Public Markets vs. Private Markets - What Are The Differences?

Public Markets Private Markets Private Equity Venture Capital Stock Market

Public Markets

This is where most companies raise funding through the issuance of stock. The stock exchange is the best-known public market. It is where individuals, as well as institutional investors (think banks and hedge funds), buy and sell stocks.

There are other public markets such as the bond market and the commodities market. For many types of investors equity allocations dominate. This includes pension funds, individual traders, and investors.

Private Markets

This is where companies seeking to raise funds go to a smaller group of investors. Examples of these investors include wealthy individuals and larger institutions such as family offices, sovereign wealth funds, and pension funds.

Those who invest in private markets are typically looking for higher returns than they can achieve from public markets. The reason for this is that they are taking on a bigger risk. This is primarily down to a lack of easy liquidity.

There will be more details on liquidity and how private market returns outperform public market returns later in the piece.

The two main types of private equity

Here are the two main types of private equity:

- Venture Capital: This is when investors provide money to early-stage companies that they feel have high growth potential.

- Buyout: When investors purchase a controlling stake in a company this is known as a buyout. A buyout typically occurs when a company is struggling.

Prime examples are seen in companies that are distressed or inefficiently operating. The purpose of a buyout is for investors to turn such a company’s fortunes around.

Key Differentiators Between Public and Private Markets

Here are three key factors that differentiate public markets from private markets:

Intermediaries

The first key difference relates to the role that intermediaries play. In the public market arena, the process of buying and selling securities involves numerous middlemen such as stock exchanges, brokers, and investment banks.

Typically, private markets have fewer intermediaries. The reason for this is that private markets are more often than not dominated by large institutional investors. This type of investor has the resources to invest directly in companies.

Regulation

Regulatory differences will vary depending on the world region that a business is registered. It is government agencies who are responsible for the heavy regulation of public markets that come under their jurisdiction. A good example is the U.S. Governments SEC (Securities and Exchange Commission).

The role of these regulatory bodies is to protect investors from fraud. They also ensure that public companies disclose relevant material information to the public.

In terms of private markets, these are not subjected to the same levels of scrutiny or governmental regulation. The reason for this is largely because private companies are not selling their securities to the public in general. That means there is less need for governments to protect investors from fraud.

Listing Requirements

This final key difference between public and private markets relates to listing requirements.

To be allowed to list on a public exchange, companies have to meet certain financial as well as disclosure requirements. It should be noted that this listing process is often time-consuming and costly.

Private companies are not subjected to such listing requirements. Because of this, private companies avoid the costs associated with a company that decides to go public.

How Private Market Returns Outperform Public Market Returns

It is very clear that those investors involved in the commercial world of investing want returns on the funding given. Historically the smaller number of investors who could take advantage of private equity investments have seen this as an attractive proposition. This is because of the characteristics and asset class that private equity offers.

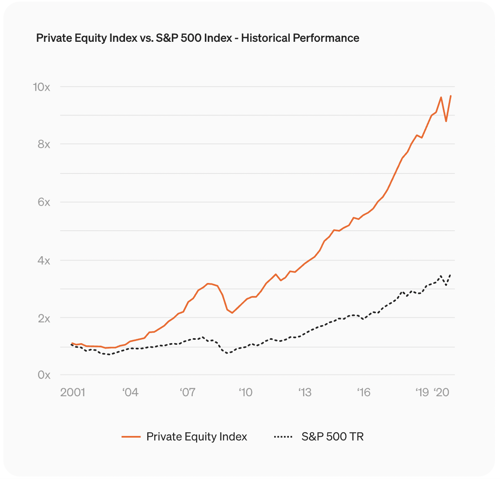

In recent years access to private equity has been opening up. With this, it has become a reality for individual investors looking to add private equity investments to their portfolios. They are doing this because records clearly show that private equity returns outperform that of public equity. In many cases, by a significant margin.

An example of this is shown below:

To explain further, liquidity and other benefits need to be looked at

Liquidity vs. Illiquidity risk premium

To give a balanced view, both public and private market liquidity need consideration. Public markets are classed as being liquid. It means that assets can easily be exchanged for cash or sold.

This liquidity allows for greater price discovery as well as quicker access to capital. Because of their status, it also means that public companies are subject to much greater and more rigorous disclosure requirements than private companies are.

However, when it comes to illiquidity risk premiums, private market returns are viewed more favorably than public markets. The increased premium seen comes because investors are being compensated for taking on extra risk. This clearly shows that the main benefit of private market investment comes from the potential for higher returns.

Two other beneficial factors of private market investing come through the lack of governmental regulation. The status of a company in the private market means they are not subjected to the same level of regulation applied to public market companies and in general they only need to satisfy a smaller client base.

Private Markets to Public Markets - When is the Transition Made?

While it is certainly not applicable to all private companies, many do prepare to transition from a private company to a public company. In the main, this opportunity comes when the value of a private company reaches a billion dollars. They then achieve what is known as Unicorn status.

To achieve this, private companies need to go through the IPO (Initial Public Offering) process. An IPO is when the company first sells its shares to the public. Successful completion of an IPO then allows a company to raise capital from public investors.

Transitioning from a private to a public company is seen as being a very important time for private investors. This is because they are positioned to fully realize gains from the investment they have made. Such investment agreements typically include share premiums for the existing private investors.

An IPO can also be seen as an exit strategy that will benefit company founders and early investors. This is seen through the realization of full profit from the private investment amount given.

How to Maximize Private Market Investments?

Access to private equity investments continues to grow. With that, the untapped potential for many individual investors to add to their portfolios is becoming a reality.

As an investor in private equity, you need insight and leverage to make decisions that will maximize your ROI (Return On Investment).

In that respect, WOWS Global is perfectly positioned to help you achieve this. We have built a best-of-breed digital ecosystem that offers a one-stop-shop solution for companies, shareholders, and investors.

Our investor services are designed to bring serious private equity investors together with companies that will grow and flourish through private funding initiatives.

The WOWS gateway to private market investing gives exclusive and priority access that will maximize private market investment opportunities and liquidity options. It also gives insights into the latest industry news and trends.

The highly experienced WOWS team will take time to understand the type of business sector that you as an investor are interested in. From there we can guide and advise you on unique investment opportunities. Ones that dovetail with your investment portfolio needs.

Among the many WOWS solution strands offered to private companies and investors is a due diligence process that is second-to-none. Our mission is to see that any private equity investment made gives increasing returns as the companies invested in grow in a structured and positive manner.

To find out exactly what WOWS can achieve for you in the private investment arena, please do not hesitate to contact us for an initial no-obligation discussion at:

Related Posts

-

Seed Indonesia Early Startups Private Equity

Arummi Raises Seed Round to Bring Indonesian Cashew Milk to the World

Arummi Foods, Indonesia’s homegrown cashew milk pioneer, has closed its Seed round, accelerating its mission to make healthier, sustainable dairy alternatives accessible to millions. In a market where 70%+ are lactose intolerant, Arummi has scaled from lab experiment to 650+ retail stores, 3,000+ cafés, and 750,000+ liters sold. Backed by BEENEXT, Korea Investment Partners, and Fondation Botnar (supported by SAGANA), Arummi is turning local cashews into global innovation. Proud partner: WOWS Global. -

Venture Capital FEBE Ventures Seed

FEBE Ventures: Founders Backing Founders from Day One

More than capital, FEBE Ventures brings founder-first support, fast decisions, and real operational insight to early-stage startups across the globe. -

Venture Capital Founder Startup Funding

The Founder-Turned VC vs. The Non-Founder VC – Two Species in the Venture Jungle

Venture capitalists come in all forms, but two stand out: the battle-tested Founder-Turned VC and the strategic Non-Founder VC. Learn how their distinct approaches to risk, pivots, and due diligence shape their partnerships with startups and find out which one is the right fit for your journey. -

Startup Funding Venture Capital VC Red Flags

Don’t Accept VC Money If You See These 5 Red Flags in a Term Sheet

A term sheet sets the tone for your startup’s future, but not all deals are created equal. Learn the five red flags you should never ignore when negotiating VC funding to protect your vision and equity. -

SEA Private Equity 2025 Outlook

Southeast Asia’s Investment Rollercoaster: Closing 2024 with Big Moves and a Bold Outlook

As 2024 draws to a close, Southeast Asia’s startup ecosystem is making waves with record-breaking deals, rising unicorns, and bold expansions in healthcare, fintech, and sustainability. Discover how December's milestones are setting the stage for a transformative 2025 in our latest blog. -

Startups Venture Capital Unicorn Startups

Superhero Franchises and Unicorn Startups: Why Investors Love the Blockbusters

What do superhero franchises and unicorn startups have in common? Investors love them for the same reason—they’re scalable, high-impact, and built for long-term success. Learn why your startup needs an origin story, a killer team, and the potential to create a universe of opportunities in this blockbuster blog from WOWS Global.