4 Reasons Every Startup Should Use a Digital Cap Table

Cap Table Startup

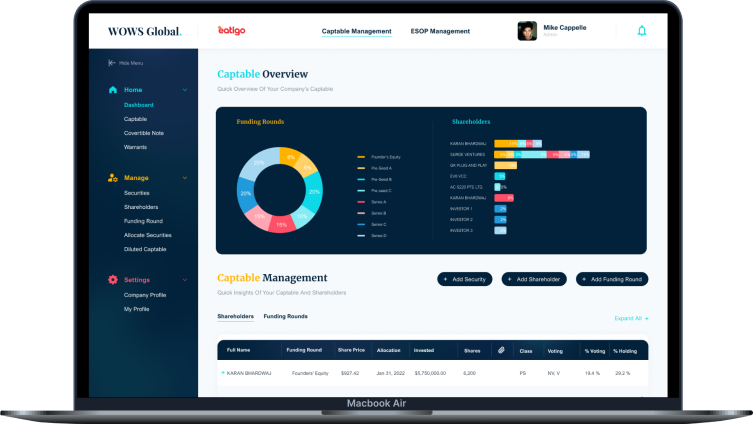

A capitalization table (cap table) is a record of a company’s ownership structure accompanied by the information of the relevant stakeholders. In recent times, companies will often have multiple types of securities from common stock and preferred shares to convertible notes, warrants and options, each with its own unique vesting periods and owned by a multitude of different shareholders. Managing these ever-changing equity structures and various securities as companies go through fundraising rounds can be tedious and time-consuming on manual spreadsheets.

An argument can be made that with the tools available online, modern startups should always digitalize their cap table to optimize data visibility and validity and to efficiently facilitate fundraising and growth.

Transparency

By using a digital cap table, startups can ensure their shareholding structure is always up-to-date and accessible to the shareholders. Stakeholder dashboards give founders, investors and other relevant parties visibility on their equity holdings and thus make it more tangible and easier to track growth and equity performance. More importantly, by digitalizing cap table, startups also avoid producing multiple versions of the cap table with discrepancies. This assist startups to streamline decision making as well as manage investor relations.

Eliminate Human Errors and Time Inefficiencies:

Using spread sheets to manage cap tables can be complicated and time consuming and cause a drain on limited finance human resources within startups. Minor errors can lead to misinformation that results in costly delays to strategic decision-making particularly during fundraising cycles. These inefficiencies slow down the growth of a startup

Transaction History:

As startups grow, equity structures change and managing these changes on spreadsheets may create backlogs of inconsistency as well as a lack of understanding on the structural changes over time. Digital cap tables allow startups to view historical cap tables by date or by funding round to see a snapshot of the shareholding structure at any given time of the startups history. Similarly, startups can also utilize the forecasting functionalities to assess various fundraising scenarios as they accelerate their growth.

Managing Various Financial Instruments:

More and more startups leverage financial instruments such as convertible cotes & warrants to raise funds required for their growth. As these instruments have different maturity dates and conditions, taking them into account on a cap table can be difficult. Digital cap tables allow startups to view their diluted cap table, taking into consideration all active financial instruments and therefore giving a more comprehensive and useful snapshot of a company’s future shareholding.

All the above reasons clearly endorse startups to utilize digital cap table to address pain points and enhance growth efficiency. WOWS Global is therefore currently offering its digital cap table tool free of charge with up to 10 users to all interested startups.

📞 Learn more about our Equity Management tools and discover how WOWS Global can support your business growth.. Ready to take the next step? Schedule a call with our experts now!

Related Posts

-

Cap Table SEA AI Startups Southeast Asia

The $200M Refill: When Coffee Chains Teach Us About Liquidity

A closer look at Kopi Kenangan’s USD 200M hybrid round—and why mid-journey liquidity, valuation discipline, and payout clarity matter. We break down the mechanics, the incentives, and the playbook for both founders and investors. -

Exit Strategy M&A readiness Cap Table Startup Exits Investor

Planning the Finish Line: Why Every Business Needs an Exit Strategy

Launch matters, but exits set the score. Learn how early planning, clean governance, and buyer mapping turn hard-won growth into the best possible outcome. -

Startup Startup Growth Founder Health Habits

Startup Growth and the Surprising Power of Sleep: What the Data Says About Founder Health Habits

Forget the hustle myth. Founders who sleep smarter, not less, are scaling faster. The data reveals surprising links between sleep, wellness, and startup success. -

Financial mistakes startup Fractional CFO

Financial Mistakes That Hurt Businesses—Startups & SMEs Alike

Many startups and SMEs unknowingly make financial mistakes that hurt profitability, cash flow, and long-term success. From misinterpreting cash in the bank to scaling without financial planning, these pitfalls can be costly but avoidable. Discover the most common financial mistakes and how to fix them in this guide by WOWS Global. -

Startup MVP Lean Startup Feedback

The MVP: Turning Bare Bones Into Billion-Dollar Dreams (Or a Glorified Prototype)

The MVP (Minimum Viable Product) is your scrappy, bare-bones version of your grand vision. Learn how to strike the right balance between too minimal and too polished while preparing for an MVP launch in this startup guide. -

cap table investor relations

Is Your Investor "Cap Table Material"?

Choosing the right investor is like finding a life partner—make sure they’re “cap table material.” Our cheeky checklist will help you spot the keepers from the flings. Read on!