Reazon Capital: Empowering Asia's Next Wave of Innovators

Reazon Capital VC SEA 6 minutes

In the dynamic landscape of Asian startups, Reazon Capital emerges as a pivotal force, channeling its resources to nurture groundbreaking ventures across the continent. As the principal investment division of Reazon Holdings, Reazon Capital operates with a distinctive approach—self-funded and unrestricted by traditional investment timelines—allowing for unparalleled flexibility and a steadfast commitment to the long-term success of its portfolio companies.

Investment Focus:

Sectors:

Reazon Capital strategically targets investments in entertainment, deep tech, and emerging markets, with a pronounced emphasis on Southeast Asia, particularly Vietnam and Indonesia.

Geographical Reach:

With a robust presence in Japan, Vietnam, and Singapore, Reazon Capital leverages its regional insights to identify and support high-potential startups poised to make significant impacts in their respective markets.

Investment Stages:

The firm primarily focuses on early-stage investments, encompassing angel to Series A rounds, with typical check sizes ranging from $100,000 to $2 million.

Notable Portfolio Companies & Investments:

Reazon Capital's portfolio reflects its commitment to fostering innovation across diverse sectors:

-

Vietcetera: In February 2025, Reazon Capital made a notable investment in Vietcetera, a burgeoning publishing company in Vietnam, underscoring its dedication to supporting media ventures in emerging markets.

-

CuboRex: In August 2024, Reazon Capital invested in CuboRex, a company specializing in hardware innovations, reflecting its focus on deep tech enterprises.

-

Jendela360: In August 2024, the firm invested in Jendela360, a real estate services company in Indonesia, highlighting its interest in the proptech sector within Southeast Asia.

-

Space Quarters: In June 2024, Reazon Capital invested in Space Quarters, a company pioneering space construction technology, aligning with its commitment to supporting ventures with unique visions and technical capabilities.

-

Kamereo: In December 2024, Reazon Capital participated in a $7.8 million Series B funding round for Kamereo, a Vietnam-based B2B food supply e-commerce platform, demonstrating its support for innovative solutions in the food supply chain industry.

Connecting with Reazon Capital:

For founders aiming to revolutionize their industries with innovative solutions, Reazon Capital offers more than just funding—it provides a partnership grounded in flexibility, strategic support, and a deep understanding of the Asian market landscape.

Your next investor could be just one connection away. Reazon Capital and hundreds of other VCs are in WOWS Global’s network—let’s get your startup in front of the right people.

Related Posts

-

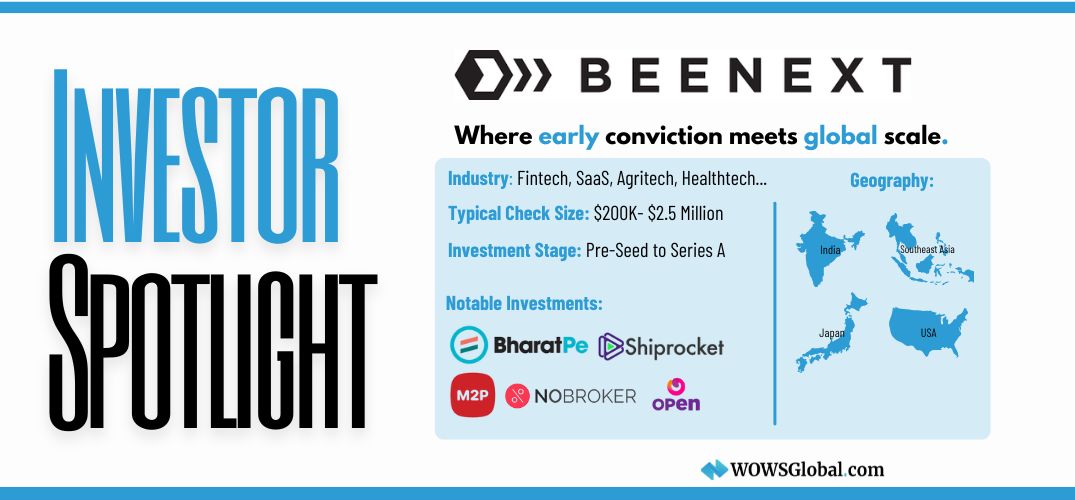

BEENEXT VC Early Stage 5 Minutes

VC Spotlight: BEENEXT – Backing Bold Founders from India to Southeast Asia

BEENEXT is a founder-first VC fund that has quietly become one of the most trusted early-stage backers across India and Southeast Asia. With over 300 investments and a long-term approach, the firm backs transformative companies in fintech, SaaS, logistics, and more. -

SEA 2025 startups 6 Minutes

Follow the Funding: What SEA’s 2025 Investment Landscape Reveals

Southeast Asia’s startup funding in 2025 is seeing a dramatic sectoral shift: while total capital is down 87%, AI and SaaS startups are booming, and traditional sectors like logistics, foodtech, and health are freezing. Here's what founders and investors need to know. -

Trump Tariffs SEA global trade 6 Minutes

Tariff Tsunami: What Trump’s New Trade War Means for Southeast Asia’s Startups

With Trump’s re-election and a 145% tariff on Chinese goods, Southeast Asia’s startup scene is facing a global trade shakeup. Startups dependent on cross-border supply chains and exports are feeling the squeeze, while local-market-focused ventures are seeing new opportunities. Learn how founders and VCs are adapting, and why resilience, localization, and ASEAN-first thinking are now essential for success. -

ZWC Partners VC VC spotlight 5 Minutes

ZWC Partners: Accelerating Asia’s Digital and Deep Tech Future

With over $2.5 billion in assets under management, ZWC Partners is a powerhouse investor supporting Asia’s high-impact startups in digital, deep tech, new energy, and consumer innovation. Explore their cross-border strategy, portfolio highlights, and why founders choose ZWC. -

March 2025 SEA VC WOWS 5 Minutes

WOWS Investment Highlights – March 2025: Southeast Asia Powers Up as Funds Flow In

March 2025 saw a surge in venture capital activity across Southeast Asia. From Malaysia’s new climate funds to Vietnam’s rise in healthtech and EV, here’s what’s driving the region’s deal frenzy and where smart money is flowing next. -

Integra Partners VC SEA 4 minutes

Integra Partners: Investing in the Future of Fintech, Healthcare & Climate Innovation

Integra Partners is empowering fintech, healthcare, and climate startups across Southeast Asia with hands-on VC support and mission-driven capital. Learn how they're making impact investing scalable.