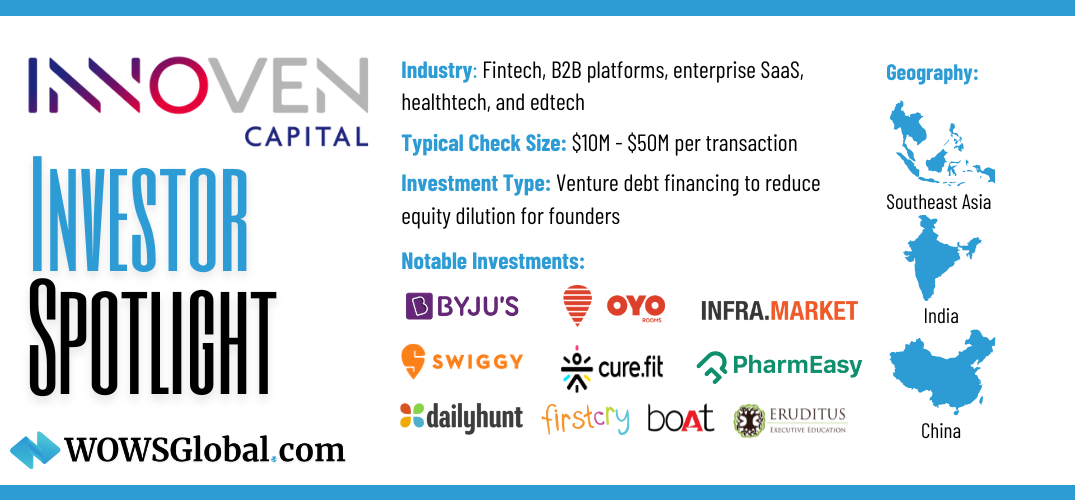

Investor Spotlight: InnoVen Capital – Powering Asia’s Startup Ecosystem with Venture Debt

Venture Debt InnoVen Capital Startup Funding 5-7 minutes

For startups aiming to scale without sacrificing equity, venture debt has emerged as a crucial financial instrument. InnoVen Capital, a leading venture debt provider in Asia, has been at the forefront of this evolution. With a strong presence in India, China, and Southeast Asia, the firm has built a reputation for supporting high-growth businesses with non-dilutive funding options tailored to their specific needs.

A Strategic Partner for Startups

Since its inception, InnoVen Capital has helped more than 180 startups navigate the challenges of scaling, providing much-needed financial support without requiring founders to give up significant ownership stakes. Their investment philosophy is clear: back promising, venture-funded startups with strong business fundamentals and high-growth potential.

Key Investment Focus

-

Geography: India, China, Southeast Asia

-

Industry: Broadly sector-agnostic, with a keen interest in fintech, B2B platforms, enterprise SaaS, healthtech, and edtech

-

Investment Type: Venture debt financing, providing capital without dilution

-

Typical Check Size: $10M - $50M per transaction

-

Total Investments Made: Over 250 transactions

-

Total Startups Funded: More than 180 startups

-

Total Capital Deployed: Over $400 million in India alone

-

Key Portfolio Companies: Byju’s, Swiggy, Oyo Rooms, Eruditus, Infra.Market, DailyHunt, PharmEasy, CureFit, FirstCry, boAt.

Backing Asia’s Most Promising Startups

From the online learning revolution to the rise of consumer electronics brands, InnoVen Capital has played a pivotal role in supporting some of Asia’s most recognizable startups. Among its notable investments are Byju’s, an edtech giant transforming education; Swiggy, one of India's largest food delivery platforms; and Oyo Rooms, a global hospitality disruptor. Other prominent names include Eruditus in executive education, Infra.Market in B2B procurement, DailyHunt in news and content aggregation, and PharmEasy in healthtech. Additionally, InnoVen has backed CureFit, a leading fitness and wellness platform; FirstCry, an e-commerce leader in baby products; and boAt, a fast-growing consumer electronics brand.

Collectively, InnoVen has deployed over $400 million in funding to Indian startups alone, participating in more than 250 transactions to date.

Why Venture Debt Matters

Equity funding is often seen as the go-to option for startups, but it comes at a cost—dilution of ownership and control. This is where venture debt stands out. By offering an alternative that extends financial runway, funds working capital needs, and supports expansion, InnoVen allows founders to scale their businesses while maintaining their stake in the company.

They look for startups that exhibit:

-

A clear path to profitability

-

Strong market traction and revenue growth

-

Experienced and resilient leadership teams

-

A proven business model with scalable potential

-

Support from established venture capital investors

What’s Next for InnoVen Capital?

With the startup ecosystem in Asia maturing rapidly, demand for non-dilutive financing is only set to grow. InnoVen Capital continues to strengthen its foothold in the region, expanding its portfolio across emerging sectors and providing strategic financial solutions to tomorrow’s market leaders.

Are you actively fundraising and exploring strategic investor connections?

WOWS Global is here to help. Connect with us to access a curated network of venture capitalists and alternative funding solutions designed to fuel your startup’s next phase of growth.

Follow WOWS Global for more investor spotlights and insights into the evolving world of venture funding.

Related Posts

-

Fractional CFO Venture Debt SEA Startups SME Loans 3 Minutes

Why Startups Fail: The 3 Reasons That Sink Great Ideas (and How to Avoid Them)

Startups rarely get killed by competitors. The big 3 killers are: no market need, running out of funding, and the wrong team. This quick playbook shows how to spot the signs early and fix them with demand tests, smart financing, and fractional expertise. -

SaaS Logistics AI Startups Venture Debt India 4 Minutes

Trifecta Capital: India’s Venture-Debt + Growth-Equity Engine

Trifecta Capital is India’s venture-debt pioneer turned full-stack partner—combining scaled credit with a selective late-stage Leaders Fund. Backing VC-funded scale-ups across consumer, fintech, logistics, and enterprise SaaS, Trifecta helps founders extend runway and accelerate toward IPO or strategic outcomes. -

Venture Debt Finance AI Investor 2 Minutes

Bridging the Funding Gap: Why Strategic Planning Between Rounds Is Critical

Between funding rounds is where the real work begins. Strategic planning during this quiet phase can determine how ready your startup is for the next big raise. From fractional CFOs to venture debt and investor engagement, WOWS Global helps you stay prepared and in control. -

Startup Funding SEA MENA Startups 5 Minutes

June 2025 Investment Snapshot: Capital Hits a Heatwave

June 2025 lit up with a VC heatwave across Southeast Asia and MENA. From insurtech unicorns and migrant fintech to AI wearables and atmospheric water, this month’s deals show the frontier is flush with cash and big ambition. Explore the standout rounds and future-casting sectors. -

Venture Capital Founder Startup Funding 6 minutes

The Founder-Turned VC vs. The Non-Founder VC – Two Species in the Venture Jungle

Venture capitalists come in all forms, but two stand out: the battle-tested Founder-Turned VC and the strategic Non-Founder VC. Learn how their distinct approaches to risk, pivots, and due diligence shape their partnerships with startups and find out which one is the right fit for your journey. -

Startup Funding Venture Capital VC Red Flags 5 Minutes

Don’t Accept VC Money If You See These 5 Red Flags in a Term Sheet

A term sheet sets the tone for your startup’s future, but not all deals are created equal. Learn the five red flags you should never ignore when negotiating VC funding to protect your vision and equity.