What Investors Consider When Investing in Venture Debt

Investors Venture Debt

What is Venture Debt?

Venture debt is a type of startup financing that allows them to secure capital without diluting their equity. Venture debt investors make loans to startups that are typically used to fund growth initiatives or to extend the company's cash runway. The investor receives interest payments and, in some cases, equity warrants in exchange for the loan.

While venture debt is not appropriate for all startups, it can be an appealing option for those with a proven business model and a track record of growth. In this blog post, we'll look at what investors look for in venture debt investments, as well as how startups can position themselves for success.

Financial strength

The financials of a startup are one of the most important factors that venture debt investors consider. Investors want to see a clear path to profitability and that the company's financial projections are realistic. They will assess the startup's ability to repay the loan by analyzing its revenue growth, margins, and cash flow.

Startups should have a strong financial management system in place to increase their chances of obtaining venture debt financing. This includes having accurate financial statements, regular financial reporting, and a firm grasp on their financial metrics. Startups should also be prepared to explain any deviations from their financial projections, as well as have a plan in place to deal with any issues that may arise.

Management Team with Years of Experience

The management team of the startup is another important factor that venture debt investors consider. Investors want to see a team with industry experience and a proven track record of success. They also want to see that the team has a clear vision for the company's future as well as a plan to put that vision into action.

Startups can increase their chances of obtaining venture debt financing by assembling a strong management team with a diverse set of skills and expertise. They should prioritize hiring individuals with industry experience and a track record of success. Furthermore, startups should ensure that their management team is on the same page as the company's vision and goals.

Excellent Market Opportunity

Startups that operate in a large and growing market are also appealing to venture debt investors. Investors want to see that there is a high demand for the startup's product or service, and that the market opportunity is large enough to support the company's expansion plans.

Startups should conduct extensive market research to determine the size of their target market as well as the key trends and drivers within that market in order to increase their chances of obtaining venture debt financing. They should also be able to articulate their competitive positioning and plan for market share capture.

Business Model that Scales

Startups with a scalable business model entice venture debt investors. Investors want to see a clear path to growth and that the company can scale its operations without incurring significant costs.

Startups should focus on developing a scalable business model that has the potential to generate significant revenue growth in order to position themselves for venture debt financing. This includes identifying key growth drivers, creating a customer acquisition strategy, and putting together a strong sales and marketing team.

Intellectual Property Protection

Finally, venture debt investors favor startups with strong intellectual property (IP) protection. Investors want to see that the startup has patents, trademarks, or other forms of protection that can help it stand out from competitors.

By developing a strong IP portfolio, startups can improve their chances of obtaining venture debt financing. This includes conducting a thorough IP audit, filing for patents and trademarks as needed, and developing a strategy for protecting their intellectual property.

Contact WOWS Global today at contact@wowsglobal.com to learn more about our services and how we can help you grow your business.

Finally, venture debt financing can be an appealing option for startups looking to expand their business without diluting their equity. Startups should focus on developing a strong financial management system in order to position themselves for success.

Related Posts

-

Retail Investors AI Startups Southeast Asia

Polarlyst: The Thai AI “Co-Pilot” Bringing Institutional-Style Research to Retail Investors

Polarlyst is a Thai AI-driven investing “co-pilot” turning complex financial data into clear, actionable insights for retail investors. In this WOWS Global spotlight, we break down why they stand out, why they’re worth watching, and what their rise says about the next wave of WealthTech in Southeast Asia. -

Fractional CFO Venture Debt SEA Startups SME Loans

Why Startups Fail: The 3 Reasons That Sink Great Ideas (and How to Avoid Them)

Startups rarely get killed by competitors. The big 3 killers are: no market need, running out of funding, and the wrong team. This quick playbook shows how to spot the signs early and fix them with demand tests, smart financing, and fractional expertise. -

SaaS Logistics AI Startups Venture Debt India

Trifecta Capital: India’s Venture-Debt + Growth-Equity Engine

Trifecta Capital is India’s venture-debt pioneer turned full-stack partner—combining scaled credit with a selective late-stage Leaders Fund. Backing VC-funded scale-ups across consumer, fintech, logistics, and enterprise SaaS, Trifecta helps founders extend runway and accelerate toward IPO or strategic outcomes. -

Venture Debt Finance AI Investor

Bridging the Funding Gap: Why Strategic Planning Between Rounds Is Critical

Between funding rounds is where the real work begins. Strategic planning during this quiet phase can determine how ready your startup is for the next big raise. From fractional CFOs to venture debt and investor engagement, WOWS Global helps you stay prepared and in control. -

Impact Investing SEA Investors ESG

Inside Southeast Asia's Impact Network: 10 Leading ESG & Impact Investors Driving Positive Change

Discover the 10 most influential ESG and impact investors shaping Southeast Asia’s sustainable startup landscape. From climate tech to gender-lens investing, learn who’s funding the region’s next wave of purpose-driven innovation. -

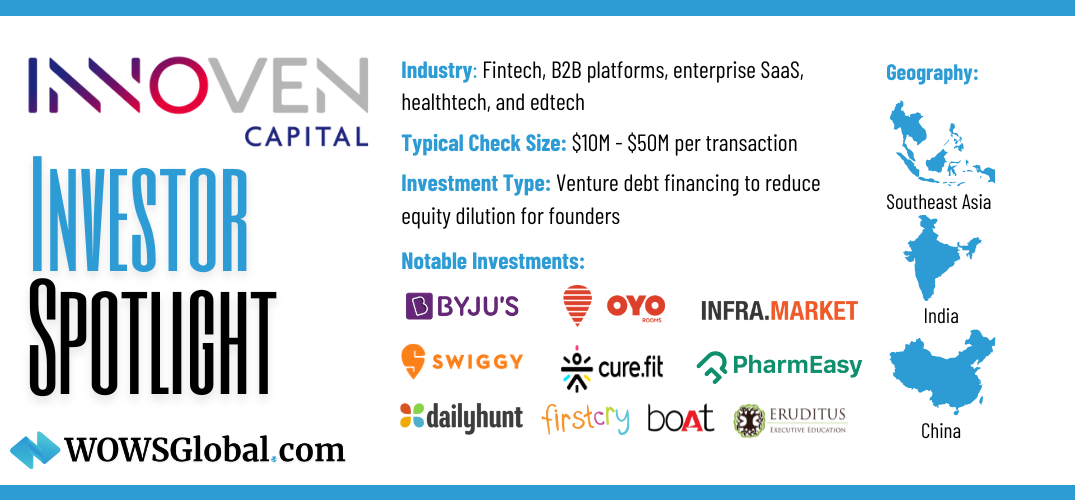

Venture Debt InnoVen Capital Startup Funding

Investor Spotlight: InnoVen Capital – Powering Asia’s Startup Ecosystem with Venture Debt

For startups aiming to scale without sacrificing equity, venture debt has emerged as a crucial financial tool. InnoVen Capital, a leading venture debt provider in Asia, has helped over 180 startups grow without dilution. With a focus on India, China, and Southeast Asia, InnoVen Capital has deployed over $400 million across 250+ transactions, backing industry giants like Byju’s, Swiggy, Oyo, and PharmEasy. Learn how venture debt can be a game-changer for your startup.