The Meaning of Exercising Stock Options

Finance Investment Stock Options

Why on earth would a professional business person with experience and key industry skills look to take a position in a fledgling company at a salary lower than they could command on the open market?

A new challenge certainly springs to mind. But that is certainly not all. Other major reasons include that the employee is convinced this new venture is set to make a significant impact on the business sector it is operating in. They are also keen to share the rewards that such growth will bring. On top of that, the position they are considering includes employee stock options as part of their remuneration package.

If you are in this position or have recently joined a company that gives stock options as part of an employment package you will already be aware that the company is not giving you outright shares of stock. What they are giving you is the right to purchase shares of company stock at a specific, agreed price over an agreed period of employment.

This price is variously termed as the strike price, grant price, or exercise price. It is usually the FMV (Fair Market Value) of the shares on the date they are granted to you. The obvious hope (and expectation!) is that the share value will increase over time and as your allocation becomes vested you will be at liberty to sell them for far more than you paid for them.

With that in mind, let’s take a detailed look at what exercising your stock options means, things to be aware of, and how you can best maximize these potential benefits.

Exercising your stock options means….

Purchasing the shares granted to you at the defined set price and staged dates of employment will clearly be defined in the agreed option grant signed between yourself and the company in question.

Should you decide to purchase these shares it means that you own a part of the company. It should be noted that you are never required to exercise your options. The choice to do so is entirely yours.

What is important is that anyone who has the right to exercise their options creates a defined strategy to maximize the benefits and be aware of any tax implications. Here’s what you need to know:

How long do I have to exercise my stock options?

Before explaining how long you have to exercise your stock options it should be made clear that in the vast majority of cases companies will not allow you to exercise immediately. You will have to remain employed with them for an agreed amount of time which is generally 1 year. This period is known as the cliff period of your employment.

The process of earning your right to exercise is known as “vesting” and you can only usually exercise stock options that are vested. Once you reach the mentioned cliff date and stay with the company you should have the right to exercise any vested options whenever you please.

However, if you decide to leave the company you will only have the right to exercise before the company’s PTE (Post-Termination Exercise) period ends. After that time you cannot exercise your options and they will revert back into the company’s option pool.

Concerning the PTE, many companies have traditionally set this period at 3 months. Having said that, it is becoming more common for companies to offer a much more generous PTE such as it equalling the time you worked at the company or for 7 years from the termination of employment.

Important note: Should you decide to leave the company it is imperative that you fully understand the PTE period. Failure to do so could mean the loss of any stock options you have earned.

What is early exercising?

Some companies have taken the decision to allow eligible employees to exercise their options early. That is before their options vest. If this is the case it means that as soon as you receive your option grant you can exercise those options. However, your options will continue to vest according to the agreed original schedule.

If you do have the option to early exercise options, here are some things to take heed of:

On the plus side, early exercising could help with qualification for favorable tax treatment but that needs checking against any national tax laws currently in place. This makes it very important that you discuss early exercise and tax implications with a qualified accountant or legal team that specializes in stock options in the location in which you are based.

On the potential downside of early exercise comes the fact that you will have to use your own funds to pay for your shares. You cannot sell some of your stock in order to pay for those shares.

Additionally, you will be unable to predict whether your shares will increase in value once purchased. This makes waiting for the mentioned (usual) 1 year vesting cliff anniversary a sensible way to go. By doing so you should have a better idea of stock values, which direction you see your company going in, and whether you should purchase or not.

A final thing to bear in mind is if you decide to leave the company once you have carried out an early exercise but do so before the stock vests. In this case, your option grant will generally give the company repurchase rights of your early-exercised but as yet unvested stock.

How do I exercise my stock options?

This will depend upon how your company has structured its terms and conditions relating to exercising stock options. However, here are 4 of the most common ways:

- Pay cash (exercise and hold): Use your own funds to purchase your shares and keep 100% of them. This is seen as the riskiest method for 2 reasons. First, you are not guaranteed to make a profit (and potentially not even get your money back). Second, the amount you have paid is tied up in those shares until you sell them.

But there is also a potentially attractive reward. This comes if those shares end up being worth a lot more than you initially paid for them.

- Cashless (exercise and sell): It may be possible to exercise and sell all of your options in one transaction. The way this method works is that some of the money from your ‘sell’ covers the ‘buy’ price (plus any applicable fees and taxes). From there, all money left over is yours

- Cashless (exercise and sell to cover): You simultaneously purchase your option share amount and then immediately sell enough of them to cover the purchase price (plus any other fees (i.e. brokerage) and any taxes.

Assuming you still have shares left over after this sale you are at liberty to do whatever you want with the remaining shares. Meaning that you can sell more and/or keep some.

- Stock Swap: This is another cashless stock option exercise and is open to those who already own company shares outright. You exchange those owned shares to pay for the shares you have obtained through exercising your stock option.

The main benefit of this method relates to tax avoidance. Again, you need to check with a tax expert in your country to see how long you would have to hold the shares used in the exchange to avoid (or minimize) tax penalties.

Factors to help you decide whether to exercise your stock options

Careful consideration is required before you decide to exercise your stock options. While it is hoped that exercising your stock option entitlement will pay off over time it should not be looked at as a guaranteed way of making money.

Here are 5 questions that you need to ask yourself:

- Are you able to? Does your company allow early exercising? If not only vested options can be exercised. On top of that, if your company is not yet public you have to find the money to purchase the required amount of stock.

- Current valuation: You will quickly become familiar with two terms relating to your stock options; ‘in-the-money’ and ‘underwater’. Both are self-explanatory but if your options are currently worth less (‘underwater’) than your exercise price it generally makes sense not to exercise.

- How is your company faring? This is not always an easy one to judge. Often your close involvement with the business can lead to unintentional familiarity bias. You need to make an honest assessment of whether you think your company’s stock is likely to fall or rise in the future?

Take time to understand what gains are being made, are new staff being recruited (or are others being laid off, or are leaving), how are the ‘order books’ looking, does cash flow seem to be healthy, and what is staff morale.

Rather than overestimating stock value due to familiarity perhaps play on the cautious side through underestimation.

- Once exercised can you sell your shares? Assuming your company is private and there does not appear to be any tender offers or IPO on the horizon, exercising your options should be seen as being inherently risky. This is because you are paying hard cash for shares that may never reach liquidity.

Fully understand the tax situation: Research and discuss with an experienced tax advisor before making a decision. Some important factors to take into account here are your current salary level, the type of options you have, and what amount you are holding. Depending upon your circumstances you may have to pay taxes upon exercise.

When should I sell my shares?

Once you have exercised your options it can be a tough call on when it is the best time to sell. This is because a big part of this decision comes down to your individual situation and needs. There is certainly no set rule for all.

The first thing to consider is what your current financial situation is and what (if any) goals you have that involve an outlay of money. If your current income is covering all of your expenses you may not need additional income through selling your shares.

On the other hand, you may need a cash infusion for such things as moving home, funding further education for yourself or your family, you have the opportunity to invest in something that attracts you, or starting a new business. If selling your shares will help fund these goals then the time is right.

You should then consider your overall financial portfolio and how your assets are allocated. If you find that you are overly exposed to your company’s shares then you may want to sell to further diversify your portfolio.

While it is important to speak with a tax advisor in the country you pay taxes, here are some general rules to consider:

- Once exercised, sell your shares right away for a guaranteed profit but be prepared to pay higher taxes.

- Once exercised, sell within 1 year. This is generally seen as the most expensive option from a taxation point of view. However, as long as your options are ‘in-the-money’ you can expect a quick return.

- Hold on to your shares for 1 year or more. This approach lends itself to potentially larger profits (or losses) and lowers taxation.

Depending upon how you are taxed this can make wading through the various ‘sale’ tax implications a real challenge. This is why it will pay you to contact a tax advisor in your country of residence to understand exactly what is best for you.

They will not be able to predict what your shares will do in the future but they will set you straight on the most favorable tax treatment options.

Conclusion

Accepting a position in a company that includes an ESOP in your remuneration package is a calculated risk. But it is one that can offer some seriously attractive financial rewards.

With that in mind, you need to maximize the leverage of these options, understand when it is possible to exercise your options, and gauge when it is right for you to hold or sell.

Whether you are an individual or a founder who wants to educate your team about important equity matters you do not have to take all of this responsibility on your own shoulders. A far more proactive approach is to seek assistance from a company that is completely focused on the creation of a highly secure online ecosystem. One that connects investors and companies alike.

WOWS Global is one such company. We are here to give expert industry advice and to provide you with access to our unique cap table platform that comes with all of the tools required to navigate each step of your financial journey.

By contacting us at contact@wowsglobal.com for a no-obligation discussion you will be taking the first step to ensuring you make the most of those hard-earned employee stock option plans.

Related Posts

-

Investment AI Innovation Smart Cities Smart Fintech Analysis

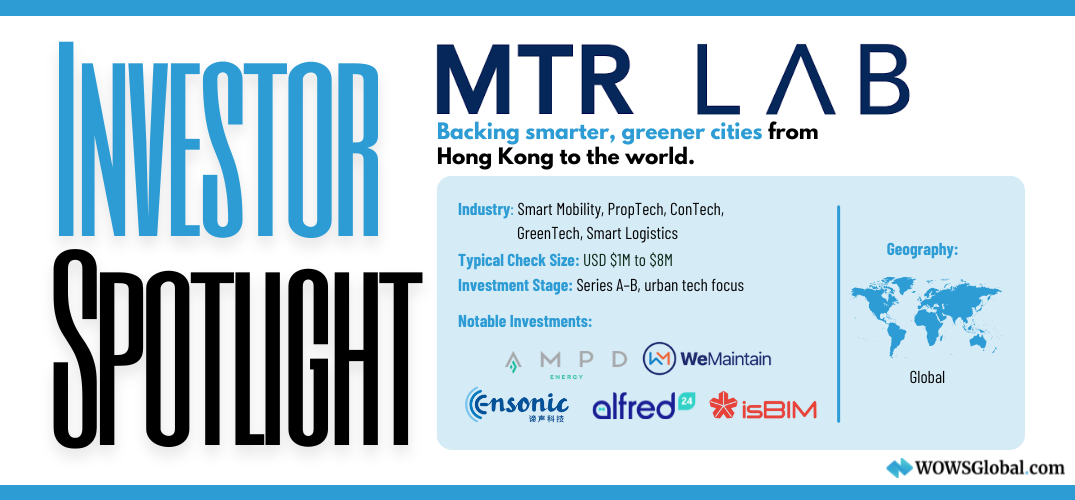

MTR Lab: Investing in the Future of Smart Cities

MTR Lab is the strategic venture arm of MTR Corporation, investing in early-growth startups driving smart city and sustainability innovation. With a focus on urban tech, from clean energy and mobility to PropTech and smart logistics. MTR Lab helps founders scale impactful solutions across Hong Kong and beyond. -

AFG Partners Fintech VC Asia finance

AFG Partners: Empowering Global B2B Fintechs to Scale Across Asia

AFG Partners is a strategic venture capital firm backing global B2B fintech and enabling tech startups. Headquartered in Singapore and Hong Kong, AFG focuses on helping early-stage companies expand into Southeast Asia’s dynamic financial markets. Explore their investment strategy, standout portfolio, and why founders value their cross-border expertise and collaborative approach. -

Indonesia Investment News

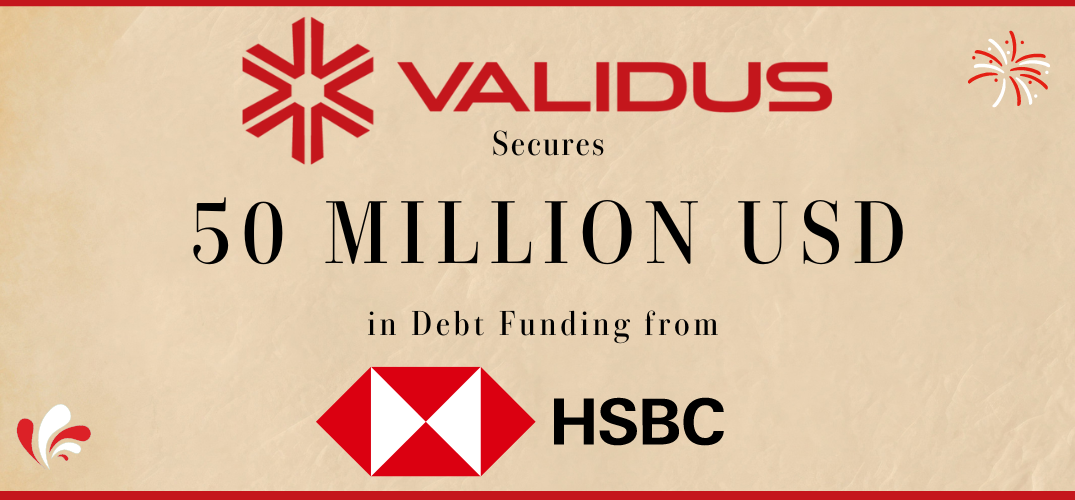

Validus Raises $50M from HSBC to Boost SME Lending in Indonesia

Discover how Validus is using a $50M debt facility from HSBC to boost SME lending in Indonesia and support financial inclusion across Southeast Asia. -

Stock Options Warrants

Options or Warrants: Which Is Right for Your Startup?

So you've launched your startup, brought on some initial investors, and now you're thinking about ways to incentivize your team and give early backers a chance to share in your potential success. You've heard about stock options and warrants, but you're not sure which is the right choice for your company. Let me break it down for you in simple terms. Options and warrants are both securities that give the holder the right to purchase stock at a set price. While they share some similarities, there are a few key differences to understand before determining which is the better fit for your startup. If you're looking for a way to motivate employees and reward early investors without giving up too much equity or control of your company upfront, warrants deserve a close look. They can be an extremely founder-friendly tool if structured properly. Ready to learn more? Let's dive into the details. -

Stock Options

What are stock options, and how do you exercise them?

Have you ever wondered how some people seem to get rich by working for startups or tech companies? Chances are, they benefited from something called stock options. Stock options are a way for companies to compensate employees, especially when the company isn't flush with cash. Instead of paying high salaries, they offer the option to buy shares of company stock at a discount. If the company does well and the stock price goes up, employees can buy shares at the lower price and sell them for a profit. -

Startup Investment Southeast Asia

Why Southeast Asia is the Next Hotspot for Startup Investments

Southeast Asia is rapidly emerging as one of the world’s most promising regions for startup investments. With a growing population, a rising middle class, and a rapidly expanding digital economy, Southeast Asia presents a wealth of opportunities for investors looking to tap into this dynamic and rapidly evolving market. In this article, we’ll take a closer look at why Southeast Asia is the next hotspot for startup investments.