Shh! Don’t Share These Fundraising Insider Secrets

Early-Stage Investors Funding Funding Round Fundraising for Founders Investor

Startup founders need to fasten their seatbelts and prepare for a roller-coaster ride if they are to achieve success. It is a straight fact that founders will find themselves wearing many hats to get their venture up, running, and thriving.

One of the most challenging aspects of growing your business comes in the form of fundraising. This is no easy task and your fundraising journey will result in a wide range of emotions. There will be trepidation and joy, highs and lows, and a lot of middle ground in between.

This means planning, determination, and heaps of perseverance are all traits you need to bring to the fundraising table.

To help you stay ahead of the pack when it comes to securing those much-needed funds, here are some key insider fundraising secrets you may not want to share with others.

<

Get a Handle on What Investors Expect

As a founder you will have good knowledge of your business, the sector you are operating in, and what the key business drivers are. The longer you are in business, the more knowledgeable and business-aware you will become.

Investors are professionals. They are business-hardened and tough negotiators. This makes sense because they are in their industry to make money.

That means founders need to make time for research. Understanding common factors that investors are looking for when considering investing in a company will certainly pay dividends. Of course, there will always be individual investor differences and preferences but having an insight into how they position themselves will be of great benefit when it comes to effective, focused, fundraising.

Investors are looking for resourceful founders, ones who have an understanding of what the investment process is all about. Founders also need to be aware of fundraising terms, abbreviations, and acronyms that are common throughout the investor world.

To help all founders understand a comprehensive A-Z of fundraising terms, please click

If you have contact with other startup founders that have successfully navigated fundraising rounds, lean on them for their insight. These founders are sure to have had different approaches and experiences during their fundraising journeys but that should be seen as your advantage. By talking to different founders you will glean enough knowledge to form your own opinion on what investors demand.

<

Be Realistic About the Amount you Want to Raise

Founders need to spend time planning their approach to a fundraising round. While it includes getting all necessary documentation together and perfecting your pitch, the other really important thing to decide on is the amount of money you are looking to raise.

At first glance, it may appear that getting as much money as possible is the right way to go. This should not be your approach because it is often the case that more is not always better!

Going for and taking bigger investment amounts than you need is putting additional pressure on yourself and your business. It means you will have to make faster progress in terms of such things as agreed growth goals and the need to show faster returns on investment.

Founders should look at a fundraising round as a means to an end, not the end game. You should think of any fundraising initiative as a stepping stone to the next milestone in your startup’s development.

To do that, factor in the following:

- The length of time in months you feel is required to reach that next milestone.

- Total up all current monthly recurring costs (office rental, utilities, current staff salaries, etc.)

- Forecast all additional costs required to take your business to the next milestone.

This will include such things as new hires, any prototype development costs, increased marketing costs, and other outgoings that will come into the equation.

- Don’t forget to add in an additional 20-30% cushion to the figure you come out with. That will help guard against any unexpected or unseen costs that arise.

Once you have the final required amount, stick to it and that is the amount you are looking to raise.

Horses for Courses

It is a fact that not every investor type will be interested in your business product or service. Investors have their own reasons for preferring to go with one business sector over others. This means that founders need to focus on investors who align with their product or service and that their criteria for success broadly match yours.

To find the right investor fit for your business plans and growth, homework is required. Look into investors you feel match your aspirations, and check out startups these investors have already invested in.

Don’t be shy to seek out the founders of these companies and talk to them. Direct questions should be asked, you need to get a feel of how smoothly things are running and how supportive the investors have and are being.

Weighing up the pros and cons of the type of investing partners you want will help when deciding on investors or firms that fit your current startup stage.

Early-stage Investors vs Multistage Investor Operations

Some pointers here are that early-stage investors tend to have smaller funds. This generally means the investment amount they are willing to give can represent a sizable portion of their total fund.

It follows that early-stage investors will be more motivated to get your company to its next stage. Their approach will be to work hard with their connections such as potential customers, partners, and talent on your behalf.

As for a multistage fund operation, their first investment amount will be a drop in the ocean in relation to the total amount of funding they have available. It can often be the case that full partnership approval is not required. What that means is that venture capitalists at these firms are ‘buying’ a call option. One that will allow them to invest in your next round of funding.

With that in mind, it is likely they will have less skin in the game and be less likely to go full tilt in making further connections on your behalf. It is also the case that more multistage firms than ever before are now investing in startups earlier and earlier.

With that in mind, founders need to be aware that this type of investor will have far more information available than any potential new investor. This could mean that if they decide not to invest further this is signaling to other potential investors that they do not think your startup is one of their top performers.

Founders should not always think going with a multistage fund is a bad thing. This particularly applies to your first or early fundraising rounds. Why? Because if you are performing well they have deep enough pockets to preempt your next funding round. If they do this, it is saving you from going through another fundraising cycle because you can double down with them.

An insider fundraising secret you should be in on

It is clear that effective fundraising is an art. While founders of startups are not expected to know everything there is to know about it, they do need to understand the fundamentals.

But there is one way that founders can gain a huge advantage. This relates to securing the funds they need to successfully move their company onto their next milestone and beyond.

That is by taking advantage of some seriously deep startup fundraising knowledge and know-how. This is where WOWS Global can be of huge benefit. Our highly experienced team is fully-focused on all aspects of startup development.

When it comes to the complex art of fundraising we are perfectly placed to assist. WOWS Global is ready to advise, guide, and assist founders from the start of their journey through as many funding rounds as are deemed necessary.

We have the inside track on what investors are looking for and our state-of-the-art, online digital ecosystem has been designed to make things easy for founders and investors alike. WOWS Global is here to give founders direction and to align the right type of investor with your specific startup needs.

To find out exactly how we can put you ahead in the fundraising stakes please do not hesitate to get in touch with us now at: contact@wowsglobal.com

Related Posts

-

Fundraising 409A Valuation Cap Table Management Investor

WTF Is 409A and Why Should I Care?

Learn what a 409A valuation is, why it matters for employee stock options and how it impacts founders, investors, taxes and diligence, plus how WOWS Global can help. -

Investor Due Diligence Readiness Virtual Data Room Founder

Data Room Done Right: A Founder’s 30-Item Investor Readiness Checklist

Investors don’t fund mysteries. This Seed–Series A checklist shows exactly what to include, governance, product, metrics, financials, security, and round mechanics, so diligence speeds up, not stalls. Need help? WOWS Global can review and structure your data room. -

Exit Strategy M&A readiness Cap Table Startup Exits Investor

Planning the Finish Line: Why Every Business Needs an Exit Strategy

Launch matters, but exits set the score. Learn how early planning, clean governance, and buyer mapping turn hard-won growth into the best possible outcome. -

Startup & Venture Capital VC Funding Founder IPO

How VCs Make Money: A Founder’s Guide to Venture Capital Economics

Venture capital isn’t a black box. Learn how LPs, GPs, fees, carry, and portfolio math actually work, then frame your pitch as the fund-maker with a credible exit path. -

Early-Stage Investors VC Startup & Venture Capital Business Growth

Lifetime Ventures: Japan’s Deeptech Bridge with Growing On-Ramps for Southeast Asia

From Yokohama to Okinawa, Lifetime Ventures is rewriting Japan’s deeptech playbook. With strong ties to academia, a thesis built on research commercialization, and a portfolio of 60+ science-driven startups, the firm is shaping the technologies that will define generations. -

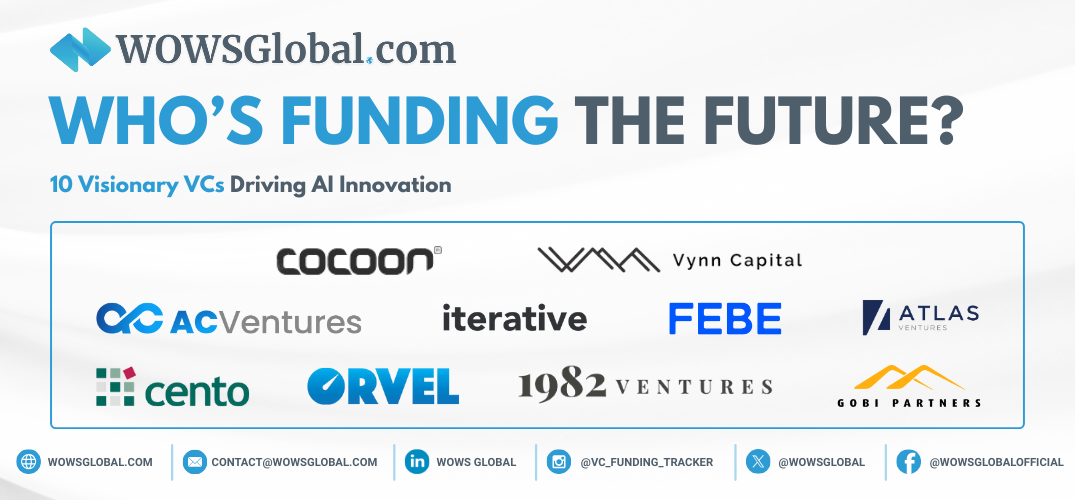

SEA Early Startups Funding VC AI in Southeast Asia

Who’s Funding the Future? 10 Visionary VCs Driving AI Innovation

Explore 10 standout venture capital firms driving Southeast Asia’s AI-first startup ecosystem, from early-stage champions to fintech and deep tech backers.