The Risks And Rewards Of Investing In Early-Stage Startups

Early Startups Investing

The startup world is buzzing with new entrants and this makes investing in them a very attractive investment proposition. The risks may be bigger than investing in publicly listed companies but choosing the right startup also means the rewards can be far greater.

While it is often mentioned that the vast majority of startups fail, the ones that succeed will give informed investors some very healthy returns.

There are risks involved in every phase of growth for startups but it is often the early risks that are most predominant. That is because these early issues can sink a startup before it has the chance to take off.

With that in mind and to help you make informed investment decisions here are some major risks and rewards related to investing in early-stage startups.

Bear these in mind, spread your funding in a positive way, and you will be increasing your chances of finding the right types of startups to invest in.

5 Risks of Investing in Early-Stage Startups

Let’s start with 5 risks that all startup investors need to be aware of. There will also be some tips on how to minimize such risks:

Lack of market fit - Unclear service or product goals

Great ideas are plentiful. Having the ability to explain exactly how the startup’s idea can be turned into a viable service or product is something else.

Unless the early-stage startup can clearly demonstrate what problem and user need their service or product can solve, potential investors need caution. Clarity of market fit and user need for the new product or service is an absolute must. Failure to establish these points will very likely mean that the business is dead in the water before it even begins to float.

To reduce this risk investors and startups alike should ask themselves questions such as:

- What exactly is the service or product being offered?

- What user problem will it solve?

- What is the route to market?

- How will it be ‘’sold’ to users?

- How much will it cost to reach market launch?

- How long will the initial market launch take?

If satisfactory answers cannot be given to the above then both the startup and any potential investor should question the validity of the business.

Having said that, this risk can be avoided through research. Carrying out thorough research will show whether the service or product being offered has a viable market fit.

What is the competition?

Another aspect of market fit that needs assessment is competition. The initial research should establish whether the market is already oversaturated or not and whether there is an untapped niche of that market that can be focused on.

Regardless of how good the proposed service or product is, if the intention is to enter an already crowded market sector where a few large companies are dominating, caution is required. This is because it is going to be even more difficult for the startup to break in and then secure a viable space within that market.

The most likely route into an overcrowded market is if the new business is offering something better than and very different from what the established competitors are offering.

It is also important for founders who believe they have a unique product or service to keep this detail secret until launch and ensure all relevant patents have been secured. Failure to do that could see more established brands or competitors using the startup’s idea.

Growth - Too fast / Too slow

This factor is all about balance and healthy growth. Every startup (and potential investor) will be looking to see fast growth. But to achieve that the timing must be right.

Any early-stage startup which grows too quickly is likely to suffer for a variety of reasons. This includes hasty recruitment, unnecessary staffing costs, and/or lack of perception relating to market demand.

On the other hand, growing too slowly can allow competitors to seize the momentum and forge ahead. Slow growth will also be detrimental to how attractive a startup is to potential investors.

Early-stage startup investors should look at the company’s growth plan and just how realistic their financial and expansion predictions are. With that, risks on growth expectations do need to be taken but these should be calculated risks based on research and available related data.

The startup’s core team

This is a crucial factor and one that all potential investors in early-stage startups must assess. Mentors and even a startup incubator can be of valuable assistance to a startup (and should certainly be taken advantage of). However, it is the core team that will ultimately be responsible for the venture’s success or failure.

The startup’s core team must have the ability to bring a diverse range of skills and expertise together for a common cause. That cause is to successfully launch and then grow their business in a structured and healthy manner.

The team needs to gel together while also being prepared to wear different hats. Multitasking is essential and an understanding of each other's abilities should dovetail and form a startup team to be reckoned with.

Potential investors should look at the previous experience of the core team but this also needs to be matched by impressions during early funding discussions. Investors need to feel confident that the key team members have a shared vision and the ability to make the business a success.

Burnout

Because early-stage startup teams are generally small and agile this puts a lot of pressure on its existing members. None more so than the founders. The pressure of things to be done and the consistently long hours that founders put in can lead to burnout from overwork and being overextended.

During the early stages of growth startup founders must be incredibly mindful of avoiding burnout. Breaks need taking to disconnect, relax, and reflect. A founder or key team member that comes back refreshed from a short break will feel invigorated, refreshed, and ready to push again toward success.

This is once again where being surrounded by the right team is invaluable. Having other team members who are competent and confident to take over the reins temporarily is essential. The ability of the team to interchange responsibilities is something that potential investors should look closely at before making any investment decision.

5 Rewards of Investing in Early-Stage Startups

Let’s match the 5 risks of investing in early-stage startups with 5 rewards. It is these rewards that startup investors should focus on because one thing is very clear; selecting the right startup to invest in can be incredibly rewarding in more ways than one.

Gaining access to new ideas and technologies

By their very nature, startups are often at the forefront of innovation and the implementation of cutting-edge projects. Investment in early-stage startups can give investors access to new ideas and technologies.

This knowledge will also allow investors to diversify their portfolios in different projects. Ones they see as being a future success.

It is also the case that investors with prior experience in a certain field will be attracted to startups in that arena and ones that are offering something truly unique. Investors with this industry or business sector insight will quickly understand if the proposition being offered by the startup is viable and whether it offers real growth potential.

Being nimble can give that competitive edge

Because early-stage startups are necessarily light on core team members this means they are nimble. That gives them far more flexibility to adapt more quickly than larger companies can. With that, this is often the opportunity that gives them a competitive edge.

Being nimble also means the startup can pivot quickly should it need to address problems or take full advantage of new opportunities. This is as opposed to established companies which have firm structures and bureaucracy in place which makes a quick pivot very difficult.

Early startup adaptability is another key strength that investors should see as a benefit. Because startup teams are typically smaller they are ready to implement new ideas as they arrive. This adaptability helps them to better respond to market changes and stay ahead of the competition curve.

Your investment amount can go further

There are a variety of reasons why investing in a startup means that your investment amount will go further than if investing in a larger business.

Overheads such as office space, equipment, and staff salaries are lower. It is also the case that lower marketing and advertising costs are seen. All of this means that any money invested can be used more effectively to grow the startup.

A well-run startup can reinvest a greater percentage of its funding and revenue into growth initiatives. It is these initiatives that make startups more attractive to investors who are seeking what they consider to be startups with high growth potential.

Supporting innovation and entrepreneurship

All investors are looking for returns on any given investment. However, many startup investors are also keen to support innovation as well as the entrepreneurs behind new ideas and projects.

This is because startups are often at the forefront of innovation and are the drivers behind new products or services that will benefit many. In turn, that can give startup investors a feel-good factor because their funding is contributing to business ideas that will change and enhance user perception.

It is also the case that through their experience and knowledge of certain products or services investors can add value to what the startup is offering. Active involvement and guidance can be invaluable to startups looking to grow their business in a structured and successful way.

The returns can be exceptional

While there are risks to early-stage startup investments, there are also huge potential rewards. Any startup investor that invests in a startup that grows from strength to strength will very likely see returns that surpass their initial expectations.

It is this potential reward that leads a growing number of investors to look closely at early-stage startup investment opportunities. Choosing the right type of startup to invest in needs careful consideration and some extensive research before committing funds.

However, carrying out extensive due diligence, having a clear understanding of what is being offered, and establishing a personal feel for the investment opportunity are all highly important. Once these factors are clear it will help investors to make an informed decision on how likely it is that the startup in question will flourish.

The bottom line here is; back the right startups with early-stage investment and you will be handsomely rewarded as their aspirations become reality.

Reduce the Risks, Increase the Potential Rewards

As can be seen from the above, there are risks as well as rewards for those investors who choose to put funds into early-stage startups.

The aim for such investors should be to reduce the risks while increasing the potential rewards. This is where the highly experienced team at WOWS Global can assist.

We have built a secure, state-of-the-art digital ecosystem that is an ideal solution for startups as well as investors. WOWS is on a mission to connect like-minded startups and investors to ensure they are the right fit for each other.

As South-East Asia’s most active investor matching platform WOWS gives preferred investors unique access to startups that are going places.

Among the many strands of our services, we offer highly secure investment readiness through due diligence and virtual data room services. Our equity management tool also gives clarity of insight for all who are given authorized access.

As for the WOWS private market opportunities offered to approved investors, this is second to none. It gives exclusive and priority investment access to startups across all stages. With that, approved investors will also have the ability to access standardized diligence material to allow for faster, more informed decision-making.

To be considered for the WOWS Investor Network, investors are invited to click here. Alternatively, please feel free to reach out to us for an initial no-obligation discussion on exactly why WOWS Global should be your go-to startup investment platform on:

Related Posts

-

Early Startups Fundraising Due Diligence Data Room

2026 Fundraising: What Changed?

Fundraising in 2026 isn’t about moving faster—it’s about showing up prepared. Learn how to build an investor-ready system (modeling, governance, data room, and investor fit) so diligence doesn’t drag and your strongest conversations go the distance. -

Fintech AI Startups Early Startups SEA

The Dip in SEA Fintech Funding: What Startups Can Learn

SEA fintech funding has dipped, but capital is still on the field for disciplined teams. This article unpacks what the new funding rules look like and how founders can upgrade models, governance, monetization, and capital stacks. Learn where investor expectations have shifted and how WOWS Global can help you get raise ready. -

Blockchain Singapore Early Startups SEA Startups SEA

GaiaSwap: The Eco-Commodity DEX Bringing Transparency & Inter-Operability to Fragmented Carbon Credits & I-REC(E)s markets

In a sea of generalist crypto venues, GaiaSwap zeroes in on eco-commodities with transparent pricing and compliant workflows. We unpack what sets it apart and the milestones to watch. -

Startup & Venture Capital Early Startups Founder Investment

How to Choose Which Startup to Invest In

Choosing a startup isn’t a coin toss. This quick-read playbook covers market sizing, founder fit, unit economics, risk mapping, and terms, written in a toned-down sports recap style. Wrap up with “WOWS Insight,” where WOWS Global explains how it matches investors with companies that fit their thesis, stage, and traction. -

Seed Indonesia Early Startups Private Equity

Arummi Raises Seed Round to Bring Indonesian Cashew Milk to the World

Arummi Foods, Indonesia’s homegrown cashew milk pioneer, has closed its Seed round, accelerating its mission to make healthier, sustainable dairy alternatives accessible to millions. In a market where 70%+ are lactose intolerant, Arummi has scaled from lab experiment to 650+ retail stores, 3,000+ cafés, and 750,000+ liters sold. Backed by BEENEXT, Korea Investment Partners, and Fondation Botnar (supported by SAGANA), Arummi is turning local cashews into global innovation. Proud partner: WOWS Global. -

SEA Early Startups Funding VC AI in Southeast Asia

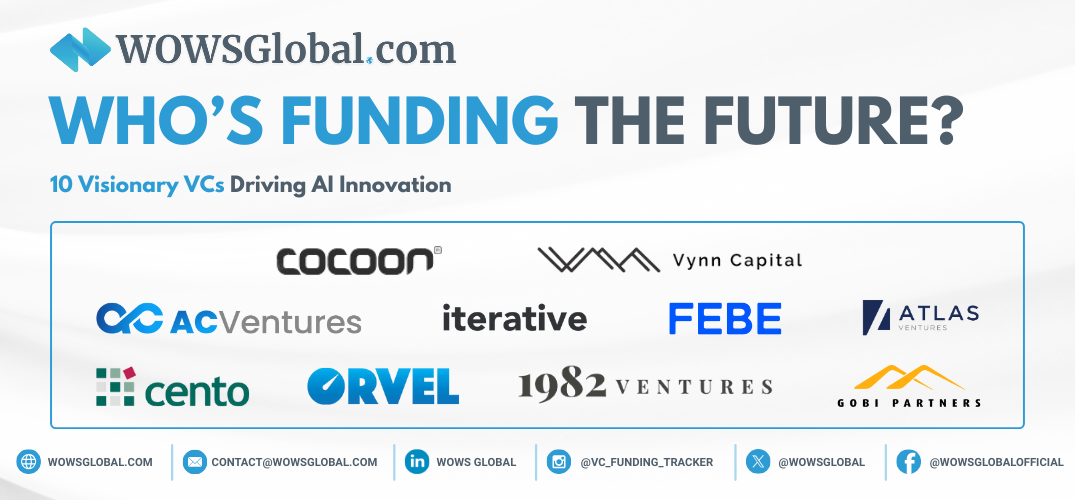

Who’s Funding the Future? 10 Visionary VCs Driving AI Innovation

Explore 10 standout venture capital firms driving Southeast Asia’s AI-first startup ecosystem, from early-stage champions to fintech and deep tech backers.