The A-Z of Fundraising (Part: 1 A-D)

Funding Funding Round Fundraising for Founders Investment Startup Funding

Founders of startups have a lot to contend with as they formalize their ideas, turn them into reality, and then proceed to grow their business in a healthy way.

As you progress, the world (and art!) of successful fundraising will become more and more important.

Similar to all business sectors, startup founders will encounter fundraising abbreviations, acronyms, terms that speak for themselves, and others that are far more obscure.

To help you grasp exactly what these terms mean, here’s a comprehensive A-Z of fundraising from WOWS Global. This handy reference guide will help every founder talk the fundraising talk with confidence.

Because we are digging deep to deliver everything related to fundraising this guide will be split into easy-to-read parts starting with:

Part 1 – A to D

A is for:

Accelerator: This is a hub where startups will receive mentorship, space to work on their ideas, and sometimes seed capital. It is a timed program to help build your startup.

Accredited Investor: An accredited investor is generally considered to be a person who has sufficient capital (a high net worth), extensive experience in financial markets, and the ability to engage in more advanced types of investment. They may also be known as sophisticated investors.

Acquihire: This is an exit strategy in which a hiring company is effectively buying your company to acquire the talent and team you have built.

Acquisition: There are 2 types of acquisition:

- Business acquisition: When a company or investment group buys another company. A business acquisition is seen as a common mechanism for an exit.

- Customer Acquisition: When your company wins a new customer.

Allocation: Relates to the size of the funding round which has been set aside for a specific investor, group of investors, or a fund, etc. It is usually communicated in monetary value.

Amortization: This is an agreed, scheduled process for companies to gradually pay off a debt.

Angel Investor: Usually a high-net-worth individual. Angel Investors often fund with their own money during the early stage of a company’s life. It is often the primary source of funding for startups. While not set in stone, investment amounts from angel investors can range from $5,000 to $250,000.

Anti-Dilution Protection: This is a contract clause. It protects some investors from having their equity or shares diluted when other investors buy stocks in your company. Such a clause is often applied when company shares are sold at less value than the amount originally paid by existing investors.

B is for:

Board Seats: It is crucial that founders fully evaluate any investor interested in making a substantial investment in their company. As has been witnessed time and again, investors that offer significant investment sums will usually insist on taking a seat on your company’s board of directors.

It is also clear that such high-profile investors come with the intention of having a major influence in terms of company decisions. The reason for this is that they will want to examine whether their investment is being put to good use or otherwise.

Bootstrapping: Where founders start a business without external help or investment.

Bridge Financing: Short-term financing which is expected to be quickly repaid.

Burn Rate: Burn rate (often called ‘burn’) is something all founders need to be acutely aware of. It is the rate at which your company is burning through money. The burn rate data is used by startups and investors to track monthly amounts of cash that a company is spending before it starts to generate its own income.

Burn rate is also used as a measurement to show the amount of time your company has before it runs out of money.

Founders need to be aware that there are 2 types of burn rates:

- Net burn: This is the total amount of money a company is losing each month. The net burn rate is calculated by subtracting total operating expenses from all incoming revenue.

- Gross burn: This is the total amount of monthly operating costs incurred. It also serves to provide insight into your company’s cost drivers and efficiency.

Buyout: A buyout is a common exit strategy. It is when a company’s shares are purchased. This results in the purchaser being granted a controlling interest in the company.

C is for:

Cap Table: A cap table is a record of company ownership that includes such data as shares (common and/or preference shares), warrants, and convertible instruments.

A cap table clearly shows the percentage ownership of all involved investors. It is a crucial tool that clarifies percentage ownership before and after an investment round. It also shows the current value of equity as well as any equity dilution.

To find out how the WOWS Global digital cap table management tool can help founders perform such things as seamless equity management, increase transparency for stakeholders, ensure you are always due diligence ready, run deal scenarios with ease, and calculate dilution impact please click here (insert link).

Churn Rate: As the term suggests, this relates to customer numbers you are churning through. Meaning, how many customers you are gaining against those you are losing. Any startup that is losing too many customers can find that its next fundraising round will be more difficult.

Common Stock: A type of security that represents company ownership. Common stock shares allow owners to vote on corporate policy and to have a say on serving directors.

Should a sale or liquidation occur, owners of common stock are only paid an amount once the bond and preferred stockholders have been paid.

Convertible Note: This is an investment vehicle. It is considered a loan that is intended to convert into equity if/when the loan provider requires it. Convertible notes help delay a valuation agreement between your company and any investors.

They also allow a far faster agreement process to be put in place. Convertible notes do have a valuation cap. They also have an agreed interest rate as well as a valuation discount from your next round of fundraising.

Crowdfunding: This is how startups can obtain money from many individuals and/or organizations. The amount raised is achieved in exchange for such things as equity (shares), loans (interest), and/or products/services rewards

D is for:

Deal Flow: The rate at which funding institutions receive investment opportunities.

Deal Room: A centralized location in which investment pitches and negotiations are carried out.

Debt Financing: A money-raising tactic. Debt financing is where a company sells bonds or notes to an investor. This transaction is carried out with the assumption that these bonds/notes will be re-purchased with interest.

Dilution: Put quite simply, dilution is the process that decreases your ownership of the company. This is carried out to raise money from investors by bringing them onboard as part owners. Each round of equity funding successfully raised means you are giving up a percentage of your company in return for the equity funding investors give.

Sensible negotiation is a must. Founders need to be careful not to give too much away but on the other hand, too little will discourage investors. Dilution discussions will depend upon the investor(s) themselves and how willing they are to agree on the required ownership percentage for the amount they intend to invest.

Due Diligence: Another very important term that founders need to be fully aware of. Due diligence means the detailed examination of all significant facts relating to your company. Examples are investments made and any acquisition or merger decisions made. Reviewed facts also include financial records, legal records plus anything else deemed material.

The premise behind due diligence is that it increases the quality and amount of information available to decision-makers who are considering an investment in a company. The information can then be systematically reviewed. By doing so, well-informed decisions can be made to strike a balance between costs, benefits, and any risk factors involved.

Founders should be acutely aware that the amount and clarity of required information available during due diligence can make or break investor decisions.

That’s it for Part 1 of this comprehensive WOWS Global A-Z of Fundraising for Founders. To read Part 2 please click here.

If you are looking to get your fundraising efforts off to the best possible start please reach out to us at contact@wowsglobal.com

Related Posts

-

SEA & Middle East Investment AI Highlight

WOWS’ 2026 Predictions: 10 Bets on Where Southeast Asia’s Money Will Move Next

WOWS’ 2026 Predictions are a forward-looking map of where Southeast Asia’s money could move next: operator-led capital, Thailand’s mid-stage moment, SME credit as a major return engine, an AI survival test, and a wave of M&A. Investors, founders, and SMEs can use these 10 bets to plan for what may come. -

Startup & Venture Capital Early Startups Founder Investment

How to Choose Which Startup to Invest In

Choosing a startup isn’t a coin toss. This quick-read playbook covers market sizing, founder fit, unit economics, risk mapping, and terms, written in a toned-down sports recap style. Wrap up with “WOWS Insight,” where WOWS Global explains how it matches investors with companies that fit their thesis, stage, and traction. -

Startup & Venture Capital VC Funding Founder IPO

How VCs Make Money: A Founder’s Guide to Venture Capital Economics

Venture capital isn’t a black box. Learn how LPs, GPs, fees, carry, and portfolio math actually work, then frame your pitch as the fund-maker with a credible exit path. -

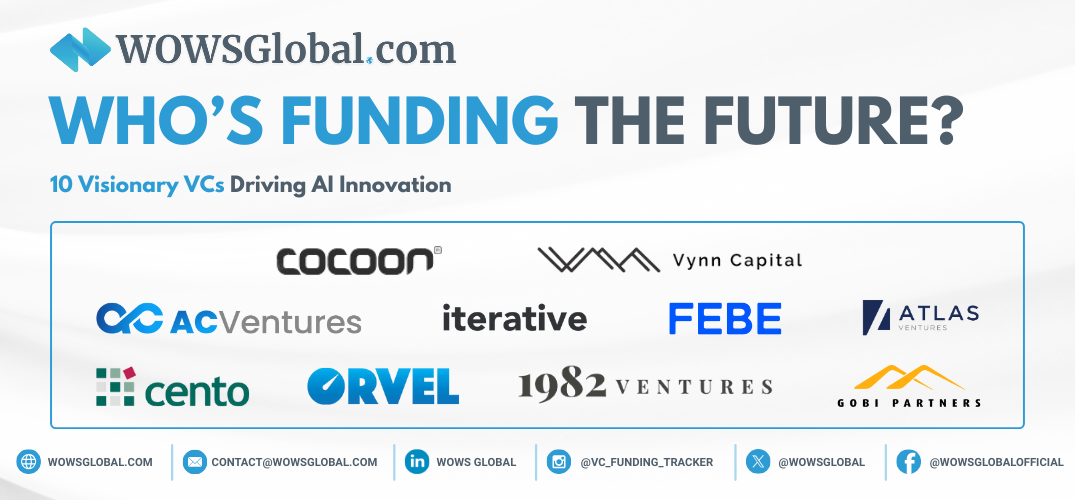

SEA Early Startups Funding VC AI in Southeast Asia

Who’s Funding the Future? 10 Visionary VCs Driving AI Innovation

Explore 10 standout venture capital firms driving Southeast Asia’s AI-first startup ecosystem, from early-stage champions to fintech and deep tech backers. -

SEA Startup & Venture Capital Seed Funding

10 Early-Stage Investors Powering Southeast Asia’s Startup Momentum

Discover the rising early-stage investors powering Southeast Asia’s startup ecosystem. From Vietnam to Indonesia and the Philippines, these funds are writing meaningful cheques, backing standout startups, and offering founders the mentorship, networks, and sector expertise needed to scale from idea to impact. -

Southeast Asia MENA Investment Fintech HealthTech

July 2025 Investment Snapshot: Southeast Asia & MENA

From fintech surges to deeptech breakthroughs, July 2025 delivered a wave of standout deals across Southeast Asia and MENA. This snapshot covers the top funding rounds, rising sectors, and the investors fueling growth across two of the world’s most dynamic startup ecosystems.