Funding and Liquidity Solutions

Embark on your capital raise journey with WOWS. Our investment portal offers you the tools and support to connect with investors, manage your stakeholder relations, and navigate your financing requirements effectively. Start by listing your company and let us guide you towards your financing goals. Join and gain the attention of the biggest investors in the ASEAN region

Simplify Your Path to Funding

Embark on your capital raising quest with confidence and no upfront investment. Build your story and apply at zero upfront cost. Once approved, choose a plan that suits your ambitions with expert guidance.

Empower Your Growth with Pivotal Tools

-

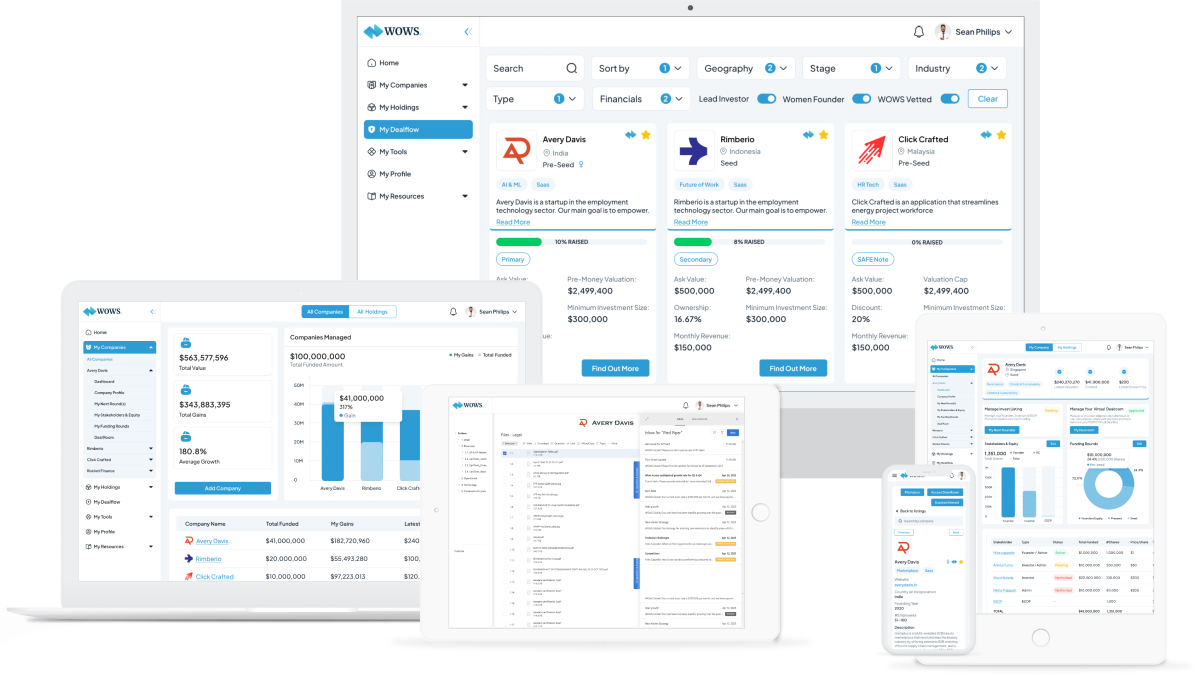

Personalized Dashboards

Track your funding history and stakeholder equity with precision.

-

Virtual Deal Room

A branded deal room for comprehensive due diligence.

-

Achieve Funding Goals

With an active listing, you'll capture the attention of WOWS' vast Investor network.

-

Analytics and Reporting

Unlock the full potential of your data with our advanced analytics and reporting tools.

Start for Free, Commit When Ready

Choose the pricing plan that fits your goals

Empower Your Funding Journey

-

Launch with No Fees

Begin your journey on WOWS without any financial commitments. Enjoy free registration and application, ensuring you only invest when you're ready

-

Connect with the Right Investors

WOWS uses intelligent matching to pair your company with investors who align with your vision and goals, maximizing potential for funding success.

-

All-in-One Investor Engagement

Harness the power of WOWS with dynamic equity dashboards, customizable deal rooms, and comprehensive stakeholder management — all in one unified platform.

Expert Answers to Your Top Questions

Your success is our mission. We've gathered the most relevant questions to help you navigate the investment process with WOWS Global. Find quick answers here and get one step closer to achieving your funding goals.

-

How does WOWS Global facilitate the fundraising process for startups and SMEs?

The WOWS Investment Portal streamlines your fundraising journey from start to finish. We offer a digital investment banking experience, from creating a compelling profile on WOWS Deal Flow to connecting you with a wide network of investors. Our platform supports primary placements, secondary transactions, and alternative financing, guiding you through each phase with expert support.

-

What is the "Endorsed" plan, and how is it different from "Pitch Ready"?

The "Endorsed" plan is a premium service offered by WOWS Global tailored to help companies secure funding more effectively. This plan goes beyond the "Pitch Ready" tier by providing comprehensive support from the WOWS investment team. It includes features like a WOWS-endorsed profile on My Deal Flow, a dedicated investment manager, personalized investor outreach, preparation for investor meetings, and assistance with term sheet negotiations.

In contrast, the "Pitch Ready" plan is more self-service oriented, offering basic tools and opportunities for companies to independently explore potential investor connections. It provides access to a platform where companies can present themselves to investors but does not include the hands-on support and personalized services included in the "Endorsed" plan. This makes "Endorsed" particularly valuable for those seeking a more guided approach to securing investment. -

What is required for approval by the WOWS Global investment team?

To gain approval from the WOWS Global investment team for the 'Endorsed' plan, companies must meet several criteria, reflecting both their readiness for investment and the alignment with investor interests. Here are key aspects of the approval process:

Investor Appetite: The primary factor is the current demand from investors. WOWS Global evaluates whether there is a match between investor interests and the company's offerings, ensuring a higher likelihood of successful funding.

Company Readiness: Companies should be well-prepared with up-to-date and comprehensive documentation. This includes a polished pitch deck, a detailed business plan, and recent financial statements that collectively present a compelling case to potential investors.

Vetting Process: As part of the approval, WOWS Global conducts a thorough vetting process. Companies are expected to have all necessary documentation ready for review. This process not only assesses the company's current status but also ensures that they are primed to enter the investment stage confidently.

Profile Completion and Due Diligence Readiness: During the approval process, WOWS Global assists companies in completing their profiles on the WOWS platform and prepares them for due diligence. This includes setting up in the WOWS Virtual Deal Room, where all relevant documents and data are organized and made accessible to prospective investors.

Overall, the approval process by the WOWS Global investment team is not just about evaluating potential but also about preparing companies for successful capital raising. By ensuring that companies are due diligence-ready, WOWS Global maximizes the chances of securing investment.

-

How is Premier different from the Endorsed plan?

While the Endorsed Plan provides you access to WOWS Global’s deal flow platform and investor network, the Premier package offers personalized, end-to-end support. You’ll work with a dedicated team of experts who will assist you with financial modeling, crafting a compelling pitch deck, preparing SAFE notes, negotiating term sheets, and securing a 409A valuation. This is a true full-service offering for startups that want professional, hands-on guidance at every step of their fundraising journey.

-

Is there a specific sector or industry WOWS Global focuses on?

WOWS Global does not restrict its focus to specific sectors or industries. Instead, the organization is open to a wide range of companies across various fields. This inclusive approach allows WOWS Global to remain flexible and responsive to changing investment trends and investor interests.

-

Who will be my dedicated investment manager?

When you join the "Endorsed" plan at WOWS Global, a dedicated investment manager is strategically assigned to your company. This selection is carefully made by the WOWS approval committee during the vetting process. The assignment of your investment manager is based on several key factors:

Expertise Match: The investment manager chosen for your company will have expertise that aligns closely with your industry, business model, and specific needs. This ensures that you receive knowledgeable and relevant guidance.Investor Demand Compatibility: Your investment manager will also be selected based on their understanding of and connections with current investor demand. This alignment is crucial to effectively match your company with the right investors.

Strategic Onboarding: The assignment process is designed to ensure that when your company is onboarded, there are target investors ready and interested. This proactive approach helps in facilitating quicker and more effective connections between your company and potential investors.

Overall, your dedicated investment manager at WOWS Global acts as a crucial link between your company and the investor community, equipped with the right tools and connections to support your capital raising efforts.

-

How long after applying will we know if we’re approved for the "Endorsed" plan?

Once you apply for the "Endorsed" plan at WOWS Global, the approval process typically takes between 2 to 5 days. The duration largely depends on how complete and accurate your application and profile are at the time of submission.

-

What types of companies is Premier ideal for?

The Premier package is perfect for startups and high-growth companies that are actively seeking investment and want to ensure they are fully prepared to meet with potential investors. Whether you are raising a Seed, Series A, or later-stage funding, this package provides the tools and guidance to present your business in the best light and maximize your chances of securing capital.

-

What if I need additional services beyond what is included in the package?

The Premier package covers the essential services required to prepare for a successful fundraising round. If you need additional support, such as extended financial advisory services, more rounds of pitch deck revisions, or legal support beyond term sheet negotiation, we can offer those services at an additional fee. Your investment manager will work with you to assess your needs and provide a customized quote if necessary.

Ready to Propel Your Venture?

Launch your venture's growth journey at no initial cost with WOWS. Register for free, craft your company's narrative, and when you’re ready, choose a plan to connect with top-tier investors. No credit card, no immediate fees—invest in your timing, on your terms.