1982 Ventures: Catalyzing Fintech’s Next Generation in Southeast Asia

1982 Ventures Fintech SEA 6 Minutes

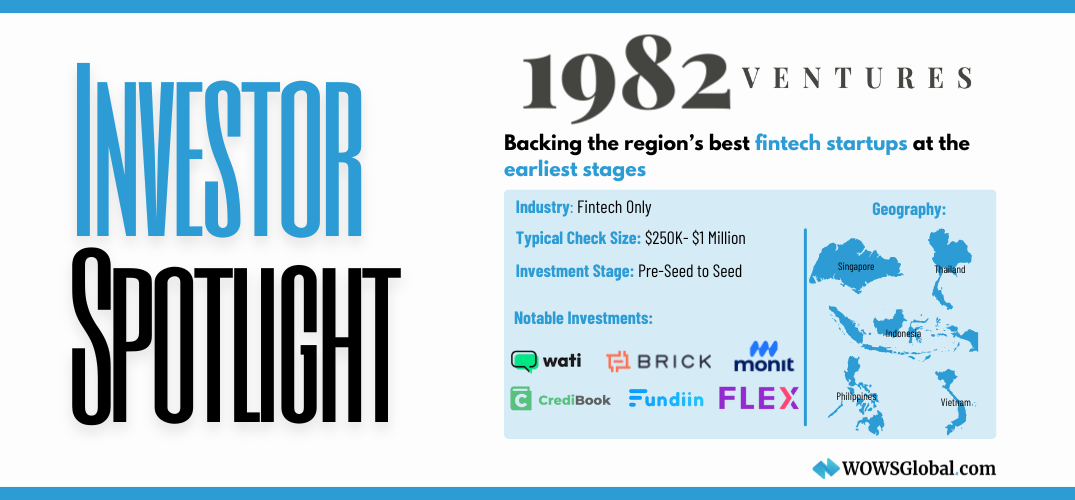

In the heart of Southeast Asia’s booming fintech scene, 1982 Ventures stands out as a laser-focused VC firm that’s not just betting on the future—it’s building it. With a core belief that Southeast Asia is the most exciting fintech opportunity globally, 1982 Ventures has positioned itself as the go-to first investor for fintech founders ready to take on this high-growth region.

Fintech-First, Southeast Asia Always

Core Investment Focus

1982 Ventures is singular in its mission: backing the region’s best fintech startups at the earliest stages. Their strategy revolves around funding founders who are modernizing financial services across emerging markets in Southeast Asia, with particular focus on:

-

Digital Banking

-

Payments & Remittances

-

Alternative Lending

-

Insurtech

-

Embedded Finance

-

Wealth & Personal Finance

-

SME Finance Infrastructure

Their fintech-only thesis means portfolio companies benefit from a network and expertise designed specifically for navigating regulatory, partnership, and growth complexities within financial services.

Geographic Focus

The firm is unapologetically regional: headquartered in Singapore and investing across Indonesia, Vietnam, the Philippines, Thailand, and other SEA markets. While global VCs often overlook early-stage SEA fintech, 1982 Ventures sees a region ripe for disruption and transformation—and is betting early and boldly.

Investment Strategy & Stage

1982 Ventures invests at pre-seed and seed stages, writing initial checks typically between $250,000 and $1 million. They aim to be the first institutional investor—bringing not just capital, but strategic fintech firepower to the cap table.

The firm often leads rounds and takes board seats, working closely with founders on:

-

Market validation

-

Product development

-

Regulatory navigation

-

Talent acquisition

-

Follow-on fundraising

Their high-conviction, hands-on approach means startups receive more than funding—they get an operator-level partner for the road ahead.

Portfolio Highlights: Backing Fintech Breakouts Early

1982 Ventures has already built a reputation for spotting fintech stars early in their journeys:

-

Brick (Indonesia) – A fintech infrastructure API startup powering open finance in Indonesia. 1982 Ventures backed Brick from the very beginning.

-

WATI (Singapore) – A customer engagement platform built on WhatsApp for SMBs, now used globally by businesses to improve customer communication. WATI has since scaled to over 100 countries.

-

Credibook (Indonesia) – A bookkeeping and digital payment solution for Indonesian micro and small businesses, driving financial inclusion through tech.

-

Fundiin (Vietnam) – A buy-now-pay-later platform built for the Vietnamese consumer market, enabling better financial access for a new generation.

-

Monit (Indonesia) – A financial wellness platform providing tools for budgeting and financial planning.

-

Flex (Vietnam) – A company providing technology and financial solutions to help merchants and businesses optimize performance. Exited in February 2025. Details of the exit type and size are not publicly disclosed.

Their growing portfolio includes dozens of startups across SEA tackling foundational financial problems—everything from underwriting to compliance to embedded insurance.

Why Founders Choose 1982 Ventures

Fintech founders in Southeast Asia don’t just need capital, they need allies who understand:

-

How to navigate regulators across fragmented jurisdictions

-

What it takes to build trust in financial products

-

Which partnerships unlock scale in bank-dominated markets

-

How to raise global capital while staying rooted locally

That’s what 1982 Ventures delivers.

Their partners come from deep fintech backgrounds and offer unmatched insight, introductions, and conviction. More than just a term sheet, founders get:

-

Instant fintech credibility

-

Access to an exclusive founder and LP network

-

Hands-on operational support at the most critical stage

WOWS Global: Connecting You to Investors Like 1982 Ventures

At WOWS Global, we’re in the business of making the right connections. 1982 Ventures is one of the most relevant VCs for early-stage fintech founders across SEA, and a valuable partner for startups looking to break into or scale within this region.

Whether you're building infrastructure APIs, embedded finance solutions, or inclusive digital banking tools, a partner like 1982 Ventures could unlock the regional momentum you need.

Ready to raise capital and scale your fintech startup? Connect with WOWS Global today and explore our investor network.

Related Posts

-

Fintech SEA AI Startups Early Stage 5 Minutes

Moonshot Ventures: Betting Early on Southeast Asia’s Purpose-Driven Builders Starting with Women-Led Innovation in Indonesia

Moonshot Ventures invests early in Southeast Asia’s most mission-driven founders, pairing capital with deep operating support. Through IWEF, it’s helping women-led innovation in Indonesia scale with a tranche-based model and a strong partner network. -

Capital SEA B2B ASEAN 7 Minutes

Cocoon Capital: Backing Southeast Asia’s Quiet B2B Revolution

From AI-powered stroke diagnostics to pharma distribution and SME payment rails, Cocoon Capital backs the “invisible” infrastructure powering Southeast Asia’s next wave of growth. This Investor Spotlight unpacks their B2B and deep-tech thesis, how they invest, and the founders they champion. -

Tourism Travel SEA Tech 5 Minutes

Yacht Me Thailand: Digital Yacht Charter Platform for a Fragmented Market

Yacht Me Thailand is digitising yacht and boat charters across Thailand’s top marine destinations. With operator-first tools, sustainability at its core and ambitions to become a regional boating OTA, the platform is emerging as a notable travel-tech and marine tourism play. -

Fintech AI Startups Early Startups SEA 4 Minutes

The Dip in SEA Fintech Funding: What Startups Can Learn

SEA fintech funding has dipped, but capital is still on the field for disciplined teams. This article unpacks what the new funding rules look like and how founders can upgrade models, governance, monetization, and capital stacks. Learn where investor expectations have shifted and how WOWS Global can help you get raise ready. -

Series B Singapore SEA India 5 Minutes

Iron Pillar: Scaling India-Built Tech Into Southeast Asia

Iron Pillar is a venture-growth firm backing India-built technology as it scales across Southeast Asia. This spotlight covers stage focus, typical checks (US$5–15M), sectors, SEA go-to-market via Singapore, and notable portfolio patterns in SaaS and platforms. For founders and co-investors, it’s a practical guide to where Iron Pillar fits, and how to engage. -

SEA Startup & Venture Capital Proptech Media 4 Minutes

Catcha Group: Company-builders Powering SEA’s Internet Plays

Catcha Group has spent two decades building and backing Southeast Asia’s internet champions, from classifieds and OTT to flexible workspaces. With hands-on operating support and smart consolidation plays, the firm has turned category leaders into headline exits.