The Battle of Angel Syndicates vs. WOWS Global: Why the Choice is Clear

Fundraising Angel Syndicates VC 6 minutes

The Battle of Angel Syndicates vs. WOWS Global: Why the Choice is Clear

Choosing the right partner for your fundraising journey is one of the most critical decisions any founder or investor can make. It’s not just about raising capital — it’s about finding a partner who brings long-term value, innovation, and the expertise necessary to help you scale. Here’s a deeper dive into why WOWS Global stands head and shoulders above traditional Angel Syndicates.

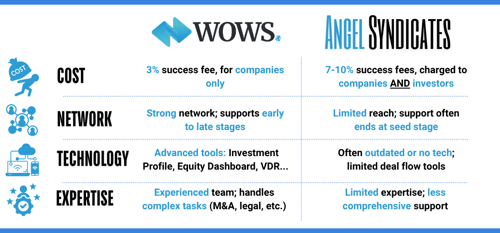

1. Cost Efficiency and True Alignment of Interests

Fundraising is already a challenging process. The last thing founders need is excessive fees eating into their hard-earned capital. Angel Syndicates typically charge high fees of 7-10%, splitting these costs between the companies raising funds and the investors who participate. This model quickly erodes the resources that should be used for growth and innovation.

WOWS Global takes a different approach. We believe in aligning our interests with yours by maintaining a straightforward, transparent fee structure.

- We charge just a 3% sell-side fee.

- Our goal is to maximize value, not create additional burdens.

By keeping costs low, we ensure more capital remains in your business and in the hands of your investors. It’s about building trust and long-term partnerships where everyone wins.

2. Network Depth and Lifelong Support

Connections and investor access are central to Angel Syndicates, but their reach is often limited. Many of these networks only extend to the Late Seed stage. As your company begins to outgrow the initial stages, these syndicates often fall short in connecting you to late-stage investors or private equity firms.

WOWS Global thrives where Angel Syndicates fall short.

- We’ve cultivated an extensive network spanning all growth stages, from Seed to Series C and beyond.

- Whether you’re just starting, scaling, or preparing for strategic exits, our connections are built to support your journey every step of the way.

Our network is designed to grow with you, giving you the strategic advantage to keep scaling.

3. Technology That Works for You

Today’s founders need more than just connections; they need cutting-edge tools to streamline operations, manage portfolios, and optimize deal flow. Angel Syndicates often rely on outdated technology, with limited capabilities to manage deals or organize information.

WOWS Global offers a comprehensive tech stack that empowers companies and investors.

- Equity management platforms

- Virtual Data Rooms (VDRs)

- Listing management solutions

Our technology simplifies the fundraising journey, making it easier to organize deals, streamline processes, and manage growth. Partnering with WOWS means gaining access to a tech-driven engine that supports every aspect of your business.

4. Expert Support for Complex Needs

Fundraising isn’t just about finding the money—it’s about navigating the complexities of scaling a business. From negotiating term sheets to developing business plans and managing M&A processes, expertise is essential. Angel Syndicates often lack the depth of experience to tackle these high-stakes tasks, leaving founders to find external help or go it alone.

WOWS Global’s seasoned team excels at navigating these complexities.

- We provide guidance on strategic business plans, legal documents, and M&A processes.

- Our experts ensure you’re making the best decisions for your business, even during the most challenging stages.

This holistic approach ensures you’re never alone, no matter how complex the fundraising journey gets.

The Bottom Line: Choose WOWS Global for Maximum Impact

If you’re looking for a partner who grows with you, provides unparalleled expertise, and maximizes your fundraising potential without exorbitant fees, the choice is clear. WOWS Global stands ready to offer value, innovation, and support at every stage of your journey.

Ready to see how we can transform your fundraising journey?

- Submit Your Pitch Deck or Schedule a Call with our team today.

Let’s build something extraordinary together.

Related Posts

-

Fundraising 409A Valuation Cap Table Management Investor 3 Minutes

WTF Is 409A and Why Should I Care?

Learn what a 409A valuation is, why it matters for employee stock options and how it impacts founders, investors, taxes and diligence, plus how WOWS Global can help. -

Early Startups Fundraising Due Diligence Data Room

2026 Fundraising: What Changed?

Fundraising in 2026 isn’t about moving faster—it’s about showing up prepared. Learn how to build an investor-ready system (modeling, governance, data room, and investor fit) so diligence doesn’t drag and your strongest conversations go the distance. -

VC SEA Startups Southeast Asia Early Stage 5 Minutes

Ansible Ventures: Backing Vietnam’s Next Generation of Builders

Ansible Ventures is a Vietnam-first, early-stage VC backing software-first founders at pre-seed to pre-Series A. See their thesis, notable bets, and how WOWS can connect you via warm, qualified introductions. -

Startup & Venture Capital VC Funding Founder IPO 2 Minutes

How VCs Make Money: A Founder’s Guide to Venture Capital Economics

Venture capital isn’t a black box. Learn how LPs, GPs, fees, carry, and portfolio math actually work, then frame your pitch as the fund-maker with a credible exit path. -

VC SaaS AI SEA AI in Southeast Asia 2 Minutes

The Great VC Divide: How AI Is Shaping Southeast Asia’s Next Wave

SEA’s funding has cooled, but AI and SaaS are heating up. Investors are prioritizing profitability, PMF, and global revenue, signaling a more disciplined, durable cycle. -

VC Startup & Venture Capital SEA Fintech 7 Minutes

Southeast Asia's Most Active Venture Capital Firms in 2025

Southeast Asia’s startup scene is on fire in 2025 and these are the 25 venture capital firms fueling it. From early-stage incubators to billion-dollar funds, this definitive short-list showcases the most active, founder-first investors driving the region’s digital, AI, and fintech boom. For founders, it’s more than a list—it’s your launchpad.