Trends and Predictions for Startups and Investors Regarding Venture Debt

Venture Debt Trends and Predictions for Startups

"Venture debt has emerged as a popular alternative funding source for startups seeking capital without sacrificing equity." As the startup ecosystem evolves, so does the future of venture debt, with new trends and predictions emerging. This article will look at the future of venture debt and what startups and investors can expect in the coming years.

The Growing Popularity of Venture Debt

In recent years, venture debt has grown in popularity as a financing option for startups. With the increasing cost of equity financing and the rise of alternative sources of capital, more startups are turning to venture debt to fund their growth. This trend is expected to continue as startups seek to balance their financing requirements while retaining ownership and control of their businesses.

Furthermore, as startups seek to maintain financial flexibility during uncertain times, the COVID-19 pandemic has accelerated the adoption of venture debt. Venture debt allows startups to access capital without diluting equity, making it an appealing financing option for startups in difficult market conditions.

New Venture Debt Providers Emerge

As the popularity of venture debt grows, new players enter the market, providing startups and investors with more options. Non-traditional lenders and crowdfunding platforms are joining traditional venture debt providers, such as banks and specialized lenders.

These new players provide startups and investors with novel financing models and structures, such as revenue-based financing and crowdfunding, both of which are gaining popularity. As a result, startups and investors now have more options than ever before, allowing them to tailor their financing requirements to their specific needs.

Increasing Pricing Pressure and Competition

As the number of venture debt providers grows, competition is expected to rise, putting downward pressure on market pricing. While venture debt has traditionally been more expensive than equity financing, pricing pressure is likely to drive down interest rates and fees, making venture debt more accessible and affordable for startups.

However, as lenders seek to maintain profitability in a more competitive market, this trend may lead to increased risk-taking. As a result, startups and investors must carefully consider the risk-return profile of venture debt investments.

Concentrate on Long-Term Growth and Profitability

As startups strive to strike a balance between growth and sustainability, venture debt is becoming an increasingly important financing tool. Venture debt enables startups to access capital while retaining ownership and control of their businesses, allowing them to pursue long-term growth and profitability.

This trend is expected to continue as startups prioritize long-term viability and profitability over rapid growth at any cost. As a result, before providing financing, venture debt providers will need to assess the sustainability and profitability of startups.

Technology Integration

Technology, like other areas of finance, is expected to play an increasingly important role in the venture debt market. The emergence of new fintech startups and platforms is expected to drive market innovation and efficiency, making capital access easier and faster for startups.

Furthermore, technology is expected to improve the underwriting and risk assessment processes for venture debt providers, allowing them to more accurately evaluate investment risk-return profiles. This is expected to result in more accurate pricing and risk management, benefiting both startups and investors in the long run.

Conclusion

The future of venture debt holds promise for startups and investors alike, with evolving trends and predictions shaping the landscape. WOWS Global, as an expert in the field, can assist you in navigating the world of venture debt. Here's why you should connect with WOWS Global for your venture debt needs:

- Expertise in Venture Debt: WOWS Global has a deep understanding of venture debt and its role in startup financing. With our experience and knowledge, we can guide you through the intricacies of venture debt, helping you make informed decisions and secure the funding you need to grow your business.

- Extensive Network of Investors: As Southeast Asia's most active investor matching platform, WOWS Global has built a vast network of investors actively seeking investment opportunities. By connecting with WOWS Global, you gain access to this network, increasing your chances of finding the right investor who aligns with your business objectives.

- Tailored Financing Solutions: We understand that each startup has unique financing requirements. At WOWS Global, we offer customized venture debt solutions that cater to your specific needs. Whether you need funding for product development, marketing, or other growth initiatives, we can assist you in structuring the right financing solution for your business.

- Holistic Support: WOWS Global provides comprehensive support throughout the venture debt process. From developing a compelling pitch deck to assisting with financial modeling, due diligence readiness, and legal documentation, our expert team is by your side, ensuring a smooth and successful funding journey.

Connect with WOWS Global today at contact@wowsglobal.com to leverage our expertise in venture debt financing. We are committed to helping startups like yours thrive by providing the necessary funding and support. Take the next step toward scaling your business with confidence and reach out to us for a consultation.

Related Posts

-

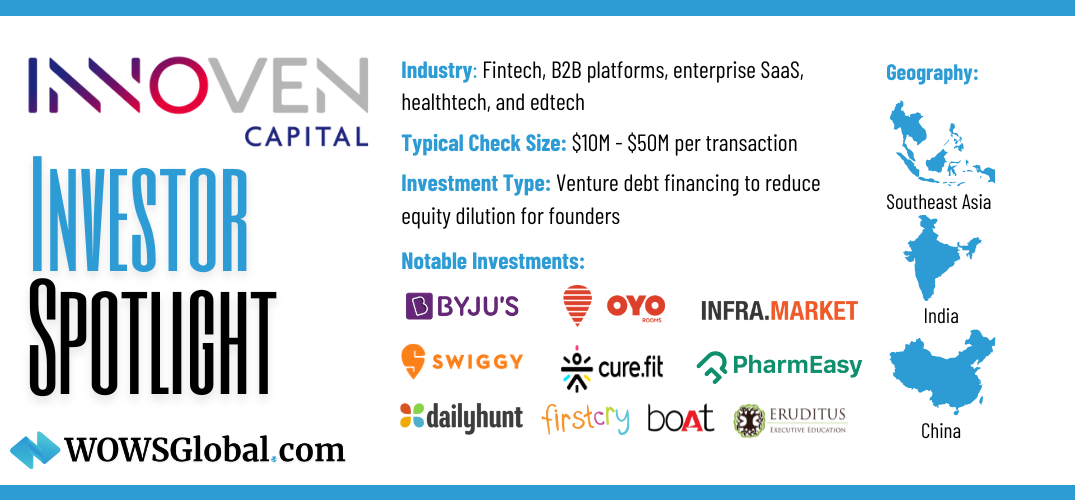

Venture Debt InnoVen Capital Startup Funding

Investor Spotlight: InnoVen Capital – Powering Asia’s Startup Ecosystem with Venture Debt

For startups aiming to scale without sacrificing equity, venture debt has emerged as a crucial financial tool. InnoVen Capital, a leading venture debt provider in Asia, has helped over 180 startups grow without dilution. With a focus on India, China, and Southeast Asia, InnoVen Capital has deployed over $400 million across 250+ transactions, backing industry giants like Byju’s, Swiggy, Oyo, and PharmEasy. Learn how venture debt can be a game-changer for your startup. -

Fintech XenCapital Helicap Venture Debt

XenCapital Secures $50M Credit Facility from Helicap to Empower Southeast Asian Businesses

XenCapital, the lending arm of Xendit, has secured a $50M credit facility from Singapore's Helicap to provide vital financing to underbanked businesses across Southeast Asia. This partnership reflects the region's growing reliance on alternative lending solutions to drive financial inclusion. -

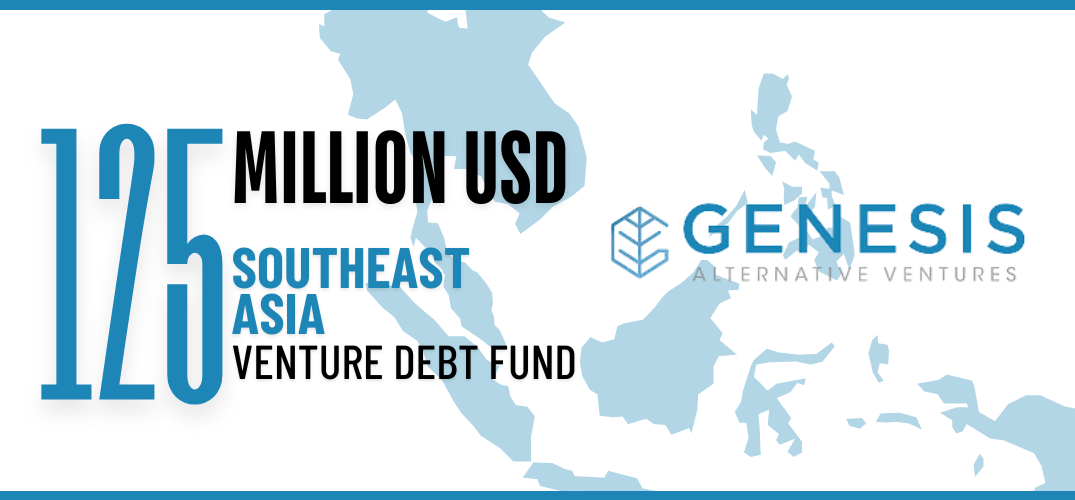

Venture Debt SEA Startups Genesis Alternative Ventures

Genesis Alternative Ventures Raises $125M for Second Venture Debt Fund: Boosting SEA’s Investment Landscape

Genesis Alternative Ventures closes $125M for its second venture debt fund, providing crucial growth capital to Southeast Asia’s startups. Discover why venture debt is the perfect tool for startups looking to scale without diluting equity. -

venture debt startup ecosystem startup funding

The Rise of Corporate Investors and Venture Debt in Early-Stage Funding

In 2024, corporate investors and venture debt are reshaping early-stage funding. Discover how these trends are creating new opportunities for startups and what founders need to know. -

Venture Debt Startups

The Advantages of Venture Debt for Fast-Growth Startups

"Securing the necessary capital to scale your business as a high-growth startup can be a difficult and complex task." While traditional financing options like bank loans and equity financing may be appropriate for some businesses, venture debt has emerged as a popular and effective option for high-growth startups. In this article, we'll look at the advantages of venture debt for high-growth businesses. -

Venture Debt Equity Financing

Which Is Better for Your Startup: Venture Debt or Equity Financing?

"One of the most important decisions you'll need to make as a startup founder is how to fund your business." Venture debt and equity financing are two popular options. Both can provide the capital you need to grow your business, but they have different risks, costs, and levels of control. In this article, we'll look at the advantages and disadvantages of venture debt and equity financing to help you decide which is best for your startup.