Venture Debt Financing Explained

Venture Debt Venture Debt Financing

Startup founders will be very aware that essential funding is required if they are to grow their business in a structured and successful way. There are a variety of different ways to secure the finances needed and the one that will be looked at here may be a lesser-traveled route for founders but it should not be discounted.

We are talking about venture debt financing and will get into exactly what this type of financing is, where it comes from, and how it should be used to complement rather than replace venture capital.

What is Venture Debt Financing?

Venture debt is a loan type offered to startups by banks as well as nonbank lenders (an example here is venture capital firms). By design, this type of loan focuses on early-stage companies who are looking in the first instance to increase their overall growth as opposed to profitability.

Venture debt financing should be viewed as an important option for all those involved in the startup industry. Granted, it is not as well known or as often used as its more popular sibling; venture capital, but it is certainly a route that startup founders should take a long look at.

Two examples of where a venture debt loan should be seen as highly advantageous to a startup are:

- To allow startups to extend their runway between funding rounds.

- To help startups finance important capital investments.

It should be made clear that to maximize your chances of securing a venture debt loan this should complement the equity you have already raised. Indeed, many industry insiders would state that the first rule of venture debt is that it follows equity rather than replacing it.

Startup founders who secure venture debt financing will find it an effective way of fuelling the development and growth of their company. This will also be achieved without the need to dilute their cap table even further than it may already have been after securing that essential initial funding through equity.

With that in mind, founders should not view venture debt funding as an alternative to venture capital funding. Instead, it should be seen as a complementary form of funding.

How Venture Debt Works?

Those founders considering venture debt financing should view this as essentially being a loan. With that comes standard inclusions that apply to other types of loans. Examples here are:

- A pre-set and agreed interest rate.

- Repayment expectations and fixed repayment schedules.

- Interest-only periods.

- Forms of protection the lender puts in place if the borrower is unable to repay the debt.

In the vast majority of cases, venture debt will only be made available to companies that have already succeeded in securing equity during a funding round. This means it is unusual to secure a venture debt loan in the pre-seed and seed funding stages.

Most typically a venture debt loan will be accessed and used in the form of additional capital after a Series A funding round has been completed.

When considering the viability of issuing a venture debt loan, lenders will take into account the equity funding amounts your startup has previously secured. They will use these figures and other metrics to assess the value and security (risk) of investing in your company. These considerations also help form a benchmark as to the loan amount they will offer your company.

As an indication, venture loan sizes are generally between 25%-50% of the amount you have raised in your previous equity round.

Venture debt loans are generally made available for growth-focused companies. This means that lenders will want assurances that founders have the ability to meet the agreed repayment obligations. A startup that is backed by venture capital certainly helps assure them of this.

Venture Debt Structure - The 2 Main Forms are….

Line of credit and term loans are the 2 main forms of venture debt structuring. Let’s take each in turn:

Line of credit

All founders will be familiar with this type of loan. It is a revolving line of credit and can be viewed similarly to a credit card or an overdraft (granted, the sums involved are generally far higher than that on personal lines of credit!)

Basically, you will be given access to the loan amount agreed (example: $1.5M) for an agreed period (example: 3 years).

During the agreed period of 3 years, founders can borrow and repay the $1.5M (or portions of that amount) as many times as they need to. The repayable amount includes the interest rate as per your initial loan agreement.

Term loan

This type of venture debt loan differs because a startup company can be given the agreed amount in one of two ways. First, you can receive the total cash amount upfront. Second, it could be given in predetermined installments (for example 50% immediately, 25% after 1 year, 25% after 2 years).

Taking a term loan means that your payments will be more structured. This is because the dates and amounts of repayment are predetermined before the loan amount and the period of the loan commences.

Whichever venture debt loan type a founder agrees on, both are generally viewed as short-to-medium-term agreements. In most cases, these loan periods will be between 3 and 5 years.

Why Consider Venture Debt Over Venture Capital?

It is clear that venture capital is the most popular form of funding and is seen as being easier to obtain than a venture debt loan. However, venture capital comes with a noticeable drawback.

That is, when taking everything into account it is relatively expensive.

To explain further, when your startup receives venture capital, you are giving up a noticeable stake of equity in your company. This means that if your company performs exceptionally well (as all founders surely hope!) the true monetary value of the equity you have surrendered can amount to millions of dollars.

Finding the Middle Ground

When seeking funding founders need to strike as ideal a balance as possible between debt and equity funding options.

From a founder’s perspective, venture debt would almost always be a favored option but there is a catch! It is a well-known fact that early-stage companies that have not yet established a reasonable revenue model and are yet to find the correct product-to-market-fit ratio have to rely on equity financing as their only viable way to raise funds.

Why? Because it is very rare for institutions to offer venture debt loans to unfunded startups.

This means that in general, the best time for founders to look at a venture debt agreement comes immediately after they have been through a successful Series A round.

There are two reasons for this:

First, it will maximize the amount of money you can access. This is because venture debt lenders tend to lend money based on the size of the venture equity dollar amount you are currently holding.

Second, it is at this point that you will have the most leverage. This is because your investor can see the success and amount of funding that has already been achieved. This will make potential investors far more confident in offering a venture debt financing loan.

One Aspect Where Caution is Required….

There is one particular use of any venture debt funding received that needs approaching with caution. That relates to using venture debt to extend your runway between funding rounds.

There is no doubt that this is a common use of venture debt funds. However, it can easily go wrong. Here’s why:

It is quite often the case that it takes a much longer period than you originally forecast to raise your Series B. If that does turn out to be the case then the lender may decide to declare a default.

In doing so they are very likely to call for accelerated payment on the loan amount given. If that does happen it could very easily put your company out of business altogether!

Major Factors That Venture Debt Lenders Look for….

Venture Debt lending is a double-edged sword. One which both founders and the lenders need to carefully consider before any commitment.

With that in mind, here are 4 major factors that venture debt lenders (banks as well as nonbank lenders) are looking for:

Equity funding has already been received

As already stated, it is most uncommon for venture debt lenders to entertain loans or to work with startups that have not already been successful in an equity funding round.

This means that founders should consider this as a primary requirement before preparing to go down the venture debt financing route.

You have established a strong, effective team

All investors will want to know that you have a great business idea. One they can relate to and one that they believe can be a success if they are to offer investment.

When it comes to venture debt lenders they will also be looking closely at the team you have put together. This makes it essential for founders to get the right employees onboard. The priority goal here is to establish a team that has the collective ability to effectively and successfully bring your product or service to market.

Your business has identified a significant market opportunity

Investors of every type are taking a gamble on the future. When it comes to venture debt lenders they will have carried out their research and looked in depth at your company structure to assess how things are progressing.

One major area of research will be the type of market opportunity your product or service fills. While it may be difficult for your business to be unique, it does need to show potential to take a significant slice of the market you are entering.

Venture debt lenders are putting up significant loan amounts. This means they will need to feel confident that your business can repay such a loan amount over the agreed term. That will only happen if you can demonstrate a very healthy future growth curve and have a persuasive/realistic go-to-market plan.

An established revenue model is a must

This point does not mean your company has to have huge revenue streams. But some form of established revenue model needs to be in place. Debt investors will want a clear understanding of how your company has established a revenue model, how it works, and that you can show a base of paying customers

Having said this, founders need to remember that the focus of debt investors is more focused on fast-growth companies. If your forecasts and projections show the potential for fast growth this will appeal to said debt investors.

Is Venture Debt Financing Right for Your Company?

As can be seen from the above detail, venture debt financing has some very positive benefits. On the other hand, it is clearly not a funding route available or suitable for every company.

Some founders will find that sticking with equity funding rounds is more suitable. However, understanding venture debt and venture capital is something that all founders need knowledge of. This is where key assistance should be sought.

The highly experienced team at WOWS Global can offer such advice and guidance. We fully understand the challenges that founders face during their startup journey. We are perfectly positioned to assist with all aspects of growing your business in a structured and effective way.

Our state-of-the-art online digital ecosystem includes an investment readiness platform that is designed to assist startups in their primary and secondary transactions.

Regardless of whether you are an early-stage founder or your venture is beginning to firmly establish itself, WOWS Global is ready to explain and guide you on the different ways to raise the necessary funds that will help secure your company’s future.

We also have exclusive access to verified investors and can help unify like-minded investors with the sector your company is operating in.

To find out more and arrange a no-obligation discussion please do not hesitate to reach out to us at - contact@wowsglobal.com

Related Posts

-

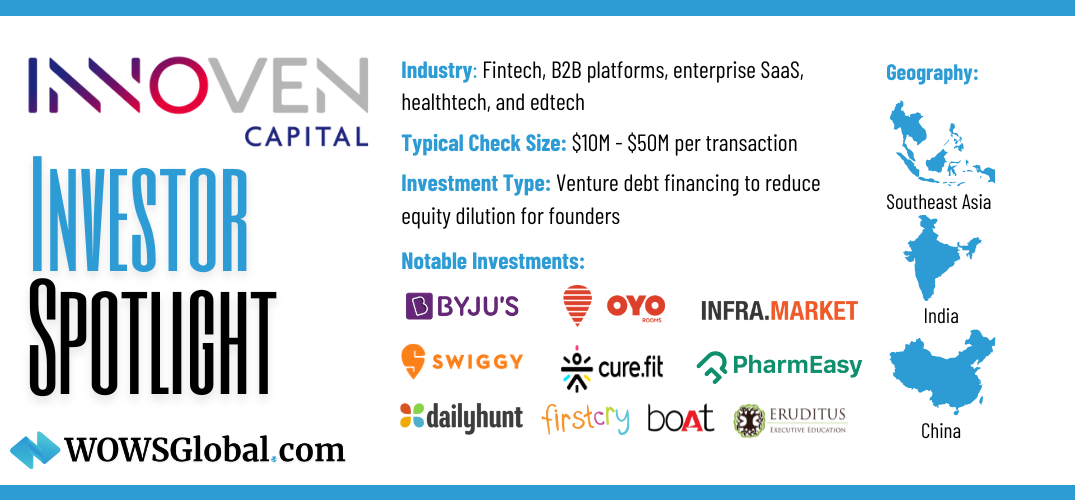

Venture Debt InnoVen Capital Startup Funding

Investor Spotlight: InnoVen Capital – Powering Asia’s Startup Ecosystem with Venture Debt

For startups aiming to scale without sacrificing equity, venture debt has emerged as a crucial financial tool. InnoVen Capital, a leading venture debt provider in Asia, has helped over 180 startups grow without dilution. With a focus on India, China, and Southeast Asia, InnoVen Capital has deployed over $400 million across 250+ transactions, backing industry giants like Byju’s, Swiggy, Oyo, and PharmEasy. Learn how venture debt can be a game-changer for your startup. -

Fintech XenCapital Helicap Venture Debt

XenCapital Secures $50M Credit Facility from Helicap to Empower Southeast Asian Businesses

XenCapital, the lending arm of Xendit, has secured a $50M credit facility from Singapore's Helicap to provide vital financing to underbanked businesses across Southeast Asia. This partnership reflects the region's growing reliance on alternative lending solutions to drive financial inclusion. -

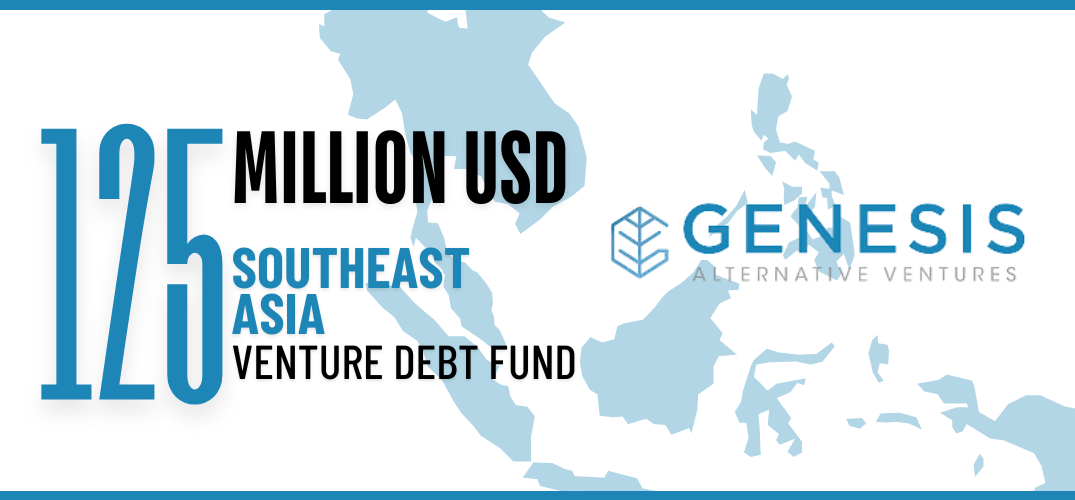

Venture Debt SEA Startups Genesis Alternative Ventures

Genesis Alternative Ventures Raises $125M for Second Venture Debt Fund: Boosting SEA’s Investment Landscape

Genesis Alternative Ventures closes $125M for its second venture debt fund, providing crucial growth capital to Southeast Asia’s startups. Discover why venture debt is the perfect tool for startups looking to scale without diluting equity. -

venture debt startup ecosystem startup funding

The Rise of Corporate Investors and Venture Debt in Early-Stage Funding

In 2024, corporate investors and venture debt are reshaping early-stage funding. Discover how these trends are creating new opportunities for startups and what founders need to know. -

Venture Debt Trends and Predictions for Startups

Trends and Predictions for Startups and Investors Regarding Venture Debt

"Venture debt has emerged as a popular alternative funding source for startups seeking capital without sacrificing equity." As the startup ecosystem evolves, so does the future of venture debt, with new trends and predictions emerging. This article will look at the future of venture debt and what startups and investors can expect in the coming years. -

Venture Debt Startups

The Advantages of Venture Debt for Fast-Growth Startups

"Securing the necessary capital to scale your business as a high-growth startup can be a difficult and complex task." While traditional financing options like bank loans and equity financing may be appropriate for some businesses, venture debt has emerged as a popular and effective option for high-growth startups. In this article, we'll look at the advantages of venture debt for high-growth businesses.