Zafar VC: Powering Southeast Asia’s Healthcare Renaissance

Healthcare HealthTech SEA Biotech Southeast Asia 7 Minutes

Malaysia’s RM1 Billion Bet on the Future of Health

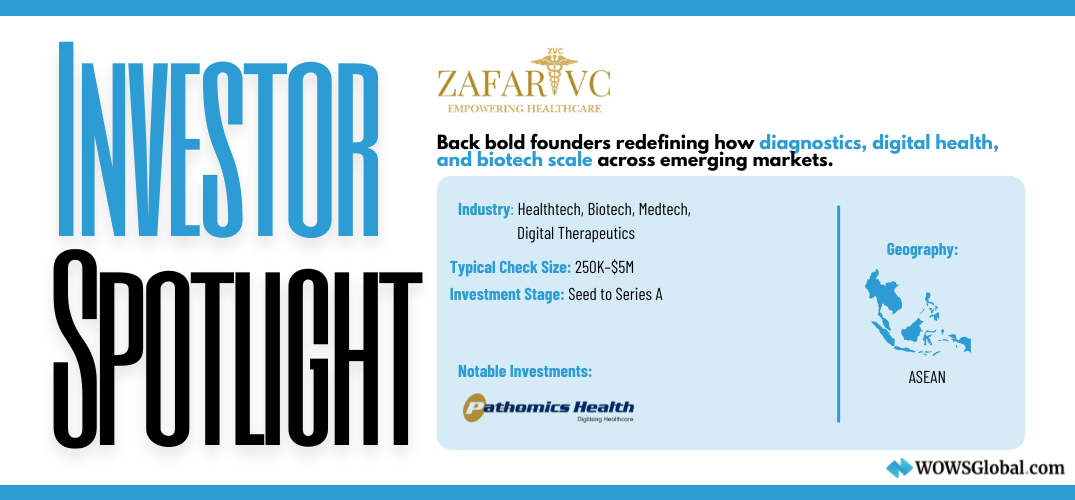

When Zafar Venture Capital (Zafar VC) launched in 2025 with an eye-popping RM1 billion (USD 220+ million) fund dedicated exclusively to healthcare, it wasn’t just a milestone for Malaysia—it was a signal to the entire ASEAN region. Zafar VC is here to rewrite the future of healthtech, medtech, and biotech across Southeast Asia.

Backed by 5 Pillars Ventures, Zafar VC is laser-focused on one mission: Fueling Innovation, Empowering Humanity. With a potent mix of capital, clinical insight, and a collaborative ecosystem mindset, Zafar is not just another check-writing fund it’s a true catalyst for health innovation in emerging markets.

Investment Philosophy: Impact Meets Innovation

Zafar VC believes that healthcare isn’t just a market it’s a mission. Its thesis centers on transforming human health through deep tech, digital tools, and scalable models. Whether it’s AI diagnostics, next-gen medical devices, or digital therapeutics, Zafar seeks founders who dare to tackle complex challenges head-on.

Key investment themes include:

-

Healthtech (telehealth, AI in diagnostics, digital health)

-

Biotech and life sciences

-

Medtech and medical devices

-

Aging population and mental health solutions

What sets them apart? Zafar provides more than money, it offers guidance through regulatory landscapes, connects founders with clinical networks, and supports scale across ASEAN’s diverse healthcare systems.

Geography & Check Size

Zafar VC is headquartered in Kuala Lumpur and primarily invests across the ASEAN region. While it maintains a strong commitment to Malaysia’s healthcare ecosystem—particularly startups aligned with national health priorities, the fund also targets high-potential ventures throughout ASEAN that align with its sector focus.

Typical check sizes:

-

Seed to Series A: $250K – $2M

-

Follow-ons (Series B+): Up to $5–10M depending on traction

Zafar also supports ultra-early-stage ventures through its Medexel Accelerator, providing structured mentorship and up to $250K in pre-seed funding.

Deal Flow & Partnerships

Zafar’s pipeline is fueled by a robust network of accelerators, healthcare providers, and institutional allies. Zafar VC’s growing portfolio reflects its mission to accelerate healthcare innovation across Southeast Asia, with a strong emphasis on digital health, diagnostics, and biotech. Its first publicly disclosed investment, Pathomics Health, is a cutting-edge healthtech company leveraging AI and digital pathology to improve early disease detection and personalized care. Backed during its critical growth phase, Pathomics Health exemplifies Zafar VC’s commitment to supporting visionary founders solving real clinical challenges and building scalable, impact-driven businesses in the region.

Beyond accelerators, Zafar collaborates with public health stakeholders like the National Cancer Society of Malaysia (NCSM), positioning itself at the intersection of public good and private opportunity.

The Team: Multidisciplinary, Mission-Driven

Zainul Alam Abdul Kadir (Managing Partner): 20+ years in strategy, ex-Frost & Sullivan, founder mentor, regional visionary.

Dr. Keith Chong (Senior Partner): PhD scientist and healthcare entrepreneur, deeply embedded in ASEAN’s medtech community.

Their combined strengths ensure portfolio companies get not only capital but also clarity and conviction.

Zafar VC is not just building a portfolio. It’s building a legacy one where Southeast Asia is not just a market for healthtech, but a producer of global-impact healthcare innovation.

WOWS Global: The Future of Health Starts with Zafar VC

At WOWS Global, we specialize in connecting ambitious founders with the region’s most strategic investors. Zafar VC is one of the most relevant venture capital firms for early-stage healthcare startups across ASEAN especially for those tackling critical challenges in healthtech, medtech, and biotech.

Whether you're building AI-driven diagnostics, digital therapeutics, or affordable care platforms, a partner like Zafar VC brings not only capital but deep sector expertise and public-private support to help you scale with purpose.

Raising capital for your healthcare startup?

Let WOWS Global help you get in front of Zafar VC, at the right stage, with the right story.

Related Posts

-

Retail Investors AI Startups Southeast Asia 4 Minutes

Polarlyst: The Thai AI “Co-Pilot” Bringing Institutional-Style Research to Retail Investors

Polarlyst is a Thai AI-driven investing “co-pilot” turning complex financial data into clear, actionable insights for retail investors. In this WOWS Global spotlight, we break down why they stand out, why they’re worth watching, and what their rise says about the next wave of WealthTech in Southeast Asia. -

Fintech SEA AI Startups Early Stage 5 Minutes

Moonshot Ventures: Betting Early on Southeast Asia’s Purpose-Driven Builders Starting with Women-Led Innovation in Indonesia

Moonshot Ventures invests early in Southeast Asia’s most mission-driven founders, pairing capital with deep operating support. Through IWEF, it’s helping women-led innovation in Indonesia scale with a tranche-based model and a strong partner network. -

Capital SEA B2B ASEAN 7 Minutes

Cocoon Capital: Backing Southeast Asia’s Quiet B2B Revolution

From AI-powered stroke diagnostics to pharma distribution and SME payment rails, Cocoon Capital backs the “invisible” infrastructure powering Southeast Asia’s next wave of growth. This Investor Spotlight unpacks their B2B and deep-tech thesis, how they invest, and the founders they champion. -

Tourism Travel SEA Tech 5 Minutes

Yacht Me Thailand: Digital Yacht Charter Platform for a Fragmented Market

Yacht Me Thailand is digitising yacht and boat charters across Thailand’s top marine destinations. With operator-first tools, sustainability at its core and ambitions to become a regional boating OTA, the platform is emerging as a notable travel-tech and marine tourism play. -

Fintech AI Startups Early Startups SEA 4 Minutes

The Dip in SEA Fintech Funding: What Startups Can Learn

SEA fintech funding has dipped, but capital is still on the field for disciplined teams. This article unpacks what the new funding rules look like and how founders can upgrade models, governance, monetization, and capital stacks. Learn where investor expectations have shifted and how WOWS Global can help you get raise ready. -

Series B Singapore SEA India 5 Minutes

Iron Pillar: Scaling India-Built Tech Into Southeast Asia

Iron Pillar is a venture-growth firm backing India-built technology as it scales across Southeast Asia. This spotlight covers stage focus, typical checks (US$5–15M), sectors, SEA go-to-market via Singapore, and notable portfolio patterns in SaaS and platforms. For founders and co-investors, it’s a practical guide to where Iron Pillar fits, and how to engage.