AFG Partners: Empowering Global B2B Fintechs to Scale Across Asia

AFG Partners Fintech VC Asia finance 5 minutes

In the fast-evolving world of financial technology, few firms are as uniquely positioned as AFG Partners. Since its founding in 2020, AFG has emerged as a strategic venture capital firm helping B2B fintech and enabling technology startups expand into Asia’s most promising markets.

With headquarters in Singapore and Hong Kong, and a presence that extends to the Philippines, AFG operates with a focused mission: to connect global fintech innovation with the dynamic opportunities of Southeast Asia and beyond.

A Targeted Strategy for Global Fintech Expansion

Core Investment Focus

AFG Partners is laser-focused on early-stage B2B fintech and enabling tech startups. They invest in companies reshaping financial infrastructure across the following verticals:

-

Embedded Finance

-

Capital Markets Infrastructure

-

Insurtech

-

CFO Tech Stack

Geography: Global Vision, Asian Focus

While deeply embedded in Southeast Asia, AFG supports startups from markets including the United States, United Kingdom, Israel, and India—helping them enter and scale across Asia. This cross-border perspective gives founders an edge in one of the world’s most complex and promising regions.

Investment Stage & Strategy

AFG typically participates in Pre-Series A to Series B rounds, writing checks between $500,000 and $1 million. The firm follows a co-investment model, working alongside other top-tier investors without always leading the round. This flexible approach allows AFG to deliver hands-on value in market entry, partnerships, and growth strategy—especially within Asia’s financial services ecosystem.

Portfolio Highlights: Catalyzing Fintech Innovation

AFG Partners' portfolio showcases their commitment to supporting startups that are transforming finance and operations around the world:

-

Brankas – A leading open banking platform in Southeast Asia, Brankas provides API solutions that enable banks and fintechs to embed secure financial services across apps and systems.

-

Aspire – Based in Singapore, Aspire delivers digital business accounts and integrated finance tools built for SMEs across Southeast Asia—simplifying banking, payments, and credit access.

-

Sprout Solutions – Headquartered in the Philippines, Sprout offers an end-to-end HR and payroll software suite, helping businesses manage workforce operations efficiently.

-

Robin AI – A UK-based legal tech startup using AI to automate contracts, Robin AI enables faster, more accurate legal operations—especially valuable for scaling enterprises.

-

SESAMm – This French company provides AI-powered ESG analytics, delivering deep insights to investors based on alternative data and sustainable investing principles.

-

Grey Market Labs (Replica) – A U.S.-based cybersecurity firm offering secure environments-as-a-service, Replica Cyber protects sensitive operations with privacy-first infrastructure.

-

Osome – A fast-growing platform providing digital accounting, company incorporation, and corporate secretary services for startups and entrepreneurs navigating admin-heavy business setup processes.

Why Founders Choose AFG Partners

Beyond funding, AFG Partners offers strategic expertise, cross-border know-how, and a powerful network across Asia’s fintech ecosystem. Founders benefit from hands-on support tailored to market entry, local partnerships, and product localization.

The firm’s co-investment approach fosters collaboration while allowing founders to retain control and flexibility. AFG’s strong ties to financial institutions, regulators, and corporates in Asia make it an ideal partner for any startup aiming to expand into the region with confidence and speed.

WOWS Global: Connecting You to Investors Like AFG

At WOWS Global, we help startups raise capital by connecting them with strategic investors who can unlock real market potential. AFG Partners is one of many high-impact VC firms in our network—supporting global fintechs looking to tap into Asia's growth story.

If you're building a B2B fintech or enabling tech company with international ambitions, the right introduction could change everything.

Ready to raise funding for your impact-driven startup?

Connect with WOWS Global today and explore our investor network.

Related Posts

-

AI Finance Startup Finance CFO 3 minutes

Smart Finance, Winning Moves: How Fractional CFOs Use Tech and AI to Raise the Score

A quick, plain-English playbook on how fractional CFOs apply AI to sharpen forecasts, streamline reporting, and guide smarter decisions, so teams move faster and investors get clarity. Talk to WOWS Global to put it in motion. -

AI Startups SEA Finance Investment Banking 2 Minutes

Lumo: Vietnam’s Fintech Pioneer Making Wealth Building Simple and Accessible

Lumo, is reimagining personal finance in Vietnam with an AI-powered investment platform that makes wealth building simple, accessible, and rewarding, Lumo is on track to become the go-to digital wealth solution for Southeast Asia’s growing mass affluent class. -

Venture Debt Finance AI Investor 2 Minutes

Bridging the Funding Gap: Why Strategic Planning Between Rounds Is Critical

Between funding rounds is where the real work begins. Strategic planning during this quiet phase can determine how ready your startup is for the next big raise. From fractional CFOs to venture debt and investor engagement, WOWS Global helps you stay prepared and in control. -

Finance SEA Fintech Business Growth 2 Minutes

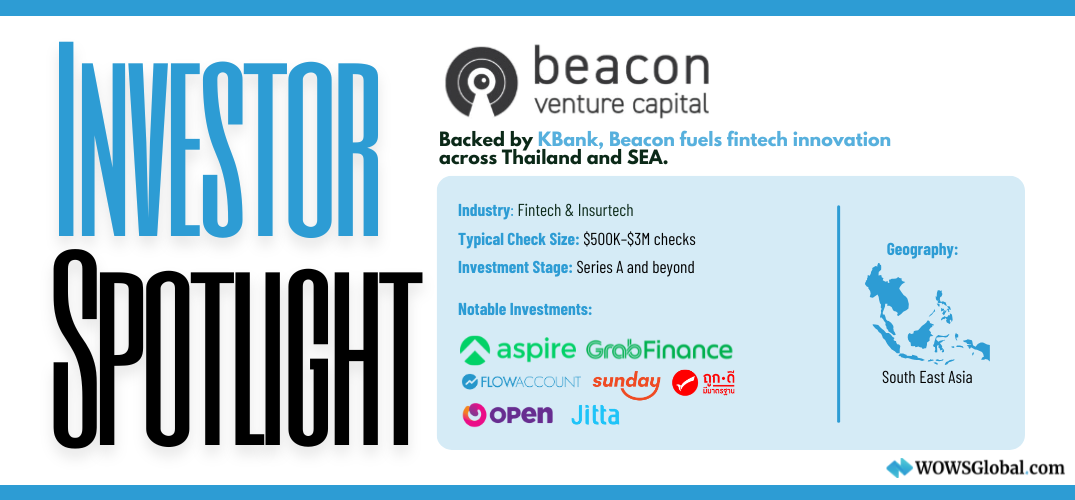

Beacon VC: Powering Fintech and Innovation from Within Thailand’s Financial Core

Beacon VC is the corporate venture capital arm of Kasikornbank (KBank), one of Thailand’s largest financial institutions. With a strong focus on fintech and strategic sectors like insurtech, AI, and blockchain, Beacon VC empowers startups through smart capital, deep domain expertise, and access to KBank’s robust network. From Bangkok to Southeast Asia and beyond, Beacon VC is driving innovation from the heart of Thailand’s financial core. -

Finance Funding Raising Funds Simple Agreement for Future Equity

KISS or Keep It Simple Security Convertible Note

Raising funds to ensure your startup thrives is a challenge that most founders face. Offering equity for the funding you intend to raise is one very tried and trusted way to achieve this but it is not the only method. Those founders who need to raise capital to grow their company can take advantage of convertible security instruments. In this respect there is one that really stands out; a KISS convertible note, alternatively known as a Keep It Simple Security. Here’s what KISS is all about and how it can be used to leverage those much-needed funds for your venture: -

Finance Investment Investor Startup

Private Equity Outperforms Public Markets

According to McKinsey, by nearly any measure, private equity has outperformed public market equivalents with an average net global return of 14% per annum. Simultaneously, the number of private companies that entered the public market grew dramatically with a record 64 per cent year-on-year increase to 2,388 IPOs in 2021. Taking into consideration both these phenomenon’s, it is understandable that investors are now eyeing private market opportunities where they have the opportunity to invest pre-IPO to maximize returns.