The Advantages of Venture Debt for Fast-Growth Startups

Venture Debt Startups

"Securing the necessary capital to scale your business as a high-growth startup can be a difficult and complex task." While traditional financing options like bank loans and equity financing may be appropriate for some businesses, venture debt has emerged as a popular and effective option for high-growth startups. In this article, we'll look at the advantages of venture debt for high-growth businesses.

What exactly is venture debt?

Venture debt is a type of debt financing that allows startups to raise additional funds without diluting their equity. Venture debt, as opposed to traditional bank loans, is typically provided by specialized lenders willing to take on more risk. Working capital, equipment purchases, and growth initiatives are all examples of how venture debt can be used.

The Advantages of Venture Debt for Fast-Growth Startups

Here are some of the most important advantages of venture debt for high-growth startups:

Access to Additional Capital: To scale their businesses, high-growth startups require a significant amount of capital. Venture debt enables startups to raise capital without diluting their equity. This is especially important for startups that have yet to generate significant revenue or profits, as they may be unable to attract equity investors.

Lower Capital Cost: Venture debt typically has a lower capital cost than equity financing, making it a more cost-effective option for startups. This is due to the fact that venture debt providers are typically willing to take on more risk than traditional lenders, allowing them to offer lower interest rates.

Flexibility: Because venture debt can be used for a broader range of purposes, it is often more flexible than equity financing. While equity financing is typically used to fund expansion initiatives, venture debt can be used for a variety of purposes ranging from working capital to product development. This adaptability is especially important for high-growth startups that need to respond quickly to changing market conditions.

Due to the less rigorous due diligence process, venture debt can be obtained more quickly than equity financing. This is especially important for high-growth startups that need to access capital quickly in order to capitalize on growth opportunities.

Non-Dilutive: Venture debt does not dilute the startup's equity. This means that founders can retain more control over their company and make key decisions without consulting with investors.

Access to Expertise: Venture debt providers frequently have extensive experience working with startups, which can provide founders with valuable insights and expertise. This is especially important for high-growth startups dealing with complex growth challenges.

Increased Valuation: By providing additional capital to invest in growth initiatives, venture debt can assist startups in increasing their valuation. This can assist startups in attracting more equity investors and, as a result, increasing their overall valuation.

The Difficulties of Venture Debt

While venture debt has many advantages for high-growth startups, it is critical to understand the challenges and risks involved. Here are some of the most significant challenges of venture debt:

Venture debt is frequently restricted to specific uses, such as funding product development or marketing initiatives. This can limit a startup's ability to use capital more creatively.

Default Risk: Because venture debt is still debt, if a startup is unable to generate enough revenue to cover loan payments, they may be forced to sell assets or give up equity to pay off the loan. This can be especially difficult for startups in their early stages of development with limited resources.

Difficulty Qualifying: Because venture debt is typically provided by specialized lenders, qualifying for it can be more difficult for startups than traditional bank loans or equity financing. In order to qualify for venture debt, lenders may require startups to meet certain revenue or profitability thresholds.

Contact WOWS Global today at contact@wowsglobal.com to learn more about our services and how we can help you grow your business.

Related Posts

-

VC SEA Startups Southeast Asia Early Stage

Ansible Ventures: Backing Vietnam’s Next Generation of Builders

Ansible Ventures is a Vietnam-first, early-stage VC backing software-first founders at pre-seed to pre-Series A. See their thesis, notable bets, and how WOWS can connect you via warm, qualified introductions. -

Fractional CFO Venture Debt SEA Startups SME Loans

Why Startups Fail: The 3 Reasons That Sink Great Ideas (and How to Avoid Them)

Startups rarely get killed by competitors. The big 3 killers are: no market need, running out of funding, and the wrong team. This quick playbook shows how to spot the signs early and fix them with demand tests, smart financing, and fractional expertise. -

SaaS Logistics AI Startups Venture Debt India

Trifecta Capital: India’s Venture-Debt + Growth-Equity Engine

Trifecta Capital is India’s venture-debt pioneer turned full-stack partner—combining scaled credit with a selective late-stage Leaders Fund. Backing VC-funded scale-ups across consumer, fintech, logistics, and enterprise SaaS, Trifecta helps founders extend runway and accelerate toward IPO or strategic outcomes. -

Venture Debt Finance AI Investor

Bridging the Funding Gap: Why Strategic Planning Between Rounds Is Critical

Between funding rounds is where the real work begins. Strategic planning during this quiet phase can determine how ready your startup is for the next big raise. From fractional CFOs to venture debt and investor engagement, WOWS Global helps you stay prepared and in control. -

SEA 2025 startups

Follow the Funding: What SEA’s 2025 Investment Landscape Reveals

Southeast Asia’s startup funding in 2025 is seeing a dramatic sectoral shift: while total capital is down 87%, AI and SaaS startups are booming, and traditional sectors like logistics, foodtech, and health are freezing. Here's what founders and investors need to know. -

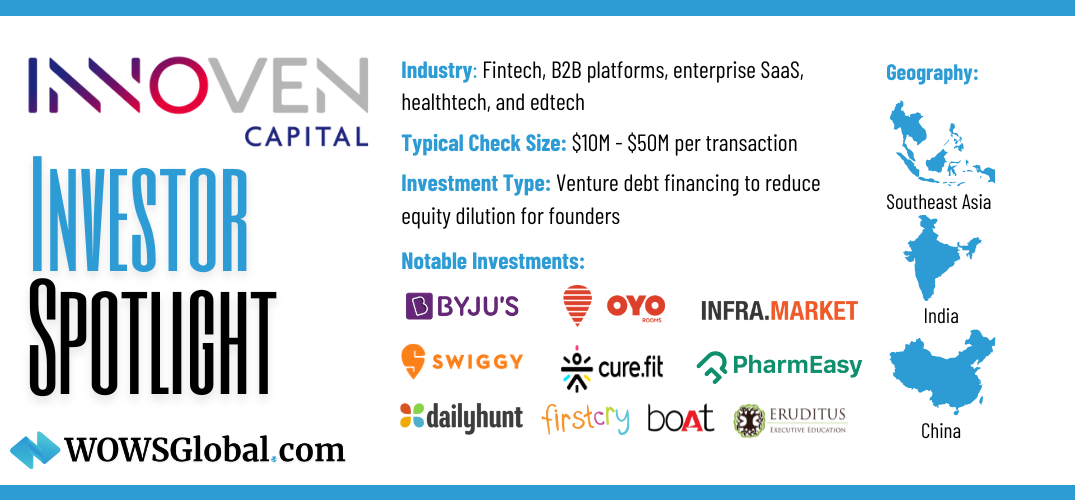

Venture Debt InnoVen Capital Startup Funding

Investor Spotlight: InnoVen Capital – Powering Asia’s Startup Ecosystem with Venture Debt

For startups aiming to scale without sacrificing equity, venture debt has emerged as a crucial financial tool. InnoVen Capital, a leading venture debt provider in Asia, has helped over 180 startups grow without dilution. With a focus on India, China, and Southeast Asia, InnoVen Capital has deployed over $400 million across 250+ transactions, backing industry giants like Byju’s, Swiggy, Oyo, and PharmEasy. Learn how venture debt can be a game-changer for your startup.