Inside the WOWS Investor Network: 250+ VC’s and Funds Powering SEA’s Startup Surge

Startup & Venture Capital Southeast Asia startups Southeast Asia SEA Startup Fundraising 6 Minutes

Why founders across Southeast Asia trust WOWS Global to unlock capital and momentum

If you're a founder building in Southeast Asia, you're probably already asking the big questions:

Who are the right investors? When should I reach out? How do I get warm intros?

This article answers all of that.

Below is a visual snapshot of the investor network we actively work with at WOWS Global.

What you’re looking at:

250+ venture capital funds, family offices, corporate venture arms, and active angels that we collaborate with across Southeast Asia and beyond. From Vietnam to Indonesia, from fintech-first to climate crusaders—this network is as deep as it is wide.

A Network That Works For Founders

This isn’t a pretty wallpaper. These are active dealmakers.

We built WOWS Global around one mission: connect great founders with the right capital, faster. Over the past few years, that’s translated into a private, curated investor graph that spans:

✅ Seed to Series B+

✅ Fintech to SaaS to climate tech

✅ Local champions to global megafunds

✅ Strategic co-investors and M&A-minded funds

Some Names You’ll Definitely Know (and Some You Should)

The Heavy Hitters

Big funds that anchor the region's growth story:

-

500 Global – A SEA legend with 250+ investments across the region.

-

Gobi Partners – Interconnected across Asia with 9 unicorns, including Carsome.

Jungle Ventures – Now managing $600M+, investing in standout consumer and enterprise plays like KiotViet and RedDoorz. -

Golden Gate Ventures – One of SEA’s OG VCs; 80+ investments, 25 in Indonesia alone.

-

Vertex Ventures – Temasek-backed, early backer of Grab, Nium, and FirstCry.

The Rising Power Players

Funds on the rise, deploying with clarity and conviction:

-

Alpha JWC Ventures – Arguably Indonesia’s most influential early-stage VC. Backed Kredivo, Ajaib, and Kopi Kenangan.

-

Insignia Ventures Partners – Founded by ex-Sequoia, now with $800M+ AUM and investments in Carro, Payfazz, and GoTo.

-

AC Ventures – Post-merger rocket ship with 120+ startups funded, including Xendit and Maka Motors.

-

1982 Ventures – A fintech-only fund headquartered in Singapore. Early backer of WATI, Brick, and Fundiin.

-

Wavemaker Partners – One of SEA’s most active early-stage funds, and now also co-building climate tech startups via Wavemaker Impact.

Noteworthy Mentions & Standouts

These firms may not always dominate headlines, but they’re making sharp, strategic moves—and founders are noticing. Some are quietly building elite portfolios; others are breakout funds with fresh momentum. Keep them on your radar.

-

SWC Global – A nimble but active investor with stakes in Evermos, GoTo, Yup, Rose All Day, Greney, and ServAuto. Strong SEA thesis with cross-sector bets.

-

Iterative – The YC-style accelerator for Southeast Asia. Backed over 80 startups with strong SEA roots and serious follow-on rates.

-

Antler – The pre-seed factory. Global reach, SEA muscle. Built and backed hundreds of SEA startups like Xendit and GajiGesa from zero.

-

Banpu Next – Thailand-based corporate VC focused on energy transition and mobility. A strong partner for climate tech and smart city plays.

-

Sunway Ventures – Malaysia’s corporate fund with growing exposure in healthtech, climate, and smart urban innovation via its iLabs accelerator.

-

Thai Union Ventures – One of Asia’s most forward-looking CVCs in food sustainability and alternative protein. Think ocean-friendly innovation meets SEA capital.

-

Wavemaker Impact – A dedicated climate tech venture co-builder. Focused on building “100x100” companies (US$100M revenue, 100M tons carbon abated).

-

Ascend Vietnam Ventures (AVV) – Rising star in Vietnam’s early-stage scene, with strong on-the-ground talent support and a clear Vietnam-first thesis.

Why This Network Matters

In fundraising, it’s not just about capital, it’s about fit.

Finding the right investor can unlock:

✅ Strategic partnerships

✅ Faster follow-on

✅ Cross-border expansion

✅ A higher chance of a healthy exit

Finding the wrong one? Delays, dead weight, and missed opportunities.

That’s why we don’t just give you a list, we help you:

✅ Curate a shortlist

✅ Build the narrative

✅ Make warm intros

✅ Navigate the deal process from pitch to close

What Happens Next?

Whether you're:

✅ Prepping for your first raise

✅ Looking for smart Series A co-investors

✅ Exploring strategic exits

✅ Or just want to test investor appetite…

WOWS Global is here to plug you into this network and accelerate your process; across capital stages, verticals, and borders.

Ready to Get Connected?

Join 100s of startups already working with WOWS Global to raise smarter and faster.

Schedule a quick chat with an expert and scale your business today.

Related Posts

-

Finance SEA Fintech Business Growth 2 Minutes

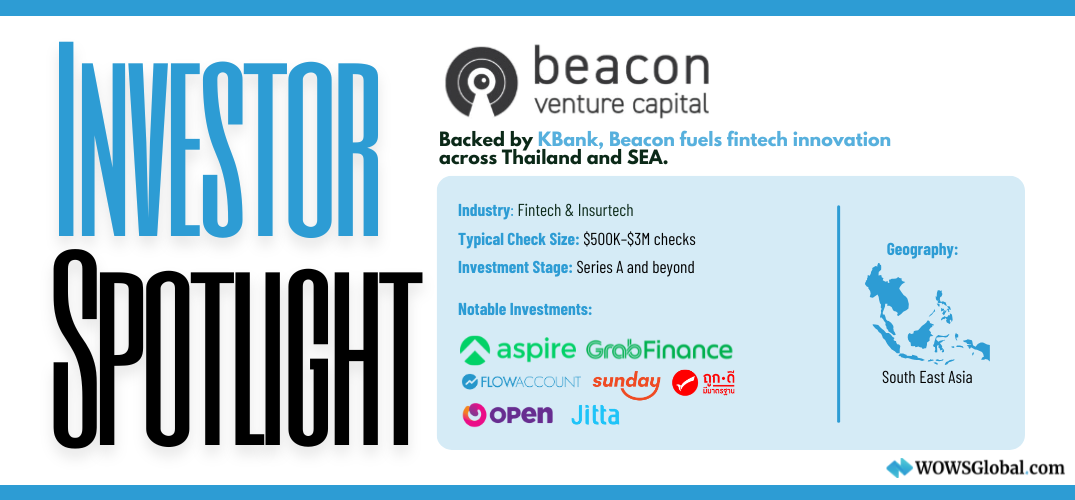

Beacon VC: Powering Fintech and Innovation from Within Thailand’s Financial Core

Beacon VC is the corporate venture capital arm of Kasikornbank (KBank), one of Thailand’s largest financial institutions. With a strong focus on fintech and strategic sectors like insurtech, AI, and blockchain, Beacon VC empowers startups through smart capital, deep domain expertise, and access to KBank’s robust network. From Bangkok to Southeast Asia and beyond, Beacon VC is driving innovation from the heart of Thailand’s financial core. -

AI Insurtech SEA AI in Southeast Asia 3 Minutes

Sembuh AI: Revolutionizing Insurance Claims with AI

Sembuh AI is a Jakarta-based insurtech startup streamlining hospital claims processing with AI that settles requests in as little as 15 seconds. With fraud detection, regulatory alignment, and strong early traction, it’s redefining how insurers scale efficiently across Southeast Asia. -

Southeast Asia MENA Investment Fintech HealthTech 4 Minutes

July 2025 Investment Snapshot: Southeast Asia & MENA

From fintech surges to deeptech breakthroughs, July 2025 delivered a wave of standout deals across Southeast Asia and MENA. This snapshot covers the top funding rounds, rising sectors, and the investors fueling growth across two of the world’s most dynamic startup ecosystems. -

Emerging Markets SEA Fintech eCommerce Logistics 3 Minutes

Alter Global: Backing the Bold in Emerging Markets

Alter Global is an early-stage VC firm backing high-character tech founders in emerging markets across Latin America, Africa, Asia, and MENA. With a unique model that combines capital, global talent, and ecosystem support, Alter partners with bold entrepreneurs building scalable solutions to real-world challenges—often in places overlooked by traditional venture capital. -

Startup Funding SEA MENA Startups 5 Minutes

June 2025 Investment Snapshot: Capital Hits a Heatwave

June 2025 lit up with a VC heatwave across Southeast Asia and MENA. From insurtech unicorns and migrant fintech to AI wearables and atmospheric water, this month’s deals show the frontier is flush with cash and big ambition. Explore the standout rounds and future-casting sectors. -

Investment Trends SEA MENA AI 6 Minutes

May 2025 Investment Snapshot: Capital Wakes Up Hungry

After a quiet Q1, global capital came roaring back in May 2025. From fintech and batteries in Singapore to quantum software in Israel, this month marked a bold return to frontier investing. WOWS Global breaks down where the money is flowing and why.