Don’t Accept VC Money If You See These 5 Red Flags in a Term Sheet

Startup Funding Venture Capital VC Red Flags 5 Minutes

Securing VC funding is often hailed as the defining moment in a startup’s journey, but what lies beneath the surface can quickly turn triumph into a cautionary tale. A term sheet is not just a contract; it’s the blueprint for how your future unfolds. And while it’s easy to get caught up in the excitement of a deal, ignoring the fine print could leave you out of your own story. Here are five red flags no founder should overlook.

1. Draconian Liquidation Preferences

Imagine this: after years of grueling work, your startup finally hits a $50 million exit. But instead of celebrating, you’re left empty-handed, watching your VC take the lion’s share thanks to participating preferred clauses or outrageous multiples.

This isn’t a horror story—it’s the reality that plagued countless founders who signed without understanding the terms. The infamous case of WeWork underscores this danger: SoftBank’s liquidation preferences gave it disproportionate control over the company’s outcome.

What to do:

Negotiate fair terms that balance risk and reward. If a VC insists on unreasonable preferences, it’s a signal to walk away.

2. Founder-Unfriendly Vesting Schedules

Your equity is your sweat, blood, and soul. Yet some term sheets bury founders in vesting schedules that stretch far beyond industry norms. Imagine being locked into an 8-year vesting period or losing control of your stake in the event of dismissal.

Even Travis Kalanick, Uber’s co-founder, learned the hard way when investor pressure forced him out while leaving him with limited recourse.

What to do:

A standard 4-year vesting schedule with a 1-year cliff is fair; anything less is a power grab disguised as a partnership.

3. Opaque Anti-Dilution Clauses

Anti-dilution clauses are designed to protect investors during down rounds, but not all are created equal. A full-ratchet anti-dilution clause, for example, can wipe out a founder’s equity.

Consider the case of down rounds at Jawbone, where aggressive anti-dilution terms gutted the team’s ownership.

What to do:

Negotiate for weighted-average anti-dilution rights, which protect both parties without gutting the cap table. Simplicity and clarity are your allies here.

4. Restrictive Board Control

Your board is your brain trust, not your ball and chain. A term sheet that grants VCs dominant control over the board can strangle your ability to execute your vision.

Theranos is a textbook example—investor dynamics allowed bad decisions to compound unchecked.

What to do:

Founders should aim for a balanced structure: equal representation for founders, investors, and independent members. Don’t relinquish your voice in the boardroom; it’s where the future of your startup is decided.

5. Excessive Protective Provisions

Protective provisions are meant to safeguard investments, but some term sheets take it too far. Provisions that require investor approval for basic operational decisions—hiring, raising funds, or even adjusting budgets—can grind your agility to a halt.

What to do:

Look for industry-standard terms that allow you room to navigate the unpredictable waters of growth. Anything else is a straightjacket.

Final Thoughts

A term sheet is a partnership proposal, not a surrender document. Negotiate terms that align with your goals, not just your VC’s. Seek counsel, dig into every clause, and always ask, “Who does this benefit?” Your startup’s future is on the line, and protecting it starts with understanding these red flags.

Related Posts

-

Startup Funding SEA MENA Startups 5 Minutes

June 2025 Investment Snapshot: Capital Hits a Heatwave

June 2025 lit up with a VC heatwave across Southeast Asia and MENA. From insurtech unicorns and migrant fintech to AI wearables and atmospheric water, this month’s deals show the frontier is flush with cash and big ambition. Explore the standout rounds and future-casting sectors. -

Venture Capital FEBE Ventures Seed 4 Minutes

FEBE Ventures: Founders Backing Founders from Day One

More than capital, FEBE Ventures brings founder-first support, fast decisions, and real operational insight to early-stage startups across the globe. -

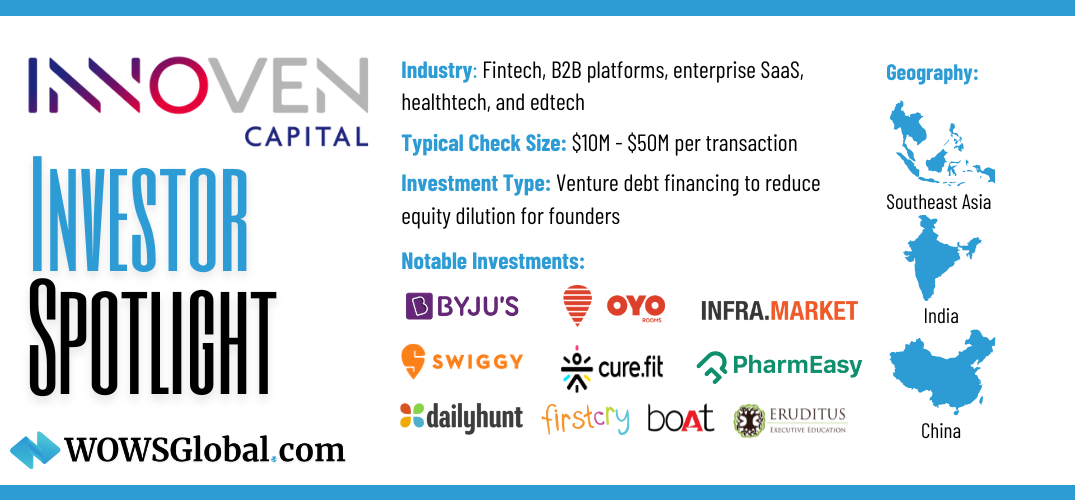

Venture Debt InnoVen Capital Startup Funding 5-7 minutes

Investor Spotlight: InnoVen Capital – Powering Asia’s Startup Ecosystem with Venture Debt

For startups aiming to scale without sacrificing equity, venture debt has emerged as a crucial financial tool. InnoVen Capital, a leading venture debt provider in Asia, has helped over 180 startups grow without dilution. With a focus on India, China, and Southeast Asia, InnoVen Capital has deployed over $400 million across 250+ transactions, backing industry giants like Byju’s, Swiggy, Oyo, and PharmEasy. Learn how venture debt can be a game-changer for your startup. -

Venture Capital Founder Startup Funding 6 minutes

The Founder-Turned VC vs. The Non-Founder VC – Two Species in the Venture Jungle

Venture capitalists come in all forms, but two stand out: the battle-tested Founder-Turned VC and the strategic Non-Founder VC. Learn how their distinct approaches to risk, pivots, and due diligence shape their partnerships with startups and find out which one is the right fit for your journey. -

Startups Venture Capital Unicorn Startups 5 minutes

Superhero Franchises and Unicorn Startups: Why Investors Love the Blockbusters

What do superhero franchises and unicorn startups have in common? Investors love them for the same reason—they’re scalable, high-impact, and built for long-term success. Learn why your startup needs an origin story, a killer team, and the potential to create a universe of opportunities in this blockbuster blog from WOWS Global. -

SEA MENA Venture Capital 6 minutes

October’s Funding Fiestas and Game-Changers: SEA and MENA’s Wild Ride Through the Investment Winter

October brought record-breaking investments and strategic partnerships to Southeast Asia and the Middle East. From electric vehicles to fintech, learn how startups and VCs are navigating the investment winter with resilience and ambition.