiving those much-needed funds will naturally excite, caution and careful consideration should be uppermost in your decision-making process. -

Term Sheet Startup Startup Founders

Startups: The Ultimate Guide to Term Sheets - Part 2

The importance of a term sheet cannot be underestimated. Any founder who is being offered funding from a professional investor or venture capital firm will find a term sheet attached. While the thought of receiving those much-needed funds will naturally excite you, it is imperative that before final acceptance you understand exactly what the terms involved are and what you are agreeing to. -

Term Sheet Startup Startup Founders

Startups: The Ultimate Guide to Term Sheets - Part 3

The importance of a term sheet cannot be underestimated. Any founder who is being offered funding from a professional investor or venture capital firm will find a term sheet attached. While the thought of receiving those much-needed funds will naturally excite you, it is imperative that before final acceptance you understand exactly what the terms involved are and what you are agreeing to. -

Term Sheet Startup Ultimate Guide to Term Sheets

Startups: The Ultimate Guide to Term Sheets - Part 4

The importance of a term sheet cannot be underestimated. Any founder who is being offered funding from a professional investor or venture capital firm will find a term sheet attached. While the thought of receiving those much-needed funds will naturally excite you, it is imperative that before final acceptance you understand exactly what the terms involved are and what you are committing to. -

Invest in Startups Introductory Guide

An Introductory Guide of how to Invest in Startups

Would-be investors in anything are taking a risk. Those who are looking to invest in startups are taking a bigger one! However, the potential rewards of investing in an early-stage company can be huge, hence the understood attraction for this type of investment. -

Private Markets Private Equity Private Equity Investments

What is the Future of Private Markets

Over recent years the rise of private equity has mushroomed. This trend shows no signs of decline with the future of private markets predicted to grow. However, it is also forecasted that there will be changes as well as challenges ahead. This means that founders, entrepreneurs, business executives, and investors from all walks of life need to keep their fingers firmly on the private market pulse. -

Equity Dilution Dilution Dilution Calculation

Founders - Understanding Dilution Is a Must!

Equity dilution is something that all startup founders must fully understand. Failure to do so could see the stake in the company they were responsible for founding greatly diminish. It is also the case that when looking for a cash injection founders see share dilution in their company as the only path open to them. This is particularly the case if they are lacking upfront investment. -

Liquidity Unicorns Resignation

How Unicorns are Tackling the Great Resignation with Liquidity

More workers than ever before are quitting their jobs in search of what they feel will be better, more rewarding positions. While this is something that is affecting companies of all sizes it is proving to be particularly concerning for startups. This exodus has been termed “The Great Resignation” and is leaving startup founders with some major challenges on how they can retain key staff members. One avenue that is proving to be effective is for founders to seek assistance from unicorn investors in the form of liquidity-as-a-benefit. -

Angel Investors

How Do Angel Investors Spot That Next Big Opportunity?

Angel investors are often the funding stepping-stone that a startup needs to grow its business. These early-stage investors are usually serial and/or successful entrepreneurs or successful business professionals who fill the funding gap between initial financing provided by family and friends and venture capitalists. -

Due Diligence Startup Investments

The Importance of Due Diligence in Startup Investments

Those investors who choose to put their money into startup companies are seen as taking a bigger risk than those who invest in publicly listed companies. However, with that risk, there is also the opportunity to achieve far healthier returns. This is a major reason why certain types of investors find investing in private startup companies so appealing. But, appealing or not, it is only sensible for startup investors to be aware of how important it is to carry out due diligence on any startup they are looking to invest in. -

Valuate Private Companies Investors

Investor’s - Here’s How To Value Private Companies

When it comes to determining the value of private companies, investors need to take a specific approach. This is because the process is not as transparent or as straightforward as assessing the value of public companies. With a publicly-traded company, valuation can be determined by multiplying its stock price by its outstanding shares. However, as private companies do not publicly report their financials this means there is no stock listed on an exchange. That factor alone means it is often difficult to determine the market value of a private company that you may be interested in investing in. -

Initial Public Offering IPO

What Is Initial Public Offering (IPO) And How Does It Work?

We have all heard the term Initial Public Offering or its more common abbreviation of ‘IPO’ but what does it mean and how does an IPO work? Let’s find out by taking a look at what an IPO is and how it works, and the process private companies need to go through to attain this status. There will also be a section on some significant pros and cons for private company owners to be aware of before committing to an IPO. -

Website Business

Here Are Things To Consider When Choosing A Website For Your Business

In today’s digital world, all businesses need to have a website that showcases what their company is all about. This is because a well-presented and relevant website allows you to express your company values, purpose, and mission. Within that, an effective website informs visitors of the products and services you offer. An informative, easy-to-navigate company website should also be seen as invaluable when it comes to reaching a wider target audience because as your website visitor numbers increase, so will your company’s profile. -

Early Startups Mistakes

6 Common Mistakes That Early Startups Make And How To Avoid Them

Founding your new business is an exciting and energetic time but the energy put into building your new company needs direction and full focus. Many new founders fall into the trap of not concentrating their efforts most effectively. That is understandable because there are so many things to deal with at the same time. However, there are some common mistakes that many startup founders make that with thought, understanding, and preparation can be avoided. With that in mind, here are 6 mistakes you can avoid: -

Business Domain Name

8 tips to find the perfect domain name for your business.

Company founders will very quickly discover that making important decisions regularly goes with the territory. One early decision that has a lot resting on it is deciding on the perfect domain name for your business. The importance of getting it right cannot be underestimated because it is one of the biggest decisions you will be called on to make. If that choice is a poor one it can have a negative impact on your brand’s reputation. -

Startup Investing

Top 10 Factors To Consider Before Investing In A Startup

Investing funds in startups gives the potential for significant returns. On the flip side, the risks need to be fully understood. This means that startup investors must take a variety of considerations into account before agreeing to any such investment. While individual investor criteria will differ, here are 10 factors that all startup investors should bear in mind: -

Early Startups Investing

The Risks And Rewards Of Investing In Early-Stage Startups

The startup world is buzzing with new entrants and this makes investing in them a very attractive investment proposition. The risks may be bigger than investing in publicly listed companies but choosing the right startup also means the rewards can be far greater. While it is often mentioned that the vast majority of startups fail, the ones that succeed will give informed investors some very healthy returns. There are risks involved in every phase of growth for startups but it is often the early risks that are most predominant. That is because these early issues can sink a startup before it has the chance to take off. -

Venture Debt Startup

How Venture Debt Can Aid in the Growth of Your Startup

Startups require capital to fuel growth and achieve long-term objectives. While equity financing is a common way to raise funds, it frequently dilutes existing shareholders' ownership. In contrast, venture debt can provide additional capital without sacrificing ownership. This article will look at how venture debt can help your startup's growth. -

Investors Venture Debt

What Investors Consider When Investing in Venture Debt

Venture debt is a type of startup financing that allows them to secure capital without diluting their equity. Venture debt investors make loans to startups that are typically used to fund growth initiatives or to extend the company's cash runway. The investor receives interest payments and, in some cases, equity warrants in exchange for the loan. While venture debt is not appropriate for all startups, it can be an appealing option for those with a proven business model and a track record of growth. In this blog post, we'll look at what investors look for in venture debt investments, as well as how startups can position themselves for success. -

Venture Debt Equity Financing

Which Is Better for Your Startup: Venture Debt or Equity Financing?

"One of the most important decisions you'll need to make as a startup founder is how to fund your business." Venture debt and equity financing are two popular options. Both can provide the capital you need to grow your business, but they have different risks, costs, and levels of control. In this article, we'll look at the advantages and disadvantages of venture debt and equity financing to help you decide which is best for your startup. -

Startups Due Diligence

A Checklist for Startups for Preparing for Due Diligence

As a startup founder, you've most likely put in countless hours building your company. When it comes time to seek outside funding or merge with another company, however, you must go through a due diligence process. Potential investors or partners will examine your company's financial and legal records to ensure that it is a good investment. Preparing for due diligence can be a difficult task, but with the right checklist, you can streamline the process and ensure your success. In this article, we'll go over the most important aspects of due diligence and provide a checklist for startups to use. -

Startups ESOP

A Comprehensive Guide for Startups for Navigating the ESOP Landscape

Employee Stock Ownership Plans (ESOPs) are gaining popularity among startups as a means of attracting and retaining top talent. WOWS advisory services specializes in assisting startups in navigating the ESOP landscape and developing customized ESOP policies to meet their specific needs. We will provide a comprehensive guide to ESOPs for startups in this article, including what they are, how they work, and the benefits and challenges of implementing an ESOP policy. -

Startup Southeast Asia

Playbook to Identify the Next Unicorn Startup in Southeast Asia

The startup ecosystem in Southeast Asia has been on the rise in recent years, with the region producing several unicorns - privately held companies valued at over $1 billion. Some of the well-known unicorns in the region include Grab, Gojek, and Tokopedia. With Southeast Asia's growing population, increasing internet penetration, and rising middle class, the region presents vast opportunities for startups to thrive. However, with so many startups emerging, it can be challenging to identify the next unicorn. In this article, we will explore how to identify the next unicorn startup in Southeast Asia. -

Startup Investments Southeast Asia

How to Navigate the Legal and Regulatory Landscape for Startup Investments in Southeast Asia

Southeast Asia is a vibrant and rapidly-growing region that is home to some of the world's fastest-growing economies. As a result, it is an attractive destination for startups and investors looking to tap into the region's potential. However, navigating the legal and regulatory landscape can be challenging, especially for first-time investors. In this article, we will discuss the key legal and regulatory considerations that investors need to keep in mind when investing in startups in Southeast Asia. -

Angel Investors Startup Investments

The Role of Angel Investors in Startup Investments

The world of startup investing has come a long way over the past few decades, with angel investors playing an increasingly important role in the process. For entrepreneurs looking to take their ideas to the next level, finding the right angel investor can be the difference between success and failure. In this article, we'll take a closer look at the role of angel investors in startup investments and explore some of the key benefits they bring to the table. -

Machine Learning Artificial Intelligence

Investing in AI and Machine Learning Startups in Southeast Asia: The Future is Here

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing the world, and Southeast Asia is no exception. This region is home to a rapidly growing startup ecosystem, with a focus on technology and innovation. In this article, we will explore why investing in AI and ML startups in Southeast Asia is a smart move and how it can help investors reap significant rewards. -

Venture Debt Startups

The Advantages of Venture Debt for Fast-Growth Startups

"Securing the necessary capital to scale your business as a high-growth startup can be a difficult and complex task." While traditional financing options like bank loans and equity financing may be appropriate for some businesses, venture debt has emerged as a popular and effective option for high-growth startups. In this article, we'll look at the advantages of venture debt for high-growth businesses. -

Startup Investment Southeast Asia

Why Southeast Asia is the Next Hotspot for Startup Investments

Southeast Asia is rapidly emerging as one of the world’s most promising regions for startup investments. With a growing population, a rising middle class, and a rapidly expanding digital economy, Southeast Asia presents a wealth of opportunities for investors looking to tap into this dynamic and rapidly evolving market. In this article, we’ll take a closer look at why Southeast Asia is the next hotspot for startup investments. -

Startup Investments

The Dos and Don'ts of Startup Investments

Starting a business necessitates a significant investment, and entrepreneurs may need to seek outside funding to get their ventures off the ground. This is where startup funding comes in. While investors can provide valuable resources and guidance, it's critical to understand the startup investment dos and don'ts in order to avoid common pitfalls and maximize your chances of success. -

409A Valuation Startups

Understanding 409A Valuation to Unlock the Value of Your Startup

Startups are always looking for new ways to increase their value and attract investors. Understanding the significance of 409A valuation is one way to accomplish this. A 409A valuation is required for startups that give their employees equity-based compensation, such as stock options, and it determines the fair market value of the company's common stock. -

Venture Debt Trends and Predictions for Startups

Trends and Predictions for Startups and Investors Regarding Venture Debt

"Venture debt has emerged as a popular alternative funding source for startups seeking capital without sacrificing equity." As the startup ecosystem evolves, so does the future of venture debt, with new trends and predictions emerging. This article will look at the future of venture debt and what startups and investors can expect in the coming years. -

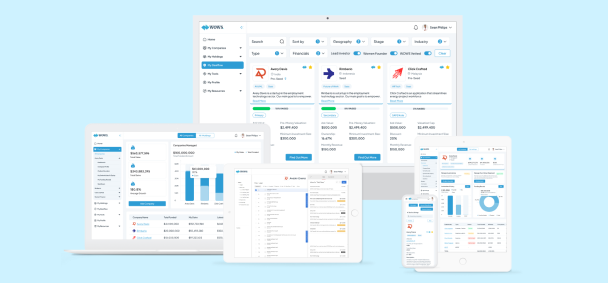

WOWS Advisory Services

How WOWS Advisory Services can help you grow your startup.

Starting a business is an exciting experience, but it can also be difficult. As a startup founder, you may face a number of challenges that will impede your company's growth and success. Scaling a business is one of the most difficult challenges that most startups face. Scaling a business necessitates extensive planning, strategy, and expertise. WOWS Advisory Services by WOWS Global can help with that. WOWS Global is Southeast Asia’s most active investor matching platform that connects startups with investors. -

Strategic Business Forecasting

Long-Term Success Requires Strategic Business Forecasting

Strategic business forecasting is the process of predicting future trends and opportunities using data and analysis and planning accordingly. Businesses can position themselves to capitalize on emerging trends, stay ahead of competitors, and achieve sustainable growth by taking a long-term approach to planning. -

Startup Investment Portfolio

How to Build a Diversified Startup Investment Portfolio

Investing in startups can be a risky endeavor, but it can also be highly rewarding. Building a diversified startup investment portfolio can help mitigate some of the risk while also increasing your chances of success. In this article, we’ll explore some strategies for building a diversified startup investment portfolio. -

Invest in Startups

Invest in Startups: Key Considerations for VCs and Angel Investors

Investing in startups has become an attractive avenue for venture capitalists (VCs) and angel investors seeking high returns and the opportunity to support innovative ideas. However, successfully investing in startups requires careful consideration and due diligence. This article will discuss key factors that VCs and angel investors should keep in mind when investing in startups, as well as how they can leverage WOWS Invest, a platform that facilitates connections and investments in growing startups. -

Deal Sourcing

What is deal sourcing? The importance and challenges

Deal sourcing is the process of identifying, evaluating, and acquiring investment opportunities. It involves actively seeking out potential deals that align with an investor's investment criteria and goals. These opportunities can range from early-stage startups and real estate projects to mergers and acquisitions. Deal sourcing is a crucial aspect of investment strategy as it enables investors to find lucrative opportunities and achieve their financial objectives. -

Angel Investors

Angel Investors: Empowering Entrepreneurs with Wings of Opportunity

In the dynamic landscape of startup ventures, angel investors play a crucial role in fostering innovation and driving economic growth. Their financial support and expertise provide aspiring entrepreneurs with the wings they need to transform their ideas into successful businesses. In this article, we will explore the concept of angel investors, their significance in the startup ecosystem, and the key attributes that define their role. Additionally, we will discuss how entrepreneurs can attract angel investors and the benefits that result from this partnership. -

Pitch Deck

What is a Pitch Deck? Tips, Examples & Best Practices (2023)

A pitch deck is a concise presentation used to introduce a business or project to potential investors or clients. It typically includes key information about the company, its products or services, market opportunities, and financial projections. The goal is to capture interest and persuade the audience to take further action, such as investing or forming a partnership. -

Virtual Data Room WOWS Deal Room

What is Virtual Data Room (VDR)?

A virtual data room, also known as a VDR or electronic data room, is an internet-based, secure platform that serves as a centralized repository for a company's documents. It enables the controlled sharing of important business information with clients, investors, and company executives in a protected online environment. -

Fundraising Legal Documents

The Importance of Fundraising Legal Documents for Startup Success

Fundraising is a critical aspect of a startup's journey, enabling founders to secure the necessary capital to fuel growth and achieve their business objectives. However, this process involves more than just pitching to potential investors. It requires careful attention to legal considerations and the creation of essential fundraising legal documents. These documents serve as the foundation for investor relationships, protect the interests of both parties, and establish clear rights and obligations. -

Founder Spotlight

Founder Spotlight: Harprem Doowa Founder of Eazy Digital

In today's interview, we have the pleasure of speaking with Harprem Doowa, the Founder of Eazy Digital, an insurtech company that is revolutionizing the insurance industry in Southeast Asia. Eazy Digital is on a mission to empower small insurance companies in the region, providing them with cutting-edge digital platforms to compete on an equal footing with their larger counterparts. With a team of industry veterans at the helm, Eazy Digital's innovative SaaS platform enables insurers to streamline and digitize various aspects of their operations, driving efficiency and scalability. -

Business Forecasting

What is Business Forecasting? Definition, Methods, and Models

Business forecasting is a crucial aspect of strategic planning for organizations across various industries. It involves using historical data, market trends, and statistical techniques to predict future business outcomes. These forecasts help businesses make informed decisions, allocate resources effectively, and anticipate potential risks and opportunities. In this blog post, we will explore the definition, methods, and models used in business forecasting, highlighting the significance of accurate predictions for business success. Additionally, we will introduce WOWS Advisory Service's expertise in business forecasting and the value they provide to organizations. -

Due Diligence Readiness

What is Due Diligence Readiness?

In the world of business, due diligence readiness plays a crucial role in mitigating risks and ensuring informed decision-making. It involves a comprehensive investigation and analysis of various aspects of a business or investment opportunity before entering into agreements or contracts with other parties. This blog post will delve into the concept of due diligence readiness, its significance, and the key elements involved in the process. Additionally, we will explore how WOWS Advisory Services can assist businesses in achieving due diligence readiness effectively and efficiently. -

Startup Investments

The Role of Incubators and Accelerators in Startup Investments

In the fast-paced world of entrepreneurship, startups often face significant challenges in accessing funding, resources, and mentorship. To overcome these hurdles and accelerate their growth, many innovative ventures turn to incubators and accelerators. These specialized programs provide invaluable support, guidance, and opportunities for startups to thrive. In this article, we will delve into the definitions of incubators and accelerators, explore their roles in startup investments, and highlight how WOWS Global, as a prominent player in the field, can help startups achieve funding and success. -

Investor Matching Platform

Why Every Startup Needs an Investor Matching Platform

Have you launched your startup and now need funding to scale? Finding investors is tough. You've pitched your idea to friends and family, maybe scored a small angel investment, but now you need serious capital to take your business to the next level. Venture capital could be the answer, if only you could get in front of the right investors. -

Term Sheet

5 Red Flags in Term Sheets That Every Founder Should Be Aware Of

A term sheet is a non-binding agreement that outlines the basic terms of an investment deal. It’s like a blueprint for the actual contract that will follow if both parties agree to move forward. -

ESOP

A Comprehensive Guide to ESOP Taxation in Singapore

Employee Stock Option Plans (ESOPs) are a popular form of employee compensation in Singapore. However, navigating the taxation rules associated with ESOPs can be complex. In this comprehensive guide, we will break down the key aspects of ESOP taxation in Singapore, including recent updates and additional insights to help you understand and manage your ESOPs effectively. -

Convertible Notes SAFEs

Understanding the Procedure of Converting Convertible Notes

When determining the price per share for Series A financing, it's relatively straightforward if there are no outstanding convertible notes or SAFEs (Simple Agreement for Future Equity). The price per share for the new investors is typically calculated as the pre-money valuation divided by the fully-diluted shares outstanding. -

Founder Spotlight

Founder Spotlight: Willy Tan, Founder of Seeds

In today's interview, we had the privilege of sitting down with Willy Tan, the visionary founder behind Seeds, a social investing platform that is making waves in Southeast Asia. Seeds stands out for its innovative approach, offering a multi-asset, community-driven investing platform designed to empower the tech-savvy Millennial generation. The platform not only opens doors to passive income opportunities but also cultivates responsible and value-driven investment practices, ushering in a new era of financial engagement. -

Founder Spotlight

Founder Spotlight: Patrick Gunadi, Founder of Danamart

In today's interview, we have the privilege of speaking with Patrick Gunadi, the visionary Founder of Danamart, a groundbreaking crowdfunding service platform in Indonesia. Danamart stands at the forefront of innovation by bridging the gap between entrepreneurs and investors, all while championing the principles of Environmental, Social, and Governance (ESG) responsibility. -