Understanding Term Sheets: Essential Insights from Gagan Singh, CEO of WOWSGlobal

term sheets startup funding liquidation preferences 5 minutes

Understanding Term Sheets: Essential Insights from Gagan Singh, CEO of WOWSGlobal

Introduction:

For startup founders, securing investment is a critical milestone, but navigating the complexities of a term sheet can be daunting. A term sheet outlines the key terms and conditions of an investment and serves as the foundation for the final agreement between the startup and the investor. In a recent video, our CEO, Gagan Singh, broke down the most important elements of a term sheet, highlighting what founders need to understand before signing on the dotted line.

This article dives deeper into those insights, ensuring that you’re fully prepared to negotiate and protect your startup's interests.

1. Liquidation Preferences: Safeguarding Investors’ Returns

Liquidation preferences dictate the order and amount that investors will be paid before common shareholders (like the founders) in the event of a liquidation, such as a sale or bankruptcy. It’s crucial to understand how these preferences work because they can significantly impact the payout you and your team might receive. Typically, investors may have a 1x preference, meaning they get back their investment before any other payouts are made, but sometimes preferences can be even higher, or include participation rights, where investors also share in the remaining proceeds.

2. Anti-Dilution Provisions: Protecting Equity During Down Rounds

Anti-dilution provisions are designed to protect investors if the company raises new capital at a lower valuation than in previous rounds (a "down round"). There are two main types: full ratchet and weighted average. Full ratchet is more aggressive, completely adjusting the price of previous shares to match the new lower price. Weighted average is more common and provides a more balanced adjustment. Founders need to understand how these provisions work because they can affect your ownership stake in the company.

3. Redemption Rights: Understanding the Investor’s Exit Strategy

Redemption rights give investors the option to require the company to repurchase their shares after a certain period, typically if the company hasn’t been sold or gone public. This can be a red flag for founders, as it may force the company into a liquidity event before it's ready, potentially leading to financial strain or the need for additional fundraising. Understanding the triggers and terms of redemption rights is essential for maintaining control over your startup’s timeline.

4. Board Matters: Maintaining Control Over Decision-Making

The composition of the board of directors is another critical aspect of a term sheet. Investors often request board seats to have a say in the company’s strategic decisions. While it’s common for investors to want representation, founders need to be cautious about giving up too much control. Ensuring that the board remains balanced and that you retain a significant degree of decision-making power is key to steering your company’s direction.

Conclusion:

Signing a term sheet is a pivotal moment in your startup’s journey, but it’s one that requires careful consideration. By understanding the key terms discussed above—liquidation preferences, anti-dilution provisions, redemption rights, and board matters—you can better protect your interests and ensure that the deal you’re entering into aligns with your long-term vision for the company.

If you’re preparing for a fundraising round, don’t miss Gagan Singh’s latest video where he breaks down these crucial elements in detail. Armed with this knowledge, you’ll be ready to negotiate a term sheet that sets your startup up for success.

About WOWS

WOWS Global is your go-to source for clear, actionable insights in the startup investment world. We break down complex industry data into digestible advice tailored for founders in Southeast Asia and the Middle East. Our mission is to simplify venture capital, helping you make informed decisions and navigate the challenges of the startup ecosystem.

Contact Us: Ready to sharpen your investment strategy? Reach out to WOWS Global today.

Disclaimer: We strive for accuracy and originality in our content. If you spot any errors or have feedback, please let us know—we’re committed to providing reliable, unique insights.

Related Posts

-

Startup Funding SEA MENA Startups 5 Minutes

June 2025 Investment Snapshot: Capital Hits a Heatwave

June 2025 lit up with a VC heatwave across Southeast Asia and MENA. From insurtech unicorns and migrant fintech to AI wearables and atmospheric water, this month’s deals show the frontier is flush with cash and big ambition. Explore the standout rounds and future-casting sectors. -

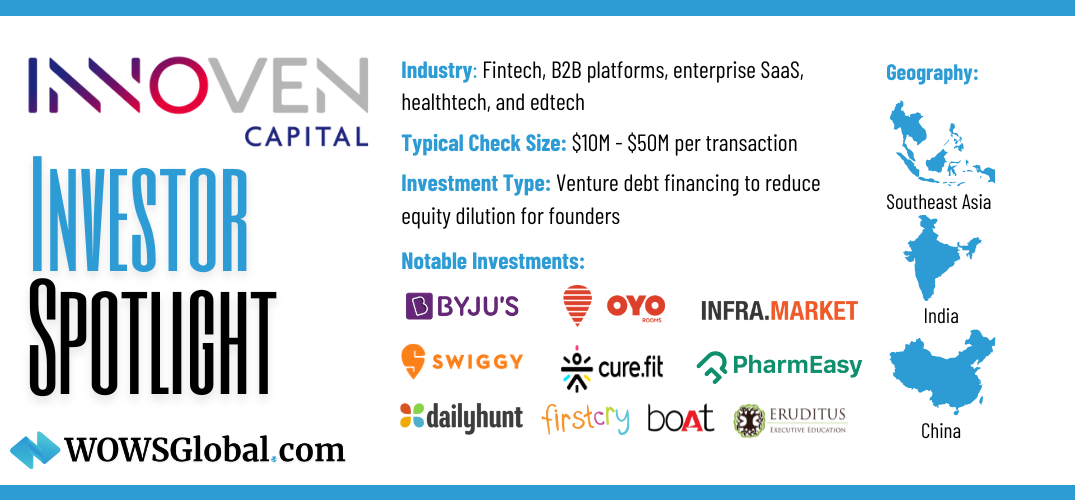

Venture Debt InnoVen Capital Startup Funding 5-7 minutes

Investor Spotlight: InnoVen Capital – Powering Asia’s Startup Ecosystem with Venture Debt

For startups aiming to scale without sacrificing equity, venture debt has emerged as a crucial financial tool. InnoVen Capital, a leading venture debt provider in Asia, has helped over 180 startups grow without dilution. With a focus on India, China, and Southeast Asia, InnoVen Capital has deployed over $400 million across 250+ transactions, backing industry giants like Byju’s, Swiggy, Oyo, and PharmEasy. Learn how venture debt can be a game-changer for your startup. -

Venture Capital Founder Startup Funding 6 minutes

The Founder-Turned VC vs. The Non-Founder VC – Two Species in the Venture Jungle

Venture capitalists come in all forms, but two stand out: the battle-tested Founder-Turned VC and the strategic Non-Founder VC. Learn how their distinct approaches to risk, pivots, and due diligence shape their partnerships with startups and find out which one is the right fit for your journey. -

Startup Funding Venture Capital VC Red Flags 5 Minutes

Don’t Accept VC Money If You See These 5 Red Flags in a Term Sheet

A term sheet sets the tone for your startup’s future, but not all deals are created equal. Learn the five red flags you should never ignore when negotiating VC funding to protect your vision and equity. -

Term Sheets Redemption Rights Anti-Dilution Liquidation Preference 5 minutes

Key Considerations for Founders in Startup Term Sheets: Do’s and Don’ts

Negotiating a term sheet is a critical step in securing investment. Learn the essential do’s and don’ts for founders when handling valuation, liquidation preferences, anti-dilution, and more. -

venture debt startup ecosystem startup funding Mike Cappelle

The Rise of Corporate Investors and Venture Debt in Early-Stage Funding

In 2024, corporate investors and venture debt are reshaping early-stage funding. Discover how these trends are creating new opportunities for startups and what founders need to know.