VC Spotlight: BEENEXT – Backing Bold Founders from India to Southeast Asia

BEENEXT VC Early Stage 5 Minutes

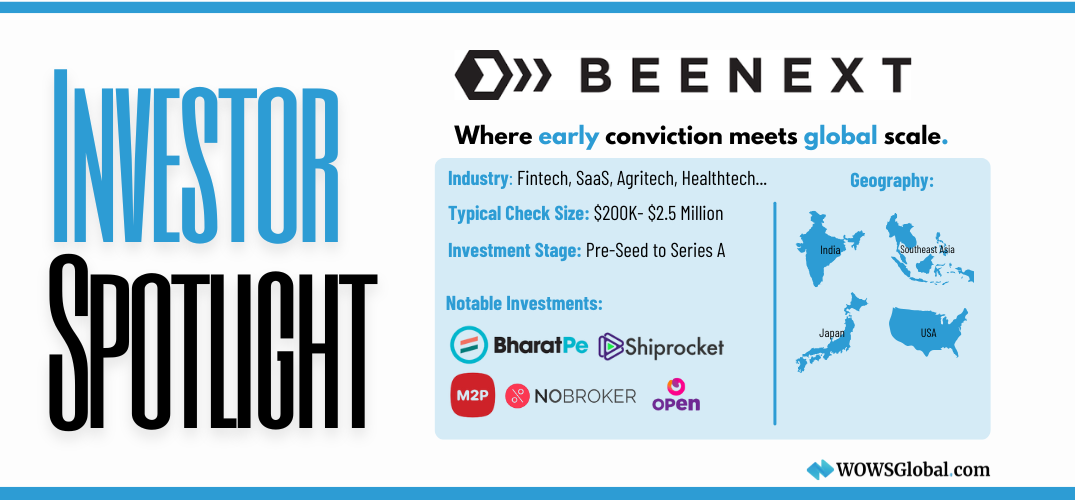

Since 2015, BEENEXT has stood out as a founder-first VC firm with deep conviction in emerging market entrepreneurs. Based in Singapore and active across India, Southeast Asia, Japan, and the U.S., BEENEXT brings global perspective and local support to early-stage companies transforming key industries.

A Global Lens on Local Champions

Core Investment Focus

BEENEXT takes a sector-agnostic approach with one constant: a belief in visionary founders building scalable technology companies. The firm has backed over 300 startups across:

-

Fintech

-

SaaS

-

Consumer Internet

-

Healthtech

-

AgriTech

-

Sustainability

-

Deep Tech

While they invest broadly, BEENEXT has a sharp eye for platform plays and category-defining innovation in traditionally underserved sectors and markets.

Geographic Focus

With teams across Singapore, India, Indonesia, and Japan, BEENEXT is uniquely positioned to support founders in:

-

India (home to more than half its portfolio)

-

Southeast Asia (notably Indonesia and Vietnam)

-

Japan

-

The United States

This global reach helps BEENEXT introduce capital, customers, and advisors across geographies—without losing sight of local execution.

Investment Strategy & Stage

BEENEXT primarily invests in pre-seed to Series A rounds, with initial check sizes ranging from $200K to $2.5M. They often lead or co-lead, and are known for:

-

High conviction, high trust partnerships

-

Deep involvement in talent, governance, and product-market fit

-

Long-term support with follow-on capital and cross-market expansion

Their commitment doesn’t stop at the first check—BEENEXT builds relationships that last far beyond the early stages.

Portfolio Highlights: Spotting Winners Early

BEENEXT’s portfolio includes early bets on startups that have gone on to dominate their sectors:

-

BharatPe (India) – Fintech infrastructure enabling digital payments and lending for millions of merchants

-

NoBroker (India) – A commission-free real estate platform that has revolutionized the Indian rental and resale market

-

M2P Fintech (India) – Banking-as-a-service infrastructure powering digital financial products

-

Open (India) – One of the world’s largest SME neobanks, offering finance and accounting tools for small businesses

-

Shiprocket (India) – A logistics platform streamlining ecommerce fulfillment across India

-

Trusting Social (Vietnam) – AI-powered credit scoring for underserved consumers in emerging markets

-

Akseleran (Indonesia) – SME lending marketplace advancing financial inclusion in Indonesia

Many of BEENEXT’s top companies have gone on to raise from tier-1 global investors or achieve significant market share in their verticals.

Why Founders Choose BEENEXT

What sets BEENEXT apart isn’t just capital—it’s culture.

Founders choose BEENEXT for:

-

Their founder-first values and respect for entrepreneurial autonomy

-

A highly collaborative investment team with deep operational empathy

-

An active global founder network that shares insights and opportunities

-

Access to the Japan and India ecosystems—two often-underestimated growth corridors

BEENEXT believes that trust, speed, and humility are the cornerstones of early-stage investing. For founders, that means fewer hurdles, faster decisions, and more aligned partnerships.

WOWS Global: Introducing Startups to BEENEXT

At WOWS Global, we match outstanding founders with the region’s most aligned capital partners. BEENEXT is one of the most active early-stage investors in India and Southeast Asia—especially for startups building mission-critical platforms in fintech, logistics, SaaS, and more.

If you’re building for emerging markets, a partner like BEENEXT can help you scale with speed and purpose.

Ready to raise funding for your impact-driven startup?

Connect with WOWS Global today and explore our investor network.

Related Posts

-

Fintech SEA AI Startups Early Stage 5 Minutes

Moonshot Ventures: Betting Early on Southeast Asia’s Purpose-Driven Builders Starting with Women-Led Innovation in Indonesia

Moonshot Ventures invests early in Southeast Asia’s most mission-driven founders, pairing capital with deep operating support. Through IWEF, it’s helping women-led innovation in Indonesia scale with a tranche-based model and a strong partner network. -

VC SEA Startups Southeast Asia Early Stage 5 Minutes

Ansible Ventures: Backing Vietnam’s Next Generation of Builders

Ansible Ventures is a Vietnam-first, early-stage VC backing software-first founders at pre-seed to pre-Series A. See their thesis, notable bets, and how WOWS can connect you via warm, qualified introductions. -

Startup & Venture Capital VC Funding Founder IPO 2 Minutes

How VCs Make Money: A Founder’s Guide to Venture Capital Economics

Venture capital isn’t a black box. Learn how LPs, GPs, fees, carry, and portfolio math actually work, then frame your pitch as the fund-maker with a credible exit path. -

VC SaaS AI SEA AI in Southeast Asia 2 Minutes

The Great VC Divide: How AI Is Shaping Southeast Asia’s Next Wave

SEA’s funding has cooled, but AI and SaaS are heating up. Investors are prioritizing profitability, PMF, and global revenue, signaling a more disciplined, durable cycle. -

VC Startup & Venture Capital SEA Fintech 7 Minutes

Southeast Asia's Most Active Venture Capital Firms in 2025

Southeast Asia’s startup scene is on fire in 2025 and these are the 25 venture capital firms fueling it. From early-stage incubators to billion-dollar funds, this definitive short-list showcases the most active, founder-first investors driving the region’s digital, AI, and fintech boom. For founders, it’s more than a list—it’s your launchpad. -

Early-Stage Investors VC Startup & Venture Capital Business Growth 5 Minutes

Lifetime Ventures: Japan’s Deeptech Bridge with Growing On-Ramps for Southeast Asia

From Yokohama to Okinawa, Lifetime Ventures is rewriting Japan’s deeptech playbook. With strong ties to academia, a thesis built on research commercialization, and a portfolio of 60+ science-driven startups, the firm is shaping the technologies that will define generations.