How Employee Stock Option Plans Work for Startups

ESOP Finance

Getting your business off the ground in the most efficient way is a challenge all startups face. Fledgling companies that achieve this are the ones most likely to thrive.

This is where balance becomes a major challenge. On the one hand, it is crucial to attract, motivate, and retain employees of the right caliber. On the other hand, a startup’s available budget to attract an experienced management team and knowledgeable support staff mean these salaries will be lower than market value.

Let’s consider one highly effective solution with an in-depth look at how an ESOP (Employee Stock Option Plan) works for startups and all potential employees.

In this article, we’re going to discuss:

What is an ESOP?

In brief, an ESOP is an employee benefit plan. It is designed to give employees a unique company ownership interest and takes the form of allocated stock shares.

Among other issues that will be discussed below, ESOPs give employees an extra incentive to see that the company succeeds. It also encourages them to put in place working practices that are most appropriate for shareholders. This is because employees themselves own company stock.

An example of how an ESOP can work

Here’s an example of how an ESOP can work. It will show how stock options are granted and how they can be exercised:

Triple-A inc. employs Joe Johnson.

As part of the agreed employment package, Triple-A grants Joe the option of acquiring 20,000 shares of their common stock at 50 cents per share (this price is based on the fair market value of 1 Triple-A common stock at the time of granting).

The options come with a 4-year vesting and 1-year cliff vesting clause.

What does this mean for Joe? It means he must remain employed with Triple A for 1-year before having the right to exercise 5,000 of his share options. He then vests the remainder (15,000 options) at a rate of 1/36 per month to cover his next 3 years (36 months) of employment.

If Joe decides to leave Triple-A or is fired before the end of his first year’s employment he is not entitled to any of the options.

If Joe stays with the company his options will be “vested” (become exercisable). Joe then has the option to buy the stock at 50 cents per share. This purchase price stands even if the share value has dramatically increased.

If Joe continues to work for Triple-A for 4 years, all 20,000 of his option shares become vested.

Triple-A continues to succeed in its business sector and is in a healthy market position. They have also made impressive gains in their target market and now has an attractive clients list.

With these factors in their favor, Triple-A goes public. Its stock trades at $20 per share.

Joe exercises his options and purchases his total share allocation of 20,000 shares for $10,000 (20,000 shares at the originally agreed 50 cents per share = $10,000).

Joe then turns this around by selling his 20,000 shares at the publicly traded price mentioned above of $20 per share. (20,000 x $20 = $400,000) – Joe deducts his initial $10,000 outlay and he has made a net profit of $390,000.

ESOPs are designed with success in mind

ESOPs (Employee Stock Option Plans) has developed into an extremely popular startup solution. Offering an ESOP as part of an employee’s remuneration package is now a well-established and attractive incentive. It also has key benefits for the startup themselves.

On the face of things, this is a win-win situation for both startups and the quality staff they need to attract. There is no doubt that many positives come from a well-planned ESOP implementation.

However, it is necessary to keep things in perspective because there are also possible downsides for both the startup and its chosen employees.

Risk/Reward is a clear factor

If ever there was a case for risk/reward, ESOPs fit very well into this category. This article will concentrate on new business ventures that are typically designed for rapid growth and their permanent employees.

Having said this, it should not be forgotten that startups can also use ESOP leverage to attract other key industry movers and shakers. This relates to acquiring services and advice from highly experienced and successful professionals who would normally be out of a startup’s reach in terms of expected remuneration. Examples here are advisors, consultants, and internet influencers.

Why should a startup consider an ESOP?

Here are 3 very valid reasons why startups should consider an ESOP:

Startup and top talent attraction:

The mentioned stability that an ESOP gives the startup cannot be under-estimated. Securing the services of top talent is crucial to the company’s success. As for these hand-picked employees, giving them the opportunity of sharing in the company’s success is certainly an attractive proposition. Indeed, it can be seen as a method for them to achieve a secure retirement plan.

Employee retention = Stability:

While these 2 examples are not set in stone, it is often the case that any employee who stays less than 1 year at a startup will forfeit their shares. As for employees who surpass the “cliff” period they vest equity based on their period of service.

This vesting process (or period of time that employees must agree to stay with the company) means the startup is benefitting from team stability through key employee retention. It also acts as a motivator for employees to stay with the startup for as long as possible in order to achieve the highest payout possible.

As for “Exits”, these can occur in a variety of different ways. This includes at the time of an M&A (Mergers & Acquisitions), through Buyback offers, or when the company goes public.

Leveling the playing field:

It is no secret to startups that they face fierce competition from established players in their chosen market sector. Startups face market recognition challenges as well as putting into place leveraging that will tempt new and competitor clients to transition to their services and or products.

To achieve this, key personnel are required. Competing on the salary front with established competitors may be unattainable, but offering these employees an attractive ESOP certainly is not. This powerful business tool can be used to level that uneven playing field.

Potential Disadvantages of ESOPs

This is where a balanced view is necessary because there are some potential disadvantages attached to ESOPs. It is important that all startups and employees are aware of these factors.

The main disadvantage for employees in a private company is that any stock options offered through an ESOP can take the place of cash bonuses. It also means they will be accepting lower salary compensation than could be received by working for a more established company.

However, ESOPs can be used by companies that lack liquidity because it allows the owner to sell part or all of the company to its employees. For startup founders, an ESOP can also provide liquidity during their lifetime. In many cases, this can be done without giving up full control of the company.

In terms of employee lack of liquidity, it should be noted that until the startup creates a public market for its stock (or it is acquired) an employee’s stock options are not the equivalent of cash benefits.

On top of this, there is the possibility that the startup will not succeed in growing its business to a healthy level. This refers to the fact that stock remains less valuable than the original price it was offered to the employee at. If that is the case these options could ultimately prove to be worthless.

Having said this, in many cases the benefits do outweigh any potential disadvantages.

Here’s what stock options can give, an example of how one works, and a couple of brief but well-voiced examples of successful ESOP implementation:

Employee stock options success is now deeply entrenched

One thing should be made perfectly clear. ESOPs are no flash in the pan. Successful implementation of an ESOP can be the difference between real startup success and ultimate business failure.

All startups should consider the fact that a well-driven ESOP will be highly beneficial for themselves as well as all potential employees.

It is a well-known fact that a healthy number of employees (and other key market players!) have become millionaires through stock options. This makes such an opportunity very appealing to all involved.

Facebook is often touted when referring to thousands of staff members who have become ‘overnight’ millionaires. But the spectacular success of numerous Silicon Valley startups should also not be forgotten.

Many of these employees have seen financial rewards beyond any expected dreams. This makes ESOPs a very powerful motivational tool, one that is a two-way street for both the startup and its employees.

Why? Because all concerned are working with an extra incentive to ensure the company’s long-term success.

Is an ESOP right for your startup?

There is no doubt that current trends and future forecasts place ESOPs as an integral part of a solid business plan.

Having said this, it is imperative that any startup intending to go through the ESOP process begins its implementation far sooner than they may think.

There is a very valid reason for stating this. The straight fact is that the longer such an implementation is delayed, the greater the chance is of a startup missing out on attracting and securing the right talent for their business needs.

Some other important points that startup entrepreneurs need to carefully evaluate include:

- Expected initial funding.

- Where additional funding could be found.

- Their financial goals.

- A succession time frame.

- Employees’ interest in ownership

In order for any startup to get their fledgling business off the ground and on the front foot they need to understand the 360-degree requirements of ESOPs.

This makes it essential that they consult with professional and respected advisors. WOWS Global is one such company. We have in-depth knowledge of such things as administrative, accounting, and all legal issues surrounding effective ESOP implementation.

Ready to Implement an Employee Stock Ownership Plan (ESOP)?To find out more, visit our ESOP Services page or schedule a no-obligation chat with one of our experts today to discuss how we can assist with your company's ESOP needs.

Related Posts

-

AI Finance Startup Finance CFO

Smart Finance, Winning Moves: How Fractional CFOs Use Tech and AI to Raise the Score

A quick, plain-English playbook on how fractional CFOs apply AI to sharpen forecasts, streamline reporting, and guide smarter decisions, so teams move faster and investors get clarity. Talk to WOWS Global to put it in motion. -

Invest in Startups Startup & Venture Capital SAFE ESOP

Event Recap: Founder Nova Bootcamp with Krungsri Finnovate

A practical recap of Founder Nova Bootcamp with Krungsri Finnovate, what founders learned about SAFEs, cap tables, and term sheets, and how to raise smarter in today’s market. -

AI Startups SEA Finance Investment Banking

Lumo: Vietnam’s Fintech Pioneer Making Wealth Building Simple and Accessible

Lumo, is reimagining personal finance in Vietnam with an AI-powered investment platform that makes wealth building simple, accessible, and rewarding, Lumo is on track to become the go-to digital wealth solution for Southeast Asia’s growing mass affluent class. -

Venture Debt Finance AI Investor

Bridging the Funding Gap: Why Strategic Planning Between Rounds Is Critical

Between funding rounds is where the real work begins. Strategic planning during this quiet phase can determine how ready your startup is for the next big raise. From fractional CFOs to venture debt and investor engagement, WOWS Global helps you stay prepared and in control. -

Finance SEA Fintech Business Growth

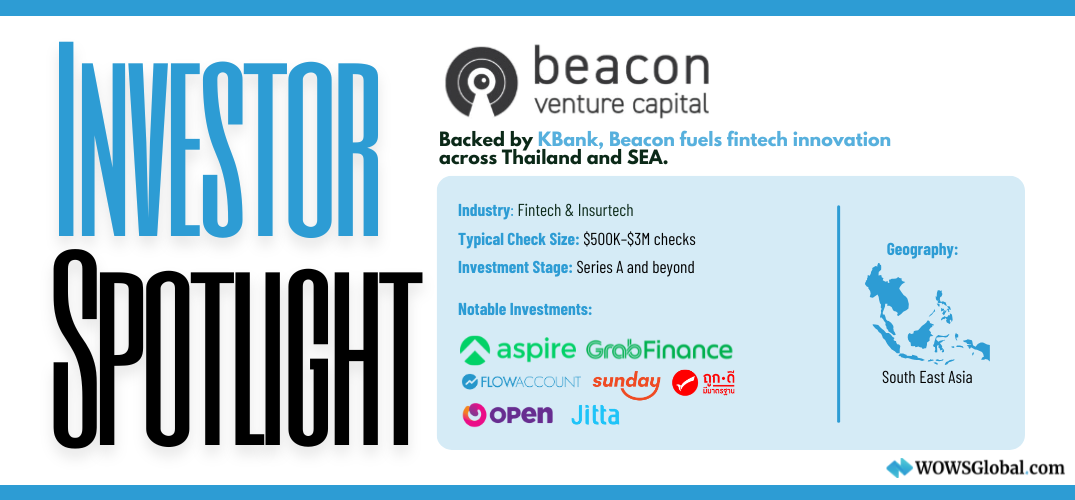

Beacon VC: Powering Fintech and Innovation from Within Thailand’s Financial Core

Beacon VC is the corporate venture capital arm of Kasikornbank (KBank), one of Thailand’s largest financial institutions. With a strong focus on fintech and strategic sectors like insurtech, AI, and blockchain, Beacon VC empowers startups through smart capital, deep domain expertise, and access to KBank’s robust network. From Bangkok to Southeast Asia and beyond, Beacon VC is driving innovation from the heart of Thailand’s financial core. -

AFG Partners Fintech VC Asia finance

AFG Partners: Empowering Global B2B Fintechs to Scale Across Asia

AFG Partners is a strategic venture capital firm backing global B2B fintech and enabling tech startups. Headquartered in Singapore and Hong Kong, AFG focuses on helping early-stage companies expand into Southeast Asia’s dynamic financial markets. Explore their investment strategy, standout portfolio, and why founders value their cross-border expertise and collaborative approach.