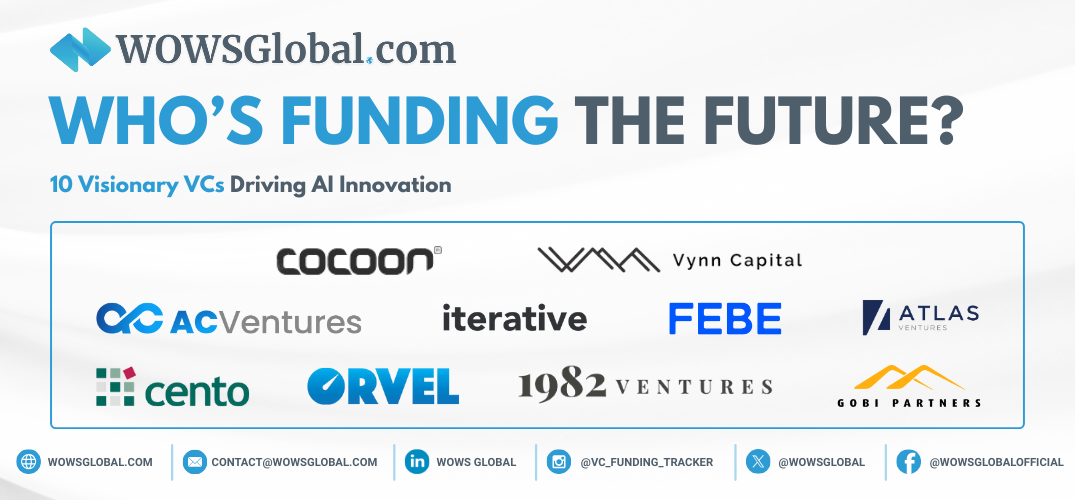

Who’s Funding the Future? 10 Visionary VCs Driving AI Innovation

SEA Early Startups Funding VC AI in Southeast Asia 5 Minutes

Southeast Asia’s venture capital landscape is surging with innovation, and at the heart of that movement are bold investors fueling AI-first and tech-driven startups. These 10 standout funds aren’t just betting on the future they’re actively building it. From deep tech leaders to specialized sector investors, here's a closer look at the tech-forward VCs shaping the next wave of groundbreaking companies.

-

Cocoon Capital - Early-Stage AI Empowerment Cocoon Capital offers initial investments between $500K and $1 million, focusing on early-stage startups primarily in Singapore, Vietnam, and the Philippines. They specialize in supporting AI-driven platforms like Augmentus, which deploys AI robotics solutions for SMEs.

-

Gobi Partners - Bridging AI Across Borders Gobi Partners invests $1-10 million per venture, focusing on Malaysia, Indonesia, and the Philippines. Their AI portfolio includes Deliveree, an AI logistics optimization platform, and EasyParcel, demonstrating their capability in scaling AI solutions regionally.

-

Vynn Capital - Strategic AI Investments in Essential Industries Vynn Capital typically invests between $500K and $3 million, targeting sectors like logistics, travel, and fintech. Geographically, they are active in Malaysia, Vietnam, and Indonesia. Their notable AI-backed investments include Dropee, a B2B marketplace employing AI-driven inventory management.

-

FEBE Ventures - Vietnam’s AI Innovation Champions FEBE Ventures, primarily focused on Vietnam and Indonesia, invests $250K-1 million in early-stage startups deploying AI across multiple sectors. Their key investments include Nano Technologies, an AI-backed wage access solution, and Kim An Group, a fintech platform leveraging AI for credit assessments.

-

AC Ventures - Powering AI Integration in Indonesia AC Ventures commits between $500K-5 million primarily focused on Indonesia's burgeoning AI market. Their portfolio includes startups like KoinWorks, employing AI-driven credit scoring, and Shipper, utilizing AI logistics optimization.

-

Cento Ventures - Pioneering AI Infrastructure Investments Cento Ventures focuses on early-growth stage investments of $1-5 million in Southeast Asia, especially Thailand, Indonesia, and Vietnam. Their portfolio highlights include Pomelo, an AI-powered fashion e-commerce platform, and iPrice, using AI for e-commerce price comparison.

-

Atlas Ventures – AI-Driven Opportunities with Regional Ambition

Atlas Ventures is an early-stage investor based in Singapore, deploying $500K–$3 million into startups that integrate AI across fintech, healthtech, and enterprise SaaS. With a strong presence in Indonesia, Vietnam, and Thailand, Atlas backs companies like MED247 (AI-powered digital clinic platform) and Aigens (F&B tech leveraging AI for customer experience). Their approach blends capital with operational support and deep local insight, making them a compelling partner for AI-first founders. -

Orvel Ventures – Backing Disruptive Tech from Day Zero Orvel Ventures is a relatively new but fast-growing VC firm investing $250K to $2 million in early-stage AI startups across Southeast Asia, particularly in Vietnam, Thailand, and Indonesia. The fund focuses on AI applications in logistics, workforce productivity, and predictive analytics. Notable investments include Abivin, a Vietnam-based AI logistics optimization platform, and Talentport, which uses AI to match Southeast Asian talent with global employers.

-

1982 Ventures – Fintech-First, AI-Empowered Based in Singapore, 1982 Ventures is a fintech-focused VC investing between $300K and $3 million. They actively back startups leveraging AI to solve financial inclusion, risk assessment, and digital lending challenges across Indonesia, Vietnam, and the Philippines. Key investments include Wagely (earned wage access with AI underwriting) and Brick (open finance APIs with AI fraud prevention layers).

-

Iterative – YC-Style Acceleration for SEA AI Startups

Iterative operates more like an accelerator fund, investing $150K-$500K with a laser focus on early-stage founders building tech-first companies, many with AI at their core. Based in Singapore and focused across SEA, Iterative has funded startups like Spenmo (AI-powered expense automation) and Mindtera (an AI-based mental wellness platform for workplaces).

The AI Investment Playbook Is Evolving

What sets these firms apart isn’t just their willingness to back AI it’s their strategic lens. Whether through verticalized AI in fintech and healthtech or foundation models being deployed for climate or commerce, these VCs are betting on AI as infrastructure. Their portfolios reflect a deep shift toward long-term defensibility and platform-scale outcomes.

Why Founders Should Pay Attention

For startup founders, aligning with a tech-centric investor means more than funding it means gaining a long-term collaborator who understands the nuances of AI development, go-to-market timing, and regulatory navigation. These funds don’t just write checks they bring roadmaps, talent networks, and credibility to the table.

WOWS Take

These 10 funds aren’t just making bets they’re crafting blueprints for Southeast Asia’s tech future. From generative AI and deep tech to sustainability-driven innovation, these firms reflect the energy, urgency, and bold ambition required to power the next decade of digital transformation.

As startup founders and tech builders look for the right partners, like WOWS Global these AI-forward funds are ready not just with capital, but with the expertise and networks to take ideas to scale.

Related Posts

-

Early Startups Fundraising Due Diligence Data Room

2026 Fundraising: What Changed?

Fundraising in 2026 isn’t about moving faster—it’s about showing up prepared. Learn how to build an investor-ready system (modeling, governance, data room, and investor fit) so diligence doesn’t drag and your strongest conversations go the distance. -

Fintech SEA AI Startups Early Stage 5 Minutes

Moonshot Ventures: Betting Early on Southeast Asia’s Purpose-Driven Builders Starting with Women-Led Innovation in Indonesia

Moonshot Ventures invests early in Southeast Asia’s most mission-driven founders, pairing capital with deep operating support. Through IWEF, it’s helping women-led innovation in Indonesia scale with a tranche-based model and a strong partner network. -

Capital SEA B2B ASEAN 7 Minutes

Cocoon Capital: Backing Southeast Asia’s Quiet B2B Revolution

From AI-powered stroke diagnostics to pharma distribution and SME payment rails, Cocoon Capital backs the “invisible” infrastructure powering Southeast Asia’s next wave of growth. This Investor Spotlight unpacks their B2B and deep-tech thesis, how they invest, and the founders they champion. -

Tourism Travel SEA Tech 5 Minutes

Yacht Me Thailand: Digital Yacht Charter Platform for a Fragmented Market

Yacht Me Thailand is digitising yacht and boat charters across Thailand’s top marine destinations. With operator-first tools, sustainability at its core and ambitions to become a regional boating OTA, the platform is emerging as a notable travel-tech and marine tourism play. -

Fintech AI Startups Early Startups SEA 4 Minutes

The Dip in SEA Fintech Funding: What Startups Can Learn

SEA fintech funding has dipped, but capital is still on the field for disciplined teams. This article unpacks what the new funding rules look like and how founders can upgrade models, governance, monetization, and capital stacks. Learn where investor expectations have shifted and how WOWS Global can help you get raise ready. -

Series B Singapore SEA India 5 Minutes

Iron Pillar: Scaling India-Built Tech Into Southeast Asia

Iron Pillar is a venture-growth firm backing India-built technology as it scales across Southeast Asia. This spotlight covers stage focus, typical checks (US$5–15M), sectors, SEA go-to-market via Singapore, and notable portfolio patterns in SaaS and platforms. For founders and co-investors, it’s a practical guide to where Iron Pillar fits, and how to engage.