Which Is Better for Your Startup: Venture Debt or Equity Financing?

Venture Debt Equity Financing

"One of the most important decisions you'll need to make as a startup founder is how to fund your business." Venture debt and equity financing are two popular options. Both can provide the capital you need to grow your business, but they have different risks, costs, and levels of control. In this article, we'll look at the advantages and disadvantages of venture debt and equity financing to help you decide which is best for your startup.

What Exactly Is Venture Debt?

Venture debt is a type of debt financing that allows startups to raise funds without diluting their equity. Venture debt, as opposed to traditional bank loans, is typically provided by specialized lenders who understand the unique needs of startups. Typically, venture debt is used to fund specific growth initiatives such as product development, marketing, and hiring.

Advantages of Venture Debt:

Minimal Equity Dilution: One of the most significant benefits of venture debt is that it allows startups to access additional capital without sacrificing equity. This means that founders can retain more control over their company while avoiding diluting their ownership stake.

Flexible Repayment Terms: Venture debt lenders typically provide flexible repayment terms that align with the growth strategy of a startup. Interest-only payments, deferred payments, and balloon payments are all examples of this.

Capital Access: Venture debt can provide startups with additional capital that they may not be able to obtain through other forms of financing. This is especially important for startups that are still in their early stages of development and may not yet be generating significant revenue.

The disadvantages of venture debt:

Higher Capital Cost: Venture debt typically has a higher capital cost than equity financing. This is because lenders assume a higher level of risk when providing debt to startups and, as a result, charge higher interest rates to compensate.

Venture debt is frequently restricted to specific uses, such as funding product development or marketing initiatives. This can limit a startup's ability to use capital more creatively.

Default Risk: Because venture debt is still debt, if a startup is unable to generate enough revenue to cover loan payments, they may be forced to sell assets or give up equity to pay off the loan. This can be especially difficult for startups in their early stages of development with limited resources.

What Exactly Is Equity Financing?

In exchange for capital, you sell ownership shares in your company to investors through equity financing. Angel investors, venture capitalists, and even family and friends can be included. Startups can use equity financing to fund a variety of initiatives, including product development, marketing, and hiring.

Advantages of Equity Financing:

Access to Large Amounts of Capital: Equity financing can give startups access to large amounts of capital that they might not be able to obtain through other forms of financing. This is especially important for startups looking to rapidly scale their operations.

More Flexibility in Funding: Equity financing allows startups to be more flexible in how they use capital. In contrast to venture debt, which is frequently restricted to specific uses, equity financing can be used to fund a wide range of initiatives, including operational expenses and strategic investments.

Reduced Financial Risk: Because equity financing does not require repayment, it can reduce the financial risk associated with incurring debt. This is especially important for startups that are still in their early stages of development and may not yet be generating significant revenue.

The disadvantages of equity financing are as follows:

One of the most significant disadvantages of equity financing is the loss of ownership in your company. As a result, founders may lose control over key decision-making processes and may be forced to share profits with investors.

Contact WOWS Global today at contact@wowsglobal.com to learn more about our services and how we can help you grow your business.

Related Posts

-

Fractional CFO Venture Debt SEA Startups SME Loans

Why Startups Fail: The 3 Reasons That Sink Great Ideas (and How to Avoid Them)

Startups rarely get killed by competitors. The big 3 killers are: no market need, running out of funding, and the wrong team. This quick playbook shows how to spot the signs early and fix them with demand tests, smart financing, and fractional expertise. -

SaaS Logistics AI Startups Venture Debt India

Trifecta Capital: India’s Venture-Debt + Growth-Equity Engine

Trifecta Capital is India’s venture-debt pioneer turned full-stack partner—combining scaled credit with a selective late-stage Leaders Fund. Backing VC-funded scale-ups across consumer, fintech, logistics, and enterprise SaaS, Trifecta helps founders extend runway and accelerate toward IPO or strategic outcomes. -

Venture Debt Finance AI Investor

Bridging the Funding Gap: Why Strategic Planning Between Rounds Is Critical

Between funding rounds is where the real work begins. Strategic planning during this quiet phase can determine how ready your startup is for the next big raise. From fractional CFOs to venture debt and investor engagement, WOWS Global helps you stay prepared and in control. -

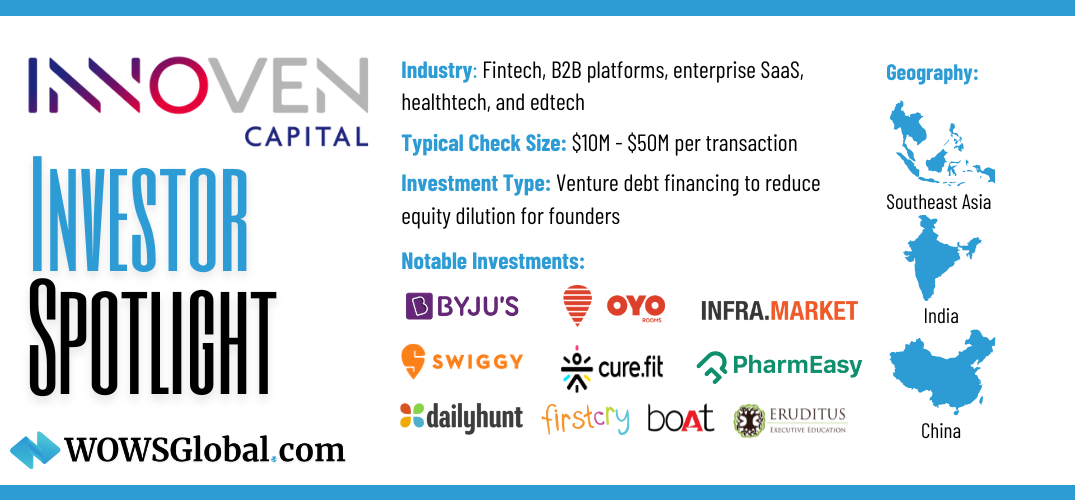

Venture Debt InnoVen Capital Startup Funding

Investor Spotlight: InnoVen Capital – Powering Asia’s Startup Ecosystem with Venture Debt

For startups aiming to scale without sacrificing equity, venture debt has emerged as a crucial financial tool. InnoVen Capital, a leading venture debt provider in Asia, has helped over 180 startups grow without dilution. With a focus on India, China, and Southeast Asia, InnoVen Capital has deployed over $400 million across 250+ transactions, backing industry giants like Byju’s, Swiggy, Oyo, and PharmEasy. Learn how venture debt can be a game-changer for your startup. -

Fintech XenCapital Helicap Venture Debt

XenCapital Secures $50M Credit Facility from Helicap to Empower Southeast Asian Businesses

XenCapital, the lending arm of Xendit, has secured a $50M credit facility from Singapore's Helicap to provide vital financing to underbanked businesses across Southeast Asia. This partnership reflects the region's growing reliance on alternative lending solutions to drive financial inclusion. -

Venture Debt SEA Startups Genesis Alternative Ventures

Genesis Alternative Ventures Raises $125M for Second Venture Debt Fund: Boosting SEA’s Investment Landscape

Genesis Alternative Ventures closes $125M for its second venture debt fund, providing crucial growth capital to Southeast Asia’s startups. Discover why venture debt is the perfect tool for startups looking to scale without diluting equity.