The Fundamentals of a Cap Table

WOWS Cap Table Fundamentals of Cap Table Cap Table Management

Smart founders need to be aware that putting in place a cap table is something that needs to be done as early as possible in their startup journey.

The reason that founders should prioritize cap table creation comes with growing complexity. While things may look straightforward at the beginning of your venture they will gradually become more intricate.

A well-structured cap table will clearly show the equity ownership capitalization for your company. On top of this, as rounds of financing are reached your cap table will become more complex. This is because it will need to record such things as potential sources of funding, IPOs (Initial Public Offering), M&As (Mergers & Acquisitions) along with all other relevant transactions.

The fact is that current and potential professional investors will want to see (and have access to) your cap table. A well-presented, orderly, secure, and easy-to-access cap table can go a long way to helping a startup achieve that much-needed funding. It is this funding that will allow your company to grow in a structured and measured way.

An Online Cap Table Platform is the way Forward

Spreadsheets (such as excel) have historically been seen as a way to produce a cap table. However, smart startup founders now opt for a far more secure, easily manageable option by taking advantage of a state-of-the-art online cap table management system.

One such system is that offered by WOWS Global. Some highlights of what this platform offers will be given towards the end of this article.

Before that though, let’s take a brief look at what a cap table is and then get into the fundamentals of the information a robust cap table should include:

What is a Cap Table?

Also known as a capitalization table, a cap table is a spreadsheet used by startup companies or early-stage ventures that lists all company securities. Examples here are:

- Common shares.

- Preferred shares.

- Warrants.

- The price investors have paid for these securities

A cap table should also indicate the following:

- Each investor’s percentage ownership in the company.

- Value of their securities.

- Dilution over time.

The Fundamentals of a Cap Table

When looking at a cap table, typical elements are included. Agreed terms such as equity share, and preference share, along with pre-money and post-money valuation need listing. As do any ESOPs (Employee Stock Option Plans) or stock options and details of any option pool.

Each of these elements is connected to the others. This means a variation (change) in one will have a definitive impact on all of the other included elements.

The significance here is that every term listed in your cap table has a numeric value attached to it. That means ease of administration and maintenance of your cap table is a must because it needs to reflect all changes made accurately and securely.

Not every cap table contains identical terms but in the majority of them you will find the following:

Amount of funding raised

This states the total amount of funds raised in a particular funding round from all involved investors.

Dilution

When referring to dilution in a cap table this means the percentage decrease in shareholding caused by new investment and all additional funds raised.

Dilution in this instance is calculated by dividing the amount invested in a particular round by the post-money value of the company.

Equity

Listed equity in a cap table shows each investor’s equity capital stake in your company. It will show ownership and the type of voting rights of each holder.

This is calculated by multiplying the share price by the number of shares owned per individual. As an aside, holders of equity shares will be aware that they are last in line when it comes to either dividend payment or any return of capital.

ESOP - Employee Stock Option Plan

Many founders find that putting an ESOP in place is beneficial. It is seen as an employee benefit and is intended to encourage your employees to acquire part-ownership in your company.

By offering key employees stock options you are allowing them to purchase company shares in the future at a fixed and usually discounted price. As well as encouraging company loyalty an ESOP gives employees the ability to convert their options to shares at a lower price than the share's existing value. This difference is seen as being the employee's reward.

Fully diluted basis

Calculation of shareholding on a fully diluted basis is taken on the assumption that all the shares issued by your startup, all convertible securities, and unallocated or reserved stock in the stock option pool have been converted to equity.

Funding Round Details

It is expected that as startups progress, they will go through several funding rounds. During these rounds, a current investor may invest more than once, and at each round, they may pay more (or less) for additional shares. It is also possible that new investors will come onto the scene.

With those factors in mind, your cap table will show the individual shareholding during each round and be accounted for and represented separately.

Name of the shareholders

The names of every shareholder in your company will be stated in your cap table. It is quite typical for shareholders to be categorized based on their relationship with your company as well as the characteristics of their investment and ownership. Examples are Founders, Angel Investors, VCs (Venture Capitalists), etc.

Net worth

These entries in your cap table will show the net worth of shares owned by each of the shareholders. This is the product of the post-money value of your company and the investors' shareholding percentage post-investment.

Net worth entries represent the amount of money a shareholder can expect to be paid should they decide to sell their total shareholding in your company.

Preference shares

Preference shares are classed as a category of your company’s stock. Any investor holding preference shares are preferred over those investors who hold equity shares.

This means that preference shareholders have priority when it comes to dividend payments or the return on invested capital.

PPS - Price Per Share

As the term suggests, PPS is the price at which each share (stock) sells at. To reach the PPS you divide the total amount invested by the number of shares that are issued in each round of funding.

Shareholding percentage

As can be imagined, the shareholding percentage figures shown in your cap table relate to the share of ownership percentages that each investor has. This is calculated by dividing the amount invested by the post-money value of your company.

During each funding round the ownership of each shareholder changes (unless a said investor invests in a successive round).

Valuation

The term ‘Valuation’ is commonly used in cap tables but perhaps it does not reflect what most people consider true valuation to mean!

This is because a company value is either determined or agreed upon during each capital investment funding round. This value (aka ‘Valuation’) determines the price investor(s) pay per share in that specific funding round.

The value of a company also decides an investor's shareholding and this is based on the number of shares issued in exchange for the amount of money given (capital) as well as (if issued) the number of equity shares to which a convertible instrument will convert.

There are two different values.

- Pre-Money Value: Your company value agreed between investors and your company for the transaction is known as the ‘pre-money’ value.

- Post-Money Value: The sum of the pre-money value and the investment amount during a particular round is known as the ‘post-money’ value.

A Flexible, Secure, Easy to Manage Cap Table is Crucial….

Understandably, some startup founders think that during early-stage formation of their company that a cap table can be kept in a spreadsheet format such as excel.

Do not make that mistake because as your company grows this type of cap table format becomes labor-intensive, error-prone, and very importantly, when presenting to potential investors such a format does not look professional.

The solution to this problem is to use a state-of-the-art, highly secure, online cap table management system. That is exactly what WOWS Global offers.

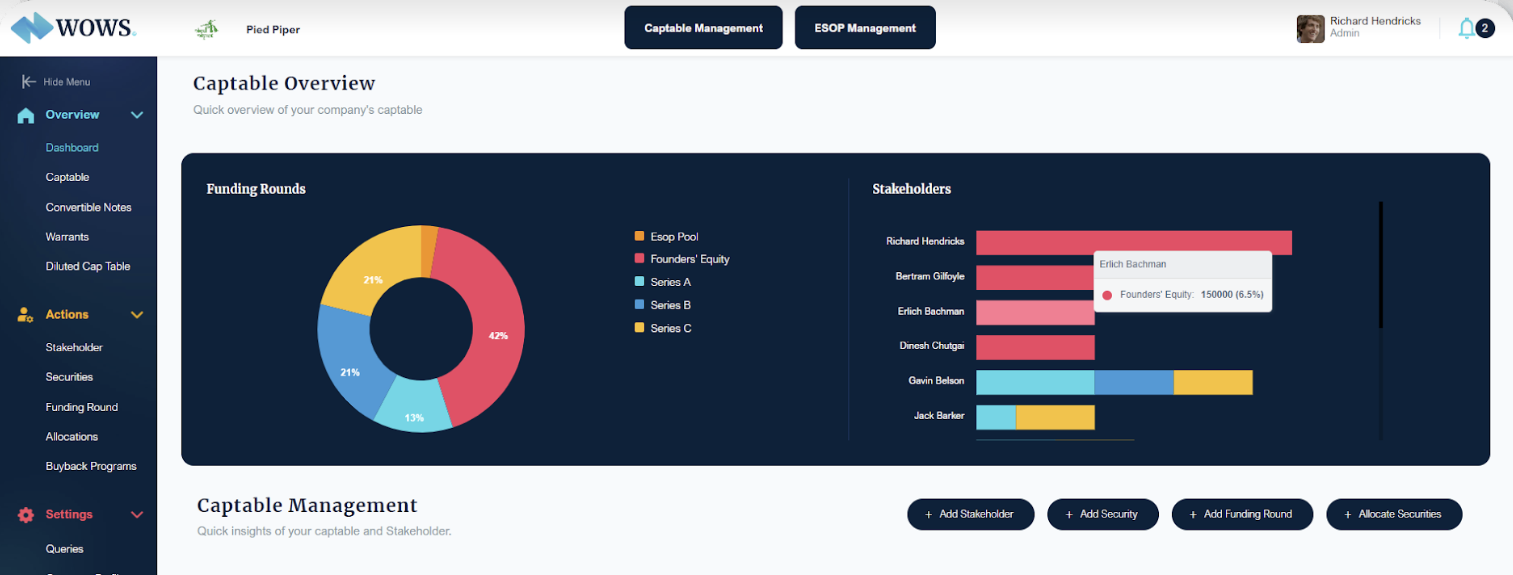

Here is an example of how the WOWS Global cap table is structured:

End of NOTE.

A major initiative in the WOWS Global mission is to simplify equity management for all. We are addressing this by helping companies to seamlessly manage their equity through our intuitive digital cap table management tool. This easy-to-access, easy-to-use tool offers everything and more at your fingertips.

It will increase transparency for stakeholders, always be due diligence ready, allow you to run deal scenarios, and gives the ability to calculate dilution impact on any financial decisions that need consideration.

For your convenience, pre-populated cap tables are available with full assistance offered during the setting up of your cap table. That will ensure your exclusive cap table structure is tailored to meet your specific needs.

The system also offers such benefits as seamless reporting, the ability to share details with individual stakeholders, and allows for the issue and monitoring of stock awards for employees.

Any startup founder who would like to understand more and how the highly experienced team at WOWS Global can help them should not hesitate to contact us for a no-obligation discussion at:

Related Posts

-

Fundraising 409A Valuation Cap Table Management Investor

WTF Is 409A and Why Should I Care?

Learn what a 409A valuation is, why it matters for employee stock options and how it impacts founders, investors, taxes and diligence, plus how WOWS Global can help. -

Cap Table Management

Why Every Startup Needs a Cap Table Management Software

So you've started a company. Congratulations! As an entrepreneur, you're surely excited to build an innovative product, assemble a stellar team, and change the world. But before diving headfirst into all the thrills of startup life, there's one important item you need to address: your capitalization table. A cap table, as it's commonly called, is a record of who owns what percentage of your company. It may not be the sexiest part of your business, but it's absolutely critical to get right from the beginning.