The Rise of Corporate Investors and Venture Debt in Early-Stage Funding

venture debt startup ecosystem startup funding Mike Cappelle

The Rise of Corporate Investors and Venture Debt in Early-Stage Funding

Welcome to 2024, where the startup funding landscape is morphing faster than a chameleon in a tie-dye shop. Gone are the days when venture capitalists (VCs) reigned supreme over early-stage investments. Today, corporate venture capital (CVC) is flexing its muscles, playing an increasingly dominant role in Seed and Pre-A rounds. And let me tell you, the implications are wild.

Corporate Behemoths in the Startup Jungle

Corporate investors have kicked down the door to the startup party, and they’re not just here for the free hors d'oeuvres. They’re writing big checks and bringing strategic value to the table. We’re talking about companies like Google, Samsung, and, closer to home, firms like Siam Commercial Bank and PTT Group in Thailand. These giants are no longer content to sit on the sidelines—they're diving headfirst into the fray, backing startups that align with their broader business strategies.

In fact, 2024 has seen a noticeable increase in CVC activity, particularly in sectors like AI, healthcare, and clean energy. These corporate titans are hunting for innovation, and they’ve got the cash to burn. Early-stage startups, once starved for funding, are now finding themselves courted by these corporate heavyweights. But it’s not just about the money—CVCs are offering something VCs can't always deliver: synergy. They provide startups with instant access to networks, resources, and markets that would otherwise take years to cultivate (Bain).

The Venture Debt Revolution

And then there’s venture debt—oh, sweet, sweet venture debt. In 2024, it’s more than just a financial tool; it's a lifeline. The traditional equity model, where founders give away chunks of their companies for growth capital, is starting to look like a bad deal, especially in a market where valuations are still reeling from last year’s tech correction.

Instead, startups are increasingly turning to venture debt to avoid the dreaded "down round" or further dilution. With interest rates stabilizing after the chaos of 2023, venture debt is becoming the go-to option for startups that need cash without sacrificing equity. It’s especially popular among high-growth industries like AI and biotech, where the need for capital is as insatiable as a shark during a feeding frenzy (Hypepotamus) (Embarc Advisors).

This shift is reshaping the landscape, creating a funding environment where startups are no longer at the mercy of venture capitalists alone. They can negotiate better terms, maintain control, and still get the capital they need to scale. It’s a win-win, baby.

What Does This Mean for Startups?

For early-stage startups, this evolving landscape means more options and potentially better deals. But with more money comes more scrutiny. Corporate investors are strategic; they’re looking for startups that not only show promise but also align with their long-term goals. And venture debt, while less dilutive, is not without its risks—startups need to be confident in their ability to repay the debt, or they could find themselves in hot water.

About WOWS:

At WOWS Global, we’ve got our finger on the pulse of these trends. We’re here to help you navigate this brave new world of funding, offering insights that cut through the noise and help you make the right moves for your startup or portfolio.

Disclaimer: We always strive to source our insights from credible and up-to-date information. If you spot any inaccuracies or have feedback, please reach out. We’re committed to delivering unique, original content that adds real value to our audience.

Related Posts

-

Fractional CFO Venture Debt SEA Startups SME Loans 3 Minutes

Why Startups Fail: The 3 Reasons That Sink Great Ideas (and How to Avoid Them)

Startups rarely get killed by competitors. The big 3 killers are: no market need, running out of funding, and the wrong team. This quick playbook shows how to spot the signs early and fix them with demand tests, smart financing, and fractional expertise. -

SaaS Logistics AI Startups Venture Debt India 4 Minutes

Trifecta Capital: India’s Venture-Debt + Growth-Equity Engine

Trifecta Capital is India’s venture-debt pioneer turned full-stack partner—combining scaled credit with a selective late-stage Leaders Fund. Backing VC-funded scale-ups across consumer, fintech, logistics, and enterprise SaaS, Trifecta helps founders extend runway and accelerate toward IPO or strategic outcomes. -

Venture Debt Finance AI Investor 2 Minutes

Bridging the Funding Gap: Why Strategic Planning Between Rounds Is Critical

Between funding rounds is where the real work begins. Strategic planning during this quiet phase can determine how ready your startup is for the next big raise. From fractional CFOs to venture debt and investor engagement, WOWS Global helps you stay prepared and in control. -

Startup Funding SEA MENA Startups 5 Minutes

June 2025 Investment Snapshot: Capital Hits a Heatwave

June 2025 lit up with a VC heatwave across Southeast Asia and MENA. From insurtech unicorns and migrant fintech to AI wearables and atmospheric water, this month’s deals show the frontier is flush with cash and big ambition. Explore the standout rounds and future-casting sectors. -

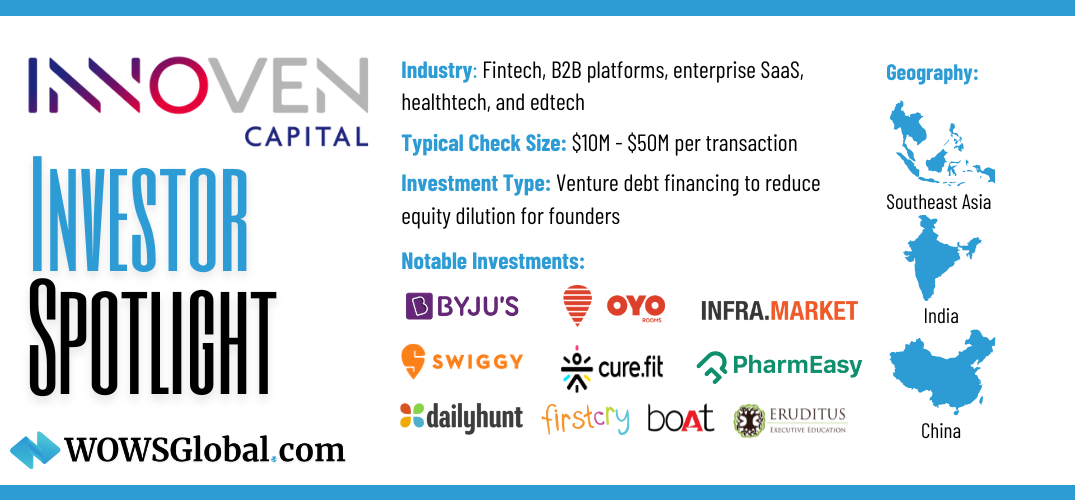

Venture Debt InnoVen Capital Startup Funding 5-7 minutes

Investor Spotlight: InnoVen Capital – Powering Asia’s Startup Ecosystem with Venture Debt

For startups aiming to scale without sacrificing equity, venture debt has emerged as a crucial financial tool. InnoVen Capital, a leading venture debt provider in Asia, has helped over 180 startups grow without dilution. With a focus on India, China, and Southeast Asia, InnoVen Capital has deployed over $400 million across 250+ transactions, backing industry giants like Byju’s, Swiggy, Oyo, and PharmEasy. Learn how venture debt can be a game-changer for your startup. -

Venture Capital Founder Startup Funding 6 minutes

The Founder-Turned VC vs. The Non-Founder VC – Two Species in the Venture Jungle

Venture capitalists come in all forms, but two stand out: the battle-tested Founder-Turned VC and the strategic Non-Founder VC. Learn how their distinct approaches to risk, pivots, and due diligence shape their partnerships with startups and find out which one is the right fit for your journey.