Genesis Alternative Ventures Raises $125M for Second Venture Debt Fund: Boosting SEA’s Investment Landscape

Venture Debt SEA Startups Genesis Alternative Ventures 4 minutes

Genesis Alternative Ventures, Singapore’s premier venture debt firm, has just announced the closing of its second fund at a staggering $125 million. With venture debt steadily gaining popularity as an alternative financing tool, especially in Southeast Asia, this new fund aims to provide crucial capital to late-stage startups across the region. According to sources like TechNode Global and The Business Times, the fund’s launch couldn’t have come at a better time, as the region grapples with tightening venture capital flows, making alternative financing options critical for growth and scale.

This $125 million venture debt fund, backed by institutional investors, family offices, and high-net-worth individuals, underscores Genesis' commitment to supporting promising ventures without diluting equity. It’s a lifeline for startups that are looking for growth capital without giving up control, a major issue in today’s venture capital world. But the cherry on top? The fund is also a signal that Southeast Asia’s startup scene is still very much alive and kicking despite the global funding winter.

Why Genesis and Why Now?

Venture debt isn’t a newcomer, but in a landscape where startups are eyeing scale with fewer options for equity rounds, it’s quickly becoming the hero. Unlike traditional venture capital, venture debt allows startups to raise capital while keeping ownership intact, which is crucial for founders who have weathered several funding rounds.

Martin Tang, co-founder and partner at Genesis, highlighted that venture debt in Southeast Asia has historically been underutilized. However, with the ecosystem maturing and startups pushing for profitability, venture debt is fast emerging as an attractive option. This fund will target high-growth sectors like fintech, e-commerce, and health tech, providing critical runway for companies to scale without giving up equity.

Big Names on Board: Philip Yeo Joins Genesis’ Advisory Board

To add even more weight to the announcement, Genesis also revealed that Philip Yeo, the former Chairman of the Singapore Economic Development Board (EDB), has joined its advisory board. Yeo’s deep understanding of both the private and public sectors is expected to be a significant asset as Genesis navigates the increasingly competitive startup landscape. Yeo has been instrumental in shaping Singapore’s technology and investment policies, and his expertise will be crucial in guiding Genesis as it deploys this capital to promising startups across the region(IBS Intelligence) .

WOWS Insight:

What does this mean for Southeast Asia’s startup scene? Well, for one, it’s a shot of adrenaline into the region’s investment ecosystem. At a time when venture capital funding has become more cautious, venture debt offers an appealing alternative for startups that need capital to scale but can’t afford to dilute their equity. The rise of funds like Genesis’ signals a broader trend: Southeast Asia is maturing, and so are its financing tools.

From our perspective at WOWS, this fund represents a pivotal shift in the region's funding landscape. More and more startups will now be able to access flexible capital solutions, allowing them to stay competitive, keep growing, and, crucially, maintain control. The tightening of global venture capital flows won’t stop Southeast Asia from rising; it will simply make the ecosystem more resourceful. Venture debt isn’t just an alternative—it’s a key tool in the toolkit for resilient growth.

The Bigger Picture:

The timing of this fund also aligns with the increasing prominence of Southeast Asia in the global tech ecosystem. As Western markets face turbulence and China navigates its own economic transitions, Southeast Asia remains an attractive destination for investors looking for high-growth opportunities. For startups, the infusion of $125 million into the region’s venture debt pool means that growth doesn’t have to stop due to a lack of traditional VC capital. Companies can now seek expansion capital while keeping their cap tables intact, a luxury that can prove invaluable in the long run.

With more funds like Genesis’ expected to emerge, the region is poised to not only survive the global funding slowdown but thrive in it.

Related Posts

-

B2B SaaS SEA Startups AI Fintech 4 Minutes

TheVentures: The Quick-strike Seed Investor Shaping Vietnam & Southeast Asia

TheVentures is redefining early-stage speed in Vietnam & SEA, writing quick, catalytic checks and opening doors to follow-on capital across the region. -

Blockchain Singapore Early Startups SEA Startups SEA 4 Minutes

GaiaSwap: The Eco-Commodity DEX Bringing Transparency & Inter-Operability to Fragmented Carbon Credits & I-REC(E)s markets

In a sea of generalist crypto venues, GaiaSwap zeroes in on eco-commodities with transparent pricing and compliant workflows. We unpack what sets it apart and the milestones to watch. -

Fractional CFO Venture Debt SEA Startups SME Loans 3 Minutes

Why Startups Fail: The 3 Reasons That Sink Great Ideas (and How to Avoid Them)

Startups rarely get killed by competitors. The big 3 killers are: no market need, running out of funding, and the wrong team. This quick playbook shows how to spot the signs early and fix them with demand tests, smart financing, and fractional expertise. -

SaaS Logistics AI Startups Venture Debt India 4 Minutes

Trifecta Capital: India’s Venture-Debt + Growth-Equity Engine

Trifecta Capital is India’s venture-debt pioneer turned full-stack partner—combining scaled credit with a selective late-stage Leaders Fund. Backing VC-funded scale-ups across consumer, fintech, logistics, and enterprise SaaS, Trifecta helps founders extend runway and accelerate toward IPO or strategic outcomes. -

Venture Debt Finance AI Investor 2 Minutes

Bridging the Funding Gap: Why Strategic Planning Between Rounds Is Critical

Between funding rounds is where the real work begins. Strategic planning during this quiet phase can determine how ready your startup is for the next big raise. From fractional CFOs to venture debt and investor engagement, WOWS Global helps you stay prepared and in control. -

Venture Debt InnoVen Capital Startup Funding 5-7 minutes

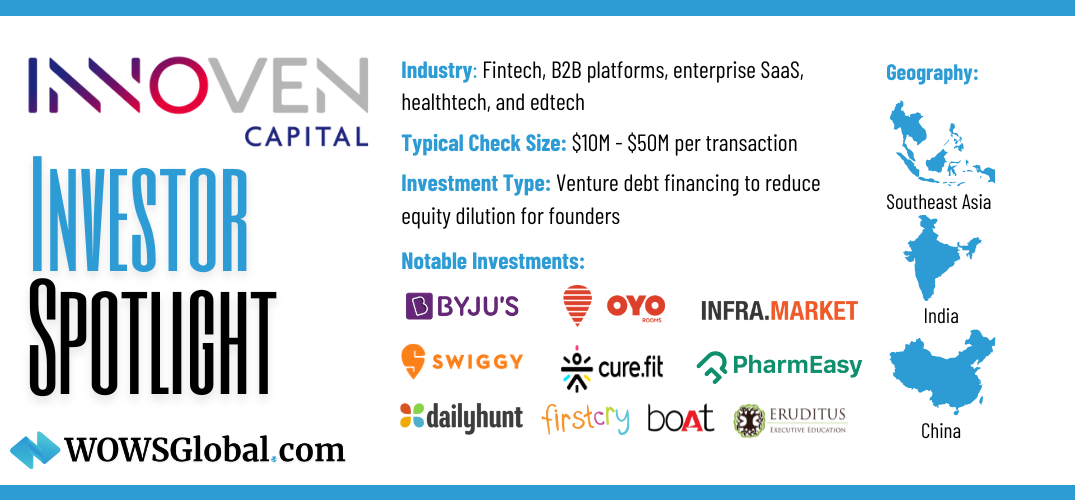

Investor Spotlight: InnoVen Capital – Powering Asia’s Startup Ecosystem with Venture Debt

For startups aiming to scale without sacrificing equity, venture debt has emerged as a crucial financial tool. InnoVen Capital, a leading venture debt provider in Asia, has helped over 180 startups grow without dilution. With a focus on India, China, and Southeast Asia, InnoVen Capital has deployed over $400 million across 250+ transactions, backing industry giants like Byju’s, Swiggy, Oyo, and PharmEasy. Learn how venture debt can be a game-changer for your startup.