How Venture Debt Can Aid in the Growth of Your Startup

Venture Debt Startup

Startups require capital to fuel growth and achieve long-term objectives. While equity financing is a common way to raise funds, it frequently dilutes existing shareholders' ownership. In contrast, venture debt can provide additional capital without sacrificing ownership. This article will look at how venture debt can help your startup's growth.

What exactly is venture debt?

Venture debt is a type of debt financing that provides additional capital to startups. Unlike traditional bank loans, venture debt lenders are often willing to take on more risk, and the loan terms are tailored to the startup's stage of growth and cash flow.

The terms of venture debt financing vary, but it usually consists of interest payments and principal repayment over a set period of time. Some venture debt lenders may also require equity warrants, which give them the right to buy a percentage of the company's equity at a later date.

What Role Can Venture Debt Play in Your Startup?

Access to Additional Capital: Access to additional capital is one of the primary advantages of venture debt. Startups can use this capital to fund expansion, research and development, or hiring new employees. This is especially beneficial for startups that have a strong revenue stream but require additional capital to fuel growth.

Lower Capital Costs: Venture debt can have lower capital costs than equity financing. While the interest rates on venture debt are higher than those on traditional bank loans, they are frequently lower than the cost of equity financing. This can help startups save money in the long run and avoid diluting existing shareholders' ownership.

Flexible Repayment Terms: Venture debt lenders are frequently willing to offer flexible repayment terms that correspond to the cash flow of the startup. This can assist startups in managing their debt obligations while investing in growth. A startup, for example, may agree to interest-only payments for the first year of the loan, allowing it to invest more in growth initiatives.

No/ Minimal Dilution of Ownership: Typically, venture debt does not result in a significant dilution of the ownership of current shareholders, or any dilution that does occur is limited to the extent of the warrants issued, which are generally minimal. This is especially important for startups that want to retain control over the company's direction. By avoiding dilution, startups can keep control of their equity and ensure that decisions are made with the company's long-term interests in mind.

Positive Impact on Valuation: The additional capital provided by venture debt can improve the company's valuation. Startups can increase their revenue and profitability by investing in growth initiatives, which can lead to a higher valuation in future funding rounds.

Complementary to Equity Financing: Venture debt can be used in conjunction with equity financing. Venture debt can help startups bridge the gap between funding rounds or supplement equity financing. This can assist startups in avoiding dilution while still gaining access to the capital they require to grow.

Risks Related to Venture Debt

While venture debt can provide significant benefits to startups, it also carries risks. These dangers include:

Higher Interest Rates: Interest rates charged by venture debt lenders are frequently higher than those charged by traditional bank loans. This is because lending to startups carries a higher risk. Startups must carefully assess the cost of venture debt to ensure that it aligns with their long-term objectives.

Riskier than traditional bank loans: Venture debt is riskier than traditional bank loans. If the startup is unable to generate enough revenue to meet its debt obligations, the loan may be forfeited. This has the potential to harm the company's credit rating and future access to capital.

To mitigate their risk, venture debt lenders frequently require covenants or restrictions on the company's operations. These covenants may make it difficult for the company to raise additional capital or make strategic decisions. Before entering into a venture debt agreement, startups must carefully consider these covenants to ensure that they can continue to operate in a way that aligns with their long-term goals.

Some venture debt lenders require equity warrants, which give them the right to purchase a percentage of the company's equity at a later date. While these warrants may not have an immediate effect on the startup's ownership, they may dilute existing shareholders' ownership in the future.

Is Venture Debt a Good Option for Your Startup?

The appropriateness of venture debt for your startup is determined by a number of factors, including your current stage of growth, cash flow, and long-term goals. Before pursuing venture debt financing, consider the following questions:

Do You Have a Lucrative Revenue Stream? Typically, venture debt is best suited for startups with a strong revenue stream and a clear path to profitability. If your startup is not generating consistent revenue, obtaining venture debt financing may be more difficult.

Do You Have a Good Growth Strategy? Venture debt is intended to aid in growth, but it is critical to have a solid growth strategy in place before pursuing this type of financing. Consider your long-term objectives and how venture debt can assist you in achieving them.

Can You Handle the Extra Debt Obligations? Venture debt is still debt, and you should carefully consider your ability to manage the additional obligations. Consider your cash flow and how you will make loan interest and principal payments.

Are You Willing to Take Risks? Higher interest rates, increased risk, and stringent covenants are all risks associated with venture debt. Before pursuing venture debt financing, carefully consider these risks.

Conclusion

For startups looking to fuel growth without sacrificing ownership, venture debt can be a useful tool. It allows for additional capital, lower capital costs, flexible repayment terms, and no dilution of ownership. It does, however, come with risks, such as higher interest rates, increased risk, and stringent covenants. Before considering venture debt financing, startups must carefully assess their current stage of growth, cash flow, and long-term goals to determine if venture debt is the best option for their company. Contact WOWS Global today at contact@wowsglobal.com to learn more about our services and how we can help you grow your business.

Related Posts

-

Fractional CFO Venture Debt SEA Startups SME Loans

Why Startups Fail: The 3 Reasons That Sink Great Ideas (and How to Avoid Them)

Startups rarely get killed by competitors. The big 3 killers are: no market need, running out of funding, and the wrong team. This quick playbook shows how to spot the signs early and fix them with demand tests, smart financing, and fractional expertise. -

SaaS Logistics AI Startups Venture Debt India

Trifecta Capital: India’s Venture-Debt + Growth-Equity Engine

Trifecta Capital is India’s venture-debt pioneer turned full-stack partner—combining scaled credit with a selective late-stage Leaders Fund. Backing VC-funded scale-ups across consumer, fintech, logistics, and enterprise SaaS, Trifecta helps founders extend runway and accelerate toward IPO or strategic outcomes. -

Startup Startup Growth Founder Health Habits

Startup Growth and the Surprising Power of Sleep: What the Data Says About Founder Health Habits

Forget the hustle myth. Founders who sleep smarter, not less, are scaling faster. The data reveals surprising links between sleep, wellness, and startup success. -

Venture Debt Finance AI Investor

Bridging the Funding Gap: Why Strategic Planning Between Rounds Is Critical

Between funding rounds is where the real work begins. Strategic planning during this quiet phase can determine how ready your startup is for the next big raise. From fractional CFOs to venture debt and investor engagement, WOWS Global helps you stay prepared and in control. -

Financial mistakes startup Fractional CFO

Financial Mistakes That Hurt Businesses—Startups & SMEs Alike

Many startups and SMEs unknowingly make financial mistakes that hurt profitability, cash flow, and long-term success. From misinterpreting cash in the bank to scaling without financial planning, these pitfalls can be costly but avoidable. Discover the most common financial mistakes and how to fix them in this guide by WOWS Global. -

Venture Debt InnoVen Capital Startup Funding

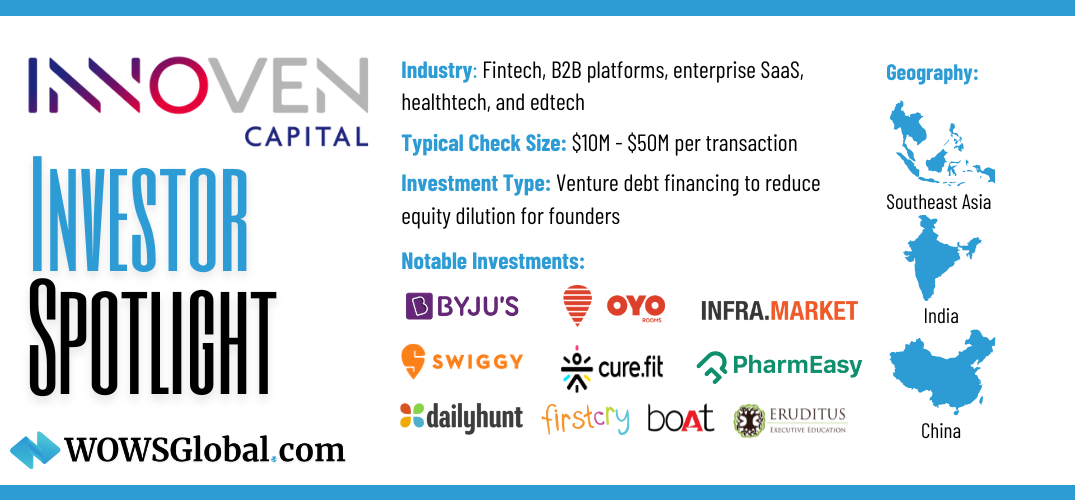

Investor Spotlight: InnoVen Capital – Powering Asia’s Startup Ecosystem with Venture Debt

For startups aiming to scale without sacrificing equity, venture debt has emerged as a crucial financial tool. InnoVen Capital, a leading venture debt provider in Asia, has helped over 180 startups grow without dilution. With a focus on India, China, and Southeast Asia, InnoVen Capital has deployed over $400 million across 250+ transactions, backing industry giants like Byju’s, Swiggy, Oyo, and PharmEasy. Learn how venture debt can be a game-changer for your startup.