Inside WOWS: Investment Insights and Trends

Welcome to the WOWS blog – your hub for an expert take on the evolving landscape of private investments. From deep dives into market trends to spotlight stories on emerging startups and strategic investment guidance, our blog is dedicated to empowering investors and entrepreneurs alike with the knowledge to succeed.

Featured blog posts

-

Capital SEA B2B ASEAN 7 Minutes

Cocoon Capital: Backing Southeast Asia’s Quiet B2B Revolution

From AI-powered stroke diagnostics to pharma distribution and SME payment rails, Cocoon Capital backs the “invisible” infrastructure powering Southeast Asia’s next wave of growth. This Investor Spotlight unpacks their B2B and deep-tech thesis, how they invest, and the founders they champion. -

Tourism Travel SEA Tech 5 Minutes

Yacht Me Thailand: Digital Yacht Charter Platform for a Fragmented Market

Yacht Me Thailand is digitising yacht and boat charters across Thailand’s top marine destinations. With operator-first tools, sustainability at its core and ambitions to become a regional boating OTA, the platform is emerging as a notable travel-tech and marine tourism play. -

Investor Due Diligence Readiness Virtual Data Room Founder 4 Minutes

Data Room Done Right: A Founder’s 30-Item Investor Readiness Checklist

Investors don’t fund mysteries. This Seed–Series A checklist shows exactly what to include, governance, product, metrics, financials, security, and round mechanics, so diligence speeds up, not stalls. Need help? WOWS Global can review and structure your data room. -

Fintech AI Startups Early Startups SEA 4 Minutes

The Dip in SEA Fintech Funding: What Startups Can Learn

SEA fintech funding has dipped, but capital is still on the field for disciplined teams. This article unpacks what the new funding rules look like and how founders can upgrade models, governance, monetization, and capital stacks. Learn where investor expectations have shifted and how WOWS Global can help you get raise ready. -

Series B Singapore SEA India 5 Minutes

Iron Pillar: Scaling India-Built Tech Into Southeast Asia

Iron Pillar is a venture-growth firm backing India-built technology as it scales across Southeast Asia. This spotlight covers stage focus, typical checks (US$5–15M), sectors, SEA go-to-market via Singapore, and notable portfolio patterns in SaaS and platforms. For founders and co-investors, it’s a practical guide to where Iron Pillar fits, and how to engage. -

CXO Thailand Artificial Intelligence AI 5 Minutes

Event Recap: FUTURE FRAME - Leadership in the Age of AI (IIT Alumni Association Thailand)

Future Frame Bangkok: real-world AI for CXOs, clear takeaways, and standout startup demos. -

Term Sheet Ultimate Guide to Term Sheets <em>Term Sheet Negotiation(s)</em> Startup & Venture Capital 3 Minutes

Term Sheet 101 (2025 Edition): Clauses, Red Flags, and Negotiation Tactics

A fast, founder-friendly breakdown of the clauses that matter in 2025 liquidation preferences, anti-dilution, pro-rata, ESOP, board, and information rights, plus negotiation do’s/don’ts and model scenarios. Close your next round with clean terms and fewer surprises. -

Fractional CFO Documentation Guide Income 4 Minutes

Year-End Finance Reset: Fractional CFO Tips

Turn tax from cost to catalyst worldwide. In 4 minutes, see how fractional CFOs time income, harness incentives, optimize pay and distributions, manage VAT/GST and treaties, and close the year clean with a CFO-style checklist. -

SEA Startup & Venture Capital Proptech Media 4 Minutes

Catcha Group: Company-builders Powering SEA’s Internet Plays

Catcha Group has spent two decades building and backing Southeast Asia’s internet champions, from classifieds and OTT to flexible workspaces. With hands-on operating support and smart consolidation plays, the firm has turned category leaders into headline exits. -

Biotech AI SEA Startup & Venture Capital deep-tech 6 Minutes

Granatus Ventures: Deep-Tech Builders Bridging Armenia and Southeast Asia

Granatus Ventures backs IP-rich startups in AI, biotech, robotics, and advanced/quantum computing, pairing early checks with an Armenia engineering engine and a Singapore touchpoint for SEA pilots. Learn how their SDG-aligned thesis translates into practical capital and deep technical diligence. -

Invest in Startups Startup & Venture Capital SAFE ESOP 4 Minutes

Event Recap: Founder Nova Bootcamp with Krungsri Finnovate

A practical recap of Founder Nova Bootcamp with Krungsri Finnovate, what founders learned about SAFEs, cap tables, and term sheets, and how to raise smarter in today’s market. -

B2B SaaS SEA Startups AI Fintech 4 Minutes

TheVentures: The Quick-strike Seed Investor Shaping Vietnam & Southeast Asia

TheVentures is redefining early-stage speed in Vietnam & SEA, writing quick, catalytic checks and opening doors to follow-on capital across the region. -

Blockchain Singapore Early Startups SEA Startups SEA 4 Minutes

GaiaSwap: The Eco-Commodity DEX Bringing Transparency & Inter-Operability to Fragmented Carbon Credits & I-REC(E)s markets

In a sea of generalist crypto venues, GaiaSwap zeroes in on eco-commodities with transparent pricing and compliant workflows. We unpack what sets it apart and the milestones to watch. -

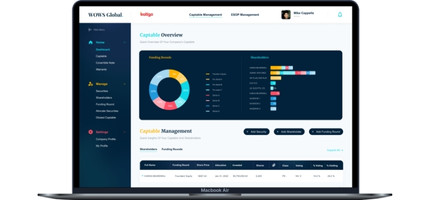

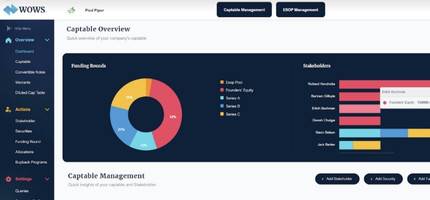

Cap Table SEA AI Startups Southeast Asia 5 Minutes

The $200M Refill: When Coffee Chains Teach Us About Liquidity

A closer look at Kopi Kenangan’s USD 200M hybrid round—and why mid-journey liquidity, valuation discipline, and payout clarity matter. We break down the mechanics, the incentives, and the playbook for both founders and investors. -

CFO Fractional CFO Cashflow Startup Finance 3 Minutes

CFO Services, Explained: What They Do and How They Work

Numbers should drive choices, not confusion. This quick read breaks down CFO services in simple terms, cash, KPIs, forecasting, and investor-ready reporting, plus a clear next step to talk with WOWS. -

SME KPI Reporting Invest in Startups SEA 5 Minutes

Vimigo: The SME Performance OS Turning KPIs into Daily Wins

We break down how vimigo turns frontline activity into results through recognition-driven performance. Want to explore funding or strategic options in HR-tech? Schedule a call with our investment team today. -

SEA India Business Growth MENA 7 Minutes

Turmeric Capital: Turning Regional Contenders into Global Consumer Champions

Turmeric Capital invests in breakout consumer brands across GCC, India, and Southeast Asia, pairing operator DNA with a cross-border playbook. From omnichannel retail to F&B and lifestyle, the firm backs efficient unit economics and formats that travel, turning regional contenders into global champions. -

Startup & Venture Capital Early Startups Founder Investment 3 Minutes

How to Choose Which Startup to Invest In

Choosing a startup isn’t a coin toss. This quick-read playbook covers market sizing, founder fit, unit economics, risk mapping, and terms, written in a toned-down sports recap style. Wrap up with “WOWS Insight,” where WOWS Global explains how it matches investors with companies that fit their thesis, stage, and traction. -

SEA Thailand Drone Platform Business Business Growth 5 Minutes

DroneEntry: Building the Full-Stack Enterprise Drone Platform for Southeast Asia

From an AIT-anchored hub in Thailand, DroneEntry unifies DJI Enterprise hardware, mission execution, and professional training for regulated, data-driven industries across SEA. Our spotlight breaks down differentiation, catalysts, and team plus what it means for investors and partners. Schedule a call with WOWS to dive deeper into the opportunity. -

SEA Indonesia AI Startups Founder 3 Minutes

Event Recap: Tech in Asia Conference 2025, Jakarta, What Builders, Founders, and Investors Are Really Talking About

The must-know insights from Tech in Asia 2025 Jakarta, AI, capital discipline, and Indonesia’s role, fresh from WOWS Global’s vantage point. -

SaaS AI B2B Business Growth 2 Minutes

AI‑Native and Vertical SaaS Are Outgrowing Horizontal Peers

AI-native and vertical SaaS are pulling ahead. Our quick read distills High Alpha’s 2024 benchmarks, why specialization and AI-first design are translating into faster, more durable growth. Read via Matchmaking Platform for Companies and Investors . -

SEA SME Lending Bitcoin Crypto 3 Minutes

Unocoin: India’s Crypto Veteran Built for Everyday Use

Founded in 2013, Unocoin has built a retail-first crypto app for India: SBP for habit-forming investing, one-tap Crypto Baskets, crypto-backed lending, public Proof-of-Reserves, and Lightning-fast BTC transfers. As rules tighten and transparency matters more, Unocoin’s durability and compliance posture position it as a pragmatic on-ramp for India’s mass market. -

Climate Tech Greentech SEA Energy 7 Minutes

INNOPOWER & EIV: Scaling Decarbonization in Southeast Asia

From Bangkok’s power ecosystem to a $100M growth vehicle with TRIREC, INNOPOWER & EIV are unlocking real-world decarbonization, EV charging, industrial efficiency, and green power, while giving founders a fast track to customers in Southeast Asia. -

Exit Strategy M&A readiness Cap Table Startup Exits Investor 4 Minutes

Planning the Finish Line: Why Every Business Needs an Exit Strategy

Launch matters, but exits set the score. Learn how early planning, clean governance, and buyer mapping turn hard-won growth into the best possible outcome. -

SaaS AI Startups AI in Southeast Asia SEA 3 Minutes

NET NEW REVENUE FROM NEW VS. EXPANSION

New logos fuel early growth, but as SaaS companies scale, expansion from existing customers becomes a core engine, about 35% of ARR beyond $20M. We break down why, and how operators should respond. Source: 2024 SaaS Benchmarks Report by High Alpha. -

Southeast Asia Healthcare hospitality tech SEA 4 Minutes

Huray: The Insurer-Integrated Chronic Care Platform to Watch

Huray builds payer-integrated digital programs for chronic diseases, combining connected devices, coaching, and clinician-backed pathways. With distribution through major insurers and a focus on measurable outcomes, the company is poised to scale across Asia’s rapidly evolving health-care landscape. -

SaaS HealthTech Southeast Asia SEA Fintech 6 Minutes

Founders Launchpad: Accelerating the Philippines’ next wave of startups

Founders Launchpad blends capital with hands-on operating support to turn early insights into traction. See why investors are watching this PH pre-seed powerhouse. -

CFO Fractional CFO Southeast Asia SEA Cashflow 4 Minutes

Why You Should Not Hire a Fractional CFO

Fractional CFOs can transform a business, but only if founders are engaged, open to challenge, and aiming for scale. This piece breaks down when not to hire one, and outlines how to partner effectively when you do, from strategic involvement and driver-based models to cash discipline and investor-ready reporting. -

AI Project Management AI Agents Enterprise 2 Minutes

Blink AI: The Execution Engine Sitting in Your Calls

Blink AI joins your calls, understands the discussion, and turns decisions into tracked actions—automating summaries, tasks, and follow-ups for enterprise PM teams. -

VC SEA Startups Southeast Asia Early Stage 5 Minutes

Ansible Ventures: Backing Vietnam’s Next Generation of Builders

Ansible Ventures is a Vietnam-first, early-stage VC backing software-first founders at pre-seed to pre-Series A. See their thesis, notable bets, and how WOWS can connect you via warm, qualified introductions. -

Startup & Venture Capital VC Funding Founder IPO 2 Minutes

How VCs Make Money: A Founder’s Guide to Venture Capital Economics

Venture capital isn’t a black box. Learn how LPs, GPs, fees, carry, and portfolio math actually work, then frame your pitch as the fund-maker with a credible exit path. -

Fractional CFO Venture Debt SEA Startups SME Loans 3 Minutes

Why Startups Fail: The 3 Reasons That Sink Great Ideas (and How to Avoid Them)

Startups rarely get killed by competitors. The big 3 killers are: no market need, running out of funding, and the wrong team. This quick playbook shows how to spot the signs early and fix them with demand tests, smart financing, and fractional expertise. -

VC SaaS AI SEA AI in Southeast Asia 2 Minutes

The Great VC Divide: How AI Is Shaping Southeast Asia’s Next Wave

SEA’s funding has cooled, but AI and SaaS are heating up. Investors are prioritizing profitability, PMF, and global revenue, signaling a more disciplined, durable cycle. -

FoodTech Health Bangkok SEA 2 Minutes

GetFresh: Thailand's Fastest Growing Health Food Brand

GetFresh is turning healthy eating into a daily habit in Bangkok. With farm-first sourcing, a multi-channel model (dine-in, delivery, meal plans, catering), and growing B2B traction, the Anchit Sachdev and Sid Sehgal-led team is building a defensible better-for-you platform poised for disciplined expansion across Thailand and select SEA metros. -

SEA Biotech Corporate Venture deep-tech 3 Minutes

GC Ventures: Where Chemistry Meets Real-World Sustainability

GC Ventures, PTT Global Chemical’s corporate VC, backs founders at the intersection of chemistry and sustainability. With hubs in Bangkok and Cambridge (MA), they help deeptech teams scale advanced materials, clean & circular tech, industrial biotech, and digital industrial solutions from lab to plant across Southeast Asia. -

Tech Startup SEA AI Startups AI 2 Minutes

Ever AI Technologies: Democratizing AI for Southeast Asia’s Digital Future

Ever AI Technologies is a Malaysian startup transforming how businesses and individuals access AI and blockchain. Through intuitive no-code tools and a strong focus on education, Ever empowers over 20,000 learners and companies to thrive in the digital era. -

SaaS Logistics AI Startups Venture Debt India 4 Minutes

Trifecta Capital: India’s Venture-Debt + Growth-Equity Engine

Trifecta Capital is India’s venture-debt pioneer turned full-stack partner—combining scaled credit with a selective late-stage Leaders Fund. Backing VC-funded scale-ups across consumer, fintech, logistics, and enterprise SaaS, Trifecta helps founders extend runway and accelerate toward IPO or strategic outcomes. -

Seed Indonesia Early Startups Private Equity 2 Minutes

Arummi Raises Seed Round to Bring Indonesian Cashew Milk to the World

Arummi Foods, Indonesia’s homegrown cashew milk pioneer, has closed its Seed round, accelerating its mission to make healthier, sustainable dairy alternatives accessible to millions. In a market where 70%+ are lactose intolerant, Arummi has scaled from lab experiment to 650+ retail stores, 3,000+ cafés, and 750,000+ liters sold. Backed by BEENEXT, Korea Investment Partners, and Fondation Botnar (supported by SAGANA), Arummi is turning local cashews into global innovation. Proud partner: WOWS Global. -

Business Growth Southeast Asia SEA Private Debt 4 Minutes

Private Debt’s Quiet Climb: The Unsung Hero of Southeast Asia’s Growth Story

While venture capital grabs headlines, private debt is quietly reshaping Southeast Asia’s growth story. By bridging SME financing gaps and fueling expansion without dilution, private credit is becoming the region’s unsung economic engine. From Temasek’s $10B platform to fintechs like Atome securing $80M facilities, investors and founders alike are waking up to private debt’s transformative power. -

VC Startup & Venture Capital SEA Fintech 7 Minutes

Southeast Asia's Most Active Venture Capital Firms in 2025

Southeast Asia’s startup scene is on fire in 2025 and these are the 25 venture capital firms fueling it. From early-stage incubators to billion-dollar funds, this definitive short-list showcases the most active, founder-first investors driving the region’s digital, AI, and fintech boom. For founders, it’s more than a list—it’s your launchpad. -

AI Sales Automation SME Business 2 Minutes

SalesHero.io: AI-Powered LinkedIn Sales Automation for SMEs

SalesHero.io is revolutionizing LinkedIn prospecting through AI-powered personalized automation, enabling SMEs to streamline sales processes and boost conversions effortlessly. -

Early-Stage Investors VC Startup & Venture Capital Business Growth 5 Minutes

Lifetime Ventures: Japan’s Deeptech Bridge with Growing On-Ramps for Southeast Asia

From Yokohama to Okinawa, Lifetime Ventures is rewriting Japan’s deeptech playbook. With strong ties to academia, a thesis built on research commercialization, and a portfolio of 60+ science-driven startups, the firm is shaping the technologies that will define generations. -

Founder SaaS Financial Advisory Business Growth Startup Growth 2 Minutes

Founders Under Pressure: Go-to-Market Execution Tops the Stress List

Go-to-market, not product or AI, is what keeps SaaS founders up at night. High Alpha’s 2024 SaaS Benchmarks shows 76% rank GTM as their top worry, with stress rising as companies scale despite greater financial security. The takeaway: founders need more than capital, they need GTM muscle, talent support, and wellbeing strategies. -

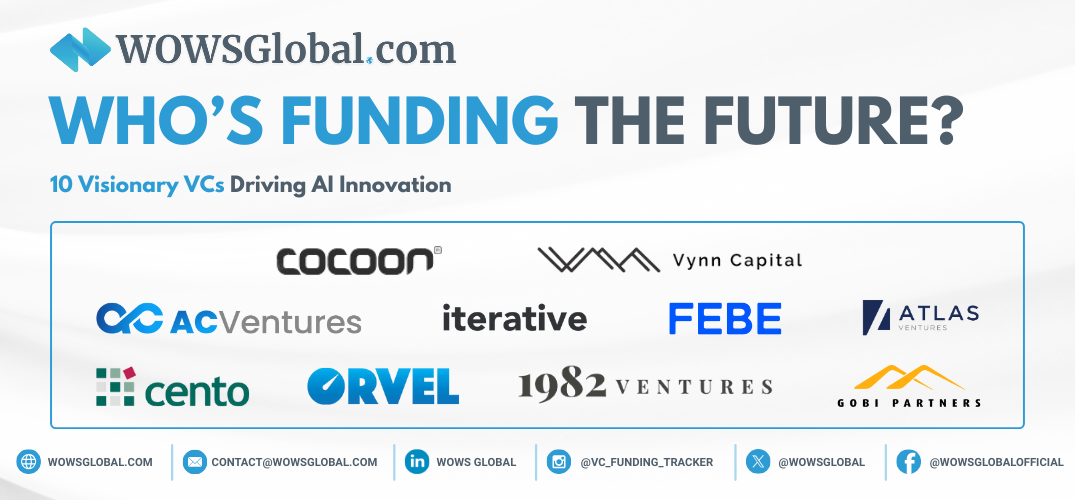

SEA Early Startups Funding VC AI in Southeast Asia 5 Minutes

Who’s Funding the Future? 10 Visionary VCs Driving AI Innovation

Explore 10 standout venture capital firms driving Southeast Asia’s AI-first startup ecosystem, from early-stage champions to fintech and deep tech backers. -

AI Startups SEA Finance Investment Banking 2 Minutes

Lumo: Vietnam’s Fintech Pioneer Making Wealth Building Simple and Accessible

Lumo, is reimagining personal finance in Vietnam with an AI-powered investment platform that makes wealth building simple, accessible, and rewarding, Lumo is on track to become the go-to digital wealth solution for Southeast Asia’s growing mass affluent class. -

Startup & Venture Capital Seed Business Growth VC 5 Minutes

Headline: Multi‑Local Capital, Global Outcomes

With local teams on the ground and fresh capital at every stage, Headline is backing founders from Seed to IPO. Active in Southeast Asia through its Asia Fund V and armed with a global Growth fund, the firm is a high-signal partner for startups aiming to scale beyond borders. -

Fundraising investor relations Traction Financials 3 Minutes

10 Red Flags Investors Spot Instantly (And How Founders Can Avoid Them)

From vague problems to broken cap tables, these are the 10 signals that turn investors off—plus practical fixes so you can raise with confidence. -

Startup Startup Growth Founder Health Habits 5 Minutes

Startup Growth and the Surprising Power of Sleep: What the Data Says About Founder Health Habits

Forget the hustle myth. Founders who sleep smarter, not less, are scaling faster. The data reveals surprising links between sleep, wellness, and startup success. -

AI Startups SEA Fintech HR Tech 2 Minutes

Insight Genie: Redefining Credit & Hiring Decisions with Behavioral AI

Insight Genie is a fast-growing AI startup using behavioral science and alternative data to unlock credit and hiring opportunities for underserved populations in Southeast Asia. With its proprietary Genie Score and strong backing from investors like HSBC, it’s redefining how risk and trust are measured in finance and HR. -

Venture Debt Finance AI Investor 2 Minutes

Bridging the Funding Gap: Why Strategic Planning Between Rounds Is Critical

Between funding rounds is where the real work begins. Strategic planning during this quiet phase can determine how ready your startup is for the next big raise. From fractional CFOs to venture debt and investor engagement, WOWS Global helps you stay prepared and in control. -

Impact Investing Fintech Healthcare Greentech SEA 4 Minutes

Ficus Capital: Building Ethical and Impact-Driven Ventures Across Southeast Asia

Ficus Capital is Southeast Asia’s first ESG-Islamic VC, investing in early-stage startups that align profit with principle. Backed by MAVCAP and MGTC, Ficus supports high-impact ventures across greentech, fintech, healthtech, and more, proving that sustainable growth and Shariah compliance can go hand in hand. -

SEA Startup & Venture Capital Seed Funding 4 Minutes

10 Early-Stage Investors Powering Southeast Asia’s Startup Momentum

Discover the rising early-stage investors powering Southeast Asia’s startup ecosystem. From Vietnam to Indonesia and the Philippines, these funds are writing meaningful cheques, backing standout startups, and offering founders the mentorship, networks, and sector expertise needed to scale from idea to impact. -

HealthTech Fintech SaaS SEA India 3 Minutes

Vertex Ventures SEA & India, Backing Bold Tech Founders Across the Region

Vertex Ventures SEA & India (VVSEAI) is a leading early-stage VC firm empowering high-potential startups across the region. With a sector-agnostic approach, deep regional roots, and global reach, VVSEAI partners with founders from Seed to Series B providing capital, strategic guidance, and operational support. Backed by Temasek’s Vertex Holdings, the firm has funded iconic unicorns like Grab, FirstCry, XPressBees, Nium, Licious, and PatSnap. With its latest $541M fund, VVSEAI continues to shape the future of fintech, SaaS, healthtech, consumer internet, and emerging tech in Southeast Asia and India. -

AI Cybersecurity Automation Response SEA 3 Minutes

Peris.AI: The AI-Hyperautomated Cybersecurity Layer for Modern Enterprises

Peris.ai is pioneering the future of cybersecurity with an AI-first, modular architecture that helps businesses scale defenses intelligently and adaptively. From threat intelligence to pentesting automation, their tools are built for today's complex digital battlefield. -

Impact Investing SEA Investors ESG 4 Minutes

Inside Southeast Asia's Impact Network: 10 Leading ESG & Impact Investors Driving Positive Change

Discover the 10 most influential ESG and impact investors shaping Southeast Asia’s sustainable startup landscape. From climate tech to gender-lens investing, learn who’s funding the region’s next wave of purpose-driven innovation. -

AI Data Analytics Business Intelligence Business Growth SEA 3 Minutes

Electrix: Turning Spreadsheet Chaos into AI-Driven Clarity for Southeast Asia’s Enterprises

Electrix is redefining business intelligence in Asia with AI-native analytics and real-time dashboards. With a “no PowerPoint” philosophy and a sharp founder at the helm, this startup helps teams turn scattered data into daily decisions fast. -

Healthcare HealthTech SEA Biotech Southeast Asia 7 Minutes

Zafar VC: Powering Southeast Asia’s Healthcare Renaissance

With a RM1 billion fund dedicated to healthtech, biotech, and medtech, Zafar VC is reshaping Southeast Asia’s healthcare landscape. Backed by a multidisciplinary team and public–private partnerships, Zafar supports mission-driven founders from seed to scale, starting with companies like Pathomics Health. -

B2B AI Business Innovation Global-Asia Innovation 3 Minutes

SalesMind AI: Automating B2B Sales with Deep Tech Innovation

SalesMind AI is rewriting the rules of B2B sales by eliminating manual prospecting and enabling scalable, hyper-personalized outreach. With deep-tech intelligence and early market traction, it’s a game-changer for sales teams and a golden opportunity for investors. -

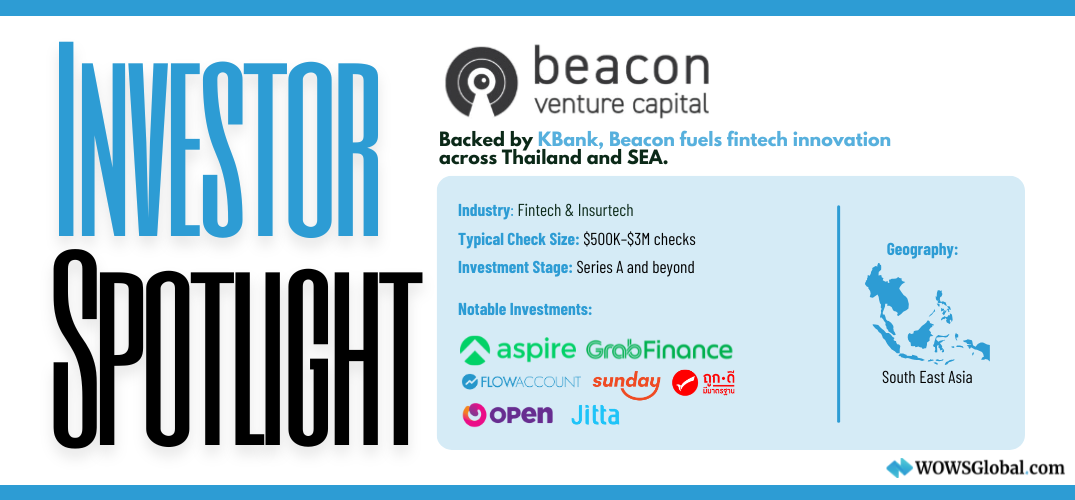

Finance SEA Fintech Business Growth 2 Minutes

Beacon VC: Powering Fintech and Innovation from Within Thailand’s Financial Core

Beacon VC is the corporate venture capital arm of Kasikornbank (KBank), one of Thailand’s largest financial institutions. With a strong focus on fintech and strategic sectors like insurtech, AI, and blockchain, Beacon VC empowers startups through smart capital, deep domain expertise, and access to KBank’s robust network. From Bangkok to Southeast Asia and beyond, Beacon VC is driving innovation from the heart of Thailand’s financial core. -

AI Insurtech SEA AI in Southeast Asia 3 Minutes

Sembuh AI: Revolutionizing Insurance Claims with AI

Sembuh AI is a Jakarta-based insurtech startup streamlining hospital claims processing with AI that settles requests in as little as 15 seconds. With fraud detection, regulatory alignment, and strong early traction, it’s redefining how insurers scale efficiently across Southeast Asia. -

Biotech Healthcare HealthTech Business Technology 2 Minutes

NeuroFore: Revolutionizing Early Parkinson’s Diagnosis with AI

NeuroFore is an innovative biotech startup that uses AI to identify early-stage Parkinson’s through non-motor symptom analysis, setting new standards for early neurological diagnostics and patient care. -

Southeast Asia MENA Investment Fintech HealthTech 4 Minutes

July 2025 Investment Snapshot: Southeast Asia & MENA

From fintech surges to deeptech breakthroughs, July 2025 delivered a wave of standout deals across Southeast Asia and MENA. This snapshot covers the top funding rounds, rising sectors, and the investors fueling growth across two of the world’s most dynamic startup ecosystems. -

#SoutheastAsia Early Stage deep-tech Robotics 6 Minutes

Wavemaker Partners: Backing Southeast Asia’s Boldest Builders

Building deep tech or B2B in Southeast Asia? Wavemaker Partners is one of the region’s most active early-stage VCs backing bold founders in enterprise, deep tech, and sustainability. From seed to scale, WOWS Global can help you connect with investors like Wavemaker who go beyond capital. -

Startup & Venture Capital Southeast Asia startups Southeast Asia SEA Startup Fundraising 6 Minutes

Inside the WOWS Investor Network: 250+ VC’s and Funds Powering SEA’s Startup Surge

This article unpacks the investor network behind WOWS Global from megafunds to niche co-investors and how this platform helps founders raise smarter, faster. See who’s in the network, what kind of capital they bring, and why this matters when you’re scaling across SEA. -

AI Enterprise Automation Business 3 Minutes

iGOT.AI: The No-Code AI Platform Powering the Next Wave of Enterprise Automation

iGOT.AI is a no-code AI platform enabling businesses to deploy virtual AI employees that automate up to 80% of workflows. With strong early traction and a scalable model, it’s quickly emerging as a leader in the enterprise AI revolution. -

Emerging Markets SEA Fintech eCommerce Logistics 3 Minutes

Alter Global: Backing the Bold in Emerging Markets

Alter Global is an early-stage VC firm backing high-character tech founders in emerging markets across Latin America, Africa, Asia, and MENA. With a unique model that combines capital, global talent, and ecosystem support, Alter partners with bold entrepreneurs building scalable solutions to real-world challenges—often in places overlooked by traditional venture capital. -

AI Corporate Venture Singapore Indonesia Cloud Computing 2 Minutes

VinVentures: Powering Vietnam’s Deep Tech Breakout from the Inside Out

Discover how VinVentures, Vingroup's $150 million venture fund, is supercharging Vietnam's emergence as a deep tech powerhouse. Under the leadership of Shark Tank investor Lê Hàn Tuệ Lâm, this innovative early-stage fund is strategically investing in the next generation of AI, semiconductor, and cloud startups, redefining corporate venture capital across Southeast Asia. -

AI AI Security Surveillance Business Growth Risk Detection 2 Minutes

Lytehouse: AI-Powered Smart Surveillance for Enhanced Security

Lytehouse is revolutionizing security by turning standard CCTV cameras into smart, AI-driven virtual guards, significantly boosting monitoring efficiency and operational insight without additional hardware. -

B2B eCommerce Stock Business Investment 3 Minutes

Liquid8: Powering Recommerce for Indonesia’s E-commerce Economy

Liquid8 is Indonesia’s first ESG-driven recommerce platform turning e-commerce returns and excess stock into profitable inventory for MSMEs. Founded by logistics veterans, the startup blends sustainability with scale—recycling over 2,100 tons of goods in under a year. Backed by SPIL Ventures, Liquid8 is redefining how Southeast Asia manages waste, returns, and small business growth. -

SME Smart Capital SME Growth Business Growth #Investment 3 Minutes

Arq Capital: Smart Money for Philippine SMEs

From solar energy and PropTech to fintech and inclusive housing, this investor spotlight explores how Arq deploys smart, flexible capital to scale the country’s most promising SMEs, without forcing founders to give up control. If you're building for scale and impact in emerging markets, Arq is one to watch. -

Digital Marketing Business Indonesia Innovation Entrepreneurship 3 Minutes

Dolan: Pioneering Indonesia’s Digital Travel Marketplace

Dolan is an Indonesian travel-tech startup offering a digital marketplace that connects global travelers with authentic local experiences and businesses. By enabling local tourism providers to reach a wider audience, Dolan opens Indonesia’s destinations to global travelers and helps drive the country’s tourism growth. As Indonesia's tourism rebounds, Dolan’s scalable model and mission to empower local businesses position it for significant growth, attracting strong investor interest. -

Startup Funding SEA MENA Startups 5 Minutes

June 2025 Investment Snapshot: Capital Hits a Heatwave

June 2025 lit up with a VC heatwave across Southeast Asia and MENA. From insurtech unicorns and migrant fintech to AI wearables and atmospheric water, this month’s deals show the frontier is flush with cash and big ambition. Explore the standout rounds and future-casting sectors. -

Raise Capital for Startup Early Stage Technology Singapore 2 Minutes

Seeds Capital: Catalyzing Singapore’s Early-Stage Tech Breakouts

Seeds Capital, the investment arm of Enterprise Singapore, bridges public funding with private capital to accelerate promising tech startups from seed to global scale. Operating through a co-investment model, Seeds has backed over 150 startups across sectors from cultivated seafood to healthtech, catalyzing more than S$1.12 billion in private investment. Recently integrated into SG Growth Capital, Seeds Capital continues to fuel Singapore's next generation of deep-tech and frontier tech companies. -

Esports Gaming Emerging Markets VC India 4 Minutes

Rooter: India’s Homegrown Game Streaming Giant

Rooter is India’s top game streaming platform, serving a fast-growing base of 17M+ monthly active users with local-language esports content and a thriving creator ecosystem. Backed by top VCs like Lightbox and March Gaming, Rooter has built a sticky, mobile-first product that’s monetizing rapidly through branded ads and virtual gifting. With plans for global expansion and profitability on the horizon, Rooter is one of the most promising gaming startups emerging from Asia. -

eCommerce AI Business Growth Business 2 Minutes

BA3 Studio: Powering eCommerce Growth with AI in Vietnam

BA3 Studio is revolutionizing Vietnamese eCommerce with its AI-powered platform, offering real-time insights, automation, and market intelligence to optimize sales on Shopee, Lazada, and TikTok Shop. Targeting a high-growth market, this innovative company has already secured significant partnerships and is poised for rapid expansion across Southeast Asia. Investors are taking notice of its unique AI-first approach, strong traction, and visionary leadership, presenting an attractive opportunity in the booming digital economy. -

Betatron Venture Group Investing B2B SaaS Business Growth 6 Minutes

Betatron Venture Group: Investing with the Exit in Mind Across Asia's B2B Frontier

Betatron Venture Group is a Hong Kong-based early-stage VC firm backing scalable B2B startups that digitize Asia’s largest traditional industries. With a US$50M fund and a disciplined focus on sectors like logistics, construction, fintech, and industrial SaaS, Betatron invests US$500K–$2M in Seed to Series A rounds across high-growth markets in South and Southeast Asia. The firm is known for its exit-focused thesis, deep regional network, and hands-on support guiding founders toward strategic acquisition or IPO. -

Sustainability FoodTech consumer tech Farm2Plate 3 Minutes

Farm2Plate: Revolutionizing Ready-to-Eat Meals with Innovation and Sustainability

Farm2Plate (F2P), founded in 2017 in Bangkok, is redefining the ready-to-eat market in Asia and Europe with clean-label, ethically produced meals. Acting as the innovation kitchen for major airlines and retailers, F2P blends food tech with culinary craftsmanship to deliver scalable, HACCP-certified recipes. Its Thailand-based team, with decades of experience, ensures healthy, convenient meals without compromising taste or ethics. -

Venture Capital FEBE Ventures Seed 4 Minutes

FEBE Ventures: Founders Backing Founders from Day One

More than capital, FEBE Ventures brings founder-first support, fast decisions, and real operational insight to early-stage startups across the globe. -

Fintech SME Finance Elephants 5 Minutes

Company Spotlight: Elephants - Rewiring SME Fintech in Southeast Asia

Elephants is building the financial OS Southeast Asia’s 8.8M SMEs have been waiting for streamlining everything from payments and FX to compliance and rewards. Learn how this fintech startup is unlocking daily utility and scaling fast. -

capital raising Business Business Growth B2B Southeast Asia startups 4 Minutes

Ally Global: Strategic Capital for the Brave and Bold in Emerging Markets

Ally Global is redefining what it means to be a founder-first VC in emerging markets. From fintech to agri-tech, they’re backing bold startups solving foundational problems across Africa, MENA, and Southeast Asia—with real capital, deep networks, and operator-led insight. -

Investment Trends SEA MENA AI 6 Minutes

May 2025 Investment Snapshot: Capital Wakes Up Hungry

After a quiet Q1, global capital came roaring back in May 2025. From fintech and batteries in Singapore to quantum software in Israel, this month marked a bold return to frontier investing. WOWS Global breaks down where the money is flowing and why. -

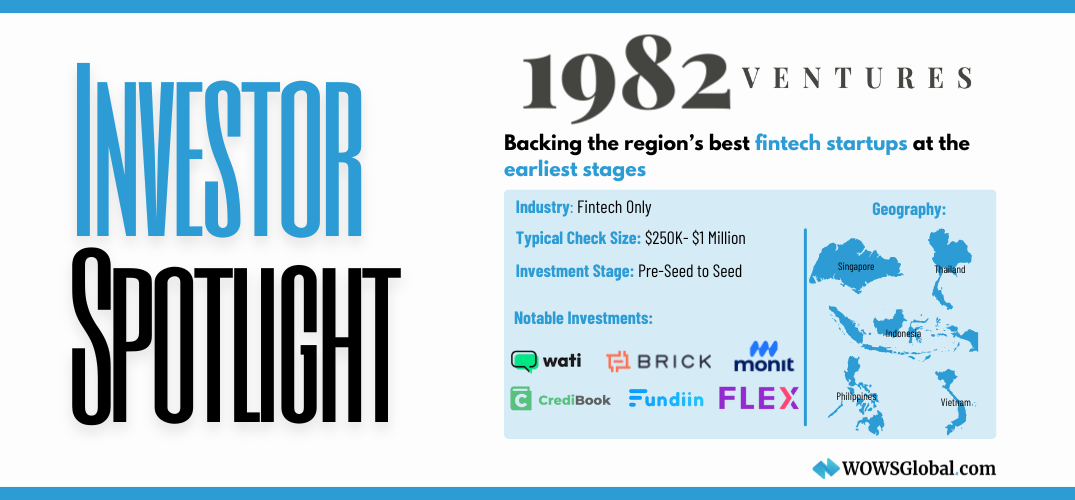

1982 Ventures Fintech SEA 6 Minutes

1982 Ventures: Catalyzing Fintech’s Next Generation in Southeast Asia

1982 Ventures is betting big on fintech in Southeast Asia — and winning. Learn how this VC firm is backing early-stage founders and how WOWS Global helps connect startups to the capital they need. -

Medtech HealthTech Personalized Surgery AI 4 Minutes

Company Spotlight: OsseoLabs – Redefining Surgery with AI, 3D Printing & Precision Biomechanics

OsseoLabs is transforming the future of surgery with AI, biomechanics, and 3D printing - making procedures more personalized, efficient, and accessible across Southeast Asia and beyond. -

Creator Economy Karaoke Tech AI 4 Minutes

Company Spotlight: SuperStarr – Where Singing Meets the Creator Economy

SuperStarr is a new-age karaoke platform turning performances into profit. Designed for the creator economy, it empowers users to earn through singing, livestreams, and exclusive fan content, backed by a high-growth Southeast Asian market and a veteran founding team. -

BEENEXT VC Early Stage 5 Minutes

VC Spotlight: BEENEXT – Backing Bold Founders from India to Southeast Asia

BEENEXT is a founder-first VC fund that has quietly become one of the most trusted early-stage backers across India and Southeast Asia. With over 300 investments and a long-term approach, the firm backs transformative companies in fintech, SaaS, logistics, and more. -

AFG Partners Fintech VC Asia finance 5 minutes

AFG Partners: Empowering Global B2B Fintechs to Scale Across Asia

AFG Partners is a strategic venture capital firm backing global B2B fintech and enabling tech startups. Headquartered in Singapore and Hong Kong, AFG focuses on helping early-stage companies expand into Southeast Asia’s dynamic financial markets. Explore their investment strategy, standout portfolio, and why founders value their cross-border expertise and collaborative approach. -

SleepHappy D2C consumer tech 5 minutes

Company Spotlight: SleepHappy - Redefining Sleep for Southeast Asia’s Digital Generation

SleepHappy is redefining what it means to shop for a mattress in Southeast Asia. Combining 5-star hotel comfort with direct-to-consumer convenience, this Thai-born brand is capturing market share with over 160,000 units sold and a powerful omnichannel presence. With its expansion into Vietnam and Singapore, SleepHappy is one of the most promising digital-first consumer brands in the region. -

Thia Ventures FoodTech Biotech 5 Minutes

Thia Ventures: Investing Where Food, Biotech, and Health Converge

Thia Ventures is a Singapore-based VC firm investing in deep tech solutions across food production, biotech, and human health. With a science-led and sustainability-focused thesis, Thia backs early-stage startups across Southeast Asia and globally, offering founders capital, credibility, and commercialization expertise. Learn more about their standout portfolio and how WOWS Global helps connect startups with VCs like Thia. -

SEA 2025 startups 6 Minutes

Follow the Funding: What SEA’s 2025 Investment Landscape Reveals

Southeast Asia’s startup funding in 2025 is seeing a dramatic sectoral shift: while total capital is down 87%, AI and SaaS startups are booming, and traditional sectors like logistics, foodtech, and health are freezing. Here's what founders and investors need to know. -

Trump Tariffs SEA global trade 6 Minutes

Tariff Tsunami: What Trump’s New Trade War Means for Southeast Asia’s Startups

With Trump’s re-election and a 145% tariff on Chinese goods, Southeast Asia’s startup scene is facing a global trade shakeup. Startups dependent on cross-border supply chains and exports are feeling the squeeze, while local-market-focused ventures are seeing new opportunities. Learn how founders and VCs are adapting, and why resilience, localization, and ASEAN-first thinking are now essential for success. -

Gowajee Thai AI voice technology 6 Minutes

Company Spotlight: Gowajee – The Future of Thai-Language AI Voice Technology

Gowajee is Thailand’s first Thai-language AI voice tech company, automating call center QA and customer engagement for enterprise clients. With clients like Generali and SCG already onboard, Gowajee is a rising player in Southeast Asia’s booming AI landscape. -

ZWC Partners VC VC spotlight 5 Minutes

ZWC Partners: Accelerating Asia’s Digital and Deep Tech Future

With over $2.5 billion in assets under management, ZWC Partners is a powerhouse investor supporting Asia’s high-impact startups in digital, deep tech, new energy, and consumer innovation. Explore their cross-border strategy, portfolio highlights, and why founders choose ZWC. -

Startup governance eFishery financial oversight 5 Minutes

When Hype Meets Reality: The Vital Role of Governance in Startup Success

The recent collapse of AI darling 11x is a reminder that hype alone doesn’t build lasting businesses. As Zilingo and eFishery have shown before, poor governance can undo years of growth. In this blog, WOWS Global explores why internal controls, financial oversight, and transparent governance are essential for investor trust and sustainable startup success. -

Lunash debt recovery AI fintech 4 Minutes

Company Spotlight: Lunash – AI-Powered Debt Recovery for the Future of Finance

Lunash is revolutionizing debt collection through AI-driven automation, predictive analytics, and personalized repayment strategies. Learn how this fintech startup is solving inefficiencies in traditional collections and enabling financial institutions to recover overdue loans while maintaining borrower relationships. -

GeoSquare.ai AI retail analytics 6 Minutes

Company Spotlight: GeoSquare.ai – AI-Driven Geospatial Intelligence for Smarter Decision-Making

GeoSquare.ai is revolutionizing geospatial intelligence with AI-powered 50m x 50m location grids. From banking to real estate, this Indonesian startup is helping companies make smarter, data-driven decisions with hyperlocal insights. -

eFishery CFO due diligence 8 Minutes

The eFishery Fiasco: A Startup Dream Turned Accounting Nightmare

What went wrong at eFishery? This blog unpacks the accounting red flags and shows why financial oversight through fractional CFO services is a must-have for fast-growing startups across Southeast Asia and MENA. -

AIPath.one venture building AI 5 Minutes

Company Spotlight: AIPath.one – AI-Powered Venture Building for Startups & Product Leaders

AIPath.one is automating the hardest parts of venture building—product validation, GTM execution, and competitive analysis—helping startups scale smarter and faster. A standout from WOWS Dealflow’s AI Demo Day. -

M&A readiness SME growth fractional CFO 5 Minutes

Signs Your Business Is Ready for M&A

Mergers & acquisitions aren’t just for billion-dollar companies anymore. Here are 7 signs your startup or SME might be ready to scale, exit, or acquire in 2025. -

March 2025 SEA VC WOWS 5 Minutes

WOWS Investment Highlights – March 2025: Southeast Asia Powers Up as Funds Flow In

March 2025 saw a surge in venture capital activity across Southeast Asia. From Malaysia’s new climate funds to Vietnam’s rise in healthtech and EV, here’s what’s driving the region’s deal frenzy and where smart money is flowing next. -

Integra Partners VC SEA 4 minutes

Integra Partners: Investing in the Future of Fintech, Healthcare & Climate Innovation

Integra Partners is empowering fintech, healthcare, and climate startups across Southeast Asia with hands-on VC support and mission-driven capital. Learn how they're making impact investing scalable. -

construction tech AI Indonesia 5 minutes

Company Spotlight: Konstruksi.AI – Transforming Construction with AI-Powered Efficiency

Konstruksi.AI is transforming the $15.46T construction industry by using AI to eliminate inefficiencies, reduce quality control failures, and simplify compliance. With early traction and strong government engagement, this Indonesian startup is a game-changer in construction tech. -

Reazon Capital VC SEA 6 minutes

Reazon Capital: Empowering Asia's Next Wave of Innovators

Reazon Capital is a self-funded venture firm with unrestricted investment timelines, allowing unparalleled flexibility in supporting high-growth startups across Asia. With a strong focus on entertainment, deep tech, and emerging markets, Reazon Capital invests in Vietnam, Indonesia, and Japan, empowering the next wave of innovators and disruptors. -

Sensory AI deep-tech AI AI-Nose 4-6 minutes

Company Spotlight: MUI Robotics – Digitizing the Sense of Smell with Sensory AI

MUI Robotics is pioneering Sensory AI technology, enabling machines to digitize the sense of smell. With over 600 enterprise clients and profitability within its first year, this Thailand-founded deep-tech startup is now expanding globally. Featured at WOWS Dealflow AI Demo Day, MUI Robotics is reshaping industries from food tech to pharmaceuticals with its AI-powered odor detection and environmental monitoring solutions. -

Insignia Ventures SEA VC 4-6 minutes

Insignia Ventures Partners: Powering Southeast Asia’s Next Tech Giants

Insignia Ventures Partners is one of Southeast Asia’s most influential venture capital firms, with $800M+ in AUM and a portfolio featuring Carro, Ajaib, GoTo, Appier, and Shipper. Focused on fintech, AI, e-commerce, and enterprise tech, Insignia provides capital, strategic support, and operational expertise to high-growth startups. Discover how this powerhouse investor is shaping the region’s next wave of tech giants. -

Financial mistakes startup Fractional CFO 4-6 minutes

Financial Mistakes That Hurt Businesses—Startups & SMEs Alike

Many startups and SMEs unknowingly make financial mistakes that hurt profitability, cash flow, and long-term success. From misinterpreting cash in the bank to scaling without financial planning, these pitfalls can be costly but avoidable. Discover the most common financial mistakes and how to fix them in this guide by WOWS Global. -

Plexis.ai healthcare AI 4-6 minutes

Company Spotlight: Plexis.ai – Transforming Healthcare with AI-Driven Automation

Plexis.ai is transforming healthcare operations by leveraging AI-driven automation to streamline workflows, enhance efficiency, and reduce staff burnout. With proven traction across hospitals and clinics, government contracts, and an ambitious global expansion plan, Plexis.ai is positioned as a leader in the AI automation space. Learn more about how this WOWS Demo Day finalist is disrupting the $50B AI healthcare automation industry. -

Alpha JWC VC SEA 6 minutes

Alpha JWC Ventures: Powering the Next Generation of Southeast Asian Startups

Alpha JWC Ventures has grown into Southeast Asia’s largest and best-performing early-stage fund, managing $650 million in assets and backing over 70 high-growth startups, including four unicorns and 27 centaurs. Learn how Alpha JWC is fueling innovation across fintech, consumer tech, agritech, and B2B sectors in Indonesia and beyond. -

AI Video Editing Short-Form Video 6 minutes

Company Spotlight: Snapcut – AI-Powered Video Editing at Scale

Snapcut is revolutionizing video editing with AI-powered automation, helping creators and businesses scale content effortlessly. By automating clip selection, captions, and formatting, Snapcut turns long-form videos into scroll-stopping short-form content in seconds. -

AI Security Identity Verification 3-5 minutes

Company Spotlight: Verihubs – Redefining Identity Verification with AI

Verihubs is revolutionizing digital security with AI-driven identity verification, helping businesses combat fraud and ensure compliance. Through face recognition, deepfake detection, and AI-powered authentication, Verihubs is securing digital transactions across fintech, banking, and enterprise security. -

Conversational AI NLP AI 3-5 minutes

Company Spotlight: Kata.ai – Transforming Customer Service with Conversational AI

Kata.ai is redefining customer engagement in B2B commerce through Conversational AI and Natural Language Processing (NLP). By automating interactions and optimizing operations, Kata.ai is empowering enterprises with AI-driven efficiency. -

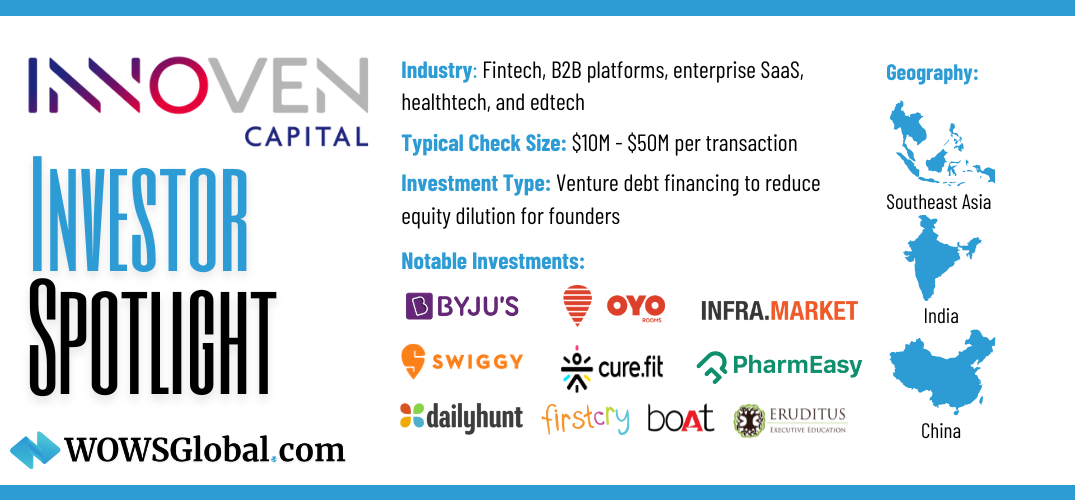

Venture Debt InnoVen Capital Startup Funding 5-7 minutes

Investor Spotlight: InnoVen Capital – Powering Asia’s Startup Ecosystem with Venture Debt

For startups aiming to scale without sacrificing equity, venture debt has emerged as a crucial financial tool. InnoVen Capital, a leading venture debt provider in Asia, has helped over 180 startups grow without dilution. With a focus on India, China, and Southeast Asia, InnoVen Capital has deployed over $400 million across 250+ transactions, backing industry giants like Byju’s, Swiggy, Oyo, and PharmEasy. Learn how venture debt can be a game-changer for your startup. -

Logistics Robotics Automation 6 minutes

Company Spotlight: Quikbot.ai—Redefining Last-Mile Deliveries for Smart Cities

Quikbot.ai is revolutionizing last-mile delivery with its autonomous final-mile delivery platform-as-a-service (AFMD PaaS). Designed for densely populated vertical smart cities, Quikbot integrates with major couriers and retailers, delivering cost-efficient, sustainable, and scalable solutions. With 50–70% cost savings and 30–50% lower emissions, Quikbot is reshaping urban logistics while aligning with global sustainability goals. -

DeepSeek AI Innovation AI Disruption 7 minutes

DeepSeek: The Market Disruptor Reshaping AI and Technology Stocks

DeepSeek’s disruptive AI model is shaking the global tech landscape. By dramatically cutting costs and innovating on legacy hardware, this Chinese AI startup is raising questions about Big Tech dominance and reshaping investment strategies worldwide. -

AI Revolution Stargate Project SEA 7 minutes

Stargate’s Ripple Effect: The $500 Billion AI Revolution and Its Global Impact

Stargate Project, a $500 billion AI megaproject launched by OpenAI, SoftBank, and Oracle, is set to reshape the global AI landscape. From the U.S. to Southeast Asia and the Middle East, discover how this ambitious endeavor is sending ripples across economies, inspiring innovation, and sparking the global AI arms race. -

Healthcare Quick Commerce E-Pharmacy 6 minutes

Company Spotlight: Medino’s—Redefining Healthcare Delivery in India, One 30-Minute Promise at a Time

Medino’s is disrupting India’s $65 billion pharmacy market with a bold promise: 30-minute medicine delivery or it’s free. With a rapidly growing footprint, 24/7 operations, and proven profitability, this quick-commerce healthcare leader is transforming accessibility and convenience for millions. -

Venture Capital Founder Startup Funding 6 minutes

The Founder-Turned VC vs. The Non-Founder VC – Two Species in the Venture Jungle

Venture capitalists come in all forms, but two stand out: the battle-tested Founder-Turned VC and the strategic Non-Founder VC. Learn how their distinct approaches to risk, pivots, and due diligence shape their partnerships with startups and find out which one is the right fit for your journey. -

AI in Southeast Asia Artificial Intelligence 2025 AI-powered 6 Minutes

Southeast Asia's AI Revolution: 2024 Recap and 2025 Outlook

2024 was a defining year for artificial intelligence (AI) in Southeast Asia. From healthcare to fintech and logistics, AI powered innovation and shaped investment trends across the region. As we look ahead to 2025, discover what lies ahead for this transformative technology in Southeast Asia’s growing economy. -

Startup Funding Venture Capital VC Red Flags 5 Minutes

Don’t Accept VC Money If You See These 5 Red Flags in a Term Sheet

A term sheet sets the tone for your startup’s future, but not all deals are created equal. Learn the five red flags you should never ignore when negotiating VC funding to protect your vision and equity. -

SEA Private Equity 2025 Outlook 6 minutes

Southeast Asia’s Investment Rollercoaster: Closing 2024 with Big Moves and a Bold Outlook

As 2024 draws to a close, Southeast Asia’s startup ecosystem is making waves with record-breaking deals, rising unicorns, and bold expansions in healthcare, fintech, and sustainability. Discover how December's milestones are setting the stage for a transformative 2025 in our latest blog. -

Startups Venture Capital Unicorn Startups 5 minutes

Superhero Franchises and Unicorn Startups: Why Investors Love the Blockbusters

What do superhero franchises and unicorn startups have in common? Investors love them for the same reason—they’re scalable, high-impact, and built for long-term success. Learn why your startup needs an origin story, a killer team, and the potential to create a universe of opportunities in this blockbuster blog from WOWS Global. -

AI in Manufacturing Quality Control 4 minutes

AEyeMynd – Redefining Quality Control with Intelligent AI

AEyeMynd is transforming quality control for high-mix, low-volume manufacturing environments with AI-driven solutions. By ensuring unmatched precision and scalability, the company is helping industries like aerospace, medical devices, and automotive achieve operational excellence. -

SEA PE Startup Ecosystem Sustainability 6 minutes

Riding the SEA Investment Wave: Resilience, Innovation and the Road to 2025

Southeast Asia's private equity scene is thriving in 2024, driven by youthful demographics, government-backed initiatives, and innovative startups. As the year ends, SEA is paving the way for a transformative 2025 with strategic investments in fintech, deeptech, and sustainability. -

Fundraising Angel Syndicates VC 6 minutes

The Battle of Angel Syndicates vs. WOWS Global: Why the Choice is Clear

WOWS Global vs. Angel Syndicates: A detailed comparison of costs, network depth, technology, and expert support. Learn why WOWS Global is the better choice for startup fundraising and scaling. -

Recruitment Workforce Management HR Tech 5 minutes

TalentHero – Revolutionizing Recruitment and Workforce Management Across APAC

TalentHero is transforming recruitment and workforce management in APAC with AI-driven solutions to address global talent shortages. Discover how this HR tech leader is redefining the hiring landscape. -

Superagent AI in Real Estate 5 minutes

Company Spotlight: Superagent – Transforming Real Estate with AI-Driven Innovation

Superagent is reimagining real estate with AI, delivering a seamless, efficient experience for buyers, sellers, and realtors. Meet the team and discover their vision for a smarter property market. -

Fractional CFO SME Growth Financial Strategy 6 minutes

Why Fractional CFOs Are the Secret Weapon for SMEs

Need expert financial strategy without the full-time cost? Discover why fractional CFOs are the game-changers for growing SMEs, providing tailored insights in cash flow, forecasting, fundraising, and more. -

SEA MENA Venture Capital 6 minutes

October’s Funding Fiestas and Game-Changers: SEA and MENA’s Wild Ride Through the Investment Winter

October brought record-breaking investments and strategic partnerships to Southeast Asia and the Middle East. From electric vehicles to fintech, learn how startups and VCs are navigating the investment winter with resilience and ambition. -

Series B Southeast Asia Middle East 4 minutes

Series B Showdown: Southeast Asia and the Middle East Break Through in 2024

In a world where raising venture capital feels like pulling teeth, Southeast Asia and the Middle East have become unlikely champions. Specifically, we’re talking about Series B funding—the so-called "make or break" round where startups are expected to have proven product-market fit and demonstrated strong growth metrics. Data from Carta shows a global drop in Series B funding, particularly in the U.S. market, where only the most capital-efficient companies are managing to score checks. But for founders in Southeast Asia and the Middle East, 2024 is shaping up differently. Series B, once a hard sell in these regions, is now a coveted target and, more importantly, an achievable milestone. Let’s break it down. -

Founder Spotlight Sirka.io Entrepreneurship 3 minutes

Founder Spotlight: Rifanditto "Ditto" Adhikara – Personalizing Healthcare with Sirka.io

Sirka.io is transforming the management of chronic health conditions through its proactive and personalized healthcare approach. Led by its founder, Rifanditto "Ditto" Adhikara, Sirka began as a nutrition consultation app, inspired by Ditto’s personal experience with pre-diabetes. The company has since evolved into a comprehensive healthcare platform offering a suite of services, from lifestyle and dietary interventions to medication management and continuous health support. Sirka empowers individuals to lead healthier lives by addressing chronic conditions with tailored solutions. -

Accelerators YC Alternative Venture Capital 6 minutes

Alternatives to Y Combinator: A Better Way to Accelerate Your Startup?

Let’s face it—when most founders think about startup accelerators, Y Combinator (YC) usually tops the list. It's the Ivy League of accelerators, famous for kickstarting unicorns like Airbnb and Dropbox. But, like choosing Harvard, going with YC has its drawbacks. The reality is that Y Combinator, and other traditional accelerators, might not be the silver bullet they seem for every startup. -

Founder Spotlight Enigma Camp Entrepreneurship' 2 minutes

Founder Spotlight: Muhammad Irfan – Solving Youth Unemployment with Enigma Camp

In the face of rising youth unemployment and a growing skills gap, Muhammad Irfan founded Enigma Camp to address these pressing global challenges. His company provides comprehensive training programs designed to prepare fresh graduates for careers as software developers, helping bridge the gap between education and employment. By offering end-to-end services, from talent acquisition to project-based work placement, Enigma Camp is ensuring that young professionals are equipped with the tools they need to succeed in the rapidly expanding tech industry. -

Startup Team MVP Business Strategy 3 minutes

Every Startup Needs a Dennis Rodman: The Real MVPs Behind Success

Building a startup team is a lot like assembling a band of misfits and expecting them to perform like the '96 Chicago Bulls. You’ve got your dreamers, your doers, your wild cards—and somehow, you’ve got to make them all play together, harmonize even, if you want to make it through the grind of startup life. It’s not about having a team of flashy superstars. It’s about finding the Dennis Rodmans of the world—the people who do the dirty work, hustle, and take pride in keeping the machine running while someone else dunks. -

409A Valuation VC valuation Startup Fundraising Post Money Valuation 4 minutes

409A Valuation vs. VC Valuation: What Every Startup Founder Needs to Know

Navigating the world of startup valuations can be challenging, especially when balancing 409A valuations for IRS compliance with VC valuations for fundraising. In this article, we break down the key differences between these two crucial valuation types, how they impact your company’s growth, and why both are essential for startup founders in Southeast Asia and the Middle East. Whether you’re issuing stock options or negotiating with investors, understanding these valuations can set your business up for long-term success. -

ESOPs Southeast Asia Startups Talent Retention 5 minutes

ESOPs: Unlocking the Future of Talent and Capital for Southeast Asian Startups

ESOPs are a crucial tool for startups to retain talent and ensure long-term success. Learn how Southeast Asian startups can navigate the complexities of ESOPs and even implement virtual options to motivate their teams. -

Business Plan Startups Financial Planning 6 minutes

The Business Plan: How to Predict the Future Without a Crystal Ball

Writing a business plan is like trying to predict the future. It’s not about perfection; it’s about creating a roadmap that can evolve as your startup grows. Learn how to strike the balance and use it to guide your entrepreneurial journey. -

Saivya Chauhan Blitz Electric Founder Spotlight 7 minutes

Founder Spotlight: Saivya Chauhan, the Force Behind Blitz Electric

Meet Saivya Chauhan, the visionary founder of Blitz Electric, a company tackling the flaws of the gig economy through sustainable logistics and better pay for delivery drivers. Learn how he’s shaping the future of last-mile logistics with electric vehicles. -

Southeast Asia SME Lending Mergers Sustainability 6 minutes

Southeast Asia’s Investment Frenzy in September 2024: Startups Thriving Across Sectors

September 2024 has been a landmark month for Southeast Asia’s startup scene, with significant investments across fintech, AI, sustainability, and EVs. Learn how these industries are driving the region’s innovation. -

Startup MVP Lean Startup Feedback 5 minutes

The MVP: Turning Bare Bones Into Billion-Dollar Dreams (Or a Glorified Prototype)

The MVP (Minimum Viable Product) is your scrappy, bare-bones version of your grand vision. Learn how to strike the right balance between too minimal and too polished while preparing for an MVP launch in this startup guide. -

Impact Investing SEA Startup Ecosystem 5 minutes

The Impact Hustle: How SEA’s Impact Investing is Changing the Game

Impact investing is transforming Southeast Asia's startup scene by blending profit with purpose. Learn how investors are backing businesses that deliver both financial returns and measurable social impact. -

Term Sheets Redemption Rights Anti-Dilution Liquidation Preference 5 minutes

Key Considerations for Founders in Startup Term Sheets: Do’s and Don’ts

Negotiating a term sheet is a critical step in securing investment. Learn the essential do’s and don’ts for founders when handling valuation, liquidation preferences, anti-dilution, and more. -

Data-Driven Decisions Business Strategy Data Overload 3 minutes

Data-Driven Decisions: The Fine Line Between Insight and Overload

Data is essential for modern decision-making, but too much can lead to overload. Learn how to find the balance between data insight and analysis paralysis for smarter, more confident decisions. -

Startup Fundraising 409A Valuation Financial Model Pitch Deck 5 minutes

Case Study: MedTech Startup in Southeast Asia Raises $3 Million USD with WOWS Global’s Premier Package

A Southeast Asia-based MedTech startup successfully raised $3M in Series A funding using WOWS Global’s Premier Package. Learn how our full-service fundraising solution helped them secure new investors and reinvestment from existing backers. -

Fintech XenCapital Helicap Venture Debt 5 minutes

XenCapital Secures $50M Credit Facility from Helicap to Empower Southeast Asian Businesses

XenCapital, the lending arm of Xendit, has secured a $50M credit facility from Singapore's Helicap to provide vital financing to underbanked businesses across Southeast Asia. This partnership reflects the region's growing reliance on alternative lending solutions to drive financial inclusion. -

Venture Debt SEA Startups Genesis Alternative Ventures 4 minutes

Genesis Alternative Ventures Raises $125M for Second Venture Debt Fund: Boosting SEA’s Investment Landscape

Genesis Alternative Ventures closes $125M for its second venture debt fund, providing crucial growth capital to Southeast Asia’s startups. Discover why venture debt is the perfect tool for startups looking to scale without diluting equity. -

#SoutheastAsia #Startups #MegaDeals 7 minutes

Big Checks, Bigger Risks: The Anatomy of Southeast Asia’s 2024 Startup Deals

Southeast Asia in 2024 is booming with big checks and bigger risks. As startups raise colossal sums, the stakes have never been higher. Fintech, e-commerce, and foodtech lead the charge, but who’s cutting the checks, and who’s taking the bait? Learn more about this high-stakes poker game unfolding in one of the world’s most dynamic regions. -

#PitchDeck #Startup #BusinessStrategy 3 minutes

The Pitch Deck: Turning Bold Ambitions into Buzzwords and Bullet Points

Creating a pitch deck is a delicate art of condensing bold ideas into bullet points and buzzwords. Learn how to craft a winning deck that strikes the perfect balance between vision and viability. -

Whistleblower Compliance Entrepreneurship 7 Minutes

Founder Spotlight: Pav Gill - The Visionary Behind Confide

Pav Gill, the whistleblower behind the Wirecard scandal, turned his experience into Confide, a platform dedicated to fostering transparency and accountability. In this Q&A, Pav shares how his journey shaped Confide's evolution into a complete compliance solution, his entrepreneurial insights, and his advice to future founders. -

Indonesia Investment News 3 Minutes

Validus Raises $50M from HSBC to Boost SME Lending in Indonesia

Discover how Validus is using a $50M debt facility from HSBC to boost SME lending in Indonesia and support financial inclusion across Southeast Asia. -

startup pivot business growth Mike Cappelle 2 minutes

The Startup Pivot: From Bright Ideas to ‘What the Hell Were We Thinking?’

Pivoting a startup can be a rollercoaster, where bright ideas sometimes lead to hard lessons. Explore how changing course can make or break a business, with insights from WOWS' Co-Founder and COO, Mike Cappelle. -

Financial Model Case Study Funding Success 3 minutes

Case Study: Transforming Financial Planning for HealthTech Innovators

Discover how WOWS Global crafted a detailed financial model for HealthTech Innovators, helping them secure $10 million in funding. Learn about our process and the impact of a robust financial strategy. -

409A Valuation Post Money Valuation Fair Market Value 3 minutes

Case Study: Comprehensive 409A Valuation for FinTech Solutions Group

Learn how WOWS Global provided FinTech Solutions Group with a detailed and accurate 409A valuation, ensuring compliance and supporting strategic financial planning. -

ESOP Employee Stock Option Plan Employee Retention 3 minutes

Case Study: Driving Employee Engagement through Customized ESOP Solutions

Discover how a tailored Employee Stock Ownership Plan (ESOP) significantly boosted employee engagement, retention, and productivity for a rapidly growing company. Learn about the steps involved in designing and implementing a successful ESOP. -

Southeast Asia startups Grab Antler Papaya Growsari 6 minutes

August Recap of the Southeast Asian Startup Scene: A Wild Ride into a New Era

August 2024 was a game-changing month for Southeast Asia’s startup scene. From Grab’s major acquisition to Antler’s ambitious fund, explore the moves reshaping the region’s future. -

venture debt startup ecosystem startup funding Mike Cappelle

The Rise of Corporate Investors and Venture Debt in Early-Stage Funding

In 2024, corporate investors and venture debt are reshaping early-stage funding. Discover how these trends are creating new opportunities for startups and what founders need to know. -

term sheets startup funding liquidation preferences 5 minutes

Understanding Term Sheets: Essential Insights from Gagan Singh, CEO of WOWSGlobal

Learn from Gagan Singh, CEO of WOWSGlobal, as he breaks down the critical elements of a term sheet. Protect your startup's interests with insights into liquidation preferences, anti-dilution provisions, redemption rights, and board matters. -

SAFE agreement Thailand startups Southeast Asia 6 minutes

Surfing the SAFE Wave: How Thailand's Startups Are Riding High

Thailand’s startups are catching the wave of innovative funding with SAFEs. Learn how these agreements are transforming early-stage financing in the region, the benefits they offer, and the legal challenges they present. -

Sunny Khurana Spark founder spotlight startup resilience 7 minutes

Founder Spotlight: Sunny Khurana, the Visionary Behind Spark

Sunny Khurana, the visionary founder of Spark, is on a mission to redefine connections through curated experiences. In this interview, he shares his journey, insights, and advice for aspiring entrepreneurs. -

Papaya startup hospitality tech Southeast Asia 5 minutes

Papaya's Expansion: A Fresh Take on Hospitality Tech in Southeast Asia

Papaya, a fintech startup from Thailand, is revolutionizing the hospitality industry in Southeast Asia. With fresh funding from BEENEXT and A2D Ventures, Papaya is ready to scale its digital ordering and payment platform across the region. -

cap table investor relations 4 minutes

Is Your Investor "Cap Table Material"?

Choosing the right investor is like finding a life partner—make sure they’re “cap table material.” Our cheeky checklist will help you spot the keepers from the flings. Read on! -

startups venture capital 5 minutes

Don't Screw Yourself by Giving Away Redemption Rights: A Cautionary Note for Startups

Startup founders, beware! Redemption rights in your term sheet can become a financial burden that jeopardizes your business. Learn how to negotiate better terms and protect your company’s future. -

Startups Fractional CFO Fundraising 5 minutes

Why Your Accounting Director Might Not Be Enough: The Surging Demand for Fractional CFOs in Startups

In the fast-paced world of startups, having an Accounting Director may not be enough. Discover why over 75% of pre-Series B startups are turning to fractional CFOs for strategic financial guidance that can make or break your growth trajectory. -

Fintech Startups Social Investing Willy Tan 8 minutes

An Interview with Willy Tan: Founder of Seeds on Empowering Financial Literacy in SEA

Dive into our exclusive interview with Willy Tan, the founder of Seeds, a groundbreaking social investing platform in Southeast Asia. Discover his journey, the platform's mission, and insights on building a fintech startup focused on financial literacy. -

SaaS ASEAN Business Growth 5 minutes

Why SaaS Alone May Not Be Enough in ASEAN - Embracing SaaS+ Service

In ASEAN’s diverse markets, offering only SaaS often falls short. Learn why combining SaaS with high-quality services (SaaS+ Service) is crucial for growth and success in the region. -

Startups Entrepreneurship Venture Capital 3-4 minutes

Navigating the Pitch Process: Questions Startups Should Ask VCs

Facing rejections while pitching your startup? Equip yourself with the right questions to ask VCs to better understand their investment focus and select partners who truly believe in your journey. -

Early-Stage Investors Funding Funding Round Fundraising for Founders Investor

Shh! Don’t Share These Fundraising Insider Secrets

Startup founders need to fasten their seatbelts and prepare for a roller-coaster ride if they are to achieve success. It is a straight fact that founders will find themselves wearing many hats to get their venture up, running, and thriving. -

Angel Investors Investor Venture Capitalists Different Types of Investors

Here Are 5 Different Types Of Investors And How They Can Meet Founders Needs

When it comes to establishing and growing your business, investors play a major role. It is the level and quality of investor involvement that can determine a startup's success or failure. -

Equity Management Finance Funding Funding Round Fundraising for Founders

The A-Z of Fundraising for founder (Part: 2 E-H)

Founders of startups have a lot to contend with as they formalize their ideas, turn them into reality, and then proceed to grow their business healthily. -

Funding Funding Round Fundraising for Founders Investment Startup Funding

The A-Z of Fundraising (Part: 1 A-D)

Founders of startups have a lot to contend with as they formalize their ideas, turn them into reality, and then proceed to grow their business in a healthy way. -

Funding Funding Round Investment Investor Startup Startup Funding Stock

Founders – Are you Ready for Your Next Funding Round?

It is no secret that startup founders need to seek funding at different stages of their venture. However, this is no straightforward process. To secure the amount of funding you are after it is necessary for founders to fully understand what each funding round entails and when the time is right to begin each stage. -

Equity Equity Management Finance Investment Investor Startup Stock

What is Equity and how can Early Stage Startups Founders Leverage it?

When starting a new venture, founders of early-stage startups need all the leverage they can get. In that respect, equity and how it is distributed must play a major part in every founder’s strategy. -

Cap Table Equity Management Finance Investment Startup Stock Dilution

Startups – Here’s a Step by Step Guide on how to Calculate Equity Dilution

Startup founders need a comprehensive understanding of equity dilution. This includes key aspects such as what it is, how it works, what causes it, and how it can be calculated. -

Finance Funding Investment Investor Startup

Founders – Here’s How to Conquer Your Fundraising Fear in 3 Simple Steps

Founders of early-stage startups know the time will come when they need to seek additional funds. This funding is necessary if they are to sustain and grow their business in a healthy way. -

ESOP Funding Investor Startup Stock

Stock Options Explained

Let’s take a look at what stock options are, discuss important issues relating to exercise periods, and explain a highly effective way in which anyone who holds options can sell them. -

Funding Fundraising for Founders Investment Investor

Master These 8 Powerful Habits for Success in Fundraising

Startup founders will quickly realize that fundraising is an art. The more effective your fundraising efforts are, the more likely you are to raise those much-needed funds in the required timescales. -

Finance Investment Stock Options

The Meaning of Exercising Stock Options

Why on earth would a professional business person with experience and key industry skills look to take a position in a fledgling company at a salary lower than they could command on the open market? -

Cap Table Finance Funding Startup

Easy Cap Table Management for Early-Stage Companies

Getting your startup off on the right footing means there are a whole host of things that need putting in place. While the early stages of such a venture are the beginning of an exciting chapter it can also be an extremely hectic one. -

Finance Investment Investor Startup

Start-Up Fundraising: Challenges & Roadblocks

90% of start-ups fail. To say all of them don’t have valid business cases, professional leadership teams or a strong drive to succeed would be too simple and naïve. Data from thorough market research demonstrates that a majority of start-up leaders believe that their greatest obstacle lies in fundraising. Considering Southeast Asia alone has 79 open Venture Capital funds with over $4.7 billion ready and available, not including alternative sources of funding, this should not be the case. Outlined below are some of the key reasons why fundraising remains a challenge based on the perspective of a regional start-up CFO and VC investment committee board member. -

ESOP Finance

How Employee Stock Option Plans Work for Startups

Getting your business off the ground in the most efficient way is a challenge all startups face. Fledgling companies that achieve this are the ones most likely to thrive. -

Cap Table Finance Funding Startup

Startup Cap Table Management in 2022 – What to Know as You Grow

Startups need investment in order to raise capital and grow their business. This funding comes from investors who are known as shareholders and it is no secret that any potential investor will want returns. -

Cap Table Startup

4 Reasons Every Startup Should Use a Digital Cap Table

A capitalization table (cap table) is a record of a company’s ownership structure accompanied by the information of the relevant stakeholders. In recent times, companies will often have multiple types of securities from common stock and preferred shares to convertible notes, warrants and options, each with its own unique vesting periods and owned by a multitude of different shareholders. Managing these ever-changing equity structures and various securities as companies go through fundraising rounds can be tedious and time-consuming on manual spreadsheets. -

ESOP

Unlocking The True Value of ESOPs

An average start-up will have an Employee Stock Ownership Plan (ESOP) of 7.5-10%. ESOPs are employee benefits that give workers ownership of shares within the company they represent as a form of compensation. It can be seen as a mutually beneficial tool for both employees and employers. Employers utilize ESOPs to attract talent in an ever-challenging labor market, incentivize loyalty amongst employees and most of all, benefit from cash cost-savings on payroll. Correspondingly, employees have the opportunity to become shareholders and earn ownership for their hard work by being invested and rewarded as the company grows. -

Finance Investment Investor Startup

Private Equity Outperforms Public Markets

According to McKinsey, by nearly any measure, private equity has outperformed public market equivalents with an average net global return of 14% per annum. Simultaneously, the number of private companies that entered the public market grew dramatically with a record 64 per cent year-on-year increase to 2,388 IPOs in 2021. Taking into consideration both these phenomenon’s, it is understandable that investors are now eyeing private market opportunities where they have the opportunity to invest pre-IPO to maximize returns. -

Finance Funding Raising Funds Simple Agreement for Future Equity

KISS or Keep It Simple Security Convertible Note

Raising funds to ensure your startup thrives is a challenge that most founders face. Offering equity for the funding you intend to raise is one very tried and trusted way to achieve this but it is not the only method. Those founders who need to raise capital to grow their company can take advantage of convertible security instruments. In this respect there is one that really stands out; a KISS convertible note, alternatively known as a Keep It Simple Security. Here’s what KISS is all about and how it can be used to leverage those much-needed funds for your venture: -

Fundraising for Founders Funding Funding for Founders Fundraising Rounds

The Things We got Wrong About Fundraising

Founding a successful company is no easy feat. It is no secret that startup founders will find countless challenges that need to be overcome along the way. However, the belief, determination, and effort you put in to be at the helm of a growing, well-structured and healthy company are worth all of that effort and some. As a founder, you would not be human if you did not make mistakes along the way. That is part of the journey and learning from such mistakes will make you even stronger. With mistakes in mind, the fundraising process that founders go through is a major area where mistakes are made. Here are some key pointers that founders get wrong during the fundraising process. Understanding these and avoiding them will make your fundraising efforts much more effective. -

Funding for Founders Fundraising Raise Capital for Startup Angel Investors

Here are the Fastest Ways to Raise Money for Founders